Ethereum Transaction Volume Spikes: Nearly 10% Growth In Two Days

Table of Contents

Analyzing the Recent Surge in Ethereum Transaction Volume

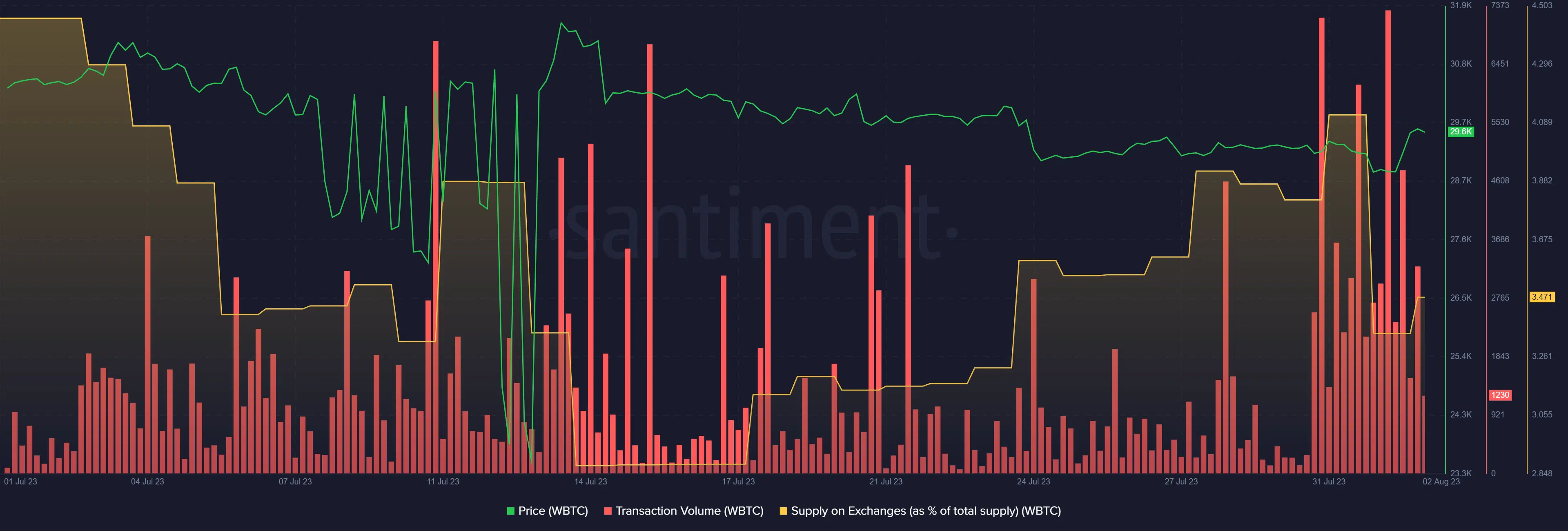

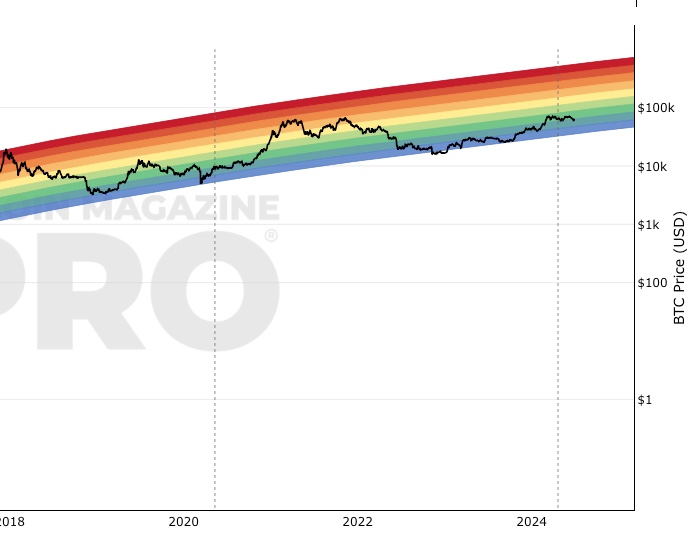

A 10% increase in Ethereum transaction volume over such a short period is a noteworthy event. This signifies a substantial upswing in the usage and activity on the Ethereum blockchain, indicating heightened interest and engagement within its ecosystem. While precise figures fluctuate, data from [insert source of data here, e.g., Etherscan] reveals a clear upward trend.

