Ethereum Price Prediction 2024 And Beyond: A Comprehensive Analysis

Table of Contents

H2: Ethereum's Current Market Position and Recent Trends

Understanding Ethereum's current standing is vital for any ETH price prediction. Currently, Ethereum boasts a significant market capitalization, placing it firmly as a major player in the cryptocurrency space. However, its market dominance fluctuates depending on Bitcoin's price movements and overall market sentiment. Recent price fluctuations have been influenced by several factors, including:

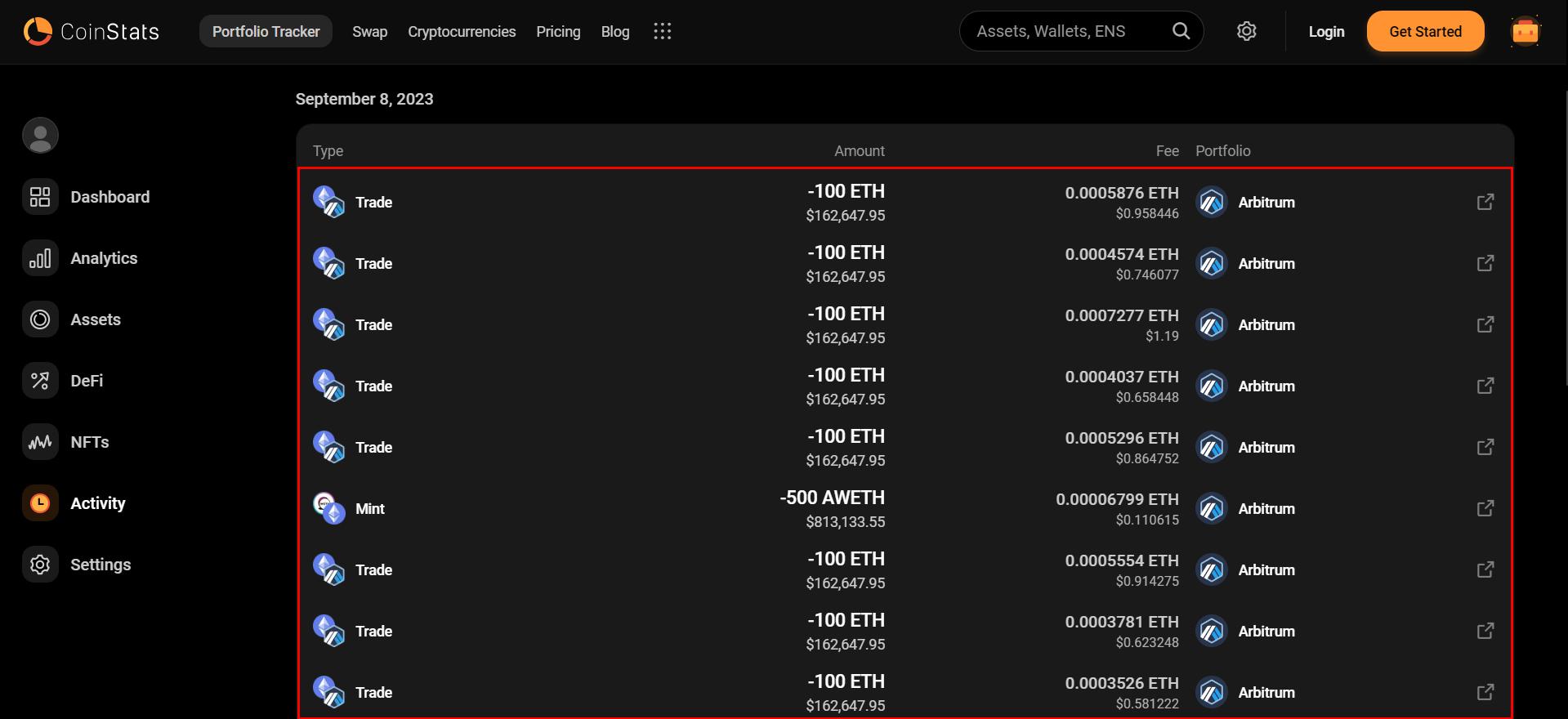

- Current ETH Price and Trading Volume: (Insert current ETH price and 24-hour trading volume from a reputable source like CoinMarketCap. This data needs to be updated regularly for accuracy). Analyzing trading volume helps gauge market interest and potential price momentum.

- Key Technical Indicators: Technical analysis using indicators like moving averages (e.g., 50-day MA, 200-day MA) and the Relative Strength Index (RSI) can provide insights into short-term and long-term price trends. (Include a brief explanation of how these indicators work and what their current readings suggest regarding the ETH price).

