Green Funding For SMEs: A Guide To Sustainability Investments

Table of Contents

Identifying Suitable Green Funding Opportunities for Your SME

Finding the right funding source is crucial for your sustainability journey. Let's explore some key options for securing green funding for SMEs.

Grants and Subsidies

Government and private sector organizations offer numerous grants and subsidies specifically designed to support sustainable initiatives within SMEs. These often target specific environmental improvements or technological advancements.

- Examples of relevant grants: (This section needs to be customized based on the target country/region. Examples could include specific grant programs from the EU, US EPA, or equivalent national/regional agencies.) For example, in [Country Name], the [Grant Program Name] provides funding for energy efficiency upgrades in SMEs, while the [Another Grant Program Name] supports the adoption of renewable energy technologies.

- Application processes: These vary widely, but typically involve submitting a detailed proposal outlining your project, its environmental benefits, and your financial plan.

- Eligibility criteria: Eligibility requirements are specific to each grant and may include factors like business size, industry, location, and the type of project.

- Typical grant amounts: Grant amounts range significantly depending on the program and the scope of your project. Some may provide small seed funding, while others offer substantial support for major upgrades. Keyword integration: Government green grants, sustainability subsidies, SME grant funding.

Green Loans and Financing

Securing green business loans offers a flexible approach to funding sustainability projects. Several financial institutions now offer specialized green loans with attractive terms.

- Green loans from banks: Many banks now offer loans specifically designed for environmentally friendly projects, often with lower interest rates or other incentives.

- Impact investing: Impact investors actively seek out opportunities to invest in businesses with a positive social and environmental impact.

- Crowdfunding platforms: Platforms dedicated to sustainable projects offer an avenue to access funding directly from individuals who support environmentally conscious businesses.

- Loan interest rates and repayment terms: These vary significantly depending on the lender, the project, and the borrower's creditworthiness. Keyword integration: Green business loans, sustainable financing, eco-friendly loans.

Equity Investment and Venture Capital

For SMEs seeking significant capital, attracting green venture capital or other equity investors who prioritize ESG (environmental, social, and governance) factors is a viable option.

- Identifying ESG investors: Research investors with a strong track record of supporting sustainable businesses. Many actively seek out businesses with demonstrable environmental impact.

- Preparing a compelling investment pitch: Highlight your company’s commitment to sustainability, quantify the environmental benefits of your project, and clearly articulate your financial projections.

- Showcasing the environmental impact of your business: Use quantifiable metrics to demonstrate the positive environmental impact of your operations and future projects.

- Understanding equity dilution: Be prepared to offer equity in exchange for investment, which will dilute your ownership. Keyword integration: ESG investing, green venture capital, sustainable equity financing.

Crafting a Compelling Sustainability Business Plan

A strong business plan is crucial for securing any type of funding, especially when seeking green funding for SMEs.

Defining Your Green Goals

Clearly articulate your sustainability objectives and their alignment with your business strategy.

- Specific environmental goals: Establish clear, measurable, achievable, relevant, and time-bound (SMART) goals, such as reducing carbon emissions by X% within Y years, or achieving Z% waste reduction.

- Measurable targets: Quantify your goals using specific metrics, such as tons of CO2 reduced, gallons of water saved, or kilograms of waste diverted from landfills.

- Timelines: Set realistic timelines for achieving your goals.

- Key performance indicators (KPIs): Establish KPIs to track your progress towards your sustainability objectives. Keyword integration: Sustainability business plan, green business goals, KPI for sustainability.

Demonstrating Environmental Impact

Quantify the positive environmental impact of your proposed projects or initiatives.

- Methods for measuring impact: Use tools and methodologies to measure your carbon footprint, water usage, waste generation, and energy consumption.

- Data collection and analysis: Collect accurate data to support your claims and analyze it to identify areas for improvement.

- Reporting frameworks: Utilize established reporting frameworks like the Global Reporting Initiative (GRI) to standardize your reporting and enhance transparency. Keyword integration: Environmental impact assessment, sustainability reporting, green business metrics.

Financial Projections and Return on Investment (ROI)

Demonstrate how your green initiatives contribute to financial success.

- Projected cost savings: Show how your sustainability initiatives will reduce operational costs through energy efficiency, waste reduction, or other means.

- Increased revenue streams: Highlight new revenue streams that may arise from developing eco-friendly products or services.

- Long-term profitability: Show investors that your green initiatives contribute to long-term profitability and increased business value. Keyword integration: Return on investment (ROI), green business profitability, sustainable business model.

Navigating the Application Process for Green Funding

The application process requires meticulous preparation and attention to detail.

Understanding Eligibility Criteria

Carefully review the eligibility criteria for each funding opportunity.

- Industry-specific requirements: Many grants and loans target specific industries or sectors.

- Size limitations: Eligibility often depends on the size of your business (number of employees, revenue, etc.).

- Geographic restrictions: Some funding opportunities are limited to specific regions or countries. Keyword integration: Green funding eligibility, SME grant application.

Preparing a Strong Application

Your application should effectively communicate your commitment to sustainability and highlight the environmental benefits of your project.

- Writing a strong proposal: Clearly articulate your project, its environmental impact, and your financial projections.

- Assembling necessary documentation: Gather all required documents, including financial statements, environmental impact assessments, and letters of support.

- Building a professional network: Connect with individuals and organizations involved in sustainable finance to access valuable advice and support. Keyword integration: Green funding application, sustainability proposal, grant writing.

Seeking Professional Guidance

Consider consulting with experts to improve your chances of success.

- Financial advisors: Financial advisors can help you develop a comprehensive financial plan and optimize your funding strategy.

- Sustainability consultants: Sustainability consultants can help you identify appropriate funding opportunities and prepare a strong application.

