Is $2,000 The Next Target For Ethereum's Price?

Table of Contents

Current Market Conditions and Ethereum's Performance

Analyzing Ethereum's recent price action is crucial for understanding its potential future trajectory. The overall cryptocurrency market sentiment significantly influences ETH's price. Positive news and increased adoption often lead to price increases, while negative news or regulatory uncertainty can trigger sell-offs. Examining trading volume and market capitalization provides further insight into investor confidence.

- Recent price highs and lows: Tracking recent peaks and troughs helps identify potential support and resistance levels for the Ethereum price. A sustained break above key resistance levels could signal a bullish trend.

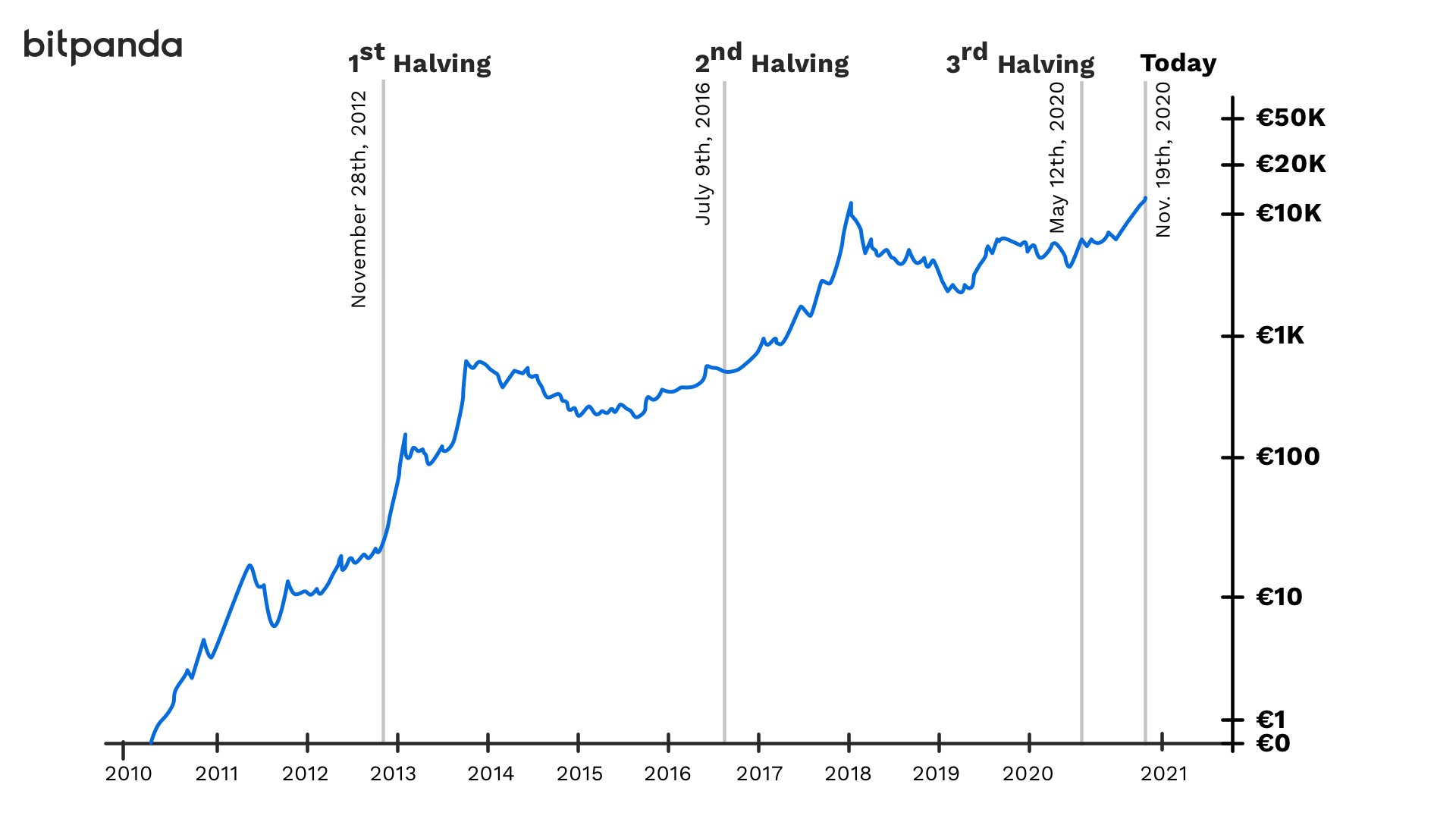

- Comparison to Bitcoin's price movements: Bitcoin often acts as a bellwether for the entire cryptocurrency market. Analyzing the correlation between Bitcoin's price and Ethereum's price can provide valuable insights into ETH's potential movements.

- Impact of regulatory news on ETH price: Regulatory announcements and changes in policy regarding cryptocurrencies can have a substantial impact on investor sentiment and, subsequently, the Ethereum price.

- Analysis of on-chain metrics like active addresses and transaction fees: On-chain data, such as the number of active addresses and transaction fees, provides valuable information about network activity and potential future growth. High transaction fees often correlate with increased network usage and a potentially higher Ethereum price. Monitoring these metrics gives a more granular view of the Ethereum ecosystem's health.

Technical Analysis: Indicators Suggesting a Potential Rise to $2,000

Technical analysis employs various indicators to predict future price movements. Examining support and resistance levels, along with chart patterns, can help assess the probability of Ethereum reaching $2,000.

- Moving Averages (MA): The 50-day and 200-day moving averages are frequently used to identify trends. A bullish crossover (50-day MA crossing above the 200-day MA) could signal a potential price increase.

- Relative Strength Index (RSI): RSI measures the magnitude of recent price changes to evaluate overbought or oversold conditions. An RSI below 30 suggests an oversold market, potentially indicating a price bounce.

- Moving Average Convergence Divergence (MACD): MACD identifies changes in momentum by comparing two moving averages. A bullish signal occurs when the MACD line crosses above the signal line.

- Support and resistance levels: Identifying historical price support and resistance levels helps predict potential price reversals. A break above a significant resistance level could trigger a substantial price increase toward $2000.

- Chart patterns: Identifying chart patterns like head and shoulders, triangles, or flags can provide insights into potential price movements.

Fundamental Factors Influencing Ethereum's Price

Beyond technical analysis, fundamental factors play a significant role in Ethereum's price. The upcoming Ethereum upgrades, DeFi growth, and NFT market trends all influence investor sentiment and, ultimately, the Ethereum price target.

- Ethereum 2.0 and sharding: The implementation of sharding is expected to significantly improve Ethereum's scalability and transaction speed, potentially leading to increased adoption and higher prices. This is a key factor in many Ethereum price predictions.

- Decentralized Finance (DeFi) ecosystem growth: The booming DeFi ecosystem built on Ethereum continues to drive demand for ETH. Increased usage of decentralized applications (dApps) on Ethereum can contribute to price appreciation.

- Non-Fungible Tokens (NFTs) and their impact: The continued popularity of NFTs minted and traded on Ethereum fuels demand for the cryptocurrency. The success of NFT projects is directly linked to Ethereum's price.

- Ethereum's scalability and competition: The competition from other layer-1 blockchains is a factor to consider. Improvements in Ethereum's scalability are vital to maintain its leading position and drive price increases.

Potential Risks and Challenges

While a $2,000 Ethereum price is possible, several risks and challenges could hinder its progress.

- Regulatory hurdles: Increased government regulation of cryptocurrencies could negatively impact investor confidence and suppress price growth.

- Macroeconomic factors: Global economic conditions, such as inflation and interest rate changes, can impact the overall cryptocurrency market and Ethereum's price.

- Competition from other layer-1 blockchains: The emergence of competing blockchains offering faster transaction speeds and lower fees could divert users and developers away from Ethereum.

- Security vulnerabilities: Any significant security breach or exploit on the Ethereum network could severely damage investor confidence and trigger a price drop.

Conclusion

Determining whether Ethereum will reach $2,000 requires considering market conditions, technical indicators, and fundamental factors. While technical analysis suggests potential price increases, fundamental factors like regulatory uncertainty and competition present significant challenges. The successful implementation of Ethereum 2.0 and continued growth of the DeFi and NFT ecosystems are crucial for driving the price towards $2,000. However, macroeconomic factors and potential regulatory hurdles pose significant risks. While predicting the exact Ethereum price remains speculative, understanding these influencing factors is crucial. Conduct thorough research before making any investment decisions. Continue your research on the potential of Ethereum reaching $2,000 and stay updated on the latest market trends to make sound investment decisions regarding the future of Ethereum's price.

Featured Posts

-

Understanding Data Transfer Methods And Best Practices

May 08, 2025

Understanding Data Transfer Methods And Best Practices

May 08, 2025 -

Cocaine Found At White House Secret Service Ends Probe

May 08, 2025

Cocaine Found At White House Secret Service Ends Probe

May 08, 2025 -

Bitcoin Rebound Is This The Start Of A New Bull Run

May 08, 2025

Bitcoin Rebound Is This The Start Of A New Bull Run

May 08, 2025 -

Ripple Xrp Price Surge Brazils Xrp Etf Approval And Trumps Ripple Post

May 08, 2025

Ripple Xrp Price Surge Brazils Xrp Etf Approval And Trumps Ripple Post

May 08, 2025 -

Googles Search Chief Raises Concerns Over Dojs Proposed Changes

May 08, 2025

Googles Search Chief Raises Concerns Over Dojs Proposed Changes

May 08, 2025