Personal Loans With Bad Credit: Direct Lenders & No Credit Check

Table of Contents

Understanding Your Credit Score and its Impact

Your credit score is a three-digit number that lenders use to assess your creditworthiness. Understanding your credit score and its impact is crucial when applying for a personal loan, especially with bad credit. A lower credit score typically results in higher interest rates and potentially loan denial.

Different credit score ranges represent different levels of risk to lenders. Generally, scores above 700 are considered good, while scores below 600 are often categorized as bad credit. Factors significantly impacting your credit score include late payments, defaults on loans or credit cards, bankruptcies, and high credit utilization.

- Check your credit report for accuracy: Regularly review your credit report from the three major credit bureaus (Equifax, Experian, and TransUnion) to identify and dispute any errors.

- Dispute any errors on your credit report: Inaccurate information can negatively impact your score. Contact the credit bureaus to correct any mistakes.

- Start building or rebuilding your credit score: Consistent on-time payments, keeping credit utilization low, and diversifying your credit accounts can help improve your score over time.

Finding Direct Lenders for Personal Loans with Bad Credit

Direct lenders are financial institutions that provide loans directly to borrowers without involving intermediaries like brokers. This offers several advantages when seeking personal loans with bad credit.

Dealing directly with a lender often leads to faster processing times and potentially more transparent terms. You'll avoid paying broker fees, and you can build a direct relationship with the institution providing the loan. Various types of direct lenders offer personal loans for bad credit, including:

-

Banks: Traditional banks may offer personal loans, but they often have stricter requirements for borrowers with bad credit.

-

Credit Unions: Credit unions are member-owned financial institutions and may be more willing to work with borrowers who have less-than-perfect credit.

-

Online Lenders: Many online lenders specialize in providing personal loans to individuals with bad credit. They often have less stringent requirements than traditional banks.

-

Research reputable direct lenders: Thoroughly research lenders before applying to ensure they are legitimate and have a positive reputation.

-

Compare interest rates and fees: Interest rates and fees can vary significantly between lenders, so comparing offers is crucial.

-

Read reviews and testimonials: Check online reviews and testimonials to get an idea of other borrowers' experiences with different lenders.

Loans with No Credit Check: Understanding the Risks and Rewards

Loans advertised as "no credit check" loans often imply that a hard credit inquiry won't be performed. While this might seem appealing, these loans usually come with significantly higher interest rates and fees. Lenders compensate for the increased risk by charging substantially more.

These loans can create a debt trap if not managed responsibly. Always carefully consider the implications of high-interest rates before taking out a no-credit-check loan. Even with these loans, responsible borrowing is crucial to avoid further financial difficulties.

- Compare APRs across different loan types: The Annual Percentage Rate (APR) reflects the total cost of borrowing. Compare APRs carefully before making a decision.

- Understand the implications of high-interest rates: High-interest rates can quickly lead to overwhelming debt. Ensure you can comfortably afford the monthly payments.

- Budget carefully to avoid further financial difficulties: Create a realistic budget to ensure you can repay the loan without jeopardizing your financial stability.

Tips for Improving Your Chances of Approval

Improving your chances of approval for a personal loan with bad credit requires careful planning and preparation. Here are some strategies that can help:

- Secure a co-signer: A co-signer with good credit can significantly increase your chances of approval. The co-signer assumes responsibility for repayment if you default.

- Improve your debt-to-income ratio: Lenders look at your debt-to-income ratio (DTI) to determine your ability to repay the loan. Lowering your DTI by paying down existing debts can improve your chances.

- Provide a stable income source documentation: Proof of consistent income, such as pay stubs or tax returns, demonstrates your ability to repay the loan.

- Consider a secured loan: A secured loan requires collateral, reducing the lender's risk. This might increase your chances of approval, even with bad credit.

- Explore options like debt consolidation: Consolidating high-interest debts into a single, lower-interest loan can improve your creditworthiness over time.

Alternative Financing Options

If securing a personal loan proves difficult, several alternative financing options exist. However, be aware that some carry significant risks:

-

Payday loans: Payday loans are short-term, high-interest loans that should be avoided if possible due to their extremely high costs.

-

Credit builder loans: These loans help you build credit by requiring regular payments. They’re a useful tool to improve your credit history.

-

Seeking financial counseling: A financial counselor can help you create a budget, manage your debt, and explore options for improving your financial situation.

-

Explore government assistance programs: Depending on your circumstances, you may be eligible for government assistance programs designed to help with financial difficulties.

