Facing Government Action For Delinquent Student Loans? Here's What To Do

Table of Contents

Understanding the Stages of Government Action for Delinquent Student Loans

Falling behind on student loan payments can lead to a series of increasingly serious actions from the government. Understanding these stages is crucial to taking appropriate action.

Initial Notices and Warning Letters

The first sign of trouble is usually a series of letters from your loan servicer or a collection agency. These notices detail your delinquency and warn of potential consequences if you don't take action.

- Examples of letters: Delinquency notice, default notice, demand letter.

- Information to look for: Specific amount owed, payment due date, contact information for your loan servicer, and details of potential consequences.

- Actions to take: Acknowledge receipt of the letter, contact your loan servicer immediately to discuss your situation, and explore repayment options. Ignoring these notices will only worsen the situation. Keywords: Default notice, delinquency notice, collection agency, wage garnishment.

Wage Garnishment and Tax Refund Offset

If you continue to miss payments, the government may resort to more forceful collection methods. These include wage garnishment and tax refund offset.

- Wage garnishment: A portion of your wages will be directly seized by your employer and sent to the government to pay off your debt. The amount garnished depends on your state laws and your income.

- Tax refund offset: Your federal tax refund will be intercepted and used to pay down your student loan debt.

- How to protect some income: While some income protection exists, it is not guaranteed. It's vital to act before reaching this stage. Keywords: Wage garnishment, tax refund offset, federal tax refund, income protection.

Legal Action and Lawsuits

In extreme cases, the government may file a lawsuit against you to recover the debt.

- What constitutes legal action: Failure to respond to previous notices and continued non-payment.

- Potential outcomes: A court judgment against you, leading to further collection actions like bank levy or property seizure.

- The role of a court order: A court order will legally solidify the debt and grant the government additional powers to collect. Keywords: Student loan lawsuit, legal action, court judgment, debt collection lawsuit.

Exploring Options to Avoid or Resolve Government Action

There are several steps you can take to avoid or resolve government action on your delinquent student loans.

Income-Driven Repayment (IDR) Plans

IDR plans base your monthly payments on your income and family size, making them more manageable for those facing financial hardship.

- List of IDR plans: IBR (Income-Based Repayment), PAYE (Pay As You Earn), REPAYE (Revised Pay As You Earn), ICR (Income-Contingent Repayment).

- Eligibility requirements: Vary depending on the plan, generally requiring financial hardship documentation.

- Calculation methods: Based on your adjusted gross income (AGI) and family size. Keywords: Income-driven repayment, IBR, PAYE, REPAYE, ICR, student loan forgiveness.

Deferment and Forbearance

These temporary options postpone your payments, but interest may still accrue.

- Differences: Deferment is typically for specific reasons (e.g., unemployment, graduate school), while forbearance is more general.

- Eligibility criteria: Vary depending on your situation and loan type.

- Implications for interest accrual: Interest continues to accrue during forbearance, except for certain types of deferment. Keywords: Student loan deferment, student loan forbearance, interest capitalization.

Loan Consolidation and Refinancing

Consolidating multiple loans into one or refinancing with a private lender might lower your monthly payments or interest rate, but it's crucial to compare options carefully.

- Advantages: Simplified repayment, potentially lower interest rates.

- Disadvantages: May extend the repayment term, possibly increasing the total interest paid.

- Eligibility requirements: Vary depending on your credit score and loan type. Keywords: Student loan consolidation, student loan refinancing, private student loans.

Contacting Your Loan Servicer

Proactive communication with your loan servicer is crucial.

- How to find your loan servicer's contact information: Check your loan documents or the National Student Loan Data System (NSLDS).

- What to expect when contacting them: Be prepared to discuss your financial situation and explore repayment options.

- Documenting communications: Keep records of all your communications, including dates, times, and the names of individuals you spoke with. Keywords: Student loan servicer, loan repayment, customer service, contact information.

Seeking Professional Help

If you're struggling to manage your student loans, don't hesitate to seek professional guidance.

Credit Counseling Agencies

Non-profit credit counseling agencies can provide free or low-cost advice and help create a debt management plan.

