Examining Minnesota's Film Tax Credit Program: Success Or Failure?

Table of Contents

Is Minnesota's film industry booming, or struggling to find its footing? The answer may lie in the effectiveness of its film tax credit program. This article will analyze Minnesota's Film Tax Credit Program, examining its economic impact, job creation, and overall contribution to the state's economy. This article will examine the evidence to determine whether the program has been a worthwhile investment for Minnesota taxpayers.

<h2>Economic Impact of Minnesota's Film Tax Credit</h2>

The economic impact of Minnesota's Film Tax Credit Program is a complex issue, requiring a thorough analysis of both direct and indirect benefits.

<h3>Direct Economic Benefits</h3>

The program aims to stimulate direct economic activity through increased spending within the state. This includes:

- Increased spending in local businesses: Film productions require a wide range of goods and services, from catering and transportation to equipment rentals and location permits, boosting local businesses.

- Revenue generated through sales tax: The increased spending from film productions generates sales tax revenue for the state, offsetting some of the costs associated with the tax credit program.

- Job creation in film-related industries: Productions create jobs for on-set crews, production assistants, and other support staff, providing short-term and potentially long-term employment opportunities.

Quantifying these benefits requires access to comprehensive data on film production spending in Minnesota. Studies analyzing the economic impact of similar programs in other states could provide a useful benchmark. For example, a study by [cite a credible source, e.g., a university research paper or government report] on the impact of film tax credits in [another state] showed [insert key findings]. Further research is needed to generate similar data specifically for Minnesota's program.

<h3>Indirect Economic Benefits</h3>

Beyond direct spending, the film tax credit program can generate indirect economic benefits:

- Increased tourism: Film productions can put Minnesota on the map, attracting tourists to filming locations and boosting the tourism sector. The popularity of filming locations featured in successful movies or TV shows can significantly impact local economies.

- Improved state image and branding: Successful film productions filmed in Minnesota can enhance the state's image and attract investment in other sectors.

- Attraction of skilled workers: The program can attract skilled film professionals to the state, contributing to long-term growth in the industry. This could involve attracting individuals with expertise in areas like visual effects, sound design, or post-production work.

However, accurately measuring these indirect benefits is challenging, and requires sophisticated econometric modeling techniques.

<h3>Cost-Benefit Analysis</h3>

A comprehensive cost-benefit analysis is crucial to assess the program's effectiveness. This requires:

- Determining the total cost of the tax credit program annually.

- Accurately measuring the economic benefits generated, both direct and indirect.

- Comparing the total cost to the total economic benefits to determine the return on investment (ROI).

Ideally, this analysis should be conducted by an independent third-party to ensure objectivity and transparency. Visual representations, such as charts and graphs comparing the program's cost to its reported economic impact, would enhance understanding and transparency.

<h2>Job Creation and Workforce Development</h2>

Minnesota's Film Tax Credit Program aims to create jobs and stimulate workforce development within the film industry.

<h3>Types of Jobs Created</h3>

The program supports the creation of diverse jobs, including:

- On-set crew positions: Directors, producers, camera operators, gaffers, and other essential on-set personnel.

- Post-production jobs: Editors, sound designers, visual effects artists, and compositors.

- Supporting roles: Catering staff, transportation services, security personnel, and location scouts.

It's crucial to distinguish between temporary jobs created during individual productions and potentially longer-term employment opportunities that arise from sustained industry growth.

<h3>Skilled Labor and Training</h3>

The success of the program hinges on its ability to attract and develop skilled labor:

- Training initiatives: Does the program actively support training programs for aspiring film professionals in Minnesota? Are there partnerships with educational institutions to provide relevant skills development?

- Attracting skilled workers: Does the program incentivize experienced professionals to relocate to Minnesota from other states or countries?

- Workforce development impact: What is the demonstrable impact of the program on the local workforce in terms of increased employment and higher earning potential?

<h3>Impact on Unemployment Rates</h3>

Analyzing unemployment data in regions where film productions are concentrated can reveal the program's impact on job creation and overall employment levels. Correlation, however, doesn't equal causation, and other factors must be considered when assessing this impact.

<h2>Challenges and Criticisms of the Minnesota Film Tax Credit Program</h2>

Despite its intended benefits, the Minnesota Film Tax Credit Program faces several challenges and criticisms.

