Greene Advocates For Scaled-Back QE During Future Economic Downturns

Table of Contents

Understanding Greene's Critique of Traditional QE

Traditional Quantitative Easing involves central banks injecting liquidity into the financial system by purchasing assets, primarily government bonds, from commercial banks. This increases the money supply, lowering interest rates and theoretically boosting lending and investment. However, Greene argues that the large-scale QE programs implemented in recent years have led to several undesirable consequences:

- Inflationary Pressures: The massive injection of liquidity can fuel inflation, eroding purchasing power and harming consumers. The [cite specific example of high inflation post-QE, e.g., post-2008 period in certain countries] serves as a stark reminder of this risk.

- Asset Bubbles: QE can inflate asset prices, creating unsustainable bubbles in the stock market and real estate, ultimately leading to market corrections and economic instability. The [mention specific examples of asset bubbles potentially linked to QE].

- Increased National Debt: QE often leads to increased government borrowing and a rise in national debt, imposing long-term fiscal burdens on future generations. The [cite data on national debt increases following specific QE programs].

The Core Principles of Greene's Scaled-Back QE Proposal

Greene's "Scaled-Back QE" proposal offers a distinct alternative to traditional, large-scale interventions. Its core principles include:

- Targeted Interventions: Instead of broad-based asset purchases, Greene advocates for focusing QE on specific sectors or industries most in need of support, such as [mention examples, e.g., small businesses, renewable energy]. This ensures that the stimulus is directed where it's most effective.

- Smaller Scale Injections: The proposed approach emphasizes limiting the overall amount of money injected into the economy. This controlled approach aims to minimize the risk of inflation and asset bubbles.

- Increased Transparency and Accountability: Greene emphasizes greater transparency and public oversight of QE programs to ensure responsible implementation and accountability.

Key Differences between Traditional QE and Scaled-Back QE:

| Feature | Traditional QE | Scaled-Back QE |

|---|---|---|

| Scope | Broad-based asset purchases | Targeted interventions |

| Scale | Large-scale injections | Smaller-scale injections |

| Transparency | Relatively opaque | Increased transparency and accountability |

| Focus | General economic stimulus | Specific sectors and industries |

Potential Benefits of a Scaled-Back QE Approach

Greene's proposal offers several potential advantages:

- Reduced Inflationary Risks: By limiting the amount of liquidity injected, the risk of triggering significant inflation is minimized.

- Mitigation of Asset Bubble Formation: Targeted interventions reduce the likelihood of creating unsustainable asset bubbles.

- More Sustainable Economic Recovery: A more measured approach can foster a more sustainable and less volatile economic recovery.

- Improved Long-Term Economic Stability: By avoiding the pitfalls of large-scale QE, this strategy aims for improved long-term economic health.

Potential Drawbacks and Counterarguments to Greene's Proposal

Despite its potential benefits, Greene's proposal faces potential criticism:

- Insufficient Stimulus During Severe Downturns: Some argue that a scaled-back approach might prove insufficient to stimulate the economy during severe recessions.

- Difficulty in Targeting Specific Sectors Effectively: Identifying and targeting the most deserving sectors requires careful analysis and could be politically challenging.

- Political Challenges in Implementing a Modified Approach: Gaining political consensus for a less expansive approach might prove difficult.

However, counterarguments exist. For example, the precise targeting of aid could prove more effective than broad-based injections, leading to a more efficient allocation of resources.

Conclusion: The Future of Economic Policy and Scaled-Back QE

Representative Greene's "Scaled-Back QE" proposal presents a compelling alternative to traditional quantitative easing strategies. While large-scale QE has its place, the potential risks associated with it, such as inflation and asset bubbles, cannot be ignored. Greene's proposal offers a more nuanced and targeted approach that aims to mitigate these risks while still providing necessary economic stimulus during downturns. The ongoing debate surrounding the optimal approach to economic stimulus highlights the need for informed discussion and careful consideration of both traditional and "Scaled-Back QE" strategies. We urge readers to further research the economic implications of both approaches and engage in the conversation surrounding the future of economic policy. Understanding the nuances of "Scaled-Back QE" and its implications is crucial for shaping effective and sustainable economic policies for the future.

