Get Pre-approved For A Personal Loan With Low Interest Rates

Table of Contents

Understanding the Pre-Approval Process for Personal Loans

Pre-approval for a personal loan is a preliminary assessment of your eligibility for a loan. It differs from a formal application because it doesn't involve a hard credit pull and doesn't guarantee loan approval. However, it provides invaluable insights into your borrowing power and the interest rates you're likely to qualify for.

The benefits of pre-approval are significant:

-

Know Your Borrowing Power: Understand how much you can realistically borrow before you start shopping for specific loans.

-

Compare Offers: Pre-approval lets you compare interest rates and loan terms from multiple lenders without impacting your credit score significantly.

-

Save Time: Once you've been pre-approved, the formal application process is often faster and smoother.

-

Pre-approval provides a range of loan amounts and interest rates you qualify for.

-

It helps avoid multiple hard credit inquiries that can lower your credit score.

-

Pre-approval gives you leverage when negotiating with lenders.

Factors Affecting Your Personal Loan Interest Rate

Several factors influence the interest rate you'll receive on a personal loan. Understanding these factors is crucial for securing a low-interest rate.

-

Credit Score: Your credit score is the most significant factor. A higher credit score demonstrates your creditworthiness and leads to lower interest rates. Before applying for any loans, check your credit report from all three major credit bureaus (Equifax, Experian, and TransUnion) to identify and correct any errors.

-

Debt-to-Income Ratio (DTI): Your DTI, calculated by dividing your monthly debt payments by your gross monthly income, reflects your ability to manage debt. A lower DTI generally results in better loan terms.

-

Loan Amount and Term Length: Borrowing a larger amount or opting for a longer repayment term typically leads to higher interest rates.

-

Improving your credit score before applying for a loan can significantly lower your interest rate.

-

Lowering your DTI can improve your chances of securing a low-interest loan.

-

Comparing loan terms from different lenders can help you find the best interest rate.

How to Get Pre-approved for a Personal Loan with Low Interest Rates

Getting pre-approved is a straightforward process:

- Gather Necessary Documents: Collect your proof of income (pay stubs, tax returns), identification, and any other documents the lender requires.

- Use Online Pre-Approval Tools: Many lenders offer quick online pre-approval applications. Complete these applications accurately and honestly.

- Compare Lenders: Use online loan comparison tools to compare APRs, fees, and loan terms from various lenders. Don't just focus on the interest rate; also consider origination fees and other charges.

- Review Loan Terms: Before accepting any offer, carefully review the loan agreement to understand all terms and conditions.

- Negotiate: Don't be afraid to negotiate with lenders. If you have excellent credit and a low DTI, you may be able to negotiate a lower interest rate.

- Gather necessary documents (proof of income, identification, etc.) beforehand.

- Use online loan comparison tools to find the best rates.

- Carefully review the loan terms and conditions before accepting an offer.

- Don't hesitate to negotiate with lenders for a better interest rate.

Tips for Securing the Lowest Possible Interest Rate

To maximize your chances of securing a low interest personal loan:

-

Improve Your Credit Score: Pay your bills on time, reduce your debt, and monitor your credit report regularly. Dispute any inaccuracies you find.

-

Negotiate: Highlight your strong credit history, a large down payment (if applicable), or a stable employment history to negotiate a better rate.

-

Consider Loan Types: Secured loans (backed by collateral) often have lower interest rates than unsecured loans.

-

Dispute any inaccuracies on your credit report.

-

Consider a secured loan for a potentially lower interest rate.

-

Show lenders your stability (long-term employment, consistent address).

Conclusion: Maximize Your Chances of Getting a Low-Interest Personal Loan

Getting pre-approved for a personal loan is a crucial first step in securing favorable loan terms, especially a low interest rate. By understanding the factors that influence interest rates and following the steps outlined above, you can significantly improve your chances of obtaining a loan with the best possible terms. Remember to compare offers from multiple lenders, negotiate rates, and improve your creditworthiness before applying. Don't wait! Start your journey towards securing a personal loan with low interest rates by initiating the pre-approval process today. Take control of your finances and explore your options!

