Evaluating Uber (UBER) As An Investment Opportunity

Table of Contents

Uber's Business Model and Market Dominance

Uber's success hinges on its multifaceted business model, extending beyond its core ride-sharing service. Understanding its market dominance in various sectors is crucial for assessing the Uber investment opportunity.

Ride-Sharing Services

Uber's ride-sharing service remains its flagship offering, commanding a significant global market share. However, the competitive landscape, particularly with rivals like Lyft, necessitates constant innovation and strategic adaptation.

- Market Share Statistics: While precise global figures fluctuate, Uber consistently holds a leading position in many major cities worldwide. Regional market share varies depending on competitive intensity and regulatory environments.

- Geographic Expansion Plans: Uber continues to expand into new markets, particularly in emerging economies with growing populations and increasing demand for convenient transportation. This expansion fuels future growth potential for Uber stock.

- Technological Innovations in Ride-Sharing: Uber invests heavily in technology, including advancements in ride matching algorithms, safety features, and autonomous vehicle development. These innovations aim to enhance the user experience and improve operational efficiency.

- Competitive Advantages and Disadvantages: Uber's extensive network effect, brand recognition, and technological capabilities provide significant competitive advantages. However, intense competition, regulatory hurdles, and driver-related issues pose ongoing challenges.

Uber Eats and Food Delivery

Uber Eats has emerged as a major player in the competitive food delivery market, vying with established players like DoorDash and Grubhub. Its performance significantly impacts the overall Uber investment opportunity.

- Market Share Comparisons: Uber Eats holds a substantial but fluctuating market share in various regions. Its performance varies depending on local competition and market saturation.

- Revenue Growth Analysis: The food delivery segment has shown significant revenue growth for Uber, contributing considerably to its overall financial performance and attractiveness as an Uber investment.

- Profitability Metrics: Profitability in the food delivery sector remains a challenge for many players, including Uber. Analyzing its operating margins and net income from this segment is crucial for evaluating the Uber investment opportunity.

- Strategies for Future Growth in Food Delivery: Uber continues to invest in marketing, technology, and strategic partnerships to enhance its food delivery service and gain market share, improving the prospects of the Uber investment.

Other Business Ventures (Freight, Autonomous Vehicles)

Uber's diversification efforts into freight transportation and autonomous vehicles represent high-growth potential but also carry significant risk. These ventures could greatly impact the long-term viability of an Uber investment.

- Market Potential of Each Venture: The freight and autonomous vehicle markets present enormous potential for future revenue streams, offering exciting possibilities for the Uber investment.

- Investment Timelines and Expected Returns: Realizing substantial returns from these ventures will likely require significant investment and a longer timeframe, affecting the attractiveness of an Uber investment in the short term.

- Associated Risks and Challenges: These ventures involve substantial technological and regulatory hurdles, increasing the risk associated with an Uber investment.

Financial Performance and Valuation of UBER Stock

Analyzing Uber's financial performance and stock valuation is paramount for determining whether it presents a sound Uber investment opportunity.

Revenue and Profitability

Uber's financial performance is characterized by fluctuating revenue streams and varying profitability levels across its different segments. Careful analysis of key financial ratios is essential.

- Historical Financial Data Analysis: Review past financial statements to identify trends in revenue growth, operating margins, and net income. This historical data provides context for future projections.

- Projected Financial Forecasts: Analyze financial forecasts from reputable sources to assess future revenue growth and profitability. These projections play a significant role in valuation models.

- Comparison with Industry Competitors: Compare Uber's financial performance to its key competitors (Lyft, DoorDash, etc.) to gauge its relative financial strength and identify areas for improvement.

Debt and Cash Flow

Understanding Uber's debt levels and cash flow generation is critical for assessing its financial health and stability.

- Debt-to-Equity Ratio: This ratio indicates Uber's reliance on debt financing. A high ratio may signal increased financial risk.

- Free Cash Flow Analysis: Analyzing free cash flow reveals Uber's ability to generate cash after covering operating expenses and capital expenditures, influencing the viability of the Uber investment.

- Liquidity Ratios: Liquidity ratios assess Uber's ability to meet its short-term obligations, which is critical for maintaining financial stability.

Stock Valuation

Employing various valuation methods helps determine whether Uber stock is currently overvalued or undervalued.

- Comparison of Valuation Metrics with Industry Peers: Compare Uber's valuation metrics (P/E ratio, Price-to-Sales ratio, etc.) to those of its competitors to assess relative valuation.

- Sensitivity Analysis of Valuation Assumptions: Conduct sensitivity analyses to understand how changes in key assumptions (e.g., revenue growth, discount rate) affect the valuation of Uber stock.

- Identification of Potential Risks and Uncertainties Affecting Valuation: Identify potential risks and uncertainties (e.g., regulatory changes, increased competition) that could impact Uber's future performance and valuation.

Risks and Challenges Facing Uber

Despite its significant market presence, Uber faces substantial risks and challenges that could negatively impact its stock price and the Uber investment opportunity.

