Ethereum Price Prediction: Significant ETH Accumulation Fuels Bullish Sentiment

Table of Contents

Growing Institutional and Whale Accumulation of ETH

Increasing accumulation of ETH by large investors and institutional players is a key driver of the bullish sentiment. On-chain data reveals significant increases in ETH holdings by whales, indicating a strong belief in Ethereum's long-term potential. This ETH whale activity is a significant indicator of market confidence.

- Increased ETH holdings by major cryptocurrency exchanges: Many large exchanges are showing increased ETH reserves, suggesting they anticipate future demand.

- Growing participation of institutional investors in the Ethereum ecosystem: Hedge funds and other institutional investors are increasingly allocating funds to Ethereum, viewing it as a valuable asset in their portfolios. This institutional Ethereum investment is a significant factor contributing to price stability and growth potential.

- Analysis of on-chain metrics like exchange balances and large wallet addresses: Tracking these metrics provides valuable insights into the distribution of ETH and the behavior of large holders. These large ETH holders are often considered key players in driving price movements.

- Evidence of long-term ETH holding strategies: Data suggests that many large investors are holding onto their ETH rather than selling, indicating a long-term bullish outlook.

Ethereum's Growing Utility and Ecosystem Development

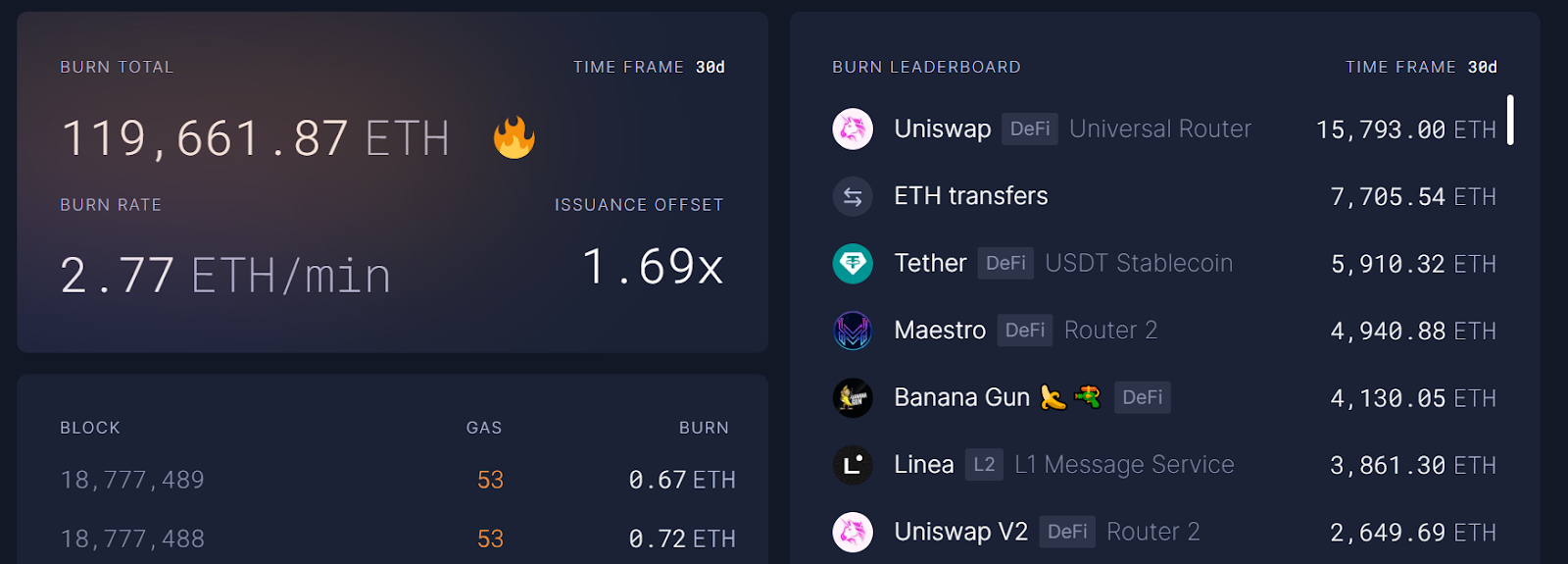

Ethereum's burgeoning ecosystem is another significant factor supporting a positive ETH price prediction. The platform's growing utility in decentralized finance (DeFi), non-fungible tokens (NFTs), and other decentralized applications (dApps) fuels demand for ETH. Furthermore, the ongoing development of Ethereum 2.0 promises to significantly enhance scalability and transaction speeds.