<h3>Concerns about Taxpayer Funding</h3>

A significant criticism centers on the use of taxpayer funds to subsidize the film industry. Opponents argue that:

- The program's cost could be better allocated to other public services.

- The economic benefits generated may not justify the expenditure of public funds.

These arguments necessitate a thorough cost-benefit analysis to determine the program's efficiency and effectiveness relative to other public spending priorities.

<h3>Accountability and Transparency</h3>

Concerns exist regarding the program's accountability and transparency:

- Is the administration of the program transparent and easily accessible to the public?

- Are mechanisms in place to prevent fraud and ensure that the tax credits are used appropriately?

- Are regular audits and independent evaluations conducted to assess the program's performance?

Improved data collection and reporting would help address these concerns and build public trust.

<h3>Competition with Other States</h3>

Minnesota's film tax credit program must compete with similar incentives offered by other states to attract film productions:

- A comparison of Minnesota's incentives with those offered by neighboring states is necessary to assess its competitiveness.

- Understanding the factors that influence production companies' location decisions is vital in evaluating the program's effectiveness.

<h2>Conclusion: Final Verdict on Minnesota's Film Tax Credit Program</h2>

While Minnesota's Film Tax Credit Program has demonstrably generated some economic activity and jobs, questions remain regarding its overall cost-effectiveness and long-term sustainability. The program’s success hinges on a transparent and rigorous cost-benefit analysis that considers both direct and indirect economic impacts, as well as the program's role in workforce development. Further research and transparent evaluation of Minnesota's film tax credit program, including independent audits and potentially adjustments to its structure, are needed to determine its future viability and optimize its effectiveness in boosting the state's film industry and attracting further film production tax credits in Minnesota. Data collection should be improved, and more rigorous methods of tracking economic benefits and cost should be implemented. Only then can we fully assess the value of Minnesota film tax incentives.

Featured Posts

-

Black Hawk Helicopter Crash Pilots Disregard For Instructor Led To 67 Deaths

Apr 29, 2025

Black Hawk Helicopter Crash Pilots Disregard For Instructor Led To 67 Deaths

Apr 29, 2025 -

Akesos Disappointing Trial Results Send Shares Plummeting

Apr 29, 2025

Akesos Disappointing Trial Results Send Shares Plummeting

Apr 29, 2025 -

Las Vegas Police Seek Publics Help In Finding Missing Paralympian

Apr 29, 2025

Las Vegas Police Seek Publics Help In Finding Missing Paralympian

Apr 29, 2025 -

Papal Conclave Convicted Cardinals Unexpected Demand

Apr 29, 2025

Papal Conclave Convicted Cardinals Unexpected Demand

Apr 29, 2025 -

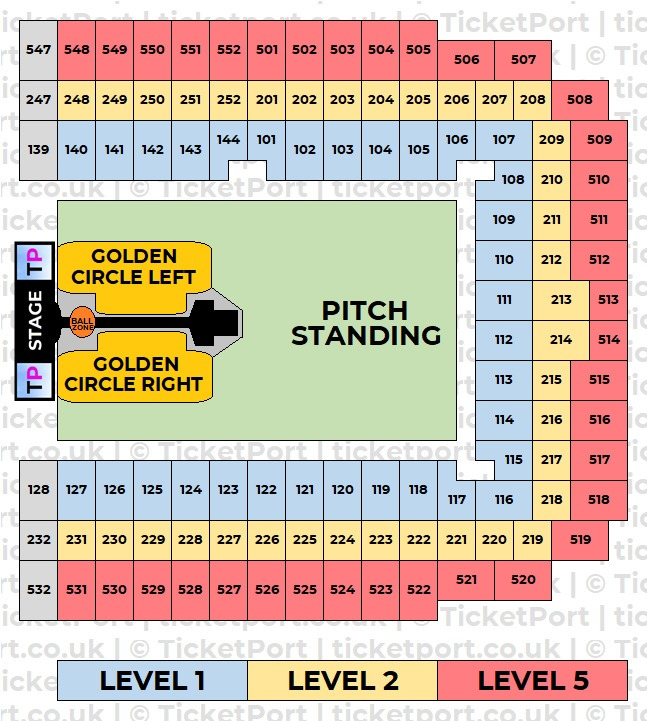

Capital Summertime Ball 2025 Tickets Purchase Process And Important Dates

Apr 29, 2025

Capital Summertime Ball 2025 Tickets Purchase Process And Important Dates

Apr 29, 2025