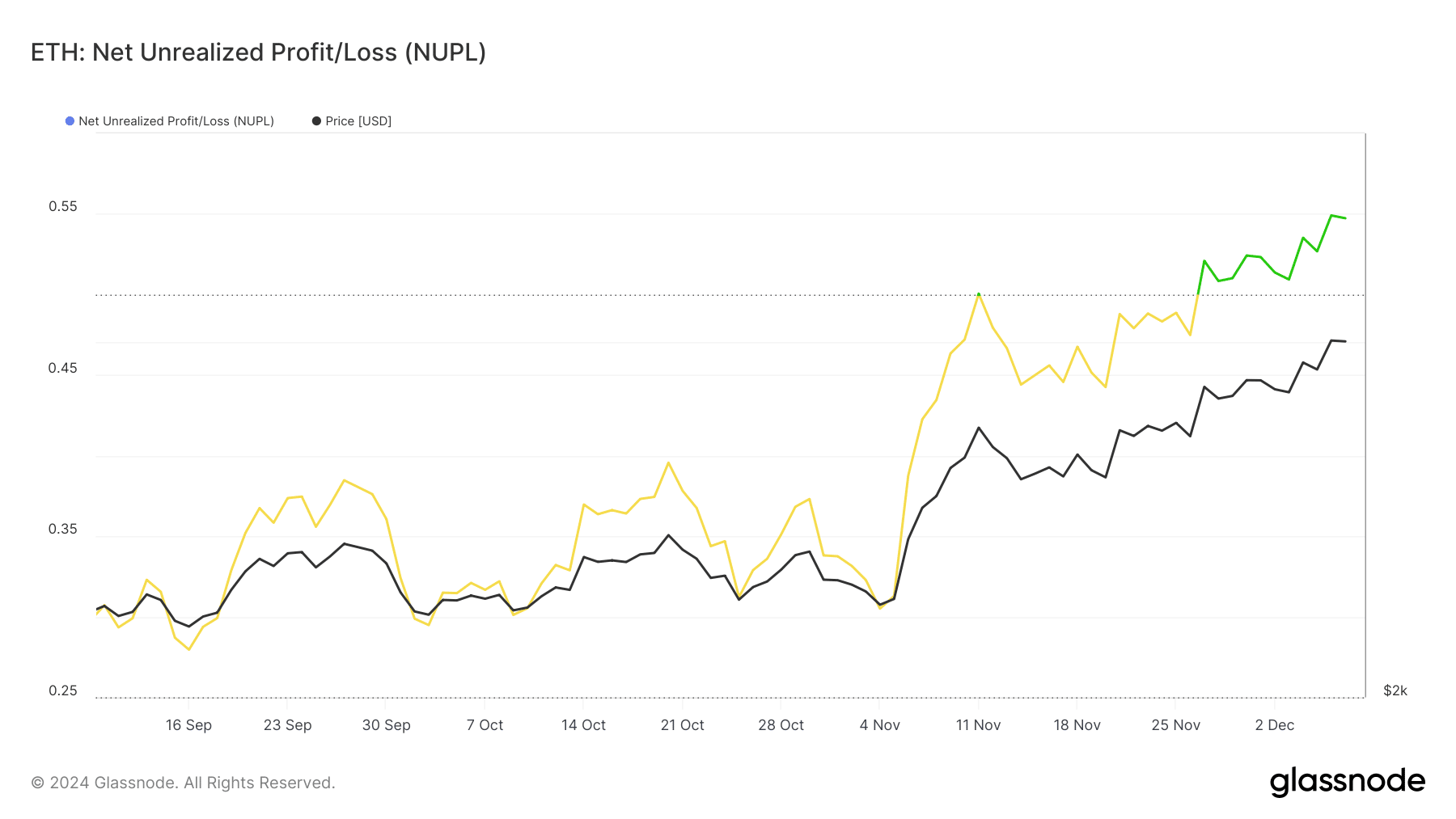

Ethereum Price Forecast: Assessing The Path To $2,000

Table of Contents

Technical Analysis: Chart Patterns and Indicators

Technical analysis provides valuable insights into potential price movements by studying historical price data and chart patterns. Analyzing Ethereum's price charts can reveal clues about its future trajectory.

