FTC Challenges Microsoft's Activision Blizzard Buyout: Analysis

Table of Contents

The FTC's Concerns Regarding Anti-Competitive Practices

The FTC's challenge to the Microsoft Activision Blizzard buyout centers on its concerns about anti-competitive behavior that could stifle innovation and harm consumers. Their arguments are multifaceted, focusing on several key areas.

Stifling Competition in the Console Market

The FTC argues that Microsoft's acquisition of Activision Blizzard would create an unfair competitive advantage, particularly in the console market. This stems primarily from the potential for Microsoft to make key franchises, most notably Call of Duty, exclusive or significantly less available on competing platforms like Sony's PlayStation.

- Exclusive access to Call of Duty could harm PlayStation's market share. Call of Duty is a highly popular and lucrative franchise; its exclusive or limited availability on PlayStation could significantly reduce its competitiveness.

- Microsoft could leverage its ownership to hinder the success of competing consoles and services. This could involve preferential treatment for Xbox-related products and services, potentially creating a significant barrier to entry for competitors.

- The FTC seeks to prevent the creation of a gaming monopoly. The concern is that this merger could lead to a situation where Microsoft dominates the market, leading to reduced innovation and higher prices for consumers.

Concerns about Cloud Gaming Dominance

Beyond console gaming, the FTC also expresses concerns about Microsoft's potential dominance in the burgeoning cloud gaming market. The acquisition of Activision Blizzard's extensive game catalog and intellectual property could significantly bolster Microsoft's already strong position in cloud gaming, potentially creating insurmountable barriers for competitors.

- Microsoft's Game Pass and cloud gaming infrastructure could become insurmountable barriers to entry for competitors. The combination of a vast game library and a robust cloud platform could make it difficult for smaller companies to compete.

- The merger could lead to higher prices and reduced quality for consumers. A lack of competition could result in less incentive for innovation and improvement of services.

- Antitrust concerns extend to the broader market, beyond just console gaming. The FTC's concerns encompass the entire gaming ecosystem, acknowledging the increasing importance of cloud gaming and its potential for consolidation.

Microsoft's Defense and Arguments

Microsoft has vigorously defended the Microsoft Activision Blizzard buyout, arguing that the merger will benefit both gamers and the industry as a whole. Their arguments primarily focus on continued platform availability and the overall benefits for consumers.

Promises of Continued Call of Duty Availability

Microsoft has repeatedly stated its commitment to maintaining Call of Duty availability on PlayStation and other platforms. They have offered long-term contractual agreements to Sony to ensure continued access to the franchise.

- Microsoft has offered long-term contractual agreements to guarantee Call of Duty's presence on rival consoles. These agreements aim to alleviate concerns about exclusivity and maintain fair competition.

- They emphasize their commitment to maintaining a multi-platform approach to gaming. This underscores their intention to avoid creating an exclusive ecosystem.

- They argue that the merger would actually benefit gamers through innovation and increased content. Microsoft believes the combined resources will lead to improved games and broader access.

Benefits of the Merger for Gamers and Innovation

Microsoft highlights several potential benefits for gamers resulting from the merger, emphasizing increased investment in game development and enhanced subscription services.

- Access to a wider range of games through Game Pass. The acquisition expands Game Pass's already impressive library, offering subscribers greater value.

- Potential improvements in game quality and development. Microsoft argues that increased investment will result in higher-quality games and a more vibrant gaming industry.

- Increased competition within the gaming industry itself, spurred by the increased resources. This claim suggests that the merger could indirectly benefit competitors by increasing overall innovation and the quality of gaming experiences.

Potential Outcomes and Implications

The FTC's challenge to the Microsoft Activision Blizzard buyout will have significant ramifications for the gaming industry and future tech mergers.

Legal Battles and Regulatory Scrutiny

The FTC's challenge will undoubtedly lead to prolonged legal battles and intense regulatory scrutiny. This case could set a crucial precedent for future mergers and acquisitions in the tech sector.

- The outcome could significantly influence how future mergers in the tech industry are evaluated. This case could establish new standards and guidelines for assessing the potential anti-competitive effects of large-scale mergers.

