Global Risk Rally: Stocks Surge On U.S.-China Trade Deal

Table of Contents

The U.S.-China Trade Deal: A Catalyst for the Global Risk Rally

The "Phase One" trade agreement between the U.S. and China, while not a complete resolution of all trade disputes, provided a much-needed dose of certainty that had been absent for a considerable time. This relative certainty acted as a powerful catalyst for the global risk rally.

Key Provisions of the "Phase One" Deal:

- Tariff Reductions: Significant reductions in tariffs imposed on certain categories of Chinese goods, easing the burden on businesses and consumers.

- Increased Chinese Purchases: A commitment by China to significantly increase its purchases of U.S. agricultural products, energy resources, and manufactured goods over the coming years.

- Intellectual Property Protections: Enhanced enforcement mechanisms and legal protections for U.S. companies’ intellectual property rights within the Chinese market. This addressed a major point of contention in the trade conflict.

These provisions breathed new life into sectors directly affected by the trade war. Agriculture, in particular, saw substantial benefits from China's commitment to increase purchases, while technology companies, previously facing significant trade barriers, experienced a surge in investor confidence.

Market Sentiment Shift: The prolonged trade war had created a pervasive "risk-off" environment, characterized by cautious investor behavior and a reluctance to invest in equities. The trade deal, however, signaled a reduction in trade uncertainty, leading to a decisive shift towards a "risk-on" mentality. Increased investor confidence translated into a significant influx of capital into global stock markets, fueling the global risk rally. This sentiment shift was readily apparent in statements from market analysts like those at Morgan Stanley, who highlighted the deal's positive impact on investor psychology.

Impact on Global Stock Markets: Winners and Losers

The global risk rally wasn't uniform across all regions and sectors. Some markets and industries experienced far more significant gains than others.

Regional Market Performance:

- United States: U.S. markets, including the S&P 500 and the Dow Jones Industrial Average, saw substantial gains, reflecting the deal's direct and positive impact on American businesses and investor confidence.

- Asia: Asian markets, notably those in China and Hong Kong, also experienced significant growth, albeit with variations depending on the specific sector. The Hang Seng Index, for example, showed a substantial increase.

- Europe: European markets also participated in the rally, albeit to a lesser degree than U.S. and Asian markets, demonstrating a broader, global impact of the deal.

Sector-Specific Analysis: Technology stocks, previously hit hard by trade tensions, saw particularly strong gains. Similarly, the agricultural sector experienced a remarkable surge, reflecting China’s commitments. However, some sectors reliant on exports to China experienced more modest growth, underscoring the nuanced impact of the deal. Charts and graphs showcasing these sector-specific performances would provide further visual clarity.

Economic Implications of the Global Risk Rally

The implications of this global risk rally extend far beyond the stock market.

Increased Investment and Growth: Reduced trade uncertainty is expected to stimulate investment both domestically and internationally. Increased business investment and renewed consumer confidence could contribute significantly to global economic growth. This positive outlook could lead to improved employment figures and a boost to global trade volumes.

Long-Term Sustainability: While the current rally is encouraging, its long-term sustainability is intrinsically linked to the successful implementation of the trade deal's provisions. The potential for future trade disputes or unexpected geopolitical events remains a significant risk, potentially influencing future market behavior. The extent to which China fulfills its commitments regarding purchasing U.S. goods will be a critical factor in determining the longevity of the current positive trends.

Conclusion: Navigating the Global Risk Rally and its Future

The global risk rally, triggered by the U.S.-China trade deal, offers significant opportunities but also presents inherent challenges. While the immediate market impact has been largely positive, the long-term trajectory depends on the consistent execution of the trade agreement and the broader geopolitical environment. Careful analysis and monitoring of the ongoing developments are necessary to fully grasp the implications for global markets and individual investment strategies. Stay informed about the global risk rally and the evolving U.S.-China trade landscape to make informed investment decisions. Understanding this dynamic relationship is crucial for successful navigation of the global economic environment.

