Euronext Amsterdam Stocks Surge 8% After Trump Tariff Pause

Table of Contents

The Impact of the Tariff Pause on Euronext Amsterdam

The pause in specific Trump-era tariffs, particularly those affecting certain Dutch exports to the US, had a direct and positive impact on the performance of Euronext Amsterdam. This unexpected policy shift significantly reduced uncertainty for numerous Dutch businesses listed on the exchange. The market volatility experienced before the announcement quickly subsided as investors reacted positively to this improved trade outlook.

-

Specific Tariffs Paused: The pause included tariffs on key Dutch exports such as agricultural products (e.g., cheese, flowers), certain manufactured goods, and technology components. These sectors represent a significant portion of the Dutch economy and their inclusion in the tariff pause greatly impacted market sentiment.

-

Sectors Most Affected: The technology and agricultural sectors, along with several manufacturing sub-sectors, experienced the most pronounced benefits. The reduced trade barriers led to immediate improvements in export prospects, impacting company profitability and bolstering investor confidence.

-

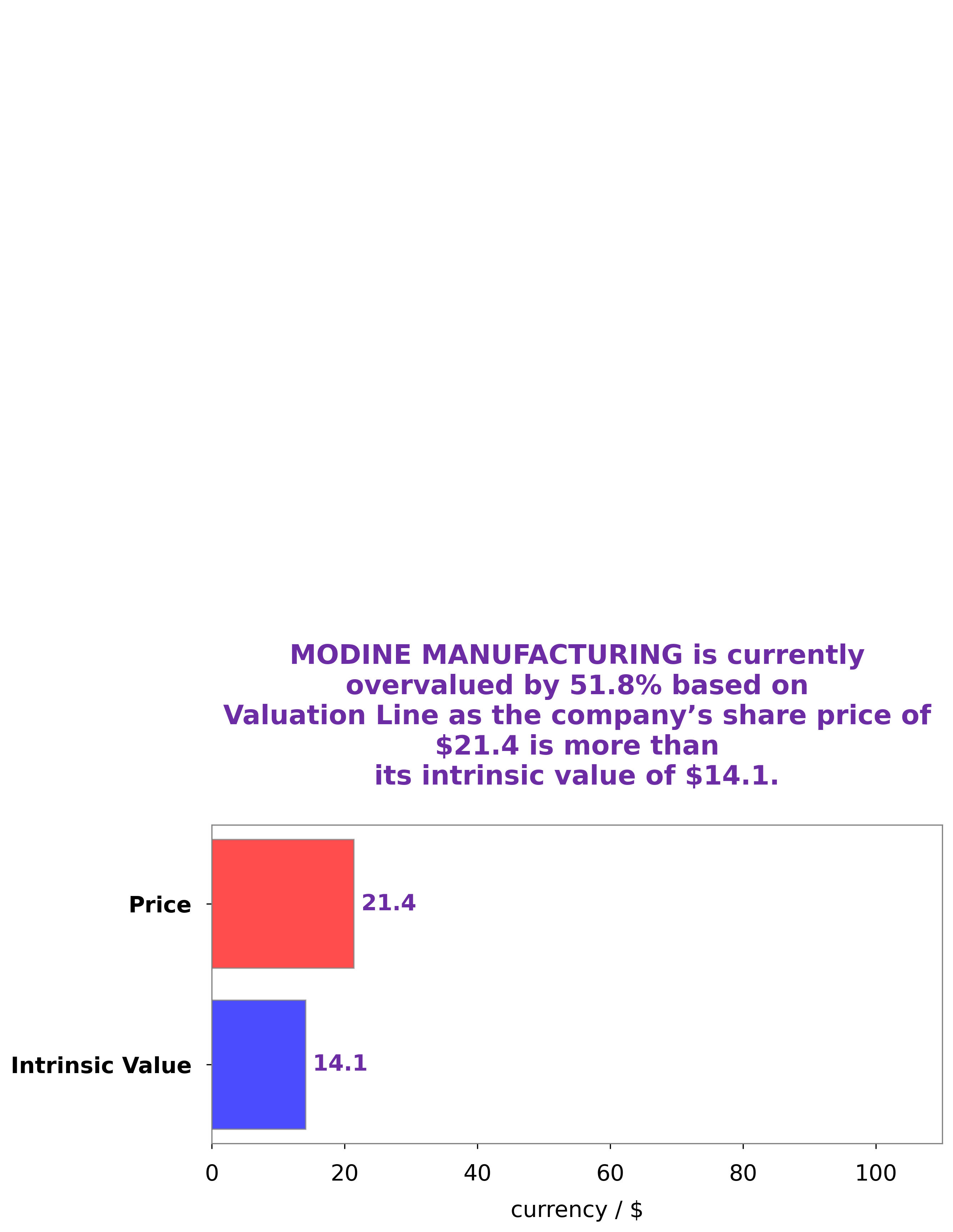

Quantifying the Surge: The 8% surge represents a substantial increase compared to the previous month's performance, which saw a more modest growth. Charts and graphs (which would be included here in a published article) clearly illustrate the sharp upward trend following the tariff announcement. This jump signifies a considerable shift in investor sentiment and a potential turning point for the Euronext Amsterdam market.

