Frankfurt Stock Market: DAX Ends Trading Session Below 24,000

Table of Contents

Main Points: Unpacking the DAX's Descent

2.1 Reasons for the DAX Drop Below 24,000: A Multifaceted Challenge

Several interconnected factors have contributed to the DAX's recent fall below the 24,000 threshold. Understanding these nuances is crucial for navigating the current market volatility.

Global Economic Uncertainty: A Headwind for the DAX

Rising inflation and interest rates globally are significantly impacting investor sentiment. The ripple effect is felt across international markets, including the DAX. Central banks worldwide are attempting to combat inflation through aggressive monetary tightening, but this inevitably leads to increased borrowing costs for businesses and dampens economic growth.

- High Inflation: Persistent inflation erodes purchasing power and weakens consumer confidence, impacting corporate profits.

- Rising Interest Rates: Increased borrowing costs make expansion and investment more expensive for businesses, leading to reduced investment and slower growth.

- Geopolitical Risks: Ongoing geopolitical tensions, such as the war in Ukraine, contribute to uncertainty and risk aversion in the global market. These uncertainties directly affect investor confidence and can trigger sell-offs.

Concerns within the German Economy: Domestic Headwinds

Beyond global pressures, the German economy faces its own unique set of challenges. The ongoing energy crisis, stemming from reduced Russian gas supplies, has severely impacted German industries, particularly energy-intensive sectors. Supply chain disruptions also continue to pose a significant threat to German manufacturers.

- Energy Crisis Impact: Soaring energy prices increase production costs and threaten the competitiveness of German businesses.

- Supply Chain Disruptions: Continued bottlenecks in global supply chains further add to the challenges faced by German companies.

- Weakening Economic Indicators: Recent economic data releases have signaled a potential slowdown in German GDP growth, fueling further concerns.

Sector-Specific Performances: A Divergent Landscape

The DAX decline isn't uniform across all sectors. Some sectors are experiencing more significant headwinds than others. For example, the automotive industry, heavily reliant on energy and supply chains, has been particularly impacted. Conversely, certain technology stocks have shown some resilience, though not enough to offset the overall decline. Analyzing sector-specific performances provides a more granular understanding of the market dynamics.

- Automotive Industry Struggles: The automotive sector is facing significant pressure due to high energy costs and supply chain disruptions.

- Technology Sector Resilience (to some degree): While showing some resilience, the technology sector is not immune to the broader market downturn.

- Financial Markets Under Pressure: Increased interest rates put pressure on financial institutions and impact their profitability.

2.2 Impact on Investors and the Market: Navigating the Volatility

The DAX's drop below 24,000 has triggered notable reactions within the market. Understanding these reactions and their implications is crucial for investors.

Investor Reactions: Fear and Uncertainty

The decline has led to increased market volatility, characterized by significant selling pressure. Investors are exhibiting risk-averse behavior, leading to capital flight from equities. The short-term outlook remains uncertain, prompting caution among investors.

- Increased Market Volatility: Sharp price swings and increased uncertainty are characterizing the current market environment.

- Selling Pressure: Investors are selling assets to reduce their exposure to risk.

- Short-term Uncertainty: The short-term outlook remains uncertain, making investment decisions challenging.

Potential Future Market Trends: Navigating Uncertainty

Predicting future market trends is inherently challenging. However, based on current conditions and expert analysis, several potential scenarios are possible. A sustained recovery might hinge on easing inflation, resolving the energy crisis, and improved global geopolitical stability. Conversely, further declines are possible if these challenges worsen. Upcoming economic data releases and central bank announcements will heavily influence market sentiment in the coming weeks and months.

- Potential for Recovery: Easing inflation and improved global economic conditions could lead to a market rebound.

- Risk of Further Decline: Worsening economic conditions or geopolitical instability could cause further declines.

- Importance of Economic Data: Upcoming economic releases will play a crucial role in shaping market sentiment.

