Analyzing The Ethereum Weekly Chart: A Potential Buy Signal

Table of Contents

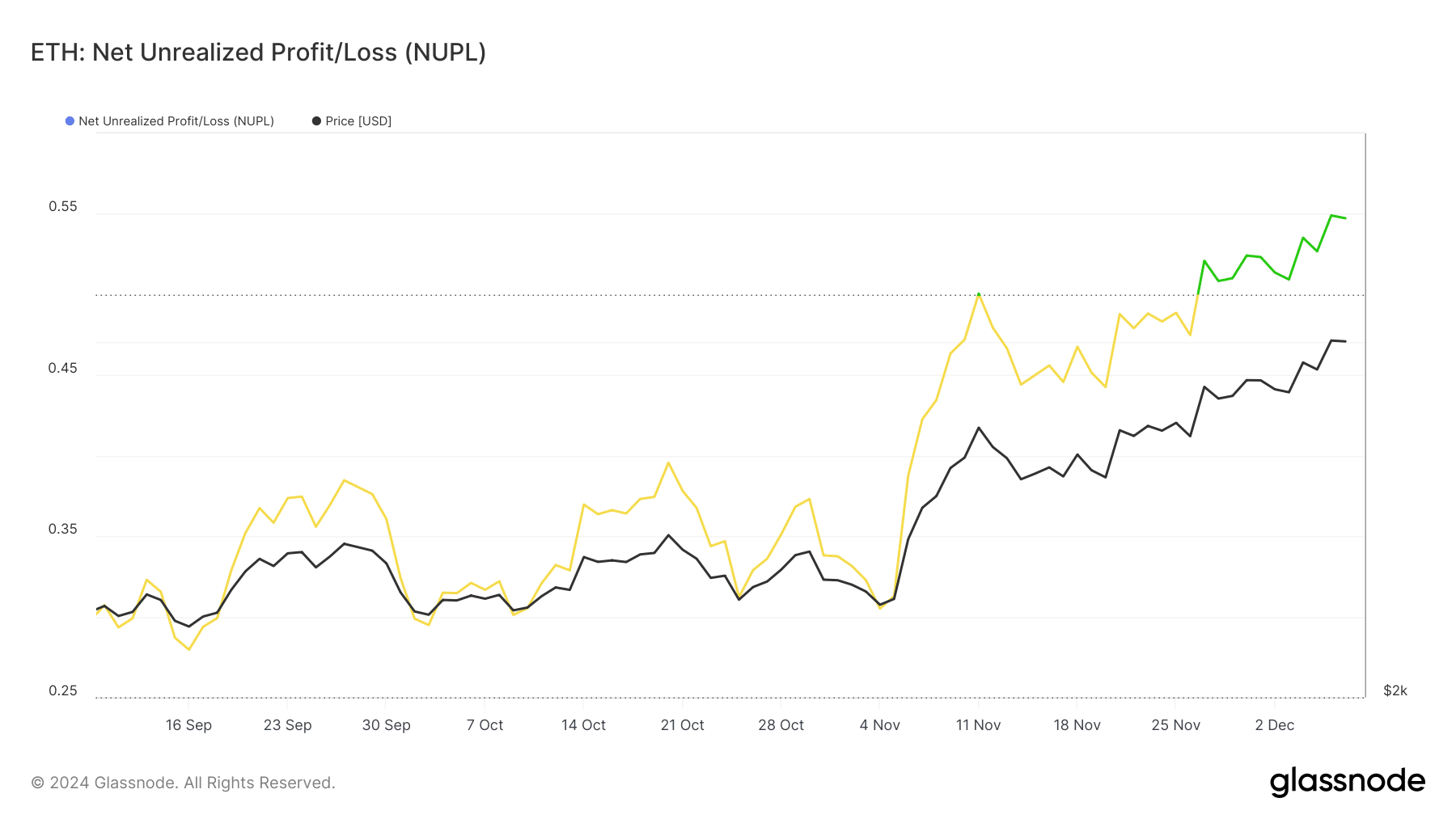

Ethereum (ETH) price action has been volatile recently, leaving investors wondering about the best course of action. This analysis delves into the Ethereum weekly chart, examining key indicators to determine if current price levels present a potential buying opportunity. We'll explore significant support levels, price trends, and technical indicators to assess the risk-reward ratio of entering a long position in ETH. Understanding the Ethereum weekly chart is crucial for making informed investment decisions.

Identifying Key Support Levels on the Ethereum Weekly Chart

The Role of Psychological Barriers

Round-number support levels, such as $1,500, $1,200, and $1,000, often act as significant barriers to further price declines in ETH. These psychological barriers represent price points where a substantial number of investors are likely to buy, providing support for the price.

- Examples of historical price bounces: Historically, Ethereum has shown a tendency to bounce off these round numbers, indicating strong buyer support at these key levels.

- Potential accumulation zones: These support levels can also represent accumulation zones, where savvy investors accumulate ETH before a potential price reversal.

- Buyer intervention: Buyers tend to step in near these levels, anticipating a price reversal and capitalizing on what they perceive as a discounted price. This influx of buying pressure can lead to a significant price bounce.

