Future Of Short-Term Rentals: Review Of Recent Letting Legislation

Table of Contents

Increased Regulation and Licensing Requirements

The days of unregulated short-term rentals are dwindling. Local governments worldwide are increasingly implementing stringent regulations to manage the impacts of this rapidly expanding sector. This intensified scrutiny manifests in two key areas: licensing and taxation.

Local Licensing and Permitting

Many cities are requiring licenses and permits for short-term rental properties, creating a more formalized and regulated market. Obtaining these licenses often involves a rigorous application process, including background checks, property inspections, and the payment of substantial fees. Non-compliance can lead to hefty fines and even the shut-down of operations.

- Examples of cities with strict licensing: New York City, Amsterdam, Barcelona, and many others are leading the way in implementing comprehensive short-term rental licensing programs. These programs often include detailed requirements for property owners, including safety inspections and adherence to specific building codes.

- Application processes: Applications typically involve providing detailed information about the property, the owner, and the intended use of the property for short-term rentals. This might include proof of ownership, insurance documentation, and even a detailed plan for managing noise and waste.

- Fees and penalties: Fees for short-term rental licenses can vary significantly, ranging from a few hundred to thousands of dollars annually. Penalties for non-compliance can be severe, including fines, legal action, and even the revocation of the rental license. Understanding these implications is vital for anyone operating a short-term rental. This applies to both the short-term rental license and any necessary short-term rental permits.

Taxation and Revenue Collection

The taxation of short-term rental income is also becoming increasingly sophisticated. Governments are implementing measures to ensure that revenue generated from short-term rentals is appropriately taxed, including occupancy taxes, income taxes, and sales taxes.

- Examples of tax regulations: Jurisdictions are implementing various methods for collecting these taxes, including direct payment by hosts and reporting through online platforms like Airbnb and Vrbo.

- Methods of tax collection: Platform reporting is becoming increasingly common, with platforms acting as intermediaries to collect and remit taxes on behalf of hosts. This simplifies the process for hosts but requires them to accurately report their income and maintain meticulous records. This is true for all forms of vacation rental tax.

- Consequences of non-payment: Failure to pay short-term rental taxes can lead to significant penalties, including back taxes, interest, and even legal action.

Impact on Neighborhoods and Community Concerns

The rapid proliferation of short-term rentals has raised several concerns within communities, leading to legislation aimed at mitigating negative impacts.

Noise Complaints and Disturbances

Noise complaints are a frequent issue associated with short-term rentals, leading to ordinances designed to limit noise levels and enforce quiet hours.

- Noise ordinances: Many municipalities now have specific noise ordinances targeting short-term rentals, often specifying permissible noise levels at certain times of day.

- Noise reduction methods: Hosts can proactively address noise issues by investing in soundproofing materials, providing clear noise guidelines to guests, and establishing effective communication channels for addressing noise complaints.

- Penalties for violations: Violations of noise ordinances can result in fines, warnings, and even the suspension or revocation of rental licenses.

Parking Restrictions and Traffic Congestion

The influx of guests associated with short-term rentals can exacerbate parking shortages and traffic congestion in residential areas.

- Parking restrictions: Many jurisdictions are imposing parking restrictions on short-term rentals, limiting the number of vehicles allowed or requiring off-street parking.

- Permit requirements: Some areas require hosts to obtain parking permits for guests, ensuring adequate parking availability and minimizing the impact on residents.

- Solutions to alleviate congestion: Strategies to address this include encouraging the use of public transportation, providing information about local parking options, and working with local authorities to develop sustainable transportation solutions.

Impact on Affordable Housing

A significant debate surrounds the effect of short-term rentals on the availability of affordable housing.

- Arguments for and against: Some argue that short-term rentals reduce the supply of long-term rental units, driving up prices and displacing residents. Others contend that short-term rentals can provide additional income for homeowners and contribute to local economies.

