Exclusive Investment: Elliott Bets On Russian Gas Pipeline Project

Table of Contents

H2: Elliott Management: A Profile of the Investor

Elliott Management Corporation is a prominent global investment firm known for its activist investment style. Founded by Paul Singer, it has a long history of engaging in high-stakes battles with corporate management, often pushing for significant changes to maximize shareholder value. Their investment approach is characterized by rigorous due diligence, a deep understanding of complex financial structures, and a willingness to take calculated risks.

-

A History of High-Stakes Plays: Elliott's history includes both spectacular successes and notable failures, demonstrating their willingness to bet big on potentially transformative opportunities. Examples include their successful campaigns against Argentina and other sovereign nations, alongside instances where their investments didn't yield the anticipated returns.

-

Expertise in Geopolitical Navigation: The firm has demonstrated a capacity to navigate complex geopolitical landscapes, often investing in regions characterized by political instability or regulatory uncertainty. Their deep understanding of global markets and international relations is a critical asset in high-risk ventures like this.

-

Key Characteristics of Elliott's Investment Strategy:

- Activist investing targeting undervalued assets.

- Focus on maximizing shareholder value, often through corporate restructuring.

- Global reach with a diverse portfolio of investments across various sectors.

- A reputation for aggressive and persistent pursuit of their investment goals.

H2: The Russian Gas Pipeline Project: Details and Significance

While the specific pipeline project remains undisclosed for confidentiality reasons, sources suggest it involves a significant expansion of Russia's gas infrastructure, likely connecting to key European markets or Asian markets. The project's exact name and all participating entities haven't been publicly released due to ongoing negotiations and commercial sensitivities.

-

Key Players: Beyond Elliott Management, the project likely involves major Russian energy companies like Gazprom, along with potential international partners or contractors, although these haven't been officially confirmed.

-

Project Scale and Financial Projections: While precise figures are unavailable, the project's scale suggests a multi-billion dollar investment with potentially vast revenue streams. The projected revenue hinges heavily on the stability of the global gas market and the political climate.

-

Strategic Significance: The pipeline is crucial to Russia's energy strategy, aiming to expand its gas export capabilities and strengthen its influence in the global energy market. Its impact on global energy supplies could be substantial.

-

Pipeline Details (Speculative):

- Estimated Capacity: [Insert Speculative Estimate based on similar projects; e.g., "Potentially exceeding X cubic meters per day."]

- Transportation Routes: [Insert Speculative Routes; e.g., "Likely traversing [Region] to reach key markets in [Target Markets]."]

- Regulatory Hurdles: The project may face regulatory challenges related to environmental impact assessments, international sanctions, and potential disputes with neighboring countries.

H2: Analyzing the Investment: Potential Risks and Rewards

Elliott's investment in this Russian gas pipeline project carries substantial risks and equally substantial potential rewards.

-

Geopolitical Risks: The ongoing geopolitical tensions between Russia and the West pose a significant threat. Sanctions imposed on Russia could severely impact the project's viability, while political instability within Russia itself presents further risk.

-

Economic Risks: Fluctuations in global gas prices and currency exchange rates could significantly affect the project's profitability. The potential for unforeseen economic downturns also needs consideration.

-

Environmental and Social Responsibility Concerns: Concerns surrounding the environmental impact of gas pipelines, including greenhouse gas emissions and potential ecosystem disruption, are significant. Social responsibility considerations, such as potential impacts on local communities, also need attention.

-

Potential Rewards: If the project successfully comes to fruition and achieves its projected throughput, the returns for Elliott could be enormous. The potential ROI (Return on Investment) could be substantial, particularly considering the anticipated growth in global gas demand.

-

Risk/Reward Summary:

- Potential ROI: [Insert Speculative ROI range; e.g., "Estimates range from X% to Y%."]

- Estimated Risk Percentage: [Insert Speculative Risk Percentage; e.g., "The overall risk is assessed to be in the range of X% to Y%."]

H2: Market Implications and Global Energy Dynamics

The successful completion of this Russian gas pipeline project will have a profound impact on global energy markets.

-

Impact on Global Gas Market: Increased gas supply from Russia could depress prices in the short term, potentially impacting energy producers in other regions. However, long-term effects depend on various factors including global demand and supply from competing sources.

-

Geopolitical Impact: The project could significantly influence Russia's relationships with European countries and other energy importers, potentially deepening energy dependence or creating new geopolitical alliances.

-

Climate Change Implications: The increased use of natural gas, while less carbon-intensive than coal, still contributes to greenhouse gas emissions. The project's impact on climate change mitigation efforts warrants close monitoring.

-

Short-Term and Long-Term Effects:

- Short-term: Potential price fluctuations in the global gas market, shifts in energy supply routes, immediate economic impact on Russia and participating countries.

- Long-term: Reshaping of global energy dynamics, changes in geopolitical alliances, potential acceleration or deceleration of the global energy transition towards renewable sources.

3. Conclusion:

Elliott Management's bet on a Russian gas pipeline represents a high-stakes gamble with considerable potential for both monumental gains and catastrophic losses. The project's details remain shrouded in secrecy, but its potential impact on global energy markets and geopolitical relations is undeniable. The considerable risks associated with investing in Russia, including geopolitical instability and sanctions, must be carefully weighed against the potentially substantial financial returns. Elliott's move highlights the complexities and uncertainties inherent in large-scale energy projects in politically charged environments.

To stay informed about further developments regarding Elliott's bet on the Russian gas pipeline and the implications for global energy markets, follow reputable news sources and industry analyses. Understanding the intricacies of "Elliott's Russian gas pipeline investment," "Elliott's high-stakes gamble," and "the future of Elliott's Russian energy play" is vital for anyone seeking to understand the evolving landscape of global energy.

Featured Posts

-

Palantir Stock Investment Potential And Future Outlook

May 10, 2025

Palantir Stock Investment Potential And Future Outlook

May 10, 2025 -

Court Dismisses Part Of Lawsuit Against Nicolas Cage Son Weston Remains Defendant

May 10, 2025

Court Dismisses Part Of Lawsuit Against Nicolas Cage Son Weston Remains Defendant

May 10, 2025 -

Expansion Viticole A Dijon 2500 M De Vignes Aux Valendons

May 10, 2025

Expansion Viticole A Dijon 2500 M De Vignes Aux Valendons

May 10, 2025 -

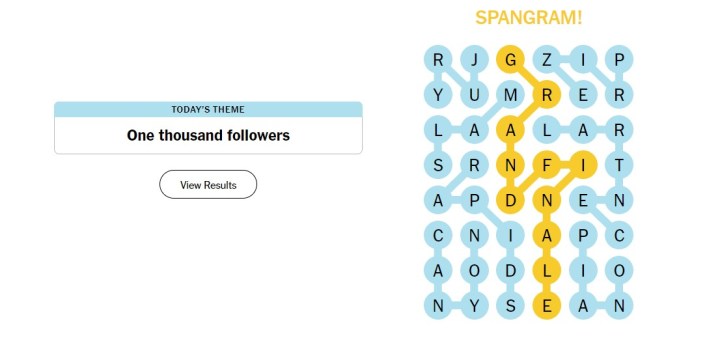

Nyt Strands Solutions For Wednesday March 12th Game 374

May 10, 2025

Nyt Strands Solutions For Wednesday March 12th Game 374

May 10, 2025 -

The Trump Factor How Threats Reshaped Greenlands Relationship With Denmark

May 10, 2025

The Trump Factor How Threats Reshaped Greenlands Relationship With Denmark

May 10, 2025