Increased Ethereum Network Activity: A 10% Jump In Address Interactions

Table of Contents

The Rise of Decentralized Finance (DeFi) and its Impact on Ethereum Activity

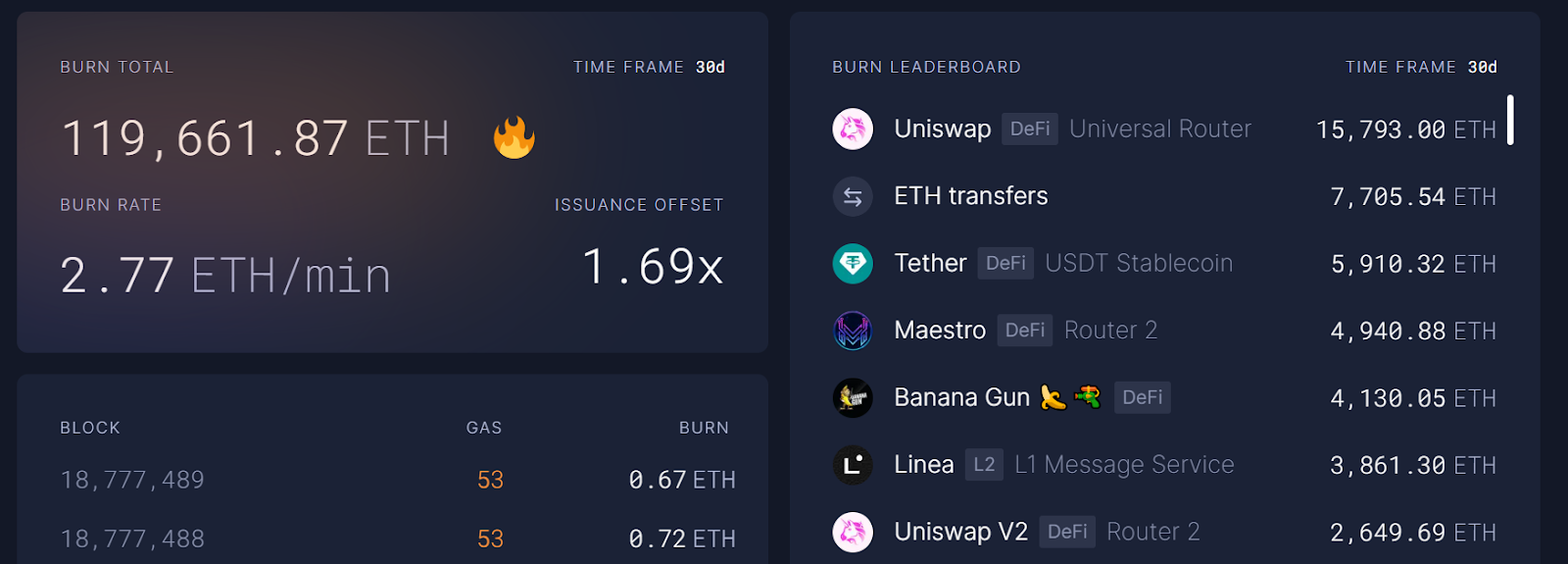

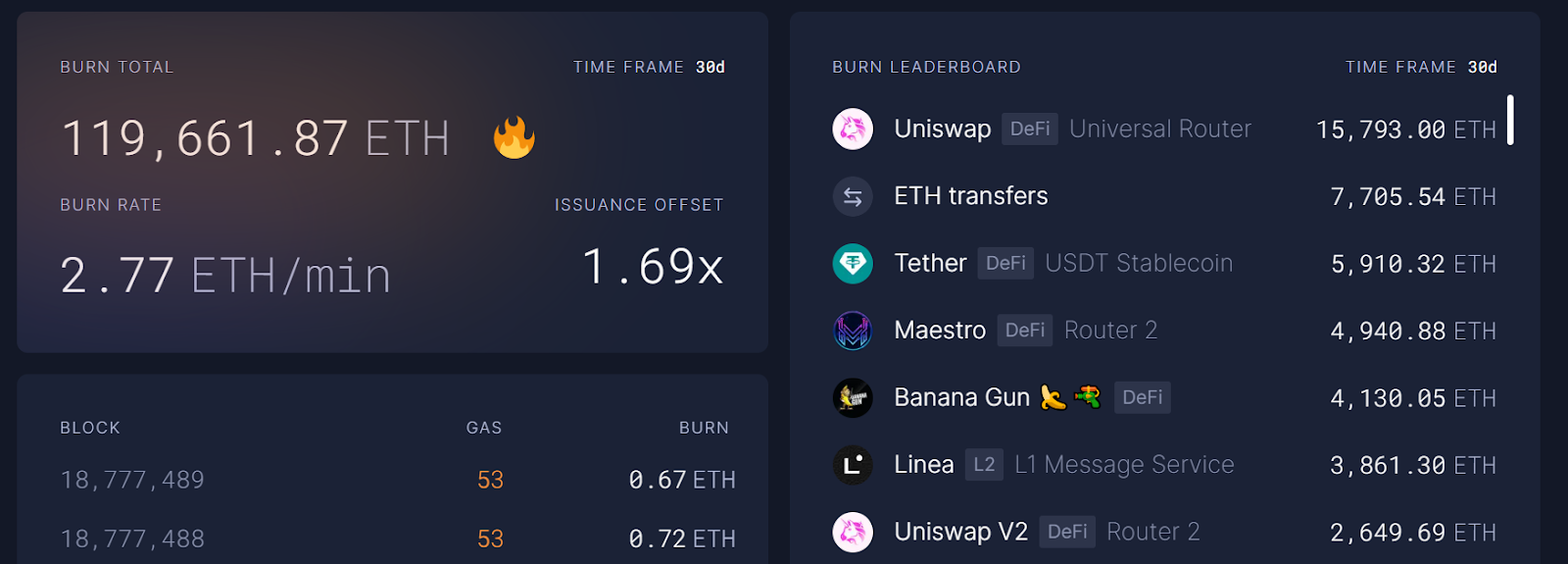

Decentralized Finance (DeFi) has undeniably become a primary catalyst for the increased Ethereum network activity. DeFi applications, built on Ethereum's smart contract functionality, offer a wide range of financial services without intermediaries, fostering unprecedented user engagement.

-

Growth of Leading DeFi Protocols: Platforms like Aave, Uniswap, and Compound are experiencing exponential growth, attracting substantial user bases and transaction volumes. These protocols facilitate lending, borrowing, trading, and yield farming, all of which contribute significantly to Ethereum's network congestion.

-

Yield Farming and Staking: The allure of high yields through yield farming and staking activities is a significant driver of Ethereum's transaction volume. Users lock up their crypto assets to earn rewards, resulting in a constant flow of transactions on the network. This increased activity, while beneficial for DeFi growth, also highlights the need for further scalability solutions.

-

Smart Contract Interactions: The very foundation of DeFi, smart contracts, are responsible for automating and facilitating countless transactions on the Ethereum network. Each interaction with a DeFi smart contract contributes to the overall increase in address interactions, further emphasizing DeFi's crucial role in this surge.

The Booming NFT Market and its Correlation with Increased Ethereum Transactions

The Non-Fungible Token (NFT) market's explosive growth is another major contributor to the heightened Ethereum network activity. NFTs, representing unique digital assets, are primarily traded on the Ethereum blockchain.

-

NFT Market Trends: The recent surge in popularity of various NFT collections, along with record-breaking high-value sales, has led to a massive influx of transactions on the Ethereum network. This includes minting new NFTs, trading existing ones, and navigating various NFT marketplaces.

-

NFT Marketplaces and Transaction Volume: Platforms like OpenSea and Rarible, acting as central hubs for NFT trading, facilitate a large portion of these transactions, directly impacting Ethereum's transaction volume and network congestion. Every purchase, sale, and listing contributes to the overall increase in address interactions.

-

Digital Collectibles and Beyond: The NFT market extends beyond digital art and collectibles. NFTs are being used to represent in-game assets, virtual real estate, and various other digital items, expanding the potential for further growth and heightened Ethereum network activity.