- The case highlights the increasing importance of antitrust concerns in the rapidly evolving digital market. The rapid pace of consolidation in the tech industry underscores the need for robust antitrust enforcement.

- The legal process could take months or even years to resolve. This protracted legal battle adds uncertainty to the future of the gaming landscape.

Impact on the Gaming Industry and Consumers

The final outcome will profoundly impact the gaming industry and its consumers, affecting competition, innovation, and consumer choice.

- Price changes for games and subscriptions are possible outcomes. Depending on the outcome, consumers could see price increases or, conversely, improved value propositions.

- The availability of certain games on various platforms will be significantly affected. The resolution will directly influence the accessibility of major titles across different gaming platforms.

- The long-term health of the gaming market is partly dependent on the case's resolution. The outcome will significantly shape the competitive landscape and the future direction of the gaming industry.

Conclusion

The FTC's challenge to the Microsoft Activision Blizzard buyout is a landmark case with far-reaching consequences. The arguments concerning competition, market dominance, and consumer welfare are multifaceted and complex. The outcome will decisively shape the gaming landscape for years to come. Staying informed about the ongoing developments in this crucial Microsoft Activision Blizzard buyout case is essential for understanding its impact on the future of the gaming world. Keep following the news to stay updated on the latest developments in this significant antitrust challenge.

Featured Posts

-

Tsx Composite Index Hits Record High What You Need To Know

May 17, 2025

Tsx Composite Index Hits Record High What You Need To Know

May 17, 2025 -

Did Kevin Durant Just Confirm Dating Rumors With Angel Reese A Pregame Comment Analysis

May 17, 2025

Did Kevin Durant Just Confirm Dating Rumors With Angel Reese A Pregame Comment Analysis

May 17, 2025 -

Greenko Founders Eyeing Orix Stake Acquisition Details Of The New Deal

May 17, 2025

Greenko Founders Eyeing Orix Stake Acquisition Details Of The New Deal

May 17, 2025 -

New York Daily News May 2025 Archives Accessing Historical News

May 17, 2025

New York Daily News May 2025 Archives Accessing Historical News

May 17, 2025 -

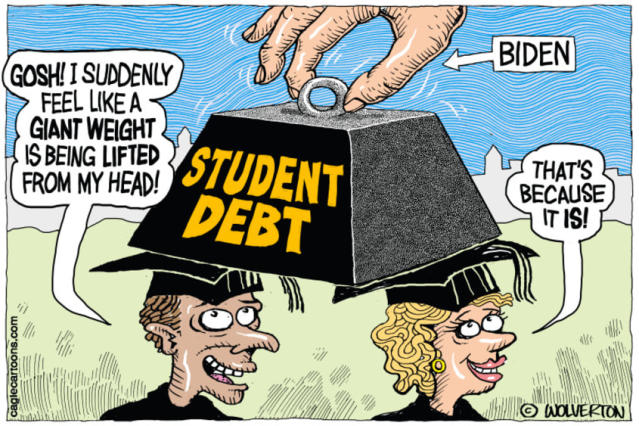

Buying A House With Student Loan Debt Is It Possible

May 17, 2025

Buying A House With Student Loan Debt Is It Possible

May 17, 2025

Latest Posts

-

Mc Collum From D2 National Champion To Iowa Wrestling Coach

May 17, 2025

Mc Collum From D2 National Champion To Iowa Wrestling Coach

May 17, 2025 -

Iowa Wrestling Adds D2 National Champion Ben Mc Collum To Coaching Team

May 17, 2025

Iowa Wrestling Adds D2 National Champion Ben Mc Collum To Coaching Team

May 17, 2025 -

75 Million Gift To Transform Healthcare In West Valley U Of Us New Hospital Project

May 17, 2025

75 Million Gift To Transform Healthcare In West Valley U Of Us New Hospital Project

May 17, 2025 -

Former D2 Champion Ben Mc Collum Named To Iowa Wrestling Coaching Staff

May 17, 2025

Former D2 Champion Ben Mc Collum Named To Iowa Wrestling Coaching Staff

May 17, 2025 -

Ben Mc Collum Joins Iowa Wrestling Staff After Successful Season At Drake

May 17, 2025

Ben Mc Collum Joins Iowa Wrestling Staff After Successful Season At Drake

May 17, 2025