Conclusion: Analyzing the DAX's Dip and Navigating the Frankfurt Stock Market

The DAX's fall below 24,000 reflects a confluence of global and domestic challenges, including rising inflation, interest rates, energy crises, and supply chain disruptions. Understanding these intertwined factors is vital for investors navigating the Frankfurt Stock Market. The current volatility underscores the importance of diversification, risk management, and staying informed about market dynamics. Before making any investment decisions, seek professional financial advice. To stay updated on the DAX index and Frankfurt Stock Market analysis, regularly consult reputable financial news sources and consider seeking professional guidance to navigate the complexities of the German stock market trends. By understanding the interplay of global and local factors impacting the DAX, investors can make more informed decisions.

Featured Posts

-

Amsterdam Stock Exchange Plunges 2 After Trumps Tariff Hike

May 24, 2025

Amsterdam Stock Exchange Plunges 2 After Trumps Tariff Hike

May 24, 2025 -

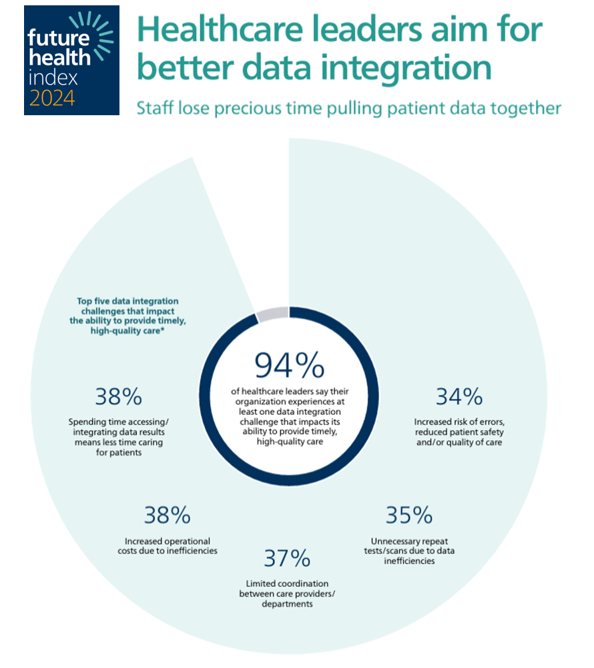

Global Healthcare Transformation Insights From The Philips Future Health Index 2025 On Ais Role

May 24, 2025

Global Healthcare Transformation Insights From The Philips Future Health Index 2025 On Ais Role