-

Investment Opportunities: This unexpected market shift presents numerous investment opportunities for those willing to analyze the market closely and understand the long-term outlook for affected sectors. However, it's crucial to conduct thorough due diligence before committing to any investment.

Analysis of Winning Sectors on Euronext Amsterdam

Following the tariff news, several sectors on Euronext Amsterdam saw exceptional performance, outpacing the overall market growth. A detailed sector analysis reveals the factors driving these gains and offers valuable insights into potential future growth.

-

Top-Performing Sectors: The technology sector, driven by companies specializing in semiconductor manufacturing and software development, showed the most significant gains. The agricultural sector also performed exceptionally well due to reduced trade barriers.

-

Reasons for Outperformance: Reduced uncertainty regarding export tariffs led to improved profit forecasts, attracting investors and driving up stock prices. The increased global demand for Dutch exports further contributed to the surge.

-

Examples of Top Performers: (Specific examples of companies with significant stock gains should be cited here, including ticker symbols for easy reference and verification). These companies represent the positive impact of the tariff pause on specific niches within their respective sectors.

-

Long-Term Outlook: While short-term gains are evident, the long-term outlook for these high-performing sectors depends on several factors, including global economic conditions and any future changes in trade policy.

Investor Sentiment and Market Predictions

Analyzing investor sentiment reveals a marked shift in confidence following the tariff pause. Before the announcement, uncertainty and pessimism prevailed. The positive news dramatically changed the sentiment, leading to a surge in buying activity.

-

Sentiment Shift: A clear shift from negative to positive sentiment is evident in various market indicators, including increased trading volume and improved investor confidence surveys.

-

Market Predictions: Experts generally predict continued growth for Euronext Amsterdam stocks in the short to medium term, although many caution against over-optimism due to various global uncertainties.

-

Potential Risks and Uncertainties: Potential risks include global economic slowdown, geopolitical instability, and any unforeseen changes in trade policies. These factors could negatively impact the market's performance.

-

Investment Strategies: Investors should adopt a diversified portfolio strategy, carefully assessing risk tolerance and investment horizons before committing substantial capital.

Short-Term vs. Long-Term Implications

Understanding both the short-term impact and the long-term outlook is crucial for effective investment planning.

-

Short-Term Gains: The 8% surge is a clear indicator of short-term gains, but the sustainability of these gains requires careful consideration.

-

Long-Term Growth Factors: Sustained long-term growth depends on the continued reduction of trade barriers, robust global economic conditions, and the successful adaptation of Dutch businesses to evolving market dynamics.

-

Investment Horizons: Investors with short-term horizons might consider capitalizing on the current market surge, while those with a longer-term perspective should focus on companies with solid fundamentals and long-term growth potential. A proper risk assessment is crucial for all investment decisions.

Conclusion

The pause in Trump-era tariffs has resulted in a significant 8% surge in Euronext Amsterdam stocks. Our analysis of winning sectors, investor sentiment, and potential risks reveals both opportunities and challenges in this dynamic market. While short-term gains are evident, the long-term outlook depends on various factors. The pause in Trump-era tariffs has created exciting opportunities within the Euronext Amsterdam market. Stay informed on the latest developments and capitalize on potential gains by researching Euronext Amsterdam stocks and developing a well-informed investment strategy. Consider consulting a financial advisor to navigate this dynamic market effectively.

Featured Posts

-

Rekomendasi Dayamitra Telekomunikasi Mtel And Merdeka Battery Mbma Pasca Masuk Msci Small Cap Index

May 24, 2025

Rekomendasi Dayamitra Telekomunikasi Mtel And Merdeka Battery Mbma Pasca Masuk Msci Small Cap Index

