Friday Forecast: Further Losses Expected For Live Music Stocks

Table of Contents

Weakening Demand and Ticket Sales

Decreased consumer spending, fueled by inflation and a potential economic slowdown, is significantly impacting ticket sales, a crucial indicator of the live music industry's health. This reduced demand directly affects the profitability and stock prices of live music companies. The combination of rising costs and decreased disposable income is creating a perfect storm for investors in concert stocks.

- Lower disposable income leading to fewer concert purchases: With inflation eroding purchasing power, discretionary spending on entertainment, including concert tickets, is one of the first things to be cut.

- Increased competition for entertainment dollars: Consumers have limited disposable income, forcing them to choose between various entertainment options. Live music faces competition from streaming services, home entertainment, and other leisure activities.

- Rising operational costs for venues and artists: Increased costs are passed onto consumers in the form of higher ticket prices, further dampening demand, particularly within the budget-conscious segments of the market.

- Impact of post-pandemic economic uncertainty on consumer behavior: The lingering effects of the pandemic continue to influence consumer behavior, creating hesitancy and a preference for more budget-friendly entertainment choices.

Rising Operational Costs and Inflationary Pressures

The live music industry is grappling with significant inflationary pressures. Increased costs across the board are squeezing profit margins, impacting the bottom line of live music companies and subsequently their stock performance. These rising costs affect everything from the smallest local gig to the largest stadium tour.

