Ethereum's Growing Momentum: Address Activity Shows A 10% Increase

Table of Contents

Understanding Ethereum Address Activity

"Ethereum address activity" encompasses all interactions on the Ethereum blockchain originating from unique addresses. This includes transactions, smart contract interactions, and token transfers. It's far more than just the number of transactions; it represents the overall engagement and utilization of the network. This metric is a crucial indicator of network health and adoption for several reasons:

- Increased activity indicates higher network usage: More addresses interacting signifies a broader user base and increased demand for the network's services.

- Higher usage suggests growing adoption and user engagement: This points towards a thriving and expanding ecosystem.

- This can be a strong indicator of future price movements: (Disclaimer: This is not financial advice. While increased activity often correlates with price increases, it's not a guaranteed predictor.) Increased network usage can signal increased demand and potentially impact the price of ETH.

Factors Contributing to the 10% Increase in Ethereum Address Activity

The recent 10% surge in Ethereum address activity is likely a result of several converging factors:

- Increased DeFi activity: Decentralized finance (DeFi) protocols built on Ethereum, such as Uniswap, Aave, Compound, and MakerDAO, continue to attract significant user participation. The volume of transactions and interactions within these protocols directly contributes to increased address activity.

- Growing NFT market: The Non-Fungible Token (NFT) market remains robust, with leading marketplaces like OpenSea, Rarible, and LooksRare facilitating millions of transactions daily. Minting, buying, and selling NFTs all contribute significantly to Ethereum address activity.

- Development of new dApps and applications: The constant innovation and development of new decentralized applications (dApps) on the Ethereum network attracts new users and increases overall network activity. These range from gaming applications to decentralized social networks.

- Improved scalability solutions: Layer-2 scaling solutions like Polygon, Optimism, Arbitrum, and zkSync are alleviating congestion on the main Ethereum network, making it more accessible and efficient. This increased efficiency leads to more transactions and higher address activity.

- Growing institutional interest in Ethereum: More institutional investors are showing interest in Ethereum, increasing the overall volume of transactions and impacting address activity.

Analyzing the Data: Types of Ethereum Address Activity

The 10% increase in Ethereum address activity isn't monolithic. It's comprised of various types of interactions:

- Percentage increase in transaction volume: A substantial portion of the increase likely stems from a rise in the overall number of transactions processed on the Ethereum network.

- Percentage increase in smart contract interactions: The growth in DeFi and NFT activity directly translates to a higher number of interactions with smart contracts.

- Growth in unique active addresses: The increase in unique active addresses is a particularly strong indicator of expanding user adoption and network growth. It represents new users joining the Ethereum ecosystem.