(Insert chart or graph visually representing the data here)

- Timeframe: The spike primarily occurred between [Start Date] and [End Date].

- Quantitative Increase: The transaction volume increased by approximately 9.8% during this period, rising from [Previous Volume] to [Current Volume] transactions.

- Historical Context: This surge is [higher/lower] compared to previous peaks and troughs observed in Ethereum transaction volume over the past [time period, e.g., six months]. This suggests [analysis of the significance of the increase in comparison to history].

Potential Drivers Behind the Increased Ethereum Activity

Several factors likely contributed to this recent surge in Ethereum transaction volume. Let's explore some of the key drivers.

DeFi Activity and its Impact

Decentralized Finance (DeFi) protocols continue to be a significant engine driving Ethereum transaction volume. Increased activity within various DeFi applications is a key contributor to this recent surge.

- Specific Protocols: Platforms like Uniswap, Aave, and Curve experienced notably increased user activity, with a rise in [specific transaction types, e.g., liquidity provision, token swaps].

- Transaction Types: The increase encompassed a variety of transactions, including lending, borrowing, yield farming, and token swaps.

- Analytics: Data from [link to DeFi analytics dashboard, e.g., DefiLlama] corroborates the heightened activity across major DeFi platforms.

NFT Market Trends

The Non-Fungible Token (NFT) market also played a role in boosting Ethereum transaction volume. A renewed interest in NFTs often translates directly into higher transaction activity on the Ethereum blockchain.

- Significant Sales: Several high-profile NFT sales and the launch of new collections likely contributed to the increase. [Mention specific examples if available].

- Market Health: The overall NFT market sentiment seems [positive/negative/neutral], which could be correlated with this spike.

- Data Sources: Consult resources like [link to NFT market data source, e.g., OpenSea] for further insights into recent NFT market trends.

Ethereum Network Upgrades and Developments

Recent developments within the Ethereum network itself might have influenced the surge.

- Protocol Changes: The [mention any relevant upgrade, e.g., recent EIP implementation] could have improved transaction efficiency or lowered costs, thus stimulating more activity.

- Impact on Efficiency: These upgrades potentially reduced transaction times and gas fees, making the network more attractive to users.

- Development News: For detailed information on recent Ethereum network upgrades, refer to [link to Ethereum development news].

External Market Factors

External market forces could also be at play.