Ethereum Network Upgrades and Scalability Improvements

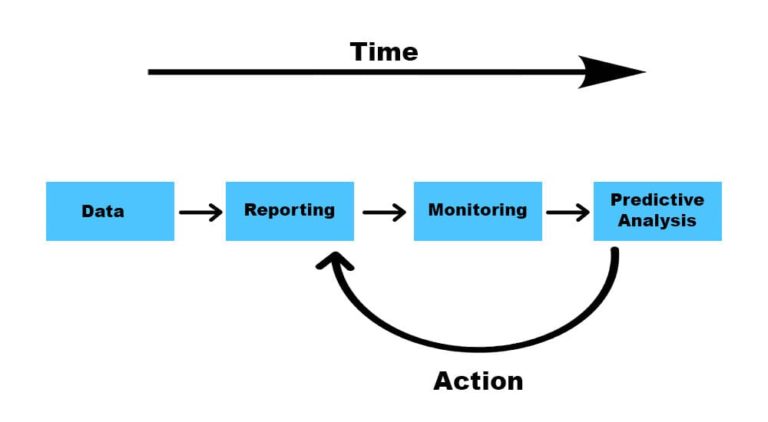

While the increased activity presents challenges, ongoing Ethereum network upgrades and scalability improvements are playing a crucial role in handling the surge.

-

Layer-2 Scaling Solutions: Projects like Polygon, Optimism, and Arbitrum offer Layer-2 scaling solutions, processing transactions off the main Ethereum chain to alleviate congestion and reduce gas fees. These solutions are becoming increasingly vital in handling the growing number of transactions.

-

Impact on Gas Fees and Transaction Speeds: The implementation of Layer-2 solutions and other scalability improvements has a direct impact on gas fees and transaction speeds, making Ethereum more accessible and efficient. While gas fees remain a factor, Layer-2 solutions offer a significant mitigation.

-

Ethereum 2.0 and Future Scalability: The ongoing transition to Ethereum 2.0 promises further scalability improvements, paving the way for even greater network capacity and potentially lower transaction costs.

Other Contributing Factors to Increased Ethereum Network Activity

Beyond DeFi and NFTs, several other factors contribute to the increased Ethereum network activity:

-

Growing Institutional Adoption: Increased interest from institutional investors is fueling the demand for Ethereum and its related services, leading to a higher transaction volume.

-

Ethereum's Expanding Use Cases: Ethereum's versatile blockchain technology continues to find applications beyond DeFi and NFTs, broadening its user base and driving further network activity.

-

Market Sentiment and Ethereum Price: Positive market sentiment and the price appreciation of Ethereum often correlate with increased trading activity and network usage.

Conclusion: Understanding the Surge in Ethereum Network Activity

The 10% jump in Ethereum address interactions reflects a confluence of factors, primarily driven by the explosive growth of DeFi applications, the booming NFT market, and ongoing advancements in network scalability. This surge underscores Ethereum's pivotal role in the cryptocurrency ecosystem and its potential for future growth. The interplay between technological advancements and user adoption continues to shape the future of Ethereum. To stay ahead of the curve in the evolving world of Ethereum, continue following our blog for the latest updates on increased Ethereum network activity and related developments within the blockchain technology sphere.

Featured Posts

-

Mike Trout Out With Knee Injury Angels Drop Fifth Consecutive Game

May 08, 2025

Mike Trout Out With Knee Injury Angels Drop Fifth Consecutive Game

May 08, 2025 -

Uber Auto Service Goes Cash Only Impact And Implications

May 08, 2025

Uber Auto Service Goes Cash Only Impact And Implications

May 08, 2025 -

The China Factor Assessing Risks And Opportunities For Automakers

May 08, 2025

The China Factor Assessing Risks And Opportunities For Automakers

May 08, 2025 -

Micro Strategy Stock Vs Bitcoin A 2025 Investment Comparison

May 08, 2025

Micro Strategy Stock Vs Bitcoin A 2025 Investment Comparison

May 08, 2025 -

Transferimi I Neymar Te Psg Ceku Ne Arabisht Detajet E Marreveshjes 222 Milione Euro

May 08, 2025

Transferimi I Neymar Te Psg Ceku Ne Arabisht Detajet E Marreveshjes 222 Milione Euro

May 08, 2025