May 24, 2025 -

Experience The Ferrari Bengaluru Service Centre A First Look

May 24, 2025

Experience The Ferrari Bengaluru Service Centre A First Look

May 24, 2025 -

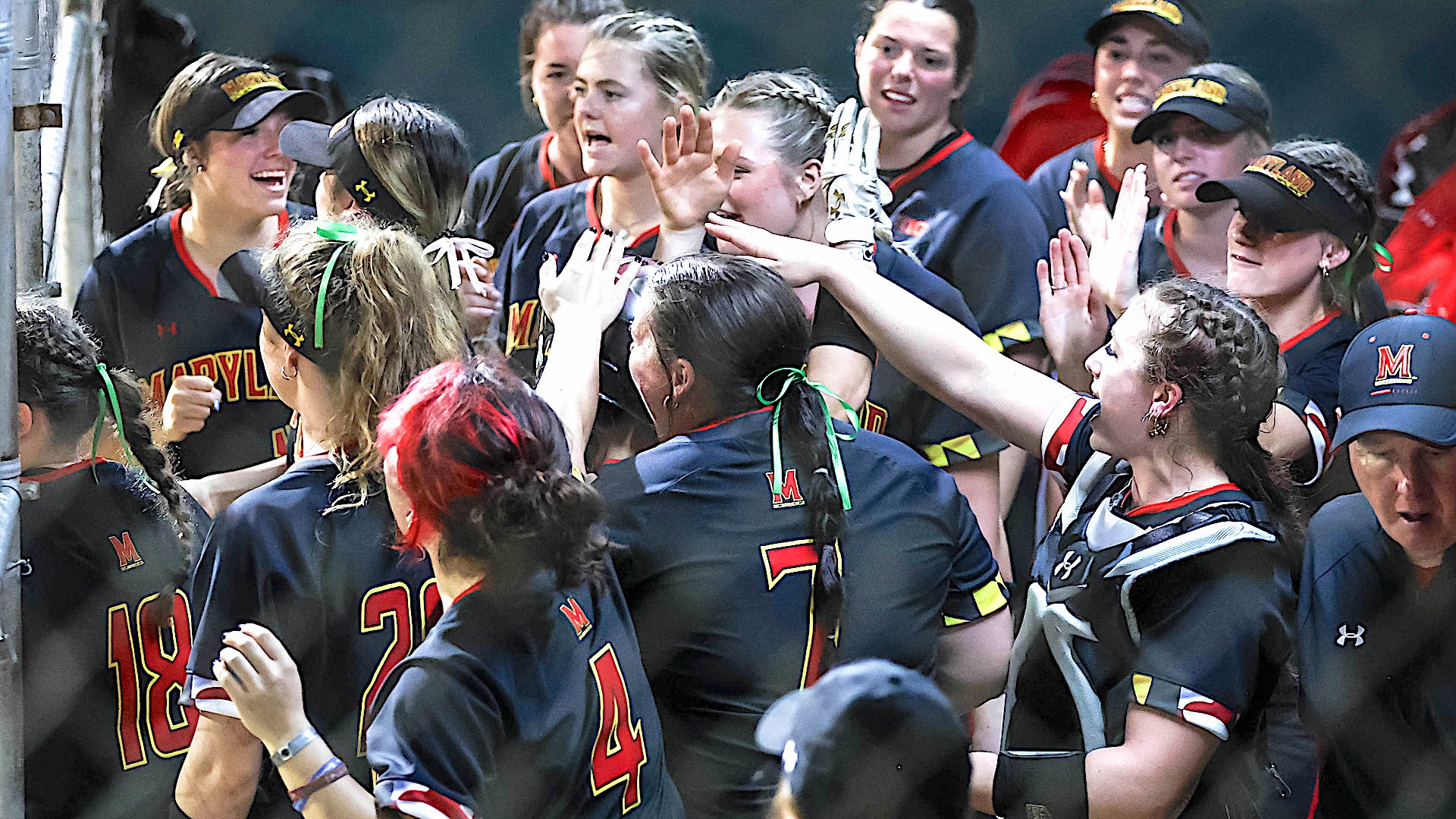

Aubrey Wurst Leads Maryland Softball To Victory Over Delaware

May 24, 2025

Aubrey Wurst Leads Maryland Softball To Victory Over Delaware

May 24, 2025 -

Dax Rally Assessing The Risk Of A Wall Street Driven Market Correction

May 24, 2025

Dax Rally Assessing The Risk Of A Wall Street Driven Market Correction

May 24, 2025

Latest Posts

-

Mia Farrow On Trump Imprisonment Necessary After Venezuelan Deportation Controversy

May 24, 2025

Mia Farrow On Trump Imprisonment Necessary After Venezuelan Deportation Controversy

May 24, 2025 -

Actress Mia Farrow Seeks Legal Action Against Trump For Venezuela Deportation Policy

May 24, 2025

Actress Mia Farrow Seeks Legal Action Against Trump For Venezuela Deportation Policy

May 24, 2025 -

Mia Farrow Calls For Trumps Arrest Over Venezuelan Deportations

May 24, 2025

Mia Farrow Calls For Trumps Arrest Over Venezuelan Deportations

May 24, 2025 -

Sinatras Four Marriages An Examination Of His Romantic Life

May 24, 2025

Sinatras Four Marriages An Examination Of His Romantic Life

May 24, 2025 -

Farrow Seeks Trumps Incarceration Focus On Venezuelan Deportations

May 24, 2025

Farrow Seeks Trumps Incarceration Focus On Venezuelan Deportations

May 24, 2025