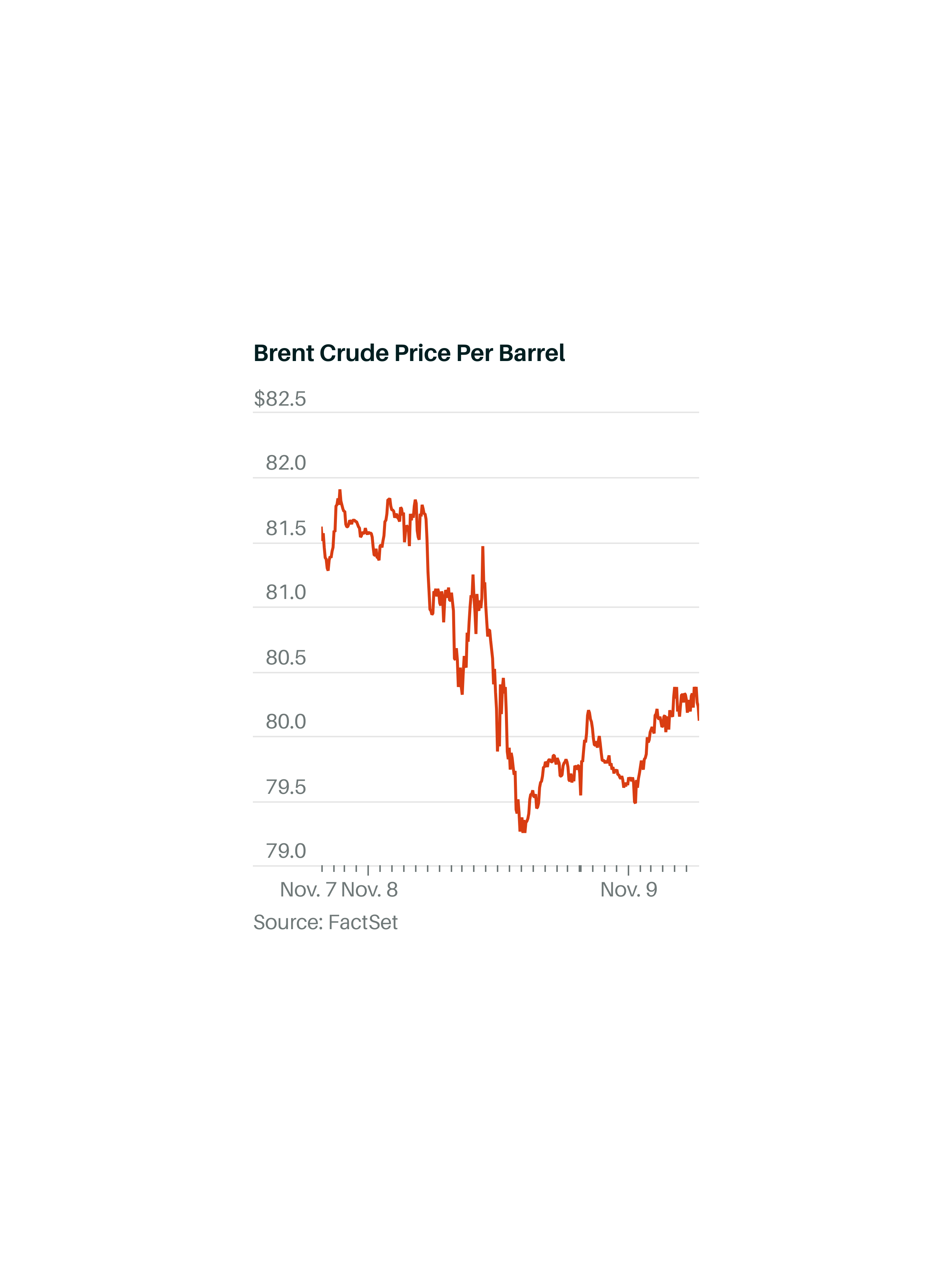

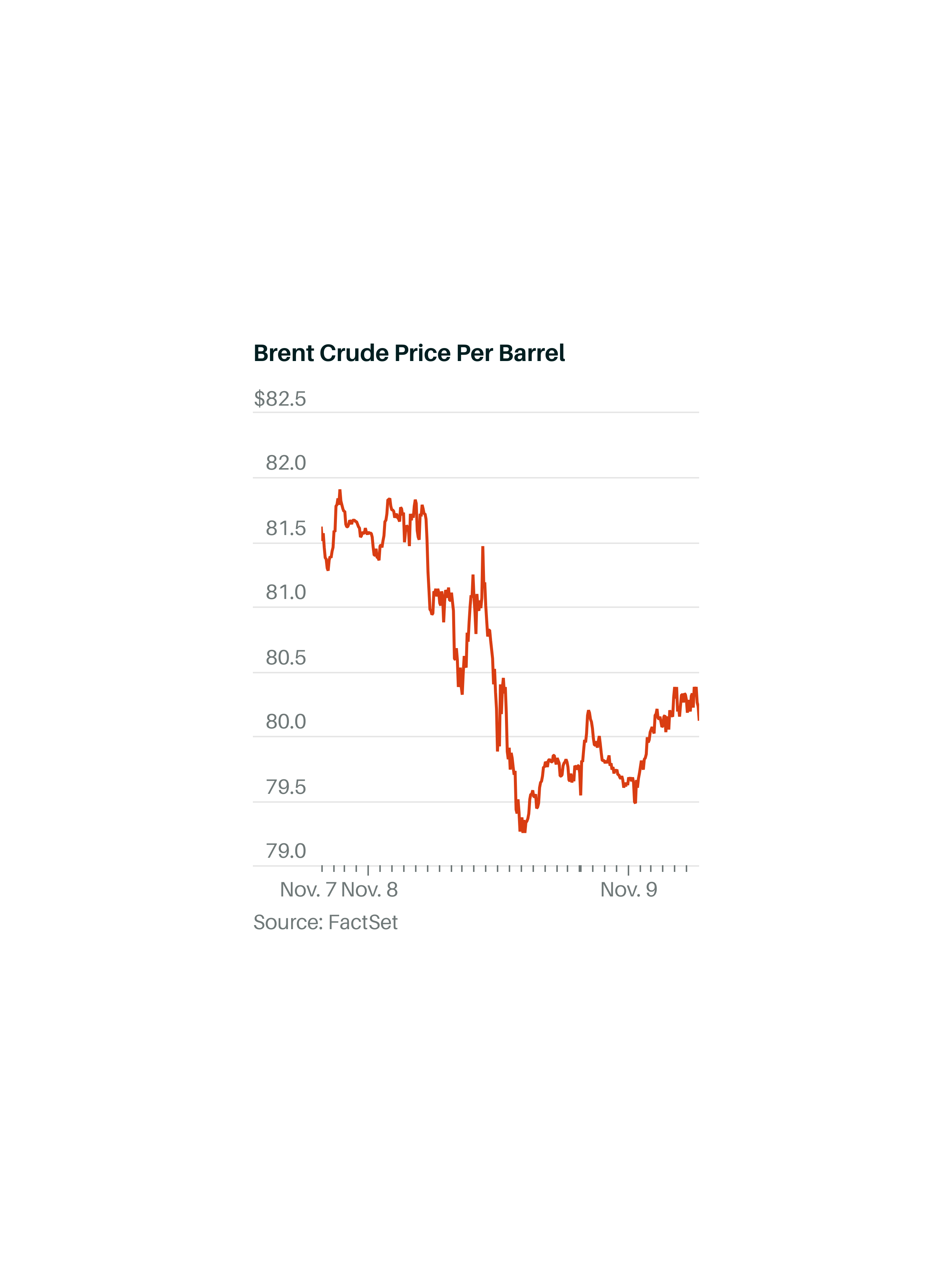

- Soaring energy prices impacting venue operations: Increased electricity and fuel costs directly impact venue operational expenses, impacting profitability.

- Increased labor costs due to wage inflation: Venues and artists are facing rising labor costs, impacting their overall budget and potentially leading to higher ticket prices or reduced profitability.

- Supply chain disruptions affecting equipment and materials: Disruptions in the supply chain continue to drive up the cost of equipment and materials needed for concerts and events.

- Higher artist fees to compensate for inflation: Artists are also feeling the pinch of inflation, leading to increased fees to cover their own rising costs, which then impacts the overall concert budget.

Geopolitical Uncertainty and Global Economic Slowdown

Global economic uncertainty and geopolitical instability are casting a long shadow over the live music sector. Reduced international tourism and potential recessions in key markets further dampen demand and investor confidence in live music stocks. This uncertainty impacts both the artists and the venues.

- Impact of global conflicts on travel and tourism: Geopolitical events can disrupt international travel, significantly reducing attendance at concerts and impacting revenue for both international and domestic artists.

- Economic uncertainty impacting consumer confidence and spending habits: A global economic slowdown leads to reduced consumer confidence and less disposable income, directly impacting spending on entertainment.

- Potential for decreased international touring revenue: International tours form a crucial part of many artists' revenue streams. Geopolitical issues and economic slowdowns can significantly impact the viability and profitability of these tours.

- Risk of cancellations and postponements due to unforeseen circumstances: Uncertainty in the global landscape leads to a higher risk of concert cancellations or postponements, impacting both revenue and investor confidence.

Specific Stock Performance Analysis