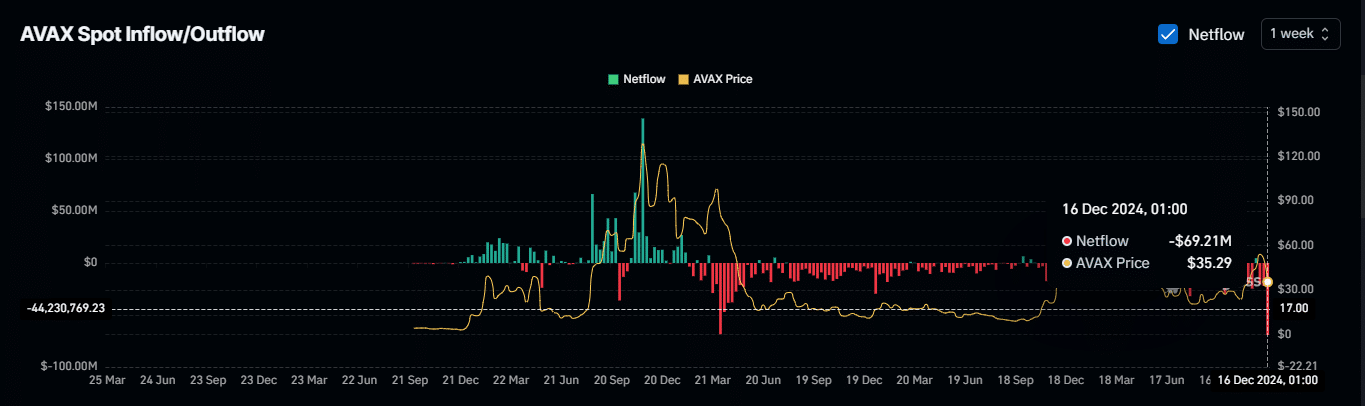

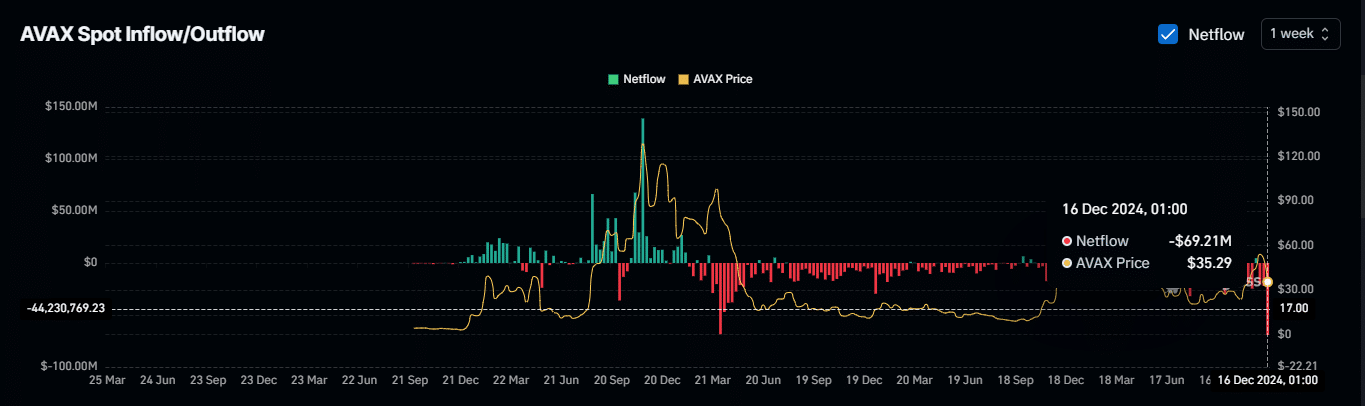

- Analysis of the types of transactions: A detailed breakdown reveals the proportion of transactions originating from DeFi, NFTs, ERC-20 token transfers, and other activities. (Note: Charts and graphs illustrating this data would be included here if available.)

Implications for the Future of Ethereum

The sustained increase in Ethereum address activity points towards a positive outlook for the platform:

- Potential for continued growth and adoption: The current trends suggest that Ethereum's growth will likely continue, driven by factors discussed above.

- Implications for Ethereum's price and market capitalization: Increased network usage often correlates with higher demand and potentially a rise in ETH's price and market capitalization. (Disclaimer: This is not financial advice.)

- The role of Ethereum 2.0: The upcoming transition to Ethereum 2.0 will further enhance scalability and efficiency, potentially leading to even higher address activity.

- Challenges and potential limitations: While the future looks bright, challenges remain, such as maintaining network security and addressing potential scalability bottlenecks.

Conclusion

The recent 10% surge in Ethereum address activity signifies a positive trend, driven by factors such as increased DeFi usage, NFT activity, and the development of new applications. This growth underscores the potential of the Ethereum ecosystem and its continued importance in the blockchain space. Stay informed about the evolving landscape of Ethereum address activity and its impact on the cryptocurrency market. Follow [your website/platform] for continued updates and analysis on Ethereum's growth and Ethereum address activity.

Featured Posts

-

Ftc Challenges Microsofts Activision Blizzard Acquisition A Deep Dive

May 08, 2025

Ftc Challenges Microsofts Activision Blizzard Acquisition A Deep Dive

May 08, 2025 -

Real Time Bitcoin Fiyat Takibi Ve Analizi

May 08, 2025

Real Time Bitcoin Fiyat Takibi Ve Analizi

May 08, 2025 -

Second Aircraft Carrier Jet Lost From Uss Truman Details Of The Incident

May 08, 2025

Second Aircraft Carrier Jet Lost From Uss Truman Details Of The Incident

May 08, 2025 -

Finding A Veteran Replacement For Taj Gibson On The Hornets

May 08, 2025

Finding A Veteran Replacement For Taj Gibson On The Hornets

May 08, 2025 -

Navigating Ubers New Cash Only Auto Service Option

May 08, 2025

Navigating Ubers New Cash Only Auto Service Option

May 08, 2025