FP Video Interviews Economists: Unpacking The Bank Of Canada's Decision

Table of Contents

Key Takeaways from the FP Video Interviews Regarding the Bank of Canada's Decision

Inflation Outlook

Economists interviewed in the FP video interviews offered a range of predictions regarding Canada's inflation rate. While there's a general consensus that inflation is easing, the speed and trajectory vary significantly. The discussions heavily featured the Consumer Price Index (CPI) and the Bank of Canada's inflation target, highlighting the complexities of monetary policy in navigating a global economic landscape. Key observations include:

- Economist A predicted inflation to reach 3.5% by the end of the year, gradually declining to 2% by mid-2024. Their analysis emphasized the impact of easing supply chain pressures and a slowdown in consumer demand.

- Economist B, however, offered a more cautious outlook, predicting inflation to remain stubbornly above the Bank of Canada's target for longer, potentially hovering around 4% until well into 2024. This perspective cited persistent wage pressures and the lingering impact of global geopolitical instability.

- The discussions also touched upon the potential for unforeseen shocks, such as further disruptions to global supply chains or unexpected spikes in energy prices, which could significantly influence the inflation trajectory. Understanding the interplay between economic growth and inflation remains crucial for navigating this uncertainty.

Interest Rate Projections

The FP video interviews explored the economists' diverse viewpoints on the Bank of Canada's future interest rate adjustments. The discussions encompassed the potential for further interest rate hikes, the possibility of a rate cut, and the implications of monetary policy tightening or further quantitative easing. Here's a summary of the key projections:

- Several economists anticipate a pause in interest rate increases, believing that the current level is sufficient to curb inflation.

- Others, however, suggest that further rate hikes might be necessary if inflation proves more persistent than anticipated.

- The debate also touched upon the timing and magnitude of any potential future rate cuts, with opinions diverging based on individual economic models and assessments of the overall economic climate.

Impact on the Canadian Economy

The FP video interviews extensively analyzed the predicted effects of the Bank of Canada's decision on various sectors of the Canadian economy. The discussions covered potential impacts on the housing market, employment rates, consumer spending, and overall economic growth (GDP).

- The predicted slowdown in economic growth sparked concerns about potential job losses in interest-sensitive sectors.

- The housing market is expected to feel the pressure of higher interest rates, with predictions of further price corrections and decreased transaction volumes.

- Consumer confidence, already impacted by inflation, could face further strain as interest rates remain elevated.

Differing Opinions and Perspectives

A notable aspect of the FP video interviews was the diversity of opinions among the participating economists. These differences stemmed from varying interpretations of economic data, differing weighting of various economic indicators, and contrasting views on the effectiveness of monetary policy tools. The discussions highlighted the inherent complexities and uncertainties in economic forecasting:

- Some economists emphasized the lagged effects of monetary policy, suggesting that the full impact of the Bank of Canada's previous rate hikes might not yet be fully felt.

- Others stressed the importance of closely monitoring leading indicators, such as consumer confidence and business investment, to anticipate future economic trends.

- The disagreements highlighted the importance of considering a range of perspectives when analyzing economic forecasts and making investment decisions.

Understanding the Bank of Canada's Decision – Actionable Insights from FP Video Interviews

The FP video interviews offer a valuable resource for understanding the Bank of Canada's recent interest rate decision and its implications. The economists' insights provide a comprehensive overview of the current economic landscape and offer various perspectives on the inflation outlook, future interest rate adjustments, and the potential impact on the Canadian economy. While predictions vary, the interviews underscore the importance of staying informed and adaptable in navigating the economic uncertainty ahead. To gain a complete picture of the Bank of Canada's decision and its potential impact, watch the insightful FP video interviews with leading economists today! [Link to FP Video Interviews]

Featured Posts

-

Portrait De Christelle Le Hir Presidente Du Directoire De La Vie Claire Et Du Synadis Bio

Apr 23, 2025

Portrait De Christelle Le Hir Presidente Du Directoire De La Vie Claire Et Du Synadis Bio

Apr 23, 2025 -

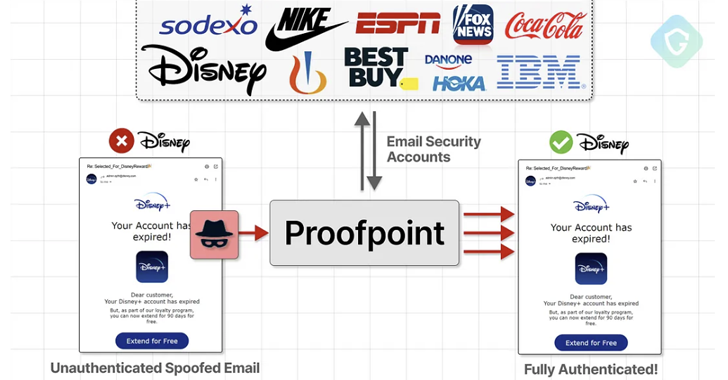

Office 365 Security Flaw Exploited Crook Makes Millions From Executive Data Breach

