Gold And Cash-like ETFs: A Safe Haven For Investors

Table of Contents

Understanding Gold ETFs as a Safe Haven Investment

Gold, a timeless precious metal, has long served as a hedge against inflation and economic downturns. Its inherent value and scarcity make it a desirable asset during periods of market uncertainty. Gold ETFs offer investors convenient and cost-effective access to this precious metal without the need for physical storage.

The Role of Gold in a Diversified Portfolio

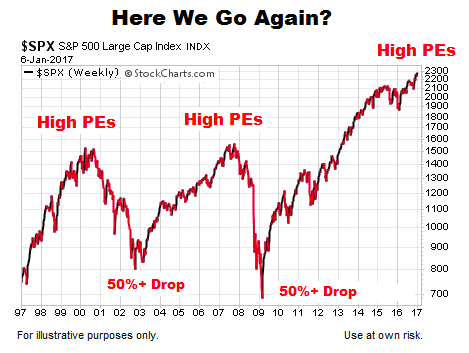

- Gold's performance during economic crises: Historically, gold has demonstrated a negative correlation with traditional asset classes like stocks and bonds. During times of economic turmoil, when stock markets decline, gold often appreciates, acting as a valuable portfolio buffer.

- Gold's role in reducing portfolio volatility: By incorporating gold into a diversified portfolio, investors can effectively reduce overall volatility and lessen the impact of market swings. The inherent stability of gold helps smooth out portfolio performance.

- Examples of successful gold ETF investment strategies: Many investors have successfully integrated gold ETFs into their long-term investment strategies, benefiting from its performance during periods of market uncertainty and inflation. These strategies often involve a strategic allocation of gold based on individual risk tolerance and investment goals.

Choosing the Right Gold ETF

Selecting the right gold ETF is critical. Factors to consider include:

- Comparison of different types of gold ETFs (physically-backed vs. unbacked): Physically-backed gold ETFs hold physical gold reserves, offering a higher degree of security and transparency. Unbacked ETFs track the price of gold without holding the physical asset.

- Key metrics to evaluate when choosing a gold ETF: Examine the expense ratio (management fees), asset under management (AUM – a measure of the fund's size and liquidity), and tracking error (how closely the ETF tracks the underlying gold price). Lower expense ratios and smaller tracking errors are generally preferred.

- Examples of popular and reputable Gold ETFs: Research and compare various reputable gold ETFs available in your market. Consider factors like their track record, management fees and regulatory compliance.

Cash-like ETFs: A Liquid Alternative for Stability

Cash-like ETFs provide investors with a liquid and relatively low-risk alternative to traditional cash holdings. These ETFs invest in highly liquid and short-term debt instruments, offering a balance between liquidity and a small return.

The Benefits of Cash-like ETFs

- Comparison with traditional cash holdings (interest rates, accessibility): Unlike traditional savings accounts which may offer low interest rates, cash-like ETFs often provide a slightly higher yield while maintaining excellent liquidity. They also offer greater accessibility and diversification than a single savings account.

- Tax implications of investing in cash-like ETFs: The tax implications of cash-like ETFs can vary depending on your jurisdiction and the specific ETF. It's essential to understand the tax implications before investing.

- Examples of different types of cash-like ETFs (money market funds, short-term bond ETFs): Money market funds and short-term bond ETFs are common examples of cash-like ETFs. Each has a slightly different risk and return profile.

Cash-like ETFs vs. Traditional Savings Accounts

| Feature | Cash-like ETFs | Traditional Savings Accounts |

|---|---|---|

| Return Potential | Slightly higher potential yield | Typically low interest rates |

| Risk Profile | Very low | Very low |

| Liquidity | High liquidity; readily tradable | High liquidity; readily accessible |

| Fees & Expenses | Typically lower than actively managed funds | May have fees and maintenance charges |

Strategic Allocation of Gold and Cash-like ETFs

Determining the optimal allocation of Gold and Cash-like ETFs within your portfolio is crucial. This depends heavily on your individual risk tolerance, investment goals, and time horizon.

Determining the Right Asset Allocation

- Factors influencing asset allocation decisions (age, risk tolerance, financial goals): Younger investors with a longer time horizon might tolerate higher risk and allocate less to Gold and Cash-like ETFs. Older investors nearing retirement may prioritize capital preservation and allocate more to these safer assets.

- Sample portfolio allocation strategies incorporating Gold and Cash-like ETFs: There is no one-size-fits-all approach. A sample strategy might include 5-10% in gold ETFs and 10-20% in cash-like ETFs, depending on your risk profile. The remaining portion would be allocated to other asset classes like stocks and bonds.

- The importance of rebalancing your portfolio periodically: Regular rebalancing ensures your portfolio remains aligned with your risk tolerance and investment goals over time.

Conclusion

Gold and Cash-like ETFs offer a powerful combination for investors seeking to navigate market volatility and secure their financial future. By strategically incorporating these safe haven investments into a well-diversified portfolio, investors can mitigate risk, reduce portfolio volatility, and potentially enhance long-term returns. Remember to carefully consider your individual risk tolerance, investment goals, and time horizon before making any investment decisions. Further research and consultation with a qualified financial advisor are recommended to determine the optimal allocation of Gold and Cash-like ETFs within your personal investment strategy. Exploring Gold and Cash-like ETFs is a vital step towards building a robust and resilient investment portfolio.

Featured Posts

-

Bof As Take Are High Stock Market Valuations Cause For Concern

Apr 23, 2025

Bof As Take Are High Stock Market Valuations Cause For Concern

Apr 23, 2025 -

Die 50 Staffel 2 2025 Teilnehmer Stream Komplette Folgen And Mehr

Apr 23, 2025

Die 50 Staffel 2 2025 Teilnehmer Stream Komplette Folgen And Mehr

Apr 23, 2025 -

The Undervalued Asset How Middle Managers Drive Company Performance And Employee Satisfaction

Apr 23, 2025

The Undervalued Asset How Middle Managers Drive Company Performance And Employee Satisfaction

Apr 23, 2025 -

Burky Brilla Con Doblete Rayadas Consiguen El Triunfo

Apr 23, 2025

Burky Brilla Con Doblete Rayadas Consiguen El Triunfo

Apr 23, 2025 -

La Montee Des Depenses De Defense Usa Vs Russie Usa Today

Apr 23, 2025

La Montee Des Depenses De Defense Usa Vs Russie Usa Today

Apr 23, 2025