Featured Posts

-

Nine Home Runs Power Yankees To Victory Judge Leads The Charge

Apr 23, 2025

Nine Home Runs Power Yankees To Victory Judge Leads The Charge

Apr 23, 2025 -

Nancy Mace Confronted Raw Video Of Tense Encounter In South Carolina

Apr 23, 2025

Nancy Mace Confronted Raw Video Of Tense Encounter In South Carolina

Apr 23, 2025 -

Asear Alktakyt Fy Msr Alywm Alathnyn 14 Abryl 2025

Apr 23, 2025

Asear Alktakyt Fy Msr Alywm Alathnyn 14 Abryl 2025

Apr 23, 2025 -

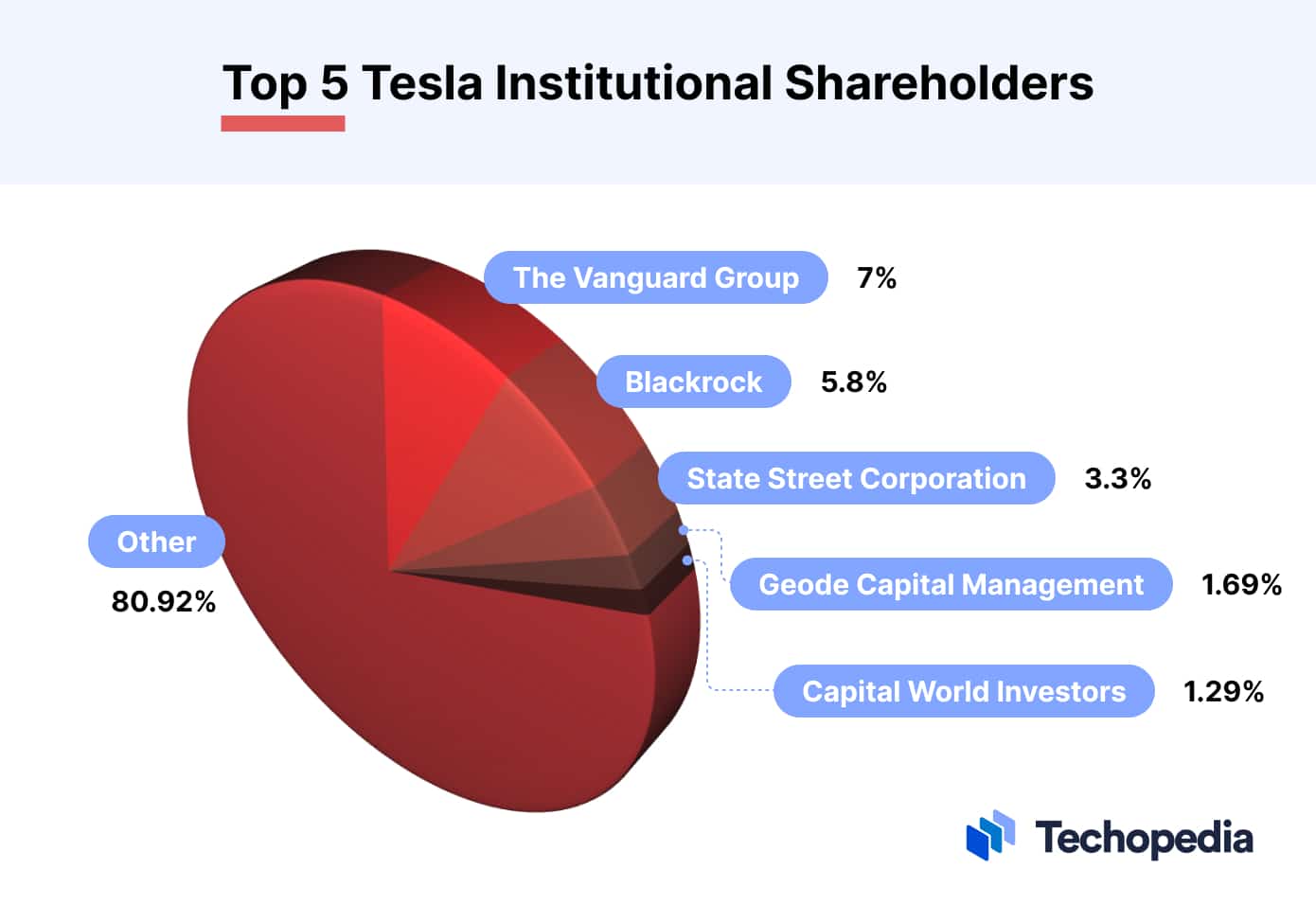

Tesla Shareholders Concerns Echoed By State Treasurers Musks Leadership Questioned

Apr 23, 2025

Tesla Shareholders Concerns Echoed By State Treasurers Musks Leadership Questioned

Apr 23, 2025 -

Hipli La Solution De Colis Reutilisables Pour Une Livraison Durable

Apr 23, 2025

Hipli La Solution De Colis Reutilisables Pour Une Livraison Durable

Apr 23, 2025