Ethereum Forecast: Rising Accumulation Addresses Hint At Potential Price Surge

Table of Contents

Understanding Accumulation Addresses and Their Significance

Accumulation addresses are cryptocurrency addresses holding substantial amounts of ETH. These addresses are often associated with long-term holders or "whales"—large investors who typically accumulate assets during periods of perceived undervaluation. The significance of these addresses lies in their potential to influence market dynamics. Why is accumulation bullish? Because it indicates that significant investors believe the price of ETH will rise, leading to increased buying pressure and potentially driving up the price. This contrasts with distribution addresses, which show a trend of selling, often signaling bearish sentiment.

- Increased accumulation addresses often precede significant price rallies in the ETH market.

- Tracking accumulation addresses provides invaluable insights into the overall market sentiment and the intentions of large investors.

- Analyzing on-chain data, such as the number of accumulation addresses and the total ETH held within them, is crucial for accurate forecasting and informed investment decisions.

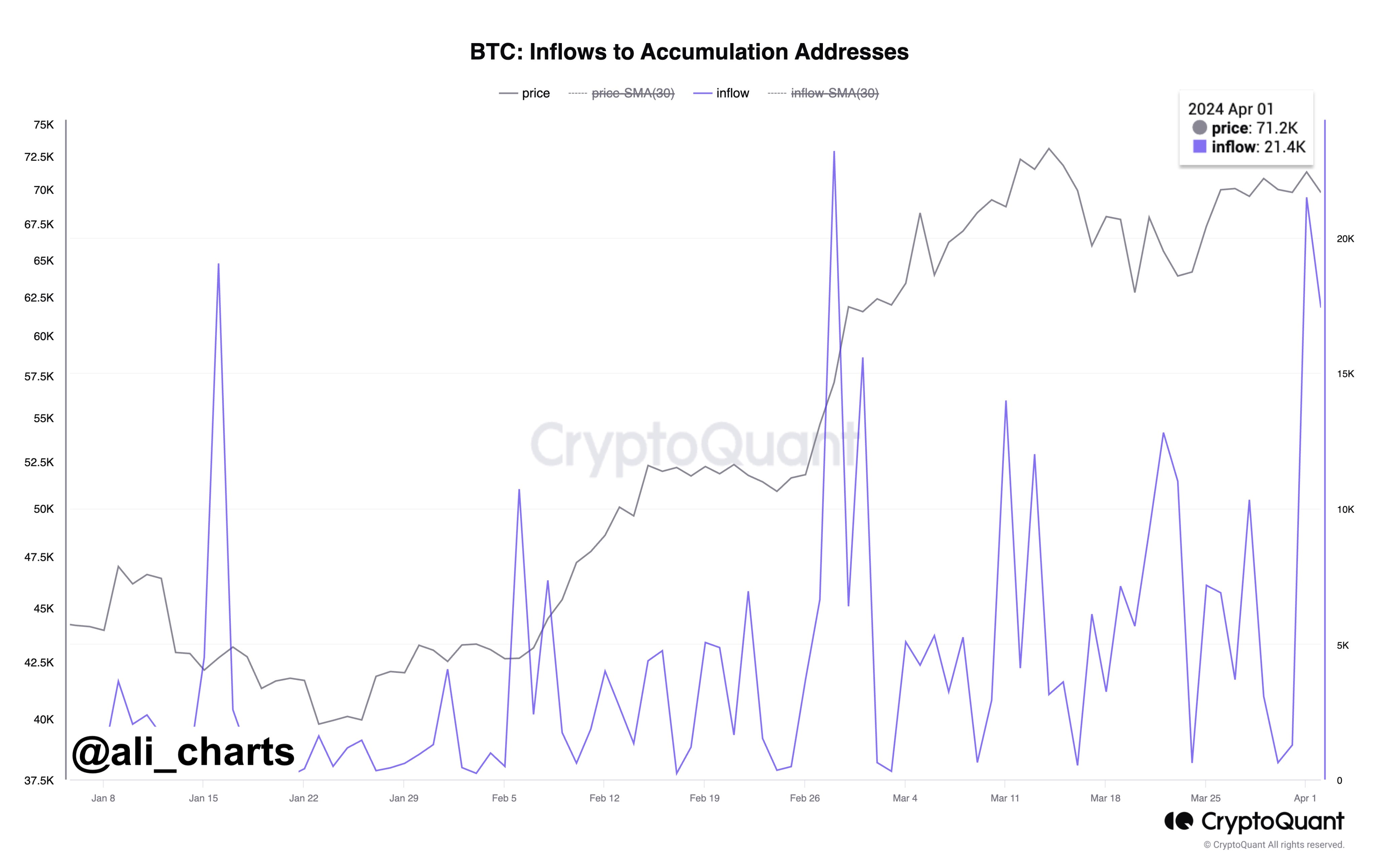

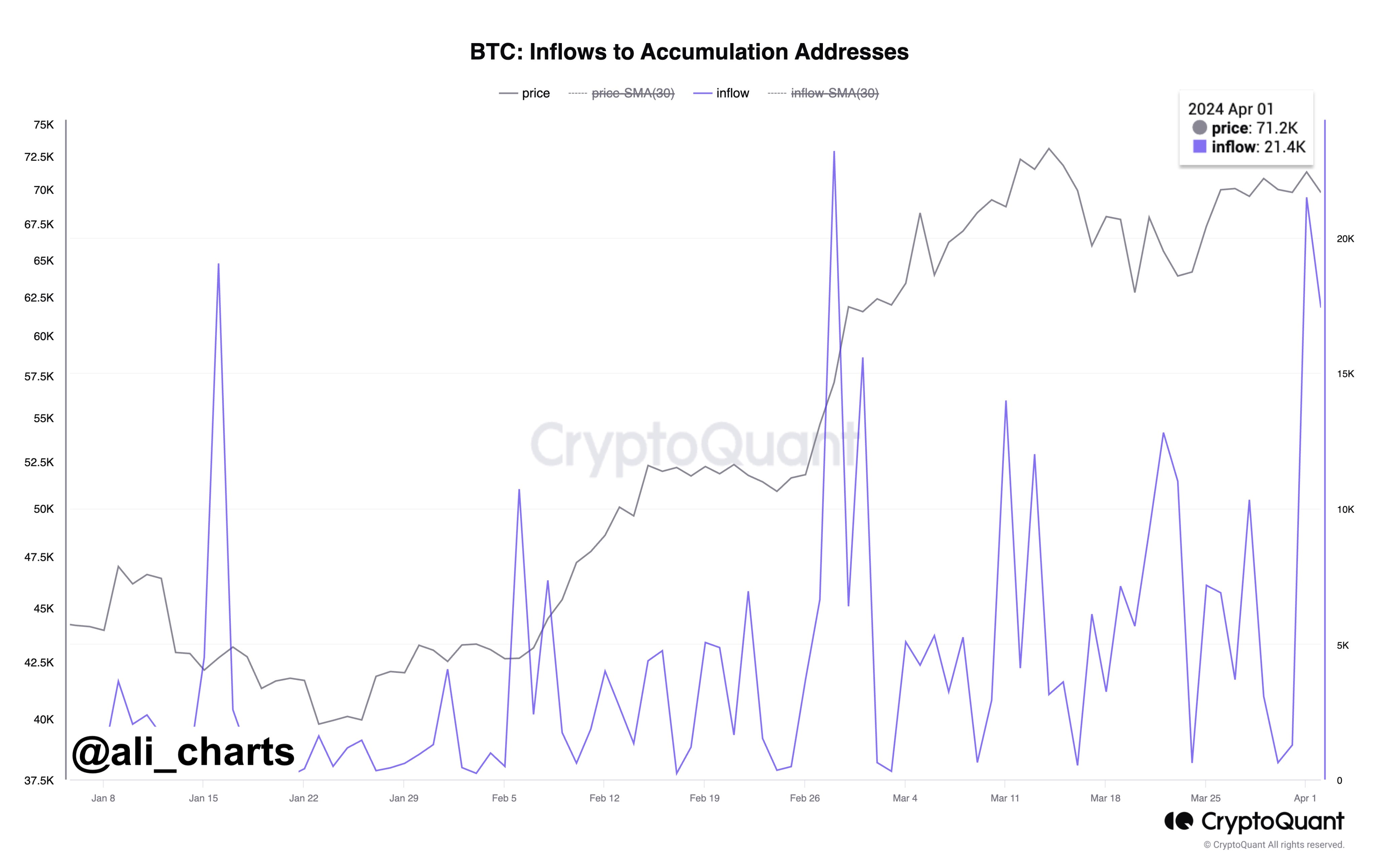

Recent On-Chain Data Supporting the Ethereum Price Surge Forecast

Recent data from reputable on-chain analytics platforms like Glassnode and CoinMetrics reveals a compelling trend: a substantial increase in the number of Ethereum accumulation addresses over the past few months. [Insert chart or graph showing the increase in accumulation addresses here, linking to the data source]. For instance, Glassnode's data shows a [insert specific percentage or number] increase in the number of addresses holding between [insert range] ETH. This surge in accumulation suggests a growing belief among significant investors in the future potential of Ethereum.

- [Insert specific metric 1: e.g., A 25% increase in addresses holding over 1000 ETH in the last quarter].

- [Insert specific metric 2: e.g., A 15% increase in the total ETH held by accumulation addresses in the last two months].

- [Insert specific metric 3: e.g., Historical correlation data showing a strong positive relationship between past surges in accumulation addresses and subsequent ETH price increases]. This correlation, however, does not guarantee future performance.