Several live music stocks, including [Specific Stock Ticker Symbol 1], [Specific Stock Ticker Symbol 2], and [Specific Stock Ticker Symbol 3], have shown significant declines in recent weeks, mirroring the overall downward trend in the sector. These declines reflect the challenges outlined above and further highlight the need for caution among investors in this market segment. Analysis of these specific stocks reveals a concerning correlation between macroeconomic factors and stock performance within the live music industry.

Conclusion

The Friday forecast for live music stocks points towards further losses driven by weakening demand, escalating operational costs, and broader macroeconomic headwinds. Investors should closely monitor these factors and adjust their portfolios accordingly. The combination of reduced consumer spending, inflation, and global uncertainties paints a challenging picture for the near future.

Call to Action: Stay informed on the latest developments impacting live music stocks. Continue monitoring this crucial sector to make informed investment decisions and mitigate potential risks associated with the volatile nature of live music stock performance. Regularly check back for updated Friday forecasts and market analyses regarding live music investments. Understanding the factors impacting live music stocks is crucial for navigating this challenging market.

Featured Posts

-

Donald Trump I Wolodymyr Zelenski Szczegoly Rozmow

May 30, 2025

Donald Trump I Wolodymyr Zelenski Szczegoly Rozmow

May 30, 2025 -

Nueva Integracion Setlist Fm Y Ticketmaster Mejoran La Experiencia De Los Fans

May 30, 2025

Nueva Integracion Setlist Fm Y Ticketmaster Mejoran La Experiencia De Los Fans

May 30, 2025 -

R45 000 Kawasaki Ninja Discount Find Your Deal Now

May 30, 2025

R45 000 Kawasaki Ninja Discount Find Your Deal Now

May 30, 2025 -

San Diego Area Faces Intense Late Winter Storm

May 30, 2025

San Diego Area Faces Intense Late Winter Storm

May 30, 2025 -

Ticketmaster Y Setlist Fm La Guia Definitiva Para Preparar Tu Concierto

May 30, 2025

Ticketmaster Y Setlist Fm La Guia Definitiva Para Preparar Tu Concierto

May 30, 2025