Gold Market Retreat: Trade Optimism Fuels Profit-Taking

Table of Contents

Rising Trade Optimism and its Impact on Gold Prices

Gold often serves as a safe-haven asset, its price rising during times of economic uncertainty and geopolitical instability. However, a growing sense of trade optimism has an inverse relationship with gold prices. When investors feel confident about the global economy, they tend to move away from safe-haven assets like gold and towards riskier investments with potentially higher returns.

Recent positive developments in international trade negotiations have significantly contributed to this shift. The ongoing US-China trade talks, although still fraught with complexities, have shown signs of progress, reducing anxieties about a full-blown trade war. Similarly, developments surrounding Brexit, while uncertain, have shown less immediate negative impact than initially feared.

- Positive economic indicators: Stronger-than-expected economic data from major economies has eased concerns about a global recession.

- Decreased demand for safe-haven assets: With reduced economic uncertainty, the demand for gold as a safe haven has fallen.

- Shifting investor sentiment: Investor confidence has increased, leading to a shift towards riskier assets such as stocks and emerging market equities. This is evidenced by increases in stock market indices globally.

Profit-Taking in the Gold Market: A Closer Look

Profit-taking is the act of selling an asset to realize a profit. In the current gold market retreat, many investors who initially bought gold as a hedge against economic uncertainty are now taking profits. This selling pressure contributes significantly to the price decline. Technical analysis also played a role.

- Resistance levels being met: Gold prices had reached resistance levels, indicating a potential ceiling in the price.

- Technical indicators suggesting a potential price reversal: Various technical indicators, such as moving averages and Relative Strength Index (RSI), signaled a potential price correction or reversal.

- Increased selling pressure from institutional investors: Large institutional investors, having reached their profit targets, likely contributed significantly to the increased selling pressure.

Alternative Investment Opportunities Emerging

The renewed optimism in the global trading environment has made other investment options more attractive. Investors are increasingly looking towards assets perceived to offer higher growth potential.

- Higher potential returns in other asset classes: Stocks, particularly in technology and emerging markets, are perceived to offer higher potential returns in the current climate of increased investor risk appetite.

- Increased risk appetite among investors: The shift in sentiment has boosted investor risk appetite, leading to a flight to assets with higher growth potential, even if they carry higher risk.

- Diversification strategies: Many investors are diversifying their portfolios, reducing their allocation to gold and increasing their positions in other asset classes.

Analyzing the Future of Gold Prices: Short-Term and Long-Term Outlook

Predicting the future of gold prices is always challenging, but considering both short-term and long-term factors provides a more balanced perspective.

In the short term, the gold market retreat may continue as long as trade optimism persists. However, a resurgence of trade tensions, geopolitical instability, or unexpected economic downturns could quickly reverse this trend.

In the long term, factors like inflation, currency debasement, and continued uncertainty in global financial markets could support gold price growth. Central bank activity, particularly large-scale quantitative easing programs, remains a key long-term factor influencing gold prices.

- Short-term predictions: Based on current market sentiment, short-term predictions suggest continued price consolidation or a slight decline.

- Long-term projections: Considering fundamental factors, long-term projections point towards a potential increase in gold prices, driven by inflation and geopolitical uncertainty.

Conclusion: Navigating the Gold Market Retreat

The current gold market retreat is primarily driven by rising trade optimism and subsequent profit-taking. Understanding these factors is crucial for making effective investment decisions. Investors should adopt a cautious approach, focusing on risk management and diversification. Don't panic sell, but carefully monitor your exposure to the gold market and consider adjusting your investment strategy based on evolving market conditions. Monitor the gold market retreat closely, understand gold market fluctuations, and adapt your gold investment strategy accordingly. Staying informed about gold price movements and market trends is key to navigating this evolving market effectively.

Featured Posts

-

New Orleans Jail Escape Cnn Releases Exclusive Video Footage

May 18, 2025

New Orleans Jail Escape Cnn Releases Exclusive Video Footage

May 18, 2025 -

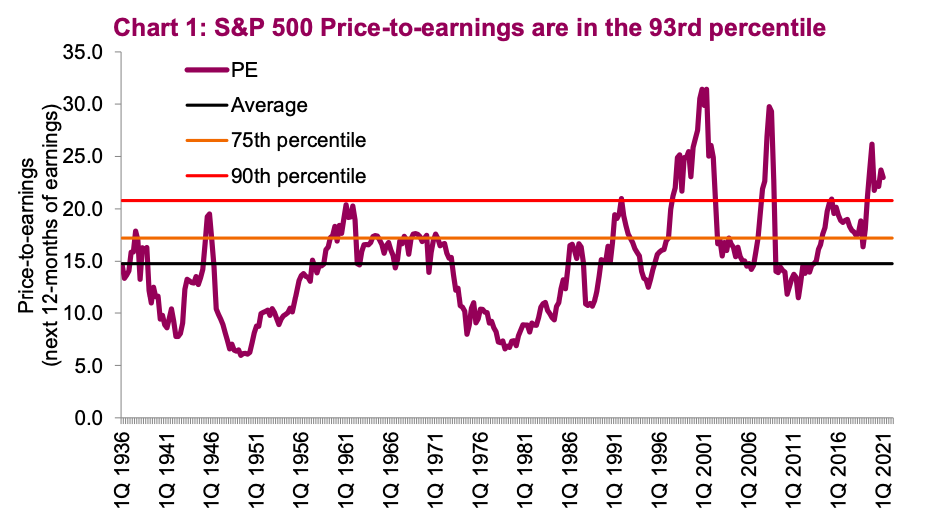

Bof A On High Stock Market Valuations A Reason For Investors To Stay Calm

May 18, 2025

Bof A On High Stock Market Valuations A Reason For Investors To Stay Calm

May 18, 2025 -

Bowen Yang Addresses Shane Gillis Snl Dismissal

May 18, 2025

Bowen Yang Addresses Shane Gillis Snl Dismissal

May 18, 2025 -

Rozluchennya Kanye Vesta Ta B Yanki Tsenzori Prichini Ta Naslidki

May 18, 2025

Rozluchennya Kanye Vesta Ta B Yanki Tsenzori Prichini Ta Naslidki

May 18, 2025 -

Stephen Miller Potential Replacement For Mike Waltz As National Security Advisor

May 18, 2025

Stephen Miller Potential Replacement For Mike Waltz As National Security Advisor

May 18, 2025