- Legal professionals: Legal professionals can ensure your application complies with all relevant regulations and requirements. Keyword integration: Green business consulting, sustainability advisors.

Conclusion

Securing green funding for your SME requires careful planning, a strong business plan that highlights your sustainability initiatives, and a thorough understanding of available funding opportunities. By exploring grants, loans, and equity investments tailored to sustainable projects, and by meticulously preparing your applications, you can significantly increase your chances of securing the financial resources needed to transition to a greener and more profitable future. Start exploring your options for green funding for SMEs today and embark on your journey towards sustainable growth. Don't delay – explore your options for sustainable financing and green business loans now to build a more environmentally responsible and successful future for your SME.

Featured Posts

-

Jennifer Lawrence And Cooke Maroney Spotted Together After Baby No 2 Reports

May 19, 2025

Jennifer Lawrence And Cooke Maroney Spotted Together After Baby No 2 Reports

May 19, 2025 -

Pasxalines Kai Protomagiatikes Ekdiloseis Stis Enories Tis Kastorias

May 19, 2025

Pasxalines Kai Protomagiatikes Ekdiloseis Stis Enories Tis Kastorias

May 19, 2025 -

French Woke Agenda Challenged By Tech Billionaires Data Driven Approach

May 19, 2025

French Woke Agenda Challenged By Tech Billionaires Data Driven Approach

May 19, 2025 -

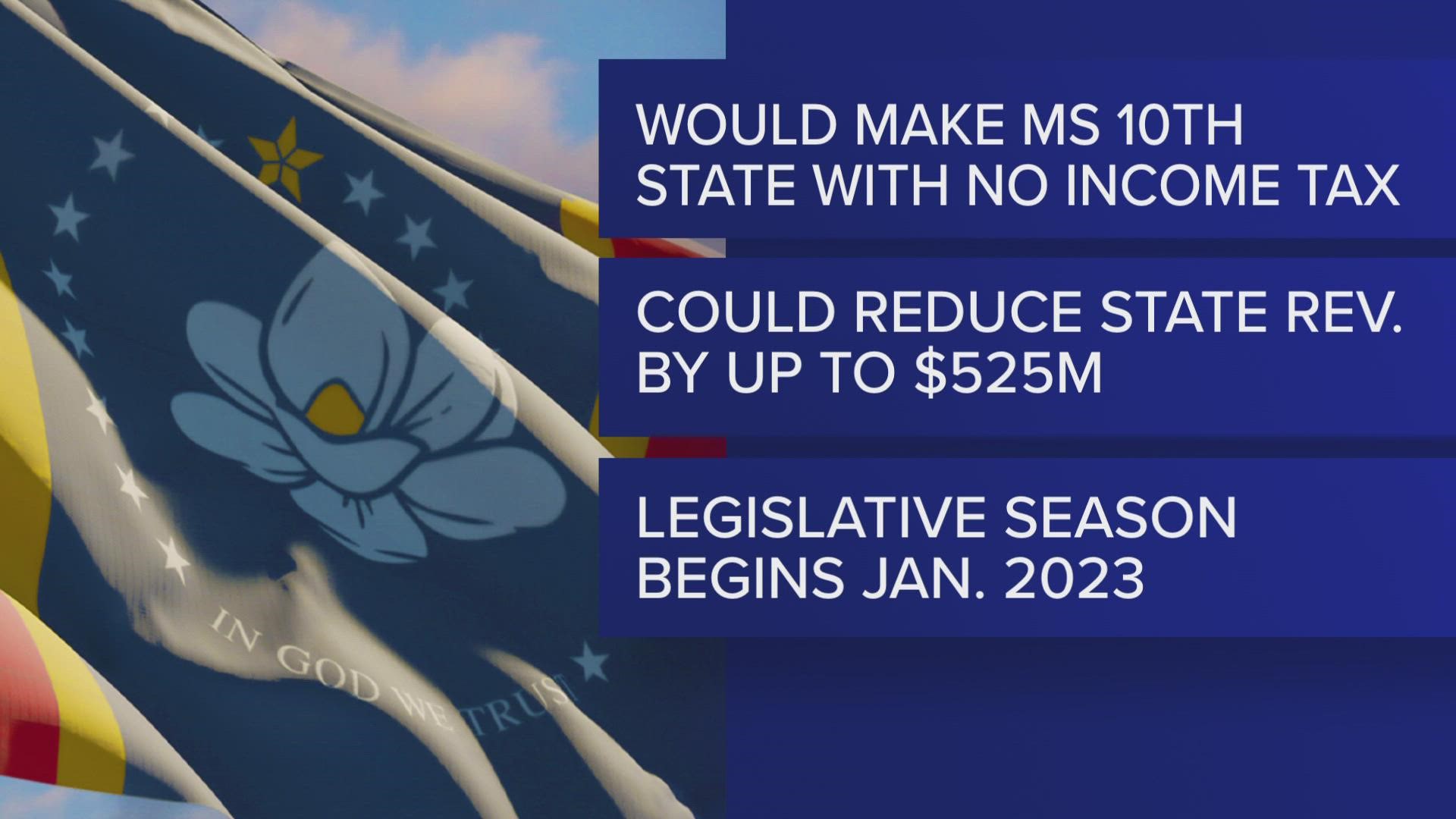

Analyzing The Potential Effects Of Income Tax Elimination On Hernando Mississippi

May 19, 2025

Analyzing The Potential Effects Of Income Tax Elimination On Hernando Mississippi

May 19, 2025 -

Disciplinary Action Expected For Lyon Coach Paulo Fonseca

May 19, 2025

Disciplinary Action Expected For Lyon Coach Paulo Fonseca

May 19, 2025