Ethereum Weekly Chart Analysis: Deciphering The Latest Buy Signal

Table of Contents

Identifying Key Support and Resistance Levels

Understanding support and resistance levels is crucial for identifying potential buy and sell signals on the Ethereum weekly chart. These levels represent price points where the price has historically struggled to break through, offering valuable insights into potential future price movements.

Support Levels

Significant support levels on the Ethereum weekly chart act as potential price floors. A bounce off these levels could signal a buying opportunity. Analyzing previous support levels that have held is critical.

- $1,500: This level has acted as strong historical support for ETH, representing a potential bounce point. A break below this level could indicate further weakness.

- $1,200: This is a crucial support level. A break below $1,200 could signal a more significant decline and potentially trigger further selling pressure in the cryptocurrency market. This level holds psychological significance as well, representing a major psychological barrier for many investors.

- $1,000: This represents a key psychological support level. A sustained break below this could signal a bearish trend in the short to medium term.

Resistance Levels

Resistance levels act as price ceilings, and breaking through them signifies a strong bullish signal. Identifying these levels on the Ethereum weekly chart is essential for gauging the strength of any potential uptrend.

- $2,000: This is a major psychological resistance level and a previous high for ETH. A strong breakout above this level would signal significant bullish momentum.

- $2,500: This represents a significant resistance level. A decisive break above $2,500 could indicate a strong bullish trend and potentially trigger further buying pressure. This level has historically proven difficult to surpass.

Analyzing Key Technical Indicators

Technical indicators provide further context to the price action observed on the Ethereum weekly chart, helping to confirm or deny potential buy signals.

Moving Averages (MA)

Analyzing the relationship between short-term (e.g., 50-week MA) and long-term (e.g., 200-week MA) moving averages is crucial.

- Bullish Crossover (Golden Cross): A bullish crossover occurs when the short-term MA crosses above the long-term MA, often signaling a potential uptrend and a possible buy signal.

- Bearish Crossover (Death Cross): Conversely, a bearish crossover (short-term MA crossing below the long-term MA) indicates potential weakness and a possible sell signal. This should be considered when evaluating potential buy signals.

- MA Convergence/Divergence: Observing the convergence or divergence of moving averages can also reveal insights into momentum and potential trend reversals.

Relative Strength Index (RSI)

The RSI helps determine whether the market is oversold or overbought.

- Oversold Conditions (RSI < 30): An RSI reading below 30 often suggests oversold conditions, indicating potential buying opportunities. However, it's essential to consider this in conjunction with other indicators.

- Overbought Conditions (RSI > 70): An RSI reading above 70 signals overbought conditions, suggesting potential selling pressure.

MACD

The Moving Average Convergence Divergence (MACD) indicator identifies momentum shifts.

- MACD Crossovers: Bullish crossovers (MACD line crossing above the signal line) often signal buying opportunities, while bearish crossovers suggest the opposite.

- MACD Divergence: Divergence between the MACD and price action can be a significant indicator of potential trend reversals. Bullish divergence (price making lower lows while the MACD makes higher lows) can precede a price increase.

Evaluating the Overall Market Sentiment

Understanding the broader market sentiment is crucial for interpreting the Ethereum weekly chart analysis.

News and Events

Recent news and events significantly influence Ethereum's price.

- Positive News (e.g., technological advancements, regulatory clarity): Positive news can boost investor confidence and lead to price increases.

- Negative News (e.g., regulatory uncertainty, security breaches): Negative news can create sell-offs and price declines.

Bitcoin's Influence

Bitcoin's price movements heavily influence the cryptocurrency market, including Ethereum.

- Correlation: Ethereum often exhibits a positive correlation with Bitcoin. A significant increase in Bitcoin's price can positively impact Ethereum, and vice versa.

Volume Analysis

Analyzing trading volume provides crucial context to price action.

- High Volume on Price Increases: High volume during price increases confirms strong bullish momentum.

- Low Volume on Price Increases: Low volume during price increases suggests weak bullish momentum and a potential reversal.