Regulatory and Legal Hurdles

Navigating the complex regulatory landscape is a persistent challenge for Uber.

- Legal Battles and Their Potential Impact: Ongoing legal battles concerning labor classifications, licensing, and safety regulations can significantly impact Uber's profitability and reputation.

- Varying Regulations Across Different Jurisdictions: Different regulations across various countries and regions pose logistical and operational challenges.

- Strategies for Navigating Regulatory Landscape: Uber's success depends on its ability to proactively adapt to and influence regulatory changes.

Competition and Market Saturation

Intense competition and potential market saturation represent major risks.

- Key Competitors and Their Market Strategies: Analyzing competitors' strategies (Lyft, DoorDash, etc.) is crucial for understanding the competitive dynamics.

- Potential for Price Wars and Reduced Profitability: Price wars could significantly erode profit margins.

- Strategies for Maintaining Competitive Advantage: Uber must continually innovate and differentiate its services to maintain a competitive edge.

Economic Factors and Market Volatility

Macroeconomic conditions significantly impact Uber's performance and stock price.

- Sensitivity Analysis to Economic Downturns: Analyze how economic downturns affect consumer spending on ride-sharing and food delivery services.

- Impact of Fuel Price Fluctuations: Fuel price volatility impacts operating costs and profitability.

- Influence of Consumer Spending Habits: Shifts in consumer spending patterns can significantly influence demand for Uber's services.

Conclusion

Investing in Uber (UBER) stock presents both opportunities and risks. While Uber's diversified business model and market leadership in ride-sharing and food delivery are attractive features, intense competition, regulatory uncertainties, and economic volatility pose significant challenges. The financial health of Uber, its revenue generation, and the long-term success of its diversifications into autonomous vehicles and freight are all pivotal factors affecting the potential return of an Uber investment. A thorough evaluation of its financial performance, valuation, and risk profile, alongside keeping up to date with financial news and market developments, is essential before making any investment decision.

Ultimately, the decision to invest in Uber (UBER) stock rests on your individual risk tolerance and investment goals. Conduct thorough research and consider consulting a financial advisor before making any investment decisions related to UBER stock. Staying updated on Uber's financial performance and market developments is crucial for making informed decisions about your UBER investment.

Featured Posts

-

Realistic Wwii Movies Military Historians Picks

May 08, 2025

Realistic Wwii Movies Military Historians Picks

May 08, 2025 -

Superman Extended Cinema Con Footage Reveals Kryptos Role

May 08, 2025

Superman Extended Cinema Con Footage Reveals Kryptos Role

May 08, 2025 -

Saturday Night Live And Counting Crows A Career Defining Moment

May 08, 2025

Saturday Night Live And Counting Crows A Career Defining Moment

May 08, 2025 -

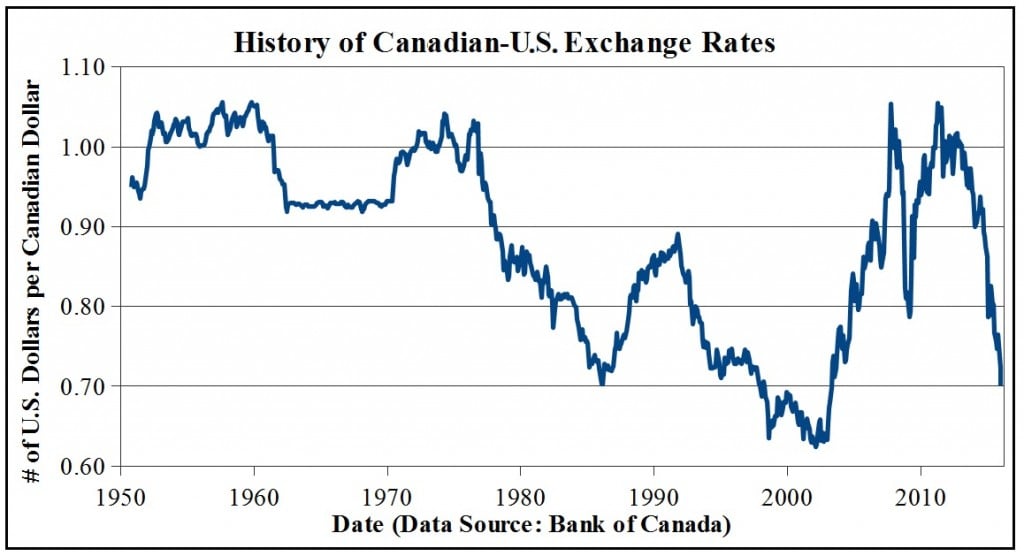

Understanding The Current State The Canadian Dollars Exchange Rate

May 08, 2025

Understanding The Current State The Canadian Dollars Exchange Rate

May 08, 2025 -

Lahwr Hayykwrt Awr Dley Edaltwn Ke Jjz Kw Sht Ky Anshwrns Ky Shwlt

May 08, 2025

Lahwr Hayykwrt Awr Dley Edaltwn Ke Jjz Kw Sht Ky Anshwrns Ky Shwlt

May 08, 2025