-

Chart Patterns: Identifying patterns like head and shoulders, triangles, or flags can signal potential price reversals or continuations. A head and shoulders pattern, for example, often precedes a bearish trend, while a bullish triangle suggests a potential breakout to higher prices. Careful observation of these patterns on the ETH/USD chart is crucial for predicting short-term price movements.

-

Technical Indicators: Indicators like the Relative Strength Index (RSI), Moving Average Convergence Divergence (MACD), and various moving averages (e.g., 50-day, 200-day) offer further insights. For instance, an RSI above 70 often suggests an overbought condition, potentially indicating a price correction. Conversely, an RSI below 30 may signal an oversold condition, suggesting a potential price rebound. The MACD, meanwhile, identifies momentum changes by comparing two moving averages.

-

Key Technical Aspects:

- Support and Resistance Levels: Identifying crucial support and resistance levels is vital. A break above a strong resistance level could signal a bullish trend, while a fall below a support level may indicate a bearish trend. Monitoring these levels on the ETH chart is essential for effective trading strategies.

- Breakout Points: Identifying potential breakout points from established chart patterns or support/resistance levels can help predict significant price movements. A successful breakout often leads to a sustained price increase or decrease.

- Trading Volume: Analyzing trading volume in conjunction with price movements is crucial. High volume accompanying a price increase confirms the strength of the move, while low volume may suggest a weak trend susceptible to reversal.

Fundamental Factors Driving Ethereum's Price

Beyond technical analysis, fundamental factors significantly impact Ethereum's price. These relate to the underlying technology, adoption rate, and overall ecosystem health.

-

Ethereum's Technological Advancements: The Merge, which transitioned Ethereum from a proof-of-work to a proof-of-stake consensus mechanism, was a landmark event. This upgrade significantly reduced energy consumption and improved network efficiency, boosting investor confidence and potentially driving price appreciation. Future upgrades, such as sharding (improving scalability), will further enhance the network's capabilities.

-

Decentralized Finance (DeFi) Boom: The thriving DeFi ecosystem built on Ethereum is a key driver of demand for ETH. DeFi applications require ETH for transactions and governance, creating sustained demand. The continued growth of DeFi platforms and the increasing adoption of decentralized applications (dApps) will likely boost the value of ETH.

-

Regulatory Landscape: Regulatory clarity or uncertainty significantly impacts cryptocurrency markets. Favorable regulatory developments in key jurisdictions could lead to increased institutional investment and wider adoption, pushing ETH's price higher. Conversely, negative regulatory actions could lead to price corrections.

-

Key Fundamental Aspects:

- Network Scalability: Improved scalability, as achieved through sharding, directly impacts transaction fees and user experience. Lower fees attract more users and developers, ultimately benefiting the ETH price.

- Ecosystem Growth: The expansion of the Ethereum ecosystem, including the number of dApps and active users, positively correlates with ETH's value. A vibrant and growing ecosystem fuels demand for ETH.

- ETH Staking: The shift to proof-of-stake introduced ETH staking, where users lock up their ETH to validate transactions and earn rewards. This reduces the circulating supply of ETH, potentially increasing its scarcity and value.

Market Sentiment and Investor Behavior

Market sentiment and investor behavior play a critical role in shaping Ethereum's price. Positive sentiment can drive prices up, while negative sentiment can lead to price corrections.

-

Sentiment Analysis: Analyzing social media sentiment, news articles, and online forums helps gauge overall market sentiment towards ETH. Positive sentiment often correlates with price increases, while negative sentiment may foreshadow price declines.