Conclusion

This Ethereum weekly chart analysis reveals a complex picture. While certain indicators suggest a potential buy signal, it's crucial to remember that cryptocurrency investments are inherently risky. The key support and resistance levels identified, combined with the insights from technical indicators and market sentiment analysis, provide a framework for decision-making. Remember, this analysis is not financial advice. Further analyze the Ethereum weekly chart, consider the potential buy signal in the context of your risk tolerance, and make informed decisions about your Ethereum investments. By carefully evaluating the Ethereum weekly chart and considering the factors discussed above, you can develop a well-informed strategy for navigating the dynamic world of Ethereum investing.

Featured Posts

-

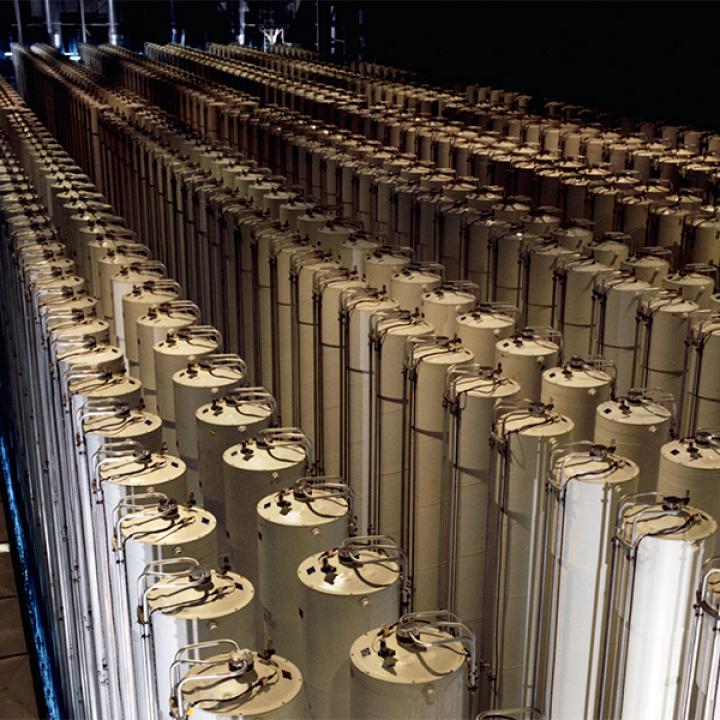

Investing In The Future A Geographic Analysis Of New Business Hot Spots

May 08, 2025

Investing In The Future A Geographic Analysis Of New Business Hot Spots

May 08, 2025 -

Top Ps 5 Pro Enhanced Games A Gamers Guide To Exclusives

May 08, 2025

Top Ps 5 Pro Enhanced Games A Gamers Guide To Exclusives

May 08, 2025 -

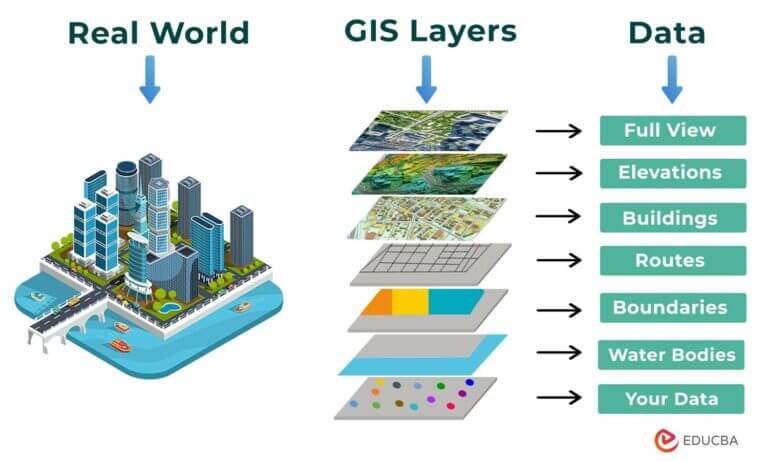

Cadillac Celestiq First Drive Review Luxury Innovation And Electric Power

May 08, 2025

Cadillac Celestiq First Drive Review Luxury Innovation And Electric Power

May 08, 2025 -

Chinas Economic Stimulus Rate Cuts And Easier Access To Bank Loans

May 08, 2025

Chinas Economic Stimulus Rate Cuts And Easier Access To Bank Loans

May 08, 2025 -

Transferimi Rekord I Neymar Ceku Detajet E Fshehta Dhe 222 Milione Eurot

May 08, 2025

Transferimi Rekord I Neymar Ceku Detajet E Fshehta Dhe 222 Milione Eurot

May 08, 2025