Green Home Loans: €750 Million Investment From Cabinet, Leveraging EU Climate Funds

Table of Contents

Funding Details and Eligibility

Breakdown of the €750 Million

The €750 million investment in green home loans will be allocated through a combination of low-interest loans and grants, with a portion dedicated to subsidizing interest rates. Funding sources include the Irish national budget and EU NextGenerationEU funds specifically earmarked for climate action and energy efficiency improvements. This blended approach ensures maximum impact and accessibility.

- Loan Amounts: Loans range from €10,000 to €50,000, depending on the scale of the project and eligibility criteria.

- Interest Rates: Interest rates are significantly reduced compared to standard home improvement loans, typically ranging from 1% to 3% annually.

- Repayment Periods: Flexible repayment periods are offered, extending up to 20 years, to make repayments manageable for homeowners.

- Eligibility Criteria: Applicants must be homeowners or prospective buyers in Ireland. Properties must meet specific energy efficiency standards, and projects must focus on eligible green improvements. Further details will be available on the official government website.

- Application Process: Applications will be submitted online through a dedicated portal, requiring supporting documentation such as proof of ownership, project plans, and energy performance certificates (EPCs).

Types of Green Home Improvements Covered

Energy Efficiency Upgrades

The green home loan scheme covers a wide range of energy efficiency upgrades designed to reduce a home's carbon footprint and energy consumption. This includes measures that significantly improve the energy performance of existing properties.

- Eligible Technologies: This includes solar panel installations, the replacement of outdated boilers with energy-efficient heat pumps, the installation of smart thermostats, and comprehensive insulation upgrades (loft, wall, and underfloor).

- Incentives: Higher loan amounts are available for projects incorporating renewable energy technologies like solar panels and heat pumps, incentivizing homeowners to adopt more ambitious upgrades.

- Minimum Energy Performance Standards: Properties must meet a minimum Building Energy Rating (BER) standard post-improvement to qualify for funding. Details on minimum BER requirements will be outlined in the application guidelines.

Sustainable Building Materials

The initiative also encourages the use of sustainable building materials in new constructions and renovations, reducing the environmental impact of construction.

- Examples: This includes recycled materials such as reclaimed timber and recycled insulation, and timber sourced from sustainably managed forests.

- Tax Breaks/Subsidies: Additional tax breaks or subsidies might be available for using specified sustainable building materials. Details on these incentives will be released closer to the scheme’s launch.

Environmental Impact and Long-Term Benefits

Reducing Carbon Footprint

The green home loan program is projected to significantly reduce Ireland's carbon emissions.

- Emissions Reductions: The initiative aims to reduce carbon emissions by an estimated [Insert Projected Amount] tonnes of CO2 annually once all projects are completed. This figure will be refined as the program progresses and more data becomes available.

- National Climate Goals: This program substantially contributes to Ireland's national climate goals and commitment to reducing greenhouse gas emissions.

Economic Benefits

Beyond environmental benefits, the green home loan program is expected to have a positive impact on the Irish economy.

- Job Creation: The scheme will stimulate job creation in various sectors, including the construction industry, renewable energy sector, and insulation industries. Estimates suggest the creation of [Insert Projected Number] jobs.

- Economic Stimulus: The increased investment in home improvements will provide a stimulus to the national economy, benefiting businesses and suppliers involved in the renovation and construction sectors.

Accessing Green Home Loans: A Step-by-Step Guide

Finding Approved Lenders

A list of participating banks and financial institutions offering green home loans will be published on the official government website dedicated to the initiative.

- Lender Websites: Links to the websites of approved lenders will be readily available.

- Contact Information: Contact information for each lender will be provided to facilitate inquiries and applications.

Preparing Your Application

Preparing a strong application is essential for securing funding.

- Required Documents: Required documents will include proof of ownership/purchase agreement, project plans, building permits, and energy performance certificates (EPCs).

- Tips for a Successful Application: Ensure all documentation is accurate and complete. Clearly outline the proposed upgrades and their energy-saving potential.

Conclusion:

The €750 million investment in green home loans represents a significant step towards Ireland's sustainable housing future. By leveraging EU climate funds and offering attractive financing options, this initiative makes energy-efficient and environmentally friendly home improvements more accessible than ever. This program offers substantial benefits, both environmentally and economically. Don't miss out on this opportunity to secure a green home loan and contribute to a more sustainable future. Find out more about eligibility and application processes for green home loans today!

Featured Posts

-

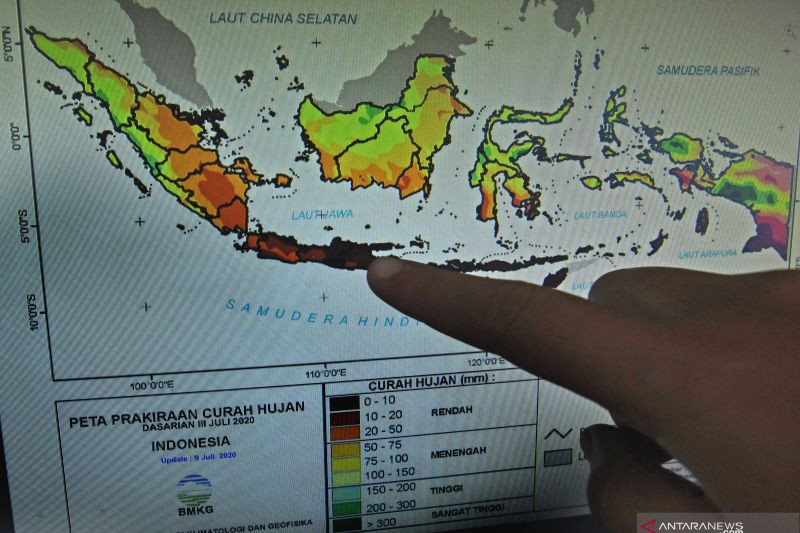

Cuaca Bali Besok Dominan Berawan Hanya Beberapa Wilayah Hujan

May 28, 2025

Cuaca Bali Besok Dominan Berawan Hanya Beberapa Wilayah Hujan

May 28, 2025 -

Exploring Chicagos Century Of Progress International Exposition 1933 1934

May 28, 2025

Exploring Chicagos Century Of Progress International Exposition 1933 1934

May 28, 2025 -

Padres Reinforce Lineup Luis Arraez And Jason Heyward Return From Il

May 28, 2025

Padres Reinforce Lineup Luis Arraez And Jason Heyward Return From Il

May 28, 2025 -

Affordable Housing At Risk Minister Hints At Rent Protection Reductions

May 28, 2025

Affordable Housing At Risk Minister Hints At Rent Protection Reductions

May 28, 2025 -

Personal Loans With Bad Credit Direct Lenders And No Credit Check

May 28, 2025

Personal Loans With Bad Credit Direct Lenders And No Credit Check

May 28, 2025