- Impact of Major Crypto Exchange Listings: New listings on major exchanges often increase liquidity and accessibility, potentially influencing the price.

- Influence of Bitcoin's Price Movements on Ethereum: Bitcoin often acts as a benchmark for the entire crypto market. A significant price movement in Bitcoin typically impacts the price of other cryptocurrencies, including Ethereum.

H2: Factors Influencing Ethereum's Future Price

Several key factors will shape the future price of Ethereum. Let's examine them closely:

H3: Technological Advancements

Ethereum 2.0, with its shift to a proof-of-stake consensus mechanism, is a game-changer. This upgrade aims to significantly improve scalability, security, and energy efficiency. Scaling solutions like Layer-2 protocols (e.g., Polygon, Optimism) and sharding will further enhance transaction speed and reduce fees. These improvements are crucial for wider adoption and a potential increase in ETH value.

- Impact on Price: Increased efficiency and scalability should attract more users and developers, potentially driving up demand and price.

- Specific Projects: Mention specific projects within the Ethereum ecosystem that are likely to impact its price (e.g., advancements in smart contract functionality, improved DeFi infrastructure).

H3: Adoption and Development

The thriving DeFi (Decentralized Finance) ecosystem built on Ethereum, along with the explosive growth of NFTs (Non-Fungible Tokens), demonstrates its widespread adoption. The large and active developer community constantly builds new dApps (Decentralized Applications), furthering the platform’s utility and attracting more users.

- Successful DeFi Applications: List examples of successful DeFi protocols built on Ethereum and their impact on the ecosystem.

- Growth in dApps: Highlight the growing number of dApps built on Ethereum and their contribution to the network's value.

- Enterprise Adoption: Discuss instances of Ethereum's use in enterprise solutions, demonstrating its potential for wider real-world applications.

H3: Regulatory Landscape and Global Adoption

Government regulations play a significant role in shaping the cryptocurrency market. Clearer regulatory frameworks could boost institutional investment and wider adoption, positively influencing Ethereum’s price. Conversely, overly restrictive regulations could stifle growth. The increasing global adoption of cryptocurrencies, especially in emerging markets, further contributes to the overall growth potential of Ethereum.

- Regulatory Actions: Discuss specific regulatory actions in different regions and their potential impact on ETH price.

- Institutional Interest: Highlight the growing interest of institutional investors in Ethereum.

- Geographical Adoption: Analyze the impact of different geographical regions on Ethereum adoption.

H2: Ethereum Price Predictions for 2024

Predicting the future price of any cryptocurrency is inherently speculative. However, several reputable sources offer Ethereum price predictions for 2024. (Insert price predictions from at least 3 different reputable sources, citing their source and methodology. Clearly state bullish, bearish, and neutral scenarios, illustrating them with charts and graphs whenever possible).

H2: Long-Term Ethereum Price Prediction (Beyond 2024)

Ethereum's long-term potential hinges on several factors. Its technological superiority, growing adoption, and expanding ecosystem suggest a strong foundation for future growth. However, challenges remain, such as competition from other blockchain networks and potential security vulnerabilities.

- Factors Contributing to Long-Term Growth: Include points like mass adoption, enhanced network security, and continued innovation.

- Factors Hindering Growth: Discuss potential risks such as competition, security breaches, and regulatory uncertainty.

- Long-Term Price Scenarios: Present potential long-term price scenarios based on the discussed factors, emphasizing the uncertainty involved.

3. Conclusion:

The Ethereum price prediction for 2024 and beyond is a complex interplay of technological advancements, adoption rates, regulatory landscapes, and market sentiment. While predicting the precise price is impossible, analyzing these factors provides a clearer picture of potential price movements. Remember that cryptocurrency investments are inherently risky. Thorough research and understanding of these risks are crucial before investing in Ethereum or any other cryptocurrency. Continue your research on Ethereum price prediction, stay updated on market developments, and make informed investment decisions based on your own risk tolerance. Share your thoughts on the Ethereum price prediction in the comments section below.