-

Consider negotiating with creditors: Contact your creditors to discuss potential options for reducing your debt burden, such as payment plans or debt settlement.

-

Seek professional financial advice: A financial advisor can offer personalized guidance on managing your finances and exploring suitable options for your situation.

Conclusion

Obtaining personal loans with bad credit can seem daunting, but by understanding your options and carefully researching direct lenders, you can increase your chances of approval. While loans with no credit check might seem appealing, remember the higher risks involved. Prioritize responsible borrowing, explore all your options, and remember to improve your credit score for better loan terms in the future. Start your search for the right personal loan with bad credit today! Don't hesitate to compare offers from various direct lenders to find the best fit for your financial situation.

Featured Posts

-

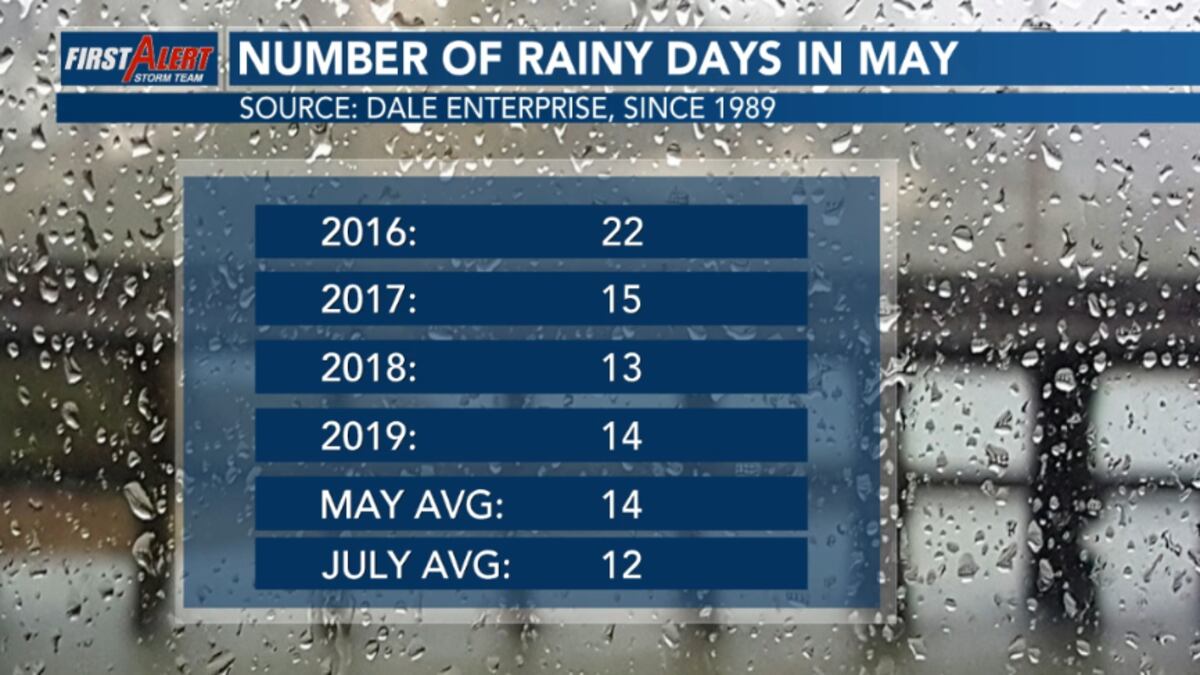

Is April Typically The Wettest Month A Rainfall Analysis

May 28, 2025

Is April Typically The Wettest Month A Rainfall Analysis

May 28, 2025 -

Legal Battle Looms As Mali Targets Barricks Gold Mine

May 28, 2025

Legal Battle Looms As Mali Targets Barricks Gold Mine

May 28, 2025 -

Gunners Striker Transfer Blow Liverpool Interest Confirmed

May 28, 2025

Gunners Striker Transfer Blow Liverpool Interest Confirmed

May 28, 2025 -

Cuaca Hari Ini Kalimantan Timur Ikn Balikpapan Samarinda Dan Lainnya

May 28, 2025

Cuaca Hari Ini Kalimantan Timur Ikn Balikpapan Samarinda Dan Lainnya

May 28, 2025 -

Euro Millions Live Record Breaking E245 Million Jackpot On Friday

May 28, 2025

Euro Millions Live Record Breaking E245 Million Jackpot On Friday

May 28, 2025