Analyzing Moving Averages

The 50-week and 200-week moving averages are crucial long-term indicators for Ethereum. Their intersection or proximity can signal potential support or resistance.

- Golden Cross and Death Cross: A "golden cross" (50-week MA crossing above the 200-week MA) is often seen as a bullish signal, suggesting a potential long-term uptrend. Conversely, a "death cross" (50-week MA crossing below the 200-week MA) can be a bearish signal.

- Support and Resistance: The moving averages themselves can act as dynamic support and resistance levels. Price bounces off these averages can confirm the strength of the trend.

- Chart Interpretation: [Insert chart/graph here illustrating the 50-week and 200-week moving averages interacting with the ETH price]. This visual representation helps clarify the interplay between price and these important indicators.

Assessing Price Trends and Momentum

Evaluating the Relative Strength Index (RSI)

The Relative Strength Index (RSI) is a momentum oscillator that helps gauge the current market sentiment. On the Ethereum weekly chart, the RSI can provide insights into potential overbought or oversold conditions.

- Overbought/Oversold Conditions: An RSI reading above 70 is generally considered overbought, suggesting potential price corrections. Conversely, a reading below 30 is often considered oversold, implying potential price reversals.

- RSI Divergence: RSI divergences (where the price makes new lows/highs but the RSI fails to confirm) can be a powerful predictive signal. For example, a bearish divergence (lower lows in price but higher lows in RSI) might precede a price bounce.

- Confirmation of Trends: The RSI can confirm trends identified by other indicators, providing a more robust trading signal.

Analyzing the MACD Indicator

The Moving Average Convergence Divergence (MACD) is another momentum indicator that can reveal potential bullish or bearish signals.

- Bullish Crossover: A bullish crossover (MACD line crossing above the signal line) could suggest an upward trend is developing. This is a positive signal for potential ETH price increases.

- Bearish Crossover: Conversely, a bearish crossover (MACD line crossing below the signal line) could suggest a downward trend. This would be a warning sign for potential price declines.

- MACD Histogram: The MACD histogram provides additional information about the momentum. Increasing histogram bars indicate growing bullish momentum, while decreasing bars indicate weakening momentum. [Insert chart/graph here illustrating the MACD indicator on the weekly chart].

Considering the Overall Market Sentiment and External Factors

The Impact of Bitcoin's Price

Bitcoin (BTC) and Ethereum (ETH) are correlated, meaning their price movements often influence each other. Bitcoin's dominance in the cryptocurrency market significantly impacts ETH's performance.

- BTC's Influence on ETH: A strong uptrend in Bitcoin often leads to a positive impact on Ethereum's price, while a downturn in Bitcoin can negatively impact ETH.

- Bitcoin Dominance: Monitoring Bitcoin dominance (the percentage of the total crypto market cap represented by Bitcoin) is crucial. A decrease in Bitcoin dominance can often benefit altcoins like ETH.

- Historical Correlation: [Insert chart/graph illustrating the historical correlation between BTC and ETH prices].

Regulatory Developments and News

Regulatory announcements and news events can significantly affect ETH's price. Positive news can lead to increased investor confidence and price appreciation, while negative news can trigger sell-offs and price drops.

- Positive News: Examples include positive regulatory developments, successful Ethereum upgrades, and partnerships with major institutions.

- Negative News: Negative news includes stricter regulations, security breaches, or negative media coverage.

- Upcoming Events: Upcoming Ethereum upgrades (like the Shanghai upgrade) or regulatory changes can significantly impact market sentiment and price volatility.

Conclusion:

This analysis of the Ethereum weekly chart reveals potential buy signals based on key support levels, favorable momentum indicators (RSI and MACD), and the overall market sentiment. While no investment is without risk, the confluence of these factors suggests a potentially attractive entry point for long-term investors. However, always conduct thorough due diligence and consider your own risk tolerance before making any investment decisions. Further monitoring of the Ethereum weekly chart and other key indicators is crucial for navigating the ever-changing cryptocurrency market. Consider conducting your own in-depth research before taking any action based on this analysis of the Ethereum weekly chart. Remember to always manage your risk appropriately when investing in any cryptocurrency, including Ethereum.

Featured Posts

-

Is 2 000 The Next Target For Ethereums Price

May 08, 2025

Is 2 000 The Next Target For Ethereums Price

May 08, 2025 -

Experience Uber One In Kenya Discounted Rides And Free Deliveries

May 08, 2025

Experience Uber One In Kenya Discounted Rides And Free Deliveries

May 08, 2025 -

Barcelona Vs Inter Milan Champions League Semifinal Result And Analysis

May 08, 2025

Barcelona Vs Inter Milan Champions League Semifinal Result And Analysis

May 08, 2025 -

Saturday Night Lives Impact On Counting Crows Career

May 08, 2025

Saturday Night Lives Impact On Counting Crows Career

May 08, 2025 -

Singapores Dbs Bank A Breathing Space For Top Polluters

May 08, 2025

Singapores Dbs Bank A Breathing Space For Top Polluters

May 08, 2025