- Growth of the DeFi ecosystem built on Ethereum: The DeFi sector built on Ethereum continues to expand rapidly, driving significant demand for ETH. This includes a wide range of applications such as lending, borrowing, and decentralized exchanges (DEXs).

- Increasing popularity of NFTs and their impact on ETH demand: The explosive growth of NFTs has further fueled demand for ETH, as many NFT transactions are conducted on the Ethereum blockchain.

- Development updates on Ethereum 2.0 and its implications for the network: The transition to Ethereum 2.0 will significantly improve the network's scalability and efficiency, making it more attractive to users and developers.

- Discussion of Layer-2 scaling solutions: Solutions like Optimism and Arbitrum are improving Ethereum's scalability, reducing transaction fees and improving user experience.

Positive Market Sentiment and Macroeconomic Factors

Positive market sentiment towards cryptocurrencies in general, combined with specific factors impacting Ethereum, contributes to the bullish ETH forecast. While correlation with Bitcoin's price remains, Ethereum’s own fundamentals are increasingly driving its price action. Macroeconomic factors also play a role.

- Overall market sentiment towards cryptocurrencies: A generally positive market sentiment tends to benefit all cryptocurrencies, including Ethereum.

- Correlation between Bitcoin and Ethereum price movements: While historically correlated, Ethereum shows increasing independence from Bitcoin's price movements.

- Impact of macroeconomic factors like inflation and interest rates: Macroeconomic conditions can influence investment decisions in cryptocurrencies, impacting ETH prices.

- Potential regulatory developments and their influence on the market: Regulatory clarity or uncertainty can significantly impact the cryptocurrency market and Ethereum's price.

Potential Ethereum Price Predictions and Scenarios

Predicting the future price of ETH is inherently speculative. However, based on the factors discussed, various scenarios are possible.

- Short-term price predictions (weeks/months): Short-term predictions are highly volatile and depend on market sentiment and immediate news.

- Long-term price predictions (years): Long-term predictions are more reliant on fundamental factors like ecosystem growth and adoption.

- Bullish scenarios and their underlying assumptions: Continued institutional adoption, successful implementation of ETH 2.0, and increasing DeFi usage could drive bullish price action.

- Bearish scenarios and their potential risks: Negative market sentiment, regulatory crackdowns, or technical issues could lead to bearish price movements.

Conclusion

Significant ETH accumulation, coupled with the growing utility of the Ethereum ecosystem and positive market sentiment, suggests a potentially bullish outlook for ETH. While no one can predict the future with certainty, the factors discussed indicate a potentially favorable environment for Ethereum's price appreciation. Analyzing the Ethereum price prediction requires a holistic approach, considering on-chain data, technological advancements, and overall market dynamics.

Call to Action: Stay informed about the latest developments in the Ethereum ecosystem and continue to monitor Ethereum price prediction analyses to make informed decisions regarding your ETH investments. Conduct thorough research and consider diversifying your cryptocurrency portfolio to manage risk. Remember, this Ethereum price prediction is for informational purposes only and should not be taken as financial advice.

Featured Posts

-

Gary Neville Predicts Psg Vs Arsenal Will The Gunners Falter

May 08, 2025

Gary Neville Predicts Psg Vs Arsenal Will The Gunners Falter

May 08, 2025 -

Seged Slavi Tri Umf Nad Parizom Plasman U Chetvrtfinale L Sh Obezbe En

May 08, 2025

Seged Slavi Tri Umf Nad Parizom Plasman U Chetvrtfinale L Sh Obezbe En

May 08, 2025 -

Increased Ethereum Network Activity A 10 Jump In Address Interactions

May 08, 2025

Increased Ethereum Network Activity A 10 Jump In Address Interactions

May 08, 2025 -

Lahore And Punjab Eid Ul Fitr Weather Prediction Next Two Days

May 08, 2025

Lahore And Punjab Eid Ul Fitr Weather Prediction Next Two Days

May 08, 2025 -

6aus49 Lotto Ergebnisse Ziehung Vom 19 April 2025

May 08, 2025

6aus49 Lotto Ergebnisse Ziehung Vom 19 April 2025

May 08, 2025