-

Bitcoin's Influence: Bitcoin's price movements often influence the entire cryptocurrency market, including Ethereum. A bullish trend in Bitcoin can often lead to a positive spillover effect on Ethereum, while a bearish trend in Bitcoin may negatively impact ETH's price.

-

Whale Activity and Institutional Investment: Large investors ("whales") and institutional investors can significantly influence ETH's price through their buying and selling activities. Large-scale purchases can drive prices up, while significant sell-offs can lead to price corrections.

-

Key Sentiment Factors:

- Social Media Sentiment: Monitoring social media platforms for discussions and sentiment regarding ETH provides valuable insights into market sentiment.

- Exchange Activity: Major cryptocurrency exchanges' trading volumes and order book data offer valuable insights into market dynamics and potential price movements.

- News and Announcements: Positive news events, such as partnerships, upgrades, or regulatory approvals, often boost investor confidence and drive price increases.

Potential Roadblocks and Challenges

While the outlook for Ethereum is generally positive, several potential challenges could hinder its price from reaching $2,000.

-

Competition: The emergence of competing layer-1 blockchains and alternative smart contract platforms poses a challenge to Ethereum's dominance. These competitors offer varying advantages, potentially diverting developers and users away from Ethereum.

-

Regulatory Uncertainty: Stringent or unclear regulations could negatively impact the cryptocurrency market, potentially leading to price volatility and hindering investment. Regulatory uncertainty creates risk aversion among investors.

-

Macroeconomic Factors: Global economic conditions, such as inflation, interest rate hikes, or recessions, can negatively impact investor risk appetite and lead to sell-offs in the cryptocurrency market, including ETH.

-

Key Challenges:

- Regulatory Risks: Changes in regulations can lead to uncertainty and potential restrictions on cryptocurrency trading, impacting ETH's price.

- Competition from Altcoins: The competitive landscape of the cryptocurrency market poses a continuous challenge to Ethereum’s market share.

- Market Corrections: The cryptocurrency market is inherently volatile, prone to periodic corrections. Such corrections can lead to temporary price declines.

Conclusion

This analysis has explored various factors influencing Ethereum's price, including technical indicators, fundamental developments, market sentiment, and potential challenges. While reaching $2,000 is not guaranteed, a confluence of positive developments in the Ethereum ecosystem and favorable market conditions could pave the way. The successful implementation of future upgrades, continued growth of the DeFi ecosystem, and positive regulatory developments are all factors that could propel ETH towards this price target. However, investors should remain aware of potential risks and challenges, including competition, regulatory uncertainty, and macroeconomic factors.

Call to Action: Stay informed about the latest developments in the Ethereum ecosystem to make informed decisions regarding your Ethereum investments. Keep monitoring this space for updated Ethereum price forecasts and analysis to help you navigate the dynamic world of cryptocurrency and assess the path to $2,000 and beyond. Continue your research on the Ethereum price forecast to make strategic investment choices.

Featured Posts

-

Nba Playoffs Triple Doubles Quiz Are You A True Basketball Fan

May 08, 2025

Nba Playoffs Triple Doubles Quiz Are You A True Basketball Fan

May 08, 2025 -

Los Angeles Angels Baseball Your 2025 Streaming Guide No Cable

May 08, 2025

Los Angeles Angels Baseball Your 2025 Streaming Guide No Cable

May 08, 2025 -

Analyzing The Ethereum Weekly Chart A Potential Buy Signal

May 08, 2025

Analyzing The Ethereum Weekly Chart A Potential Buy Signal

May 08, 2025 -

Liga Chempionov 2024 2025 Predmatcheviy Obzor Igr Arsenal Ps Zh I Barselona Inter

May 08, 2025

Liga Chempionov 2024 2025 Predmatcheviy Obzor Igr Arsenal Ps Zh I Barselona Inter

May 08, 2025 -

Is The Recent Bitcoin Price Rebound Sustainable Exploring The Factors

May 08, 2025

Is The Recent Bitcoin Price Rebound Sustainable Exploring The Factors

May 08, 2025