May 24, 2025 -

News Corp Undervalued And Underappreciated Analyzing Its Current Market Position

May 24, 2025

News Corp Undervalued And Underappreciated Analyzing Its Current Market Position

May 24, 2025 -

Pameran Otomotif Dan Seni Porsche Indonesia Classic Art Week 2025

May 24, 2025

Pameran Otomotif Dan Seni Porsche Indonesia Classic Art Week 2025

May 24, 2025 -

Gear Essentials For Ferrari Owners A Comprehensive Guide

May 24, 2025

Gear Essentials For Ferrari Owners A Comprehensive Guide

May 24, 2025 -

Country Living On A Budget Securing Your Dream Home For Under 1 Million

May 24, 2025

Country Living On A Budget Securing Your Dream Home For Under 1 Million

May 24, 2025

Latest Posts

-

Open Ais Chat Gpt An Ftc Investigation And The Future Of Ai

May 24, 2025

Open Ais Chat Gpt An Ftc Investigation And The Future Of Ai

May 24, 2025 -

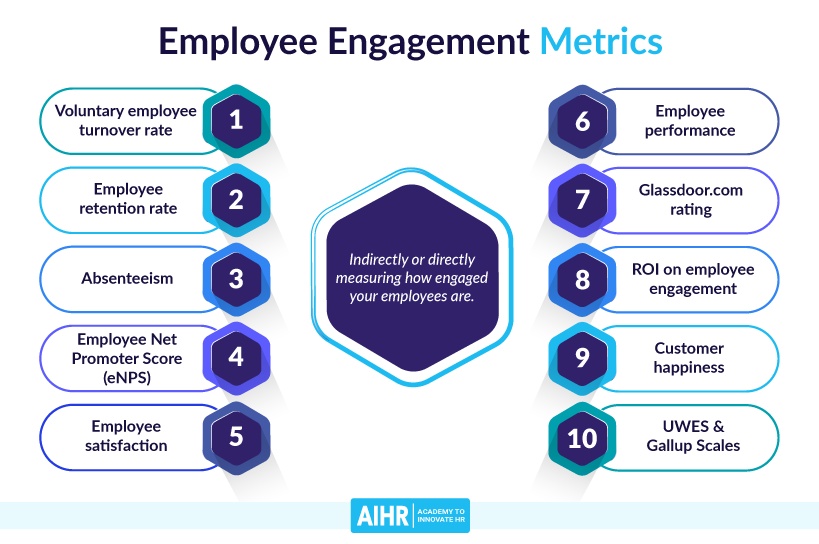

The Importance Of Middle Management A Key To Employee Engagement And Business Growth

May 24, 2025

The Importance Of Middle Management A Key To Employee Engagement And Business Growth

May 24, 2025 -

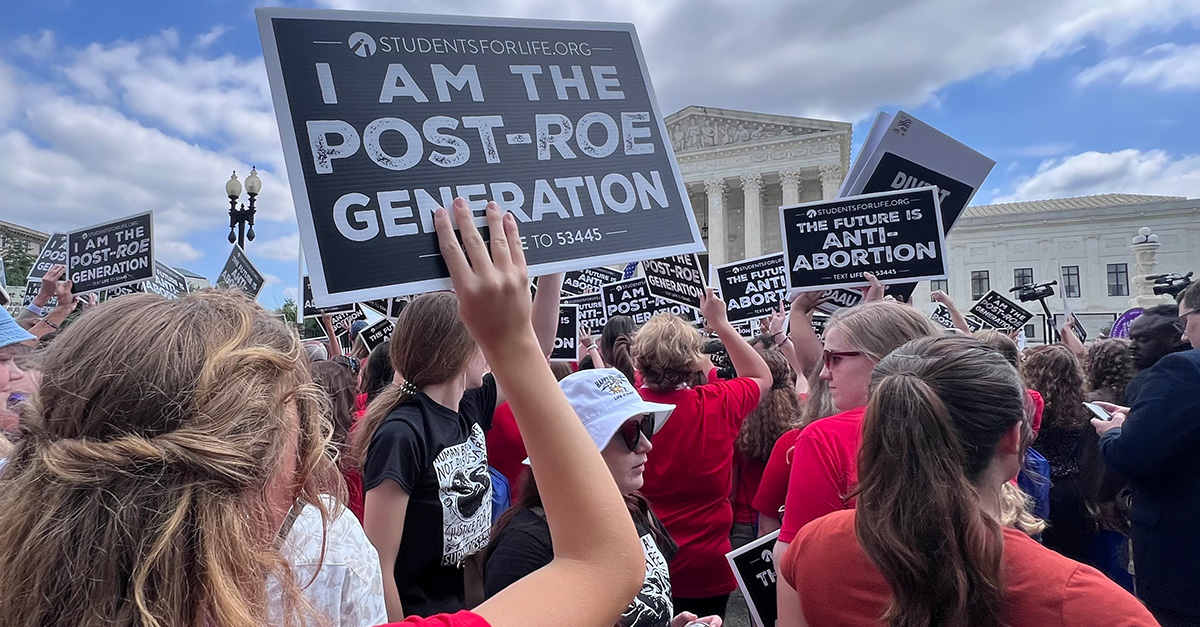

Access To Birth Control The Impact Of Over The Counter Options In A Post Roe World

May 24, 2025

Access To Birth Control The Impact Of Over The Counter Options In A Post Roe World

May 24, 2025 -

Understanding The Crucial Role Of Middle Managers In Organizations

May 24, 2025

Understanding The Crucial Role Of Middle Managers In Organizations

May 24, 2025 -

Bmw And Porsches China Challenges A Growing Trend

May 24, 2025

Bmw And Porsches China Challenges A Growing Trend

May 24, 2025