Featured Posts

-

Die Kirschbluete In Pretzfeld Ein Besonderes Erlebnis In Der Fraenkischen Schweiz

May 14, 2025

Die Kirschbluete In Pretzfeld Ein Besonderes Erlebnis In Der Fraenkischen Schweiz

May 14, 2025 -

Pokemon Go Max Monday Guide Dynamax Sobble Raid Strategies

May 14, 2025

Pokemon Go Max Monday Guide Dynamax Sobble Raid Strategies

May 14, 2025 -

Global Risk Rally Stocks Surge On U S China Trade Deal

May 14, 2025

Global Risk Rally Stocks Surge On U S China Trade Deal

May 14, 2025 -

Damiano David Povernennya Na Stsenu Yevrobachennya

May 14, 2025

Damiano David Povernennya Na Stsenu Yevrobachennya

May 14, 2025 -

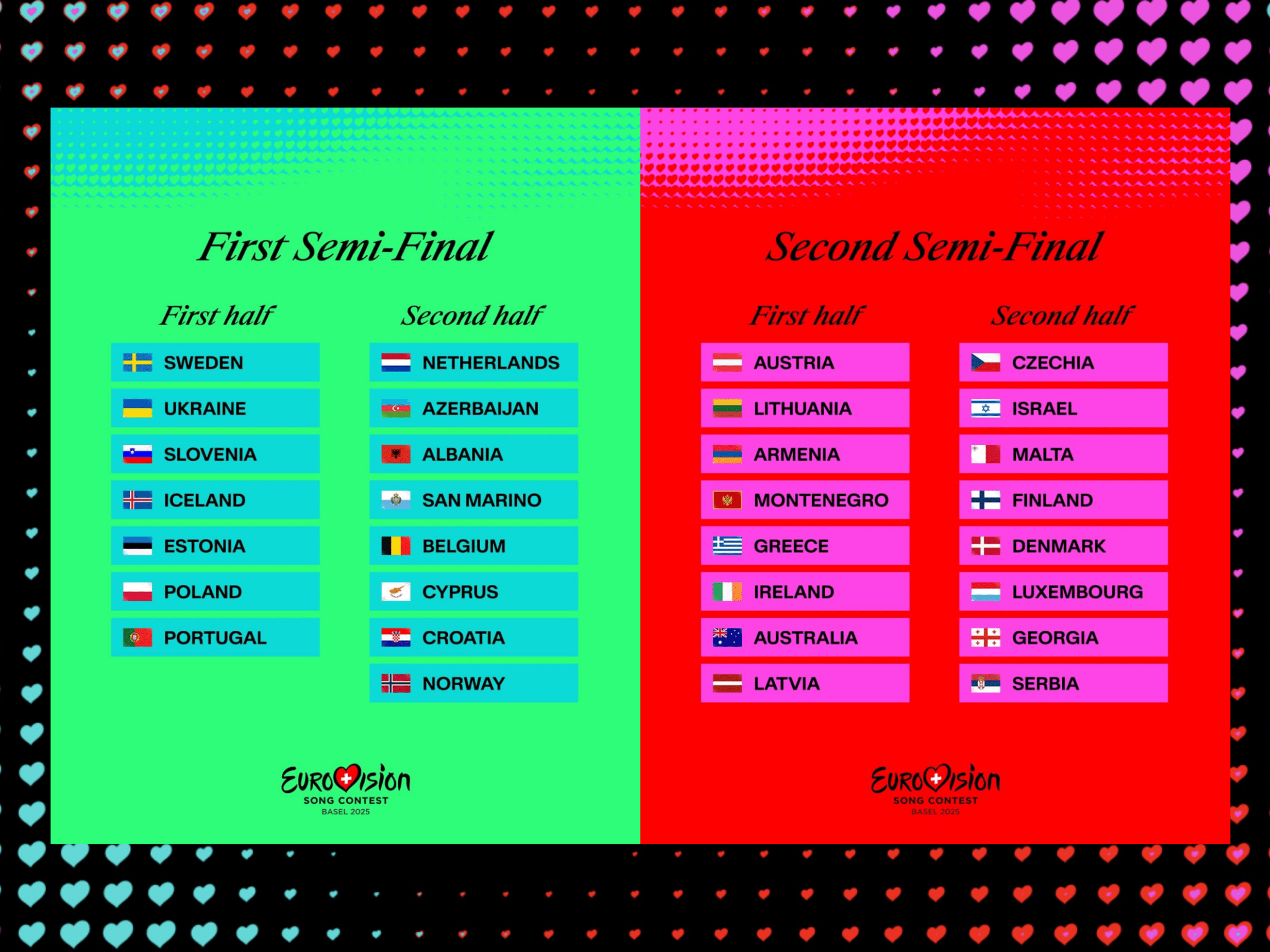

Eurovision 2025 Final And Semi Final Dates

May 14, 2025

Eurovision 2025 Final And Semi Final Dates

May 14, 2025