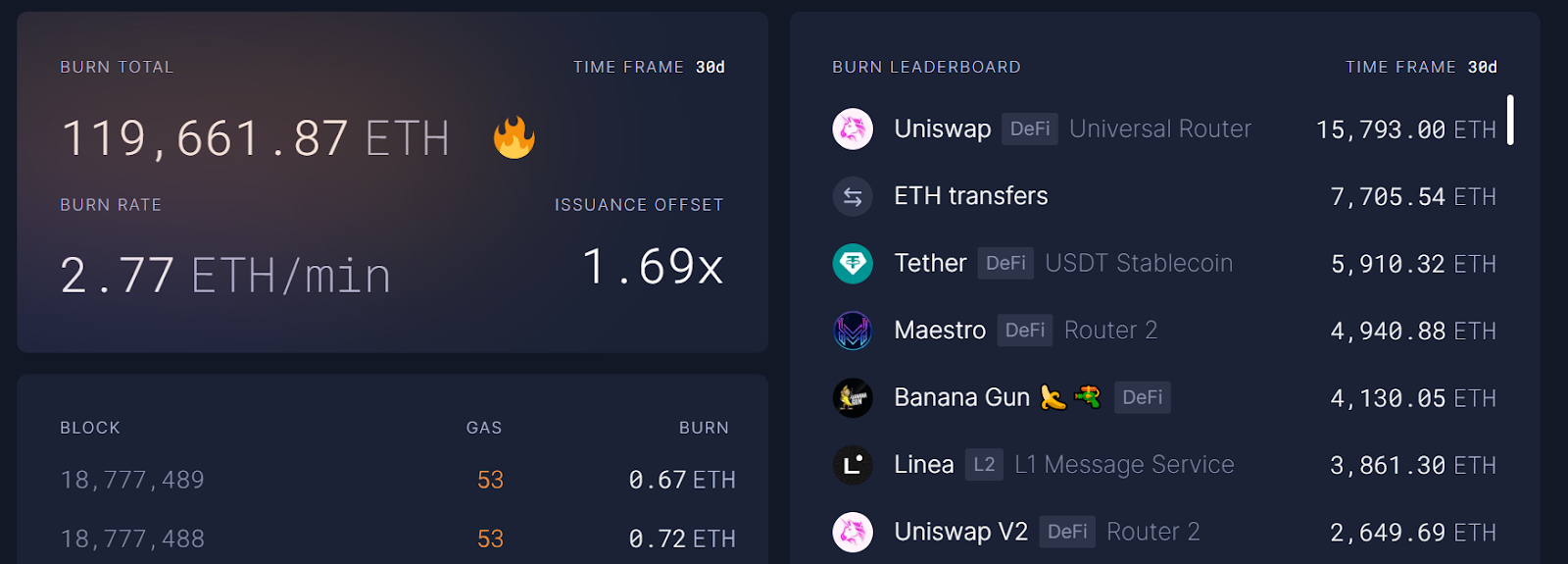

The Role of Ethereum's Development and Upgrades

Ethereum's ongoing development and planned upgrades play a pivotal role in this bullish forecast. The upcoming Shanghai upgrade, for example, is expected to unlock staked ETH, potentially increasing liquidity and positively impacting the price. Furthermore, continuous improvements in scalability and efficiency, such as the transition to proof-of-stake, make Ethereum a more attractive platform for developers and investors, thereby driving up demand for ETH. The thriving DeFi ecosystem and the continued popularity of NFTs on the Ethereum blockchain further contribute to this positive outlook.

- Upgrades improve scalability and transaction efficiency, leading to a more user-friendly experience.

- Network improvements boost investor confidence and attract further investment into the ecosystem.

- The growth of DeFi and NFT markets on the Ethereum network increases demand for ETH, strengthening its value proposition.

Potential Risks and Counterarguments to the Ethereum Price Surge Forecast

While the increase in accumulation addresses paints a bullish picture, it's essential to acknowledge potential downsides. Macroeconomic conditions, regulatory uncertainty, and the overall sentiment in the broader cryptocurrency market could all negatively impact Ethereum's price. A market correction, even with increased accumulation, remains a possibility. Furthermore, while accumulation is typically bullish, it's not a foolproof indicator of future price movements.

- Regulatory hurdles and uncertainty in various jurisdictions pose a significant risk to cryptocurrency prices, including ETH.

- Overall market sentiment can greatly influence Ethereum’s price, irrespective of on-chain metrics.