Featured Posts

-

Eredivisie Race Heats Up Ajax Feyenoord And Psv Battle For Top Spot

May 28, 2025

Eredivisie Race Heats Up Ajax Feyenoord And Psv Battle For Top Spot

May 28, 2025 -

Trumps Threat To Redirect Harvard Funding A Blow To Higher Education

May 28, 2025

Trumps Threat To Redirect Harvard Funding A Blow To Higher Education

May 28, 2025 -

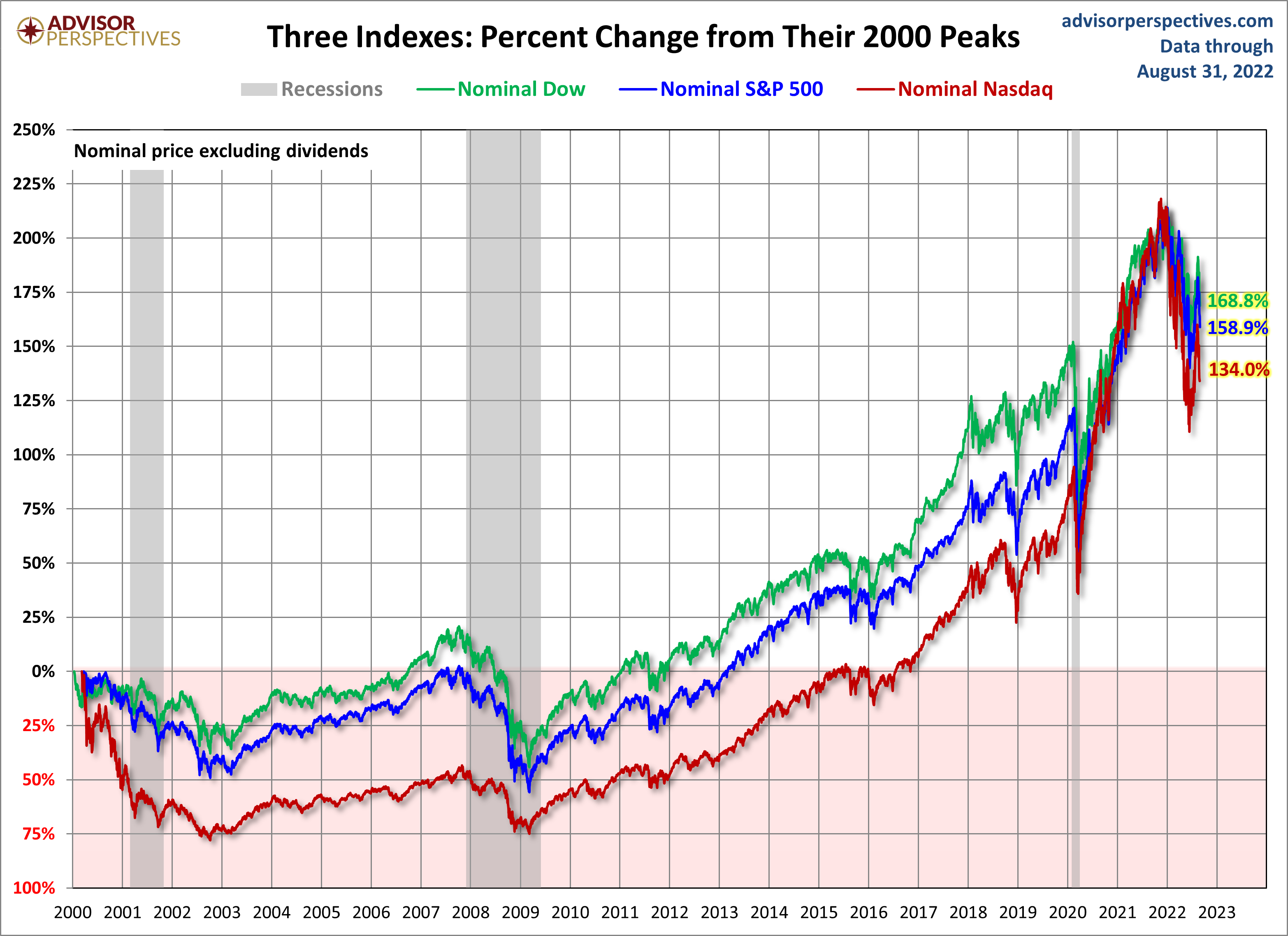

Stock Market Recap Dow S And P 500 Performance For May 27

May 28, 2025

Stock Market Recap Dow S And P 500 Performance For May 27

May 28, 2025 -

Descubre Pepper Premiere Lo Mejor De Pepper 96 6 Fm

May 28, 2025

Descubre Pepper Premiere Lo Mejor De Pepper 96 6 Fm

May 28, 2025 -

Bali Suksesnya Penanganan Sampah Menjadi Acuan Nasional Menteri Hanif Faisol

May 28, 2025

Bali Suksesnya Penanganan Sampah Menjadi Acuan Nasional Menteri Hanif Faisol

May 28, 2025