Grim Retail Sales: Are Rate Cuts On The Horizon?

Table of Contents

Declining Retail Sales: A Deeper Dive into the Numbers

The latest retail sales data reveals a worrying trend of declining consumer spending. Grim retail sales figures reflect a significant downturn across various sectors, signaling a potential economic slowdown. Percentage changes compared to previous periods paint a stark picture of the current economic climate.

- Clothing sales: Decreased by 5% in October 2023 compared to October 2022, indicating reduced consumer confidence in discretionary spending.

- Automotive sales: Fell by 8% in the same period, reflecting both high prices and reduced consumer purchasing power.

- Furniture and home furnishings sales: Experienced a 7% drop, likely due to high interest rates impacting mortgages and home improvements.

- Electronics sales: Showed a modest decline of 3%, suggesting consumers are prioritizing essential purchases.

[Insert relevant chart or graph visually representing the data here]

Several factors contribute to these grim retail sales numbers. High inflation continues to erode purchasing power, forcing consumers to cut back on non-essential spending. Lingering global economic uncertainty and concerns about potential job losses further dampen consumer confidence, leading to decreased spending.

Consumer Confidence and Spending Habits: A Shifting Landscape

The correlation between consumer confidence indices and retail sales is undeniable. Recent consumer sentiment surveys reflect a significant drop in optimism, directly impacting spending habits. Consumers are increasingly relying on discounts and promotions, focusing on essential goods rather than discretionary purchases.

- High inflation erodes purchasing power: Rising prices for essential goods like groceries and energy leave less disposable income for other purchases.

- Concerns about job security impact spending decisions: Fear of job loss leads to cautious spending and saving.

- Increased reliance on credit: Consumers are increasingly turning to credit cards to finance purchases, potentially leading to further financial strain.

This shift in consumer behavior is a key factor contributing to the grim retail sales landscape. Understanding these evolving spending habits is crucial for businesses and policymakers alike.

The Federal Reserve's Response: Rate Cuts on the Horizon?

The Federal Reserve plays a crucial role in managing interest rates to influence economic activity. Recent statements suggest a cautious approach, with the Fed carefully weighing the risks of inflation against the potential for a deeper economic slowdown. While recent increases in interest rates aimed to curb inflation, the persistently weak retail sales data suggests a potential shift in policy.

- A 0.25% rate cut could stimulate consumer spending by lowering borrowing costs.

- Delaying rate cuts might curb inflation more effectively but risk further economic slowdown and potentially exacerbate already grim retail sales figures.

- Quantitative easing, an alternative monetary policy tool, could be considered if rate cuts prove insufficient.

The decision to implement rate cuts will depend on several factors, including inflation data, unemployment rates, and overall economic growth. The Fed will carefully analyze these indicators before making any policy changes.

Alternative Economic Indicators: A Broader Perspective

While grim retail sales provide a vital indicator of economic health, it's essential to consider other economic indicators for a more comprehensive view.

- Unemployment Rate: A rising unemployment rate could further depress consumer spending and worsen grim retail sales.

- Manufacturing Output: Declining manufacturing output suggests weakening economic activity.

- Housing Starts: A slowdown in housing starts reflects decreased investment and consumer confidence.

Analyzing these interrelationships helps provide context to the grim retail sales data and assists the Federal Reserve in formulating appropriate monetary policy.

Grim Retail Sales and the Path Forward

The persistently grim retail sales figures, coupled with weakening consumer confidence and other economic indicators, present a challenging economic outlook. The likelihood of rate cuts remains uncertain, with the Federal Reserve carefully balancing the risks of inflation and economic slowdown. Understanding the interplay of these factors is crucial for businesses and consumers alike.

Stay updated on the latest grim retail sales figures and Federal Reserve announcements to make informed financial decisions. Understanding the implications of potential rate cuts is crucial for navigating the current economic climate and adapting your financial strategies accordingly. Monitoring changes in consumer spending habits, alongside broader economic indicators, will be essential in the coming months.

Featured Posts

-

Is The Public Sector Pension System Sustainable A Taxpayer Perspective

Apr 29, 2025

Is The Public Sector Pension System Sustainable A Taxpayer Perspective

Apr 29, 2025 -

Managing Adhd Naturally Diet Exercise And Lifestyle Changes

Apr 29, 2025

Managing Adhd Naturally Diet Exercise And Lifestyle Changes

Apr 29, 2025 -

Will Trump Pardon Pete Rose Examining The Baseball Betting Controversy

Apr 29, 2025

Will Trump Pardon Pete Rose Examining The Baseball Betting Controversy

Apr 29, 2025 -

Fn Abwzby 2024 Dlyl Shaml

Apr 29, 2025

Fn Abwzby 2024 Dlyl Shaml

Apr 29, 2025 -