- A market correction, despite increased accumulation, is a possibility and should be considered when assessing risk.

Conclusion: Ethereum Forecast and Call to Action

The increase in Ethereum accumulation addresses presents a compelling argument for a potential price surge. The on-chain data, coupled with positive developments in the Ethereum ecosystem and upcoming upgrades, paints a largely bullish picture. However, investors should remain aware of the inherent risks involved in the cryptocurrency market. Conduct thorough due diligence before making any investment decisions.

Stay informed about the latest developments in the Ethereum network and keep an eye on accumulation addresses for future Ethereum forecast updates. Remember to always conduct your own research before making any investment decisions. Understanding the interplay between on-chain data and broader market forces is crucial for navigating the dynamic world of Ethereum and cryptocurrencies in general.

Featured Posts

-

Increased Ethereum Network Activity A 10 Jump In Address Interactions

May 08, 2025

Increased Ethereum Network Activity A 10 Jump In Address Interactions

May 08, 2025 -

222 Milione Euro Per Neymar Historia E Plote E Transferimit Sipas Agjentit

May 08, 2025

222 Milione Euro Per Neymar Historia E Plote E Transferimit Sipas Agjentit

May 08, 2025 -

Reliable Crypto News Your Key To Informed Investment Decisions

May 08, 2025

Reliable Crypto News Your Key To Informed Investment Decisions

May 08, 2025 -

Universal Credit Back Payments Could You Be Owed Money

May 08, 2025

Universal Credit Back Payments Could You Be Owed Money

May 08, 2025 -

Can You Name The Nba Playoffs Triple Doubles Leaders A Challenging Quiz

May 08, 2025

Can You Name The Nba Playoffs Triple Doubles Leaders A Challenging Quiz

May 08, 2025