Apr 23, 2025

Office 365 Security Flaw Exploited Crook Makes Millions From Executive Data Breach

Apr 23, 2025 -

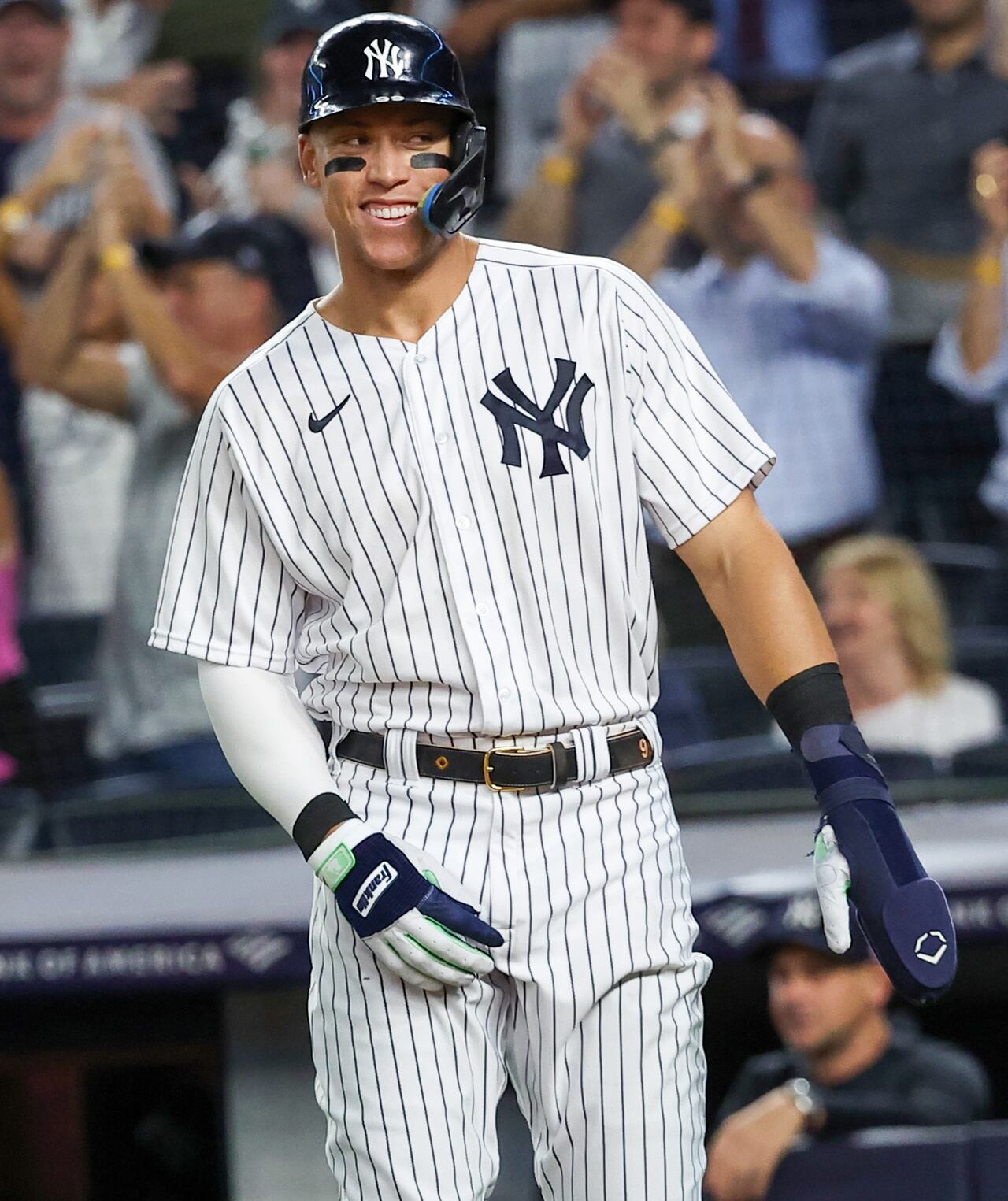

Yankees Historic Night 9 Home Runs Judges Triple Crown Performance

Apr 23, 2025

Yankees Historic Night 9 Home Runs Judges Triple Crown Performance

Apr 23, 2025 -

Boe Should Consider Smaller Qe In Future Economic Shocks Greenes Proposal

Apr 23, 2025

Boe Should Consider Smaller Qe In Future Economic Shocks Greenes Proposal

Apr 23, 2025 -

Reds Snap Scorless Streak Despite Loss To Brewers

Apr 23, 2025

Reds Snap Scorless Streak Despite Loss To Brewers

Apr 23, 2025