Finding The Best Tribal Loan For Bad Credit: A Comparison Of Direct Lenders

Table of Contents

Understanding Tribal Loans and Their Advantages

What are Tribal Loans?

Tribal loans are short-term loans offered by lenders affiliated with Native American tribes. These loans operate under the principle of tribal sovereign immunity, meaning they are often less subject to the same regulations as traditional lenders. This can make them a more accessible option for individuals with bad credit who may be denied by banks or credit unions. Key differences include potentially faster processing times and less stringent credit checks. However, it's important to note that this does not mean they are inherently risk-free.

Benefits of Choosing a Direct Lender

When considering tribal loans for bad credit, opting for a direct lender offers several advantages:

- Lower Fees: Eliminating intermediaries means potentially lower fees compared to using a loan broker.

- Transparency: Direct communication with the lender ensures clarity on terms and conditions.

- Simplified Application: The application process is usually streamlined, potentially leading to faster approval.

- Faster Funding: Direct lenders may offer quicker funding compared to those working through brokers.

Risks Associated with Tribal Loans

While tribal loans for bad credit can provide a needed financial lifeline, it's crucial to acknowledge potential risks:

- High Interest Rates: Interest rates on tribal loans can be significantly higher than traditional loans. Always carefully compare APRs (Annual Percentage Rates).

- Hidden Fees: Scrutinize the loan agreement for any hidden fees or charges that could increase the overall cost.

- Debt Trap Potential: Failing to manage repayments responsibly can lead to a cycle of debt. Create a realistic repayment plan before applying.

- Responsible Borrowing: Borrow only what you can comfortably afford to repay to avoid financial hardship.

Comparing Direct Tribal Lenders: Key Factors to Consider

Choosing the best tribal loan requires careful comparison across different lenders. Consider these key factors:

Interest Rates and APR

The Annual Percentage Rate (APR) reflects the total cost of borrowing, including interest and fees. A lower APR translates to a lower overall cost.

- Compare APRs: Always compare APRs from multiple direct lenders before making a decision.

- Hidden Fees Awareness: Watch out for hidden fees that can significantly inflate the APR.

- Impact of High Rates: Understand how high interest rates can impact your overall repayment amount.

Repayment Terms and Flexibility

Repayment terms define the timeframe for repaying the loan. Flexibility in repayment schedules can help manage your finances better.

- Understand Schedules: Carefully review the repayment schedule to ensure it aligns with your budget.

- Repayment Plan Options: Inquire about different repayment plan options offered by the lender.

- Late Payment Penalties: Be aware of the consequences of late payments, which can include additional fees and damage to your credit score.

Loan Amounts and Eligibility Requirements

Different lenders offer various loan amounts and have specific eligibility criteria.

- Loan Amount Variations: Compare the loan amounts offered by different lenders to find one that meets your needs.

- Bad Credit Acceptance: Many tribal lenders cater to individuals with bad credit, but eligibility criteria may vary.

- Required Documentation: Understand the specific documentation required by each lender for the application process.

Finding Reputable Tribal Lenders: Tips and Resources

Finding a reputable lender is paramount to avoid scams and protect your financial well-being.

Research and Due Diligence

Thorough research is crucial before engaging with any lender offering tribal loans for bad credit:

- Check Reviews: Look for online reviews and testimonials from past borrowers.

- Verify Licensing: Confirm the lender's licensing and registration details with the appropriate authorities.

- Tribal Affiliation Confirmation: Verify the lender's genuine affiliation with a Native American tribe.

Protecting Yourself from Scams

Be vigilant and aware of potential scams:

- Avoid Upfront Fees: Legitimate lenders will not request upfront fees.

- Recognize Aggressive Tactics: Beware of lenders using aggressive or high-pressure sales tactics.

- Report Suspicious Activity: Report any suspicious activity to the relevant consumer protection agencies.

Alternatives to Tribal Loans

While tribal loans can be helpful, explore alternative options:

- Credit Unions: Credit unions often offer more favorable terms than traditional banks.

- Payday Loan Alternatives: Consider alternatives to payday loans, such as community development financial institutions (CDFIs).

- Debt Consolidation: Explore debt consolidation options to manage multiple debts more effectively.

Conclusion

Securing a tribal loan for bad credit can be a viable option for those facing financial difficulties, but careful research is crucial. By comparing direct lenders and understanding the factors discussed above – interest rates, repayment terms, and lender reputation – you can make an informed decision that aligns with your financial needs. Remember to prioritize responsible borrowing and choose a lender you trust. Don't hesitate to explore your options and find the best tribal loan for bad credit to suit your circumstances. Remember to compare and choose wisely!

Featured Posts

-

Garnacho Transfer Saga Man Uniteds E60 Million Valuation

May 28, 2025

Garnacho Transfer Saga Man Uniteds E60 Million Valuation

May 28, 2025 -

Beyonce And Taylor Swifts Dominance At The 2025 Amas

May 28, 2025

Beyonce And Taylor Swifts Dominance At The 2025 Amas

May 28, 2025 -

Gledayte Treylra Benisio Del Toro V Noviya Film Na Ues Andersn

May 28, 2025

Gledayte Treylra Benisio Del Toro V Noviya Film Na Ues Andersn

May 28, 2025 -

Cabinets E750 Million Investment Expanding Green Home Loans With Eu Climate Funding

May 28, 2025

Cabinets E750 Million Investment Expanding Green Home Loans With Eu Climate Funding

May 28, 2025 -

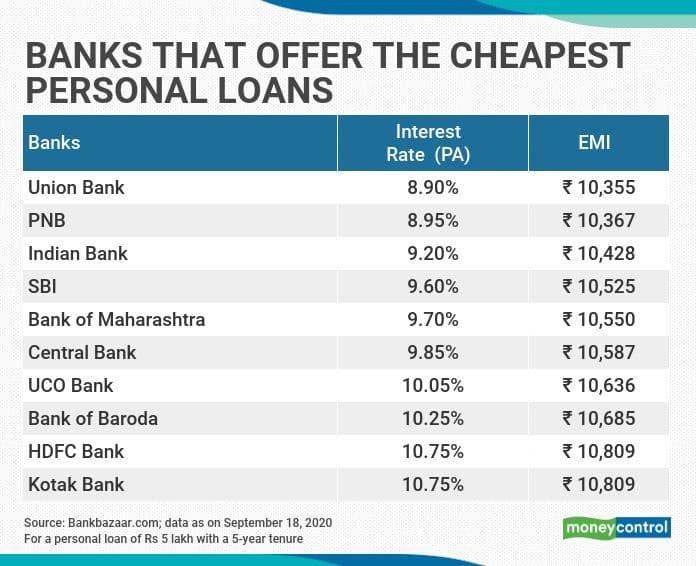

Lowest Personal Loan Interest Rates Compare Offers Today

May 28, 2025

Lowest Personal Loan Interest Rates Compare Offers Today

May 28, 2025