- Legislative attempts to address the issue: Various jurisdictions are exploring strategies to address the potential negative impacts on affordable housing, including restrictions on whole-home rentals or the implementation of occupancy limits. This is a critical aspect of short-term rentals affordable housing.

The Role of Online Platforms and Technology

Online platforms play a significant role in the short-term rental market, and their actions are increasingly influenced by evolving legislation.

Platform Compliance and Responsibility

Platforms like Airbnb and Vrbo are adapting to the changing regulatory landscape by enhancing their compliance measures.

- Platform initiatives: Many platforms are now actively working with local governments to share data, automate license verification, and ensure that hosts comply with local regulations. This includes implementing stricter verification processes for both hosts and guests. This affects Airbnb regulations, Vrbo regulations, and other short-term rental platform compliance measures.

Technology for Host Management

Technology is proving crucial for hosts to effectively manage their short-term rentals while adhering to new regulations.

- Software and tools: A range of software and tools are available to streamline tasks such as managing bookings, communicating with guests, collecting taxes, and ensuring compliance with local regulations. Short-term rental management software and vacation rental automation tools are becoming increasingly sophisticated.

Conclusion

The future of short-term rentals is undeniably intertwined with the evolving landscape of letting legislation. Understanding and adapting to new regulations, such as licensing requirements, taxation policies, and community concerns, is paramount for success in this dynamic market. By leveraging technology and proactively engaging with local authorities, both hosts and platforms can navigate these changes and ensure the continued growth and sustainability of the short-term rental industry. Stay informed about the latest updates in short-term rental legislation to optimize your strategy and ensure compliance. Learn more about the impact of recent changes on your local short-term rental market.

Featured Posts

-

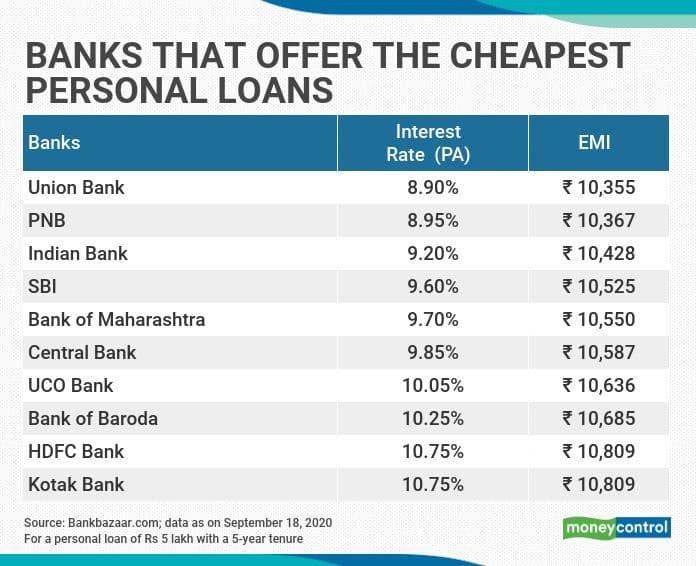

Lowest Personal Loan Interest Rates Compare Offers Today

May 28, 2025

Lowest Personal Loan Interest Rates Compare Offers Today

May 28, 2025 -

Wawali Balikpapan Bangun Taman Kota 1 Hektare Per Kecamatan

May 28, 2025

Wawali Balikpapan Bangun Taman Kota 1 Hektare Per Kecamatan

May 28, 2025 -

Clooney Vs Jackman Broadway Battle Brewing

May 28, 2025

Clooney Vs Jackman Broadway Battle Brewing

May 28, 2025 -

Guaranteed Approval Tribal Loans Best Options For Bad Credit

May 28, 2025

Guaranteed Approval Tribal Loans Best Options For Bad Credit

May 28, 2025 -

Logan 2017 Streaming Availability Hugh Jackman Film Gets A New Home This April

May 28, 2025

Logan 2017 Streaming Availability Hugh Jackman Film Gets A New Home This April

May 28, 2025