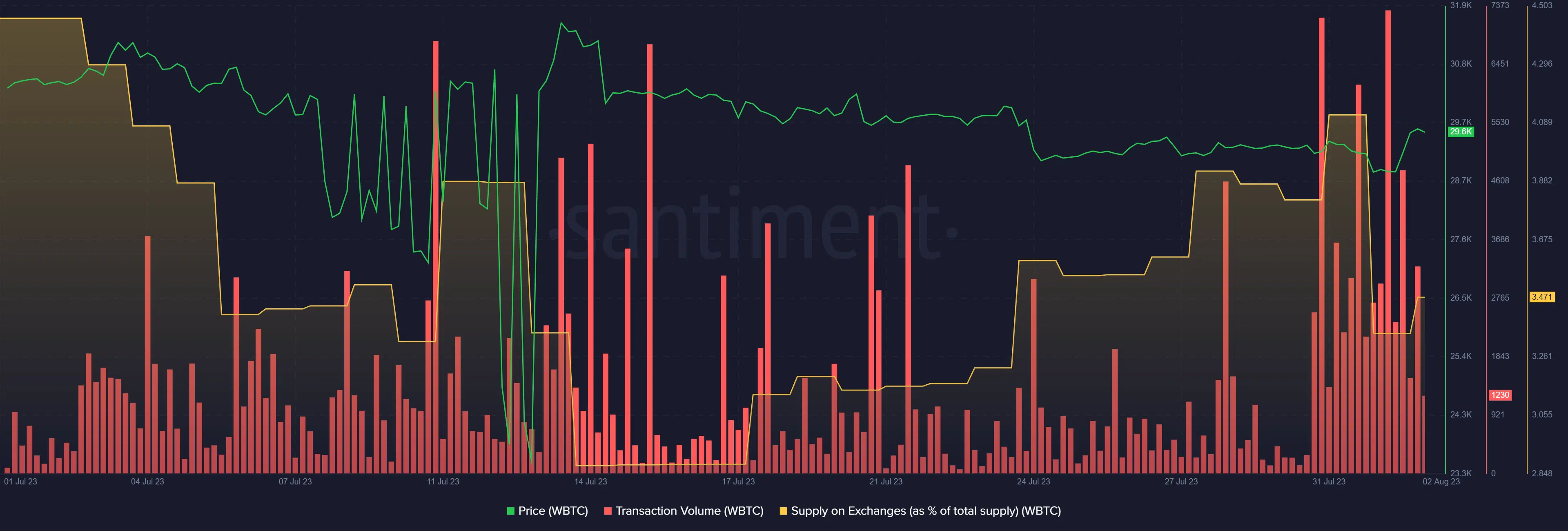

- Bitcoin Correlation: The relationship between Bitcoin's price and Ethereum transaction volume is often intertwined. A [rise/fall] in Bitcoin's price frequently influences Ethereum's activity.

- Regulatory News: Any major regulatory developments concerning cryptocurrencies could either stimulate or dampen investor activity on the Ethereum network.

- Market Sentiment: The overall market sentiment towards cryptocurrencies and the broader economic outlook can influence trading volume on all cryptocurrencies, including Ethereum.

Implications of the Increased Ethereum Transaction Volume

This surge in Ethereum transaction volume has several implications.

Network Congestion and Gas Fees

Higher transaction volume can lead to network congestion and increased gas fees.

- Average Gas Fees: During the spike, average gas fees were observed to be [high/low/average], resulting in [analysis of the impact on user experience].

- User Experience: High gas fees can impact the user experience, potentially discouraging smaller transactions or users with limited funds.

- Mitigation Strategies: Various strategies, including layer-2 scaling solutions, are being implemented to mitigate network congestion and high gas fees.

Ethereum's Position in the Crypto Market

This increase in Ethereum transaction volume reinforces its position as a leading blockchain platform.

- Comparative Analysis: Comparing its transaction volume with competitors like Solana or Cardano highlights its dominant market share and network utilization.

- Market Capitalization: The increased activity may positively influence Ethereum's overall market capitalization and value.

- Ecosystem Growth: The thriving DeFi and NFT ecosystems built on Ethereum further cement its relevance and importance in the crypto landscape.

Conclusion

The recent near 10% surge in Ethereum transaction volume is a significant event, driven by a confluence of factors including increased DeFi activity, NFT market trends, network upgrades, and external market forces. This heightened activity, while positive for the Ethereum ecosystem's growth, also presents challenges related to network congestion and gas fees. Understanding these dynamics is crucial for navigating the ever-evolving landscape of the Ethereum blockchain. Stay updated on the latest developments in Ethereum transaction volume and broader Ethereum network activity by subscribing to our newsletter, following us on social media, or revisiting our site for further in-depth analysis on Ethereum blockchain activity and the cryptocurrency market.

Featured Posts

-

Nuggets Rest Day Jokic And Starting Lineup Out After Grueling Loss

May 08, 2025

Nuggets Rest Day Jokic And Starting Lineup Out After Grueling Loss

May 08, 2025 -

Is 5 Xrp Realistic By 2025 A Comprehensive Look

May 08, 2025

Is 5 Xrp Realistic By 2025 A Comprehensive Look

May 08, 2025 -

10x Bitcoin Multiplier A Chart Of The Week Analysis

May 08, 2025

10x Bitcoin Multiplier A Chart Of The Week Analysis

May 08, 2025 -

Winning Lotto Numbers Saturday April 12th Draw Results

May 08, 2025

Winning Lotto Numbers Saturday April 12th Draw Results

May 08, 2025 -

Analyzing Chinas Response To Tariffs Lowering Rates And Boosting Bank Lending

May 08, 2025

Analyzing Chinas Response To Tariffs Lowering Rates And Boosting Bank Lending

May 08, 2025