Featured Posts

-

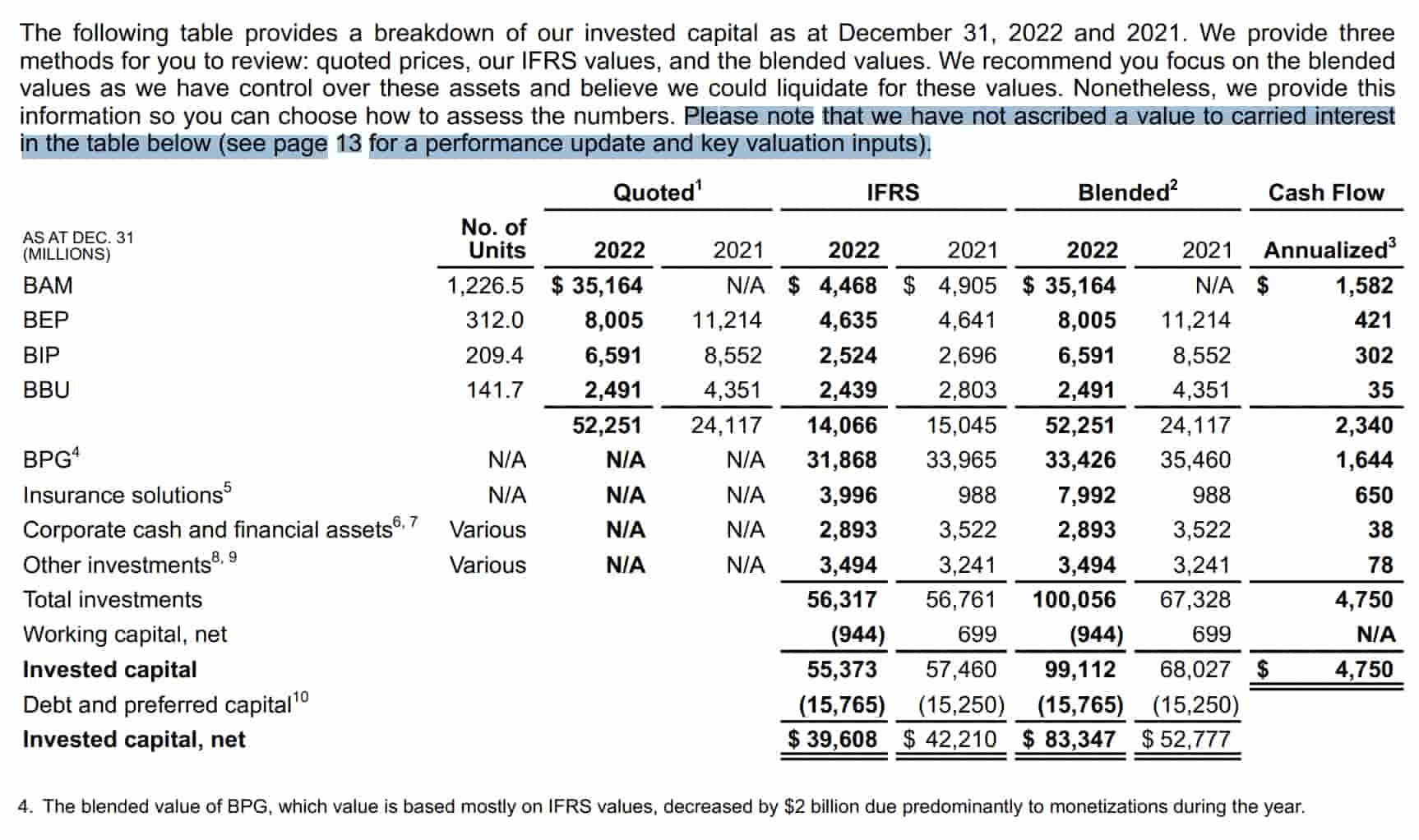

Brookfield Capitalizes On Market Dislocation With Opportunistic Investments

May 08, 2025

Brookfield Capitalizes On Market Dislocation With Opportunistic Investments

May 08, 2025 -

Ethereum Cross X Indicators Flash Buy Signal Institutions Accumulating 4 000 Price Predicted

May 08, 2025

Ethereum Cross X Indicators Flash Buy Signal Institutions Accumulating 4 000 Price Predicted

May 08, 2025 -

Xrp On The Brink Examining Etf Potential Sec Actions And Ripples Impact

May 08, 2025

Xrp On The Brink Examining Etf Potential Sec Actions And Ripples Impact

May 08, 2025 -

Inter Milan Vs Barcelona A Classic Champions League Showdown

May 08, 2025

Inter Milan Vs Barcelona A Classic Champions League Showdown

May 08, 2025 -

Lahwr Ky Ahtsab Edaltyn Khtm Wfaqy Hkwmt Ka Aqdam Awr Mmknh Ntayj

May 08, 2025

Lahwr Ky Ahtsab Edaltyn Khtm Wfaqy Hkwmt Ka Aqdam Awr Mmknh Ntayj

May 08, 2025