- Finding reputable agencies: Look for agencies certified by the National Foundation for Credit Counseling (NFCC).

- Services offered: Budget counseling, debt management plans, and educational resources.

- Cost considerations: While some services are free, debt management plans typically involve fees. Keywords: Credit counseling, non-profit credit counseling, debt management plan.

Student Loan Attorneys

A student loan attorney can provide legal advice and representation if you're facing legal action or exploring complex repayment options.

- When to seek legal counsel: If you've received a lawsuit, are facing wage garnishment, or need help navigating complex legal issues.

- What they can help with: Negotiating with loan servicers, challenging incorrect information, and representing you in court.

- Cost considerations: Attorneys typically charge hourly fees or a contingency fee. Keywords: Student loan attorney, legal representation, debt relief.

Conclusion

Facing government action for delinquent student loans is a serious matter, but proactive steps can significantly improve your situation. Contacting your loan servicer immediately, exploring repayment options like IDR plans, deferment, or forbearance, and seeking professional help from a credit counselor or student loan attorney are crucial steps. Ignoring government action only leads to more severe consequences. Take immediate action to address government action on your student loan debt and avoid further government action for delinquent student loans. Don't wait until the situation worsens; address your delinquent student loans today.

Featured Posts

-

Novak Djokovic Kortlarda Efsane Devam Ediyor

May 17, 2025

Novak Djokovic Kortlarda Efsane Devam Ediyor

May 17, 2025 -

Celtics Vs Magic Nba Playoffs Game 1 Where To Watch Time And Live Stream Options

May 17, 2025

Celtics Vs Magic Nba Playoffs Game 1 Where To Watch Time And Live Stream Options

May 17, 2025 -

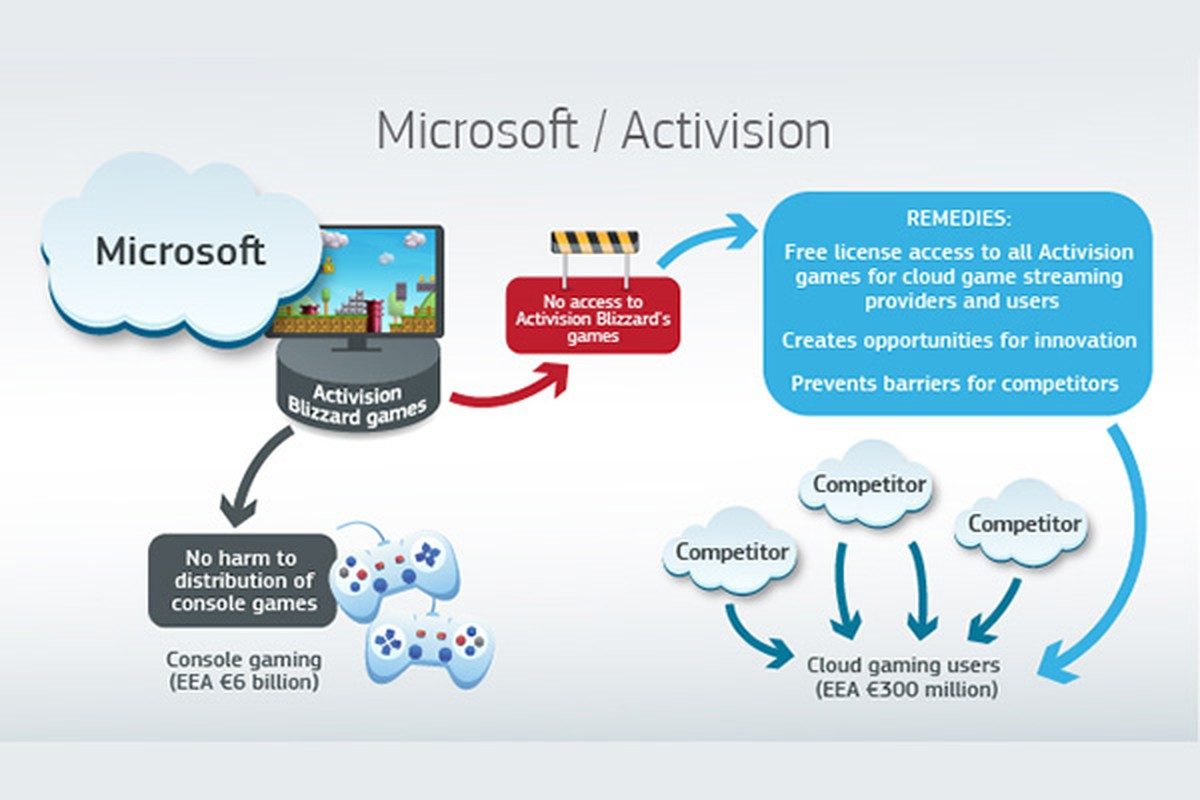

The Ftcs Appeal Against The Microsoft Activision Merger Key Details

May 17, 2025

The Ftcs Appeal Against The Microsoft Activision Merger Key Details

May 17, 2025 -

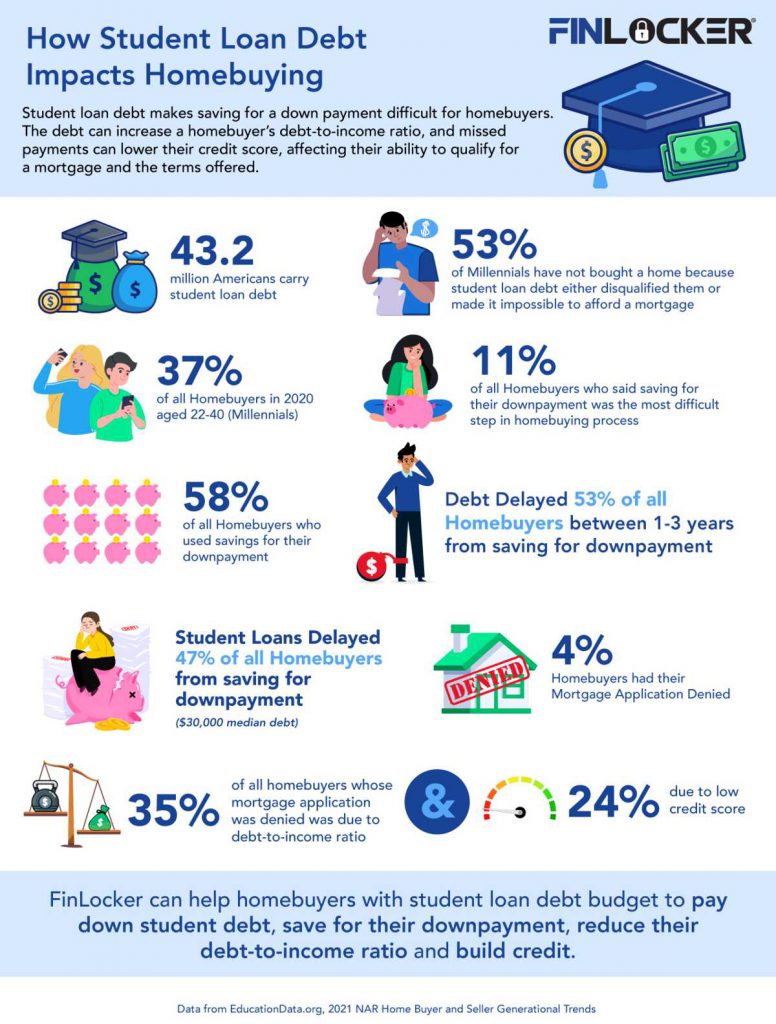

How Student Loan Debt Affects Your Ability To Buy A House

May 17, 2025

How Student Loan Debt Affects Your Ability To Buy A House

May 17, 2025 -

Situatia Lui Stiller Vf B Stuttgart Asteapta Cu Nerabdare Finala Cupei

May 17, 2025

Situatia Lui Stiller Vf B Stuttgart Asteapta Cu Nerabdare Finala Cupei

May 17, 2025