Government Pursuit Of Delinquent Student Loan Borrowers: A Guide To Your Rights

Table of Contents

Understanding the Stages of Delinquency

Defining Delinquency

A delinquent student loan is defined as a loan where you've missed one or more payments. The specific definition of delinquency varies depending on the type of loan (federal or private) and the lender. Generally, a loan becomes delinquent after 30 days of missed payments. This can lead to a negative impact on your credit score and trigger collection efforts. Federal student loans have specific stages of delinquency, which can be severe.

Early Warning Signs

Early indicators of delinquency include late payment notices, phone calls or emails from your loan servicer, or increasingly insistent collection calls. Don't ignore these signs. Ignoring them will not make the problem go away; rather, it will escalate the situation, possibly leading to wage garnishment or tax refund offset.

- Specific timelines for delinquency stages: Federal student loans typically progress through stages of delinquency, starting with 30 days late, then 60, 90, and beyond. Each stage carries increasing consequences.

- Consequences of each stage: Consequences range from damaged credit scores to wage garnishment, tax refund offset, and even legal action.

- Resources for checking loan status: You can check your loan status online through the National Student Loan Data System (NSLDS) or your loan servicer's website.

Government Collection Agencies and Their Methods

Identifying Legitimate Agencies

It's crucial to verify the legitimacy of any agency contacting you about your delinquent student loans. Legitimate agencies will identify themselves clearly and provide you with information about your loan. Never give out personal information to someone you are not sure is legitimate.

Common Collection Tactics

The government uses various methods to collect delinquent student loans. These include:

-

Phone calls and letters: Initial attempts to contact borrowers usually involve phone calls and written notices.

-

Wage garnishment: A portion of your wages can be legally garnished to repay your debt.

-

Tax refund offset: The government can withhold your tax refund to pay off your delinquent loans.

-

Bank levy: The government can seize funds directly from your bank account.

-

Rights related to communication from collection agencies: The Fair Debt Collection Practices Act (FDCPA) limits the times and methods collection agencies can use to contact you.

-

Steps to take if harassed by collectors: Document all communication and report harassment to the appropriate authorities.

-

Information on debt validation: You have the right to request validation of your debt from the collection agency.

Protecting Your Rights as a Borrower

Understanding Your Federal Rights

Federal law provides borrowers with several protections, including the right to due process, the right to dispute the debt, and the right to seek repayment options. Familiarize yourself with these rights to effectively advocate for yourself.

Negotiating with the Government

Several options exist for borrowers facing delinquency:

-

Repayment plans: Various repayment plans, including income-driven repayment (IDR) plans, can make your monthly payments more manageable.

-

Loan consolidation: Combining multiple loans into a single loan can simplify repayment.

-

Deferment/forbearance: Temporary postponement of payments due to hardship.

-

Importance of documenting all communication: Keep records of all calls, letters, and emails related to your loans.

-

Steps to initiate a dispute process: If you disagree with the amount you owe, you can dispute it with your loan servicer.

-

Seeking legal counsel if necessary: If you're struggling to navigate the process, seeking legal advice is advisable.

-

Resources for free or low-cost legal aid: Several organizations offer free or low-cost legal services to borrowers facing financial hardship.

Avoiding Delinquent Student Loans in the Future

Proactive Loan Management

The best way to avoid delinquency is through proactive loan management. This includes:

- Creating a realistic budget: Track your income and expenses to determine how much you can comfortably afford to pay each month.

- Prioritizing loan payments: Make loan payments a top priority in your budget.

Utilizing Available Resources

Several resources can help borrowers manage their loans effectively:

- Automatic payments: Set up automatic payments to avoid missed payments.

- Contacting your loan servicer promptly if facing financial hardship: Don't wait until you're severely behind on payments to seek help.

- Exploring income-driven repayment plans: Income-driven repayment plans can reduce your monthly payments based on your income.

- Understanding loan forgiveness programs: Explore programs that may offer loan forgiveness, such as Public Service Loan Forgiveness (PSLF).

Conclusion

Navigating the government's pursuit of delinquent student loans requires understanding your rights, proactively managing your loans, and utilizing available resources. Remember, you have legal protections, and various options can help you manage your debt. Don't hesitate to seek help from legal aid organizations or credit counselors. Don't let the complexities of delinquent student loans overwhelm you. Take control of your situation by learning about your rights and exploring available options. Start by understanding the stages of delinquency and protect yourself from aggressive collection tactics. Remember, knowledge is your best defense against the government's pursuit of delinquent student loans.

Featured Posts

-

Ontarios 14 6 Billion Deficit Tariff Impacts And Economic Outlook

May 17, 2025

Ontarios 14 6 Billion Deficit Tariff Impacts And Economic Outlook

May 17, 2025 -

Is Josh Hart The Knicks Draymond Green A Role Comparison

May 17, 2025

Is Josh Hart The Knicks Draymond Green A Role Comparison

May 17, 2025 -

Inversion En Koriun Noticias Sobre El Descongelamiento De Cuentas

May 17, 2025

Inversion En Koriun Noticias Sobre El Descongelamiento De Cuentas

May 17, 2025 -

Reviewing The Week Identifying And Addressing Past Failures

May 17, 2025

Reviewing The Week Identifying And Addressing Past Failures

May 17, 2025 -

Top Rated Bitcoin Online Casino Jack Bit In 2025

May 17, 2025

Top Rated Bitcoin Online Casino Jack Bit In 2025

May 17, 2025

Latest Posts

-

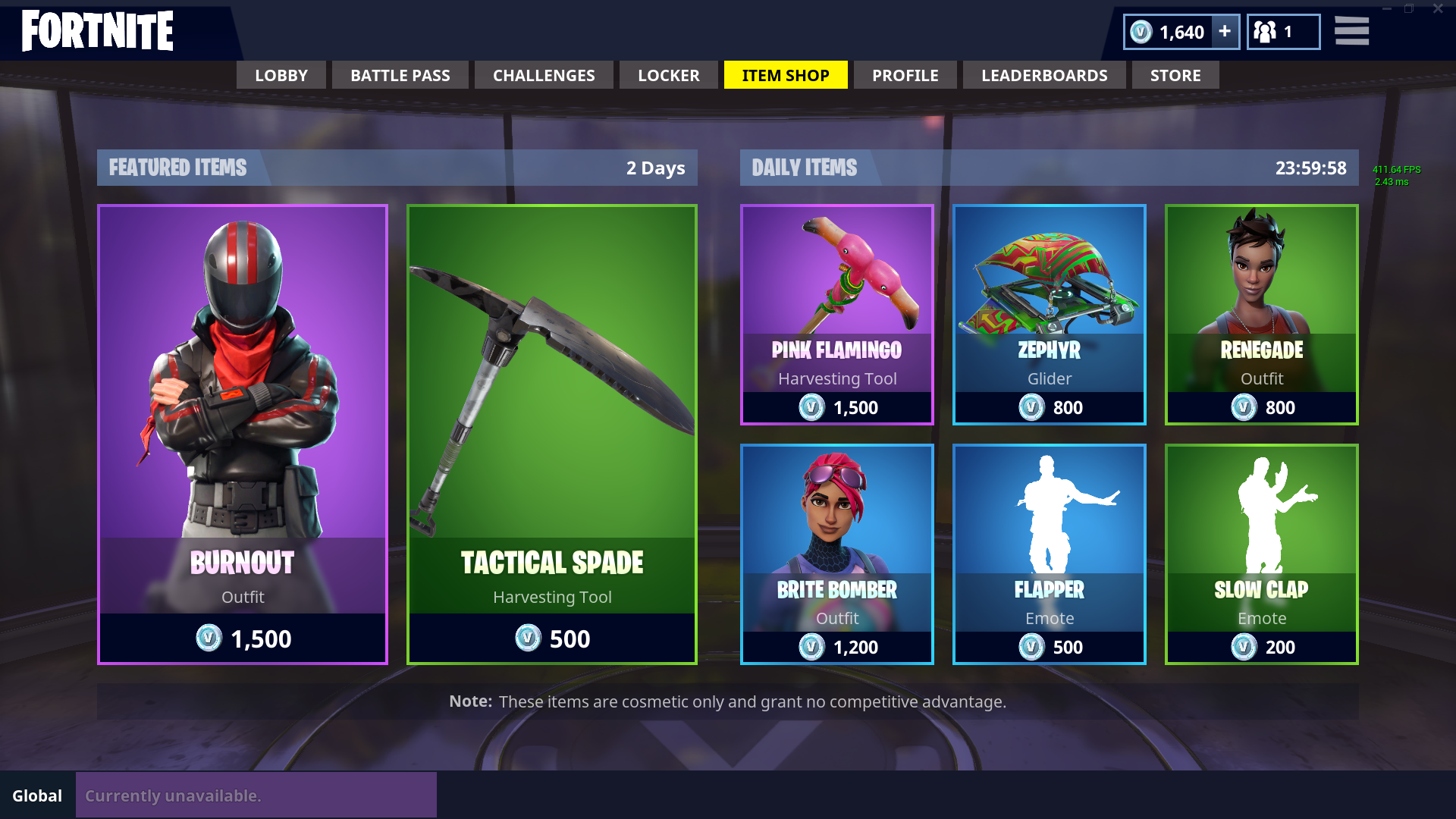

Are Fortnites Latest Shop Items Worth The Hype Spoiler No

May 17, 2025

Are Fortnites Latest Shop Items Worth The Hype Spoiler No

May 17, 2025 -

Discontent Mounts Among Fortnite Players Over Shop Update

May 17, 2025

Discontent Mounts Among Fortnite Players Over Shop Update

May 17, 2025 -

Latest Fortnite Shop Update Receives Backlash From Players

May 17, 2025

Latest Fortnite Shop Update Receives Backlash From Players

May 17, 2025 -

Fortnites Item Shop Update A Source Of Fan Frustration

May 17, 2025

Fortnites Item Shop Update A Source Of Fan Frustration

May 17, 2025 -

Cowboy Bebop Fortnite Skins Faye Valentine And Spike Spiegel Bundle Price Revealed

May 17, 2025

Cowboy Bebop Fortnite Skins Faye Valentine And Spike Spiegel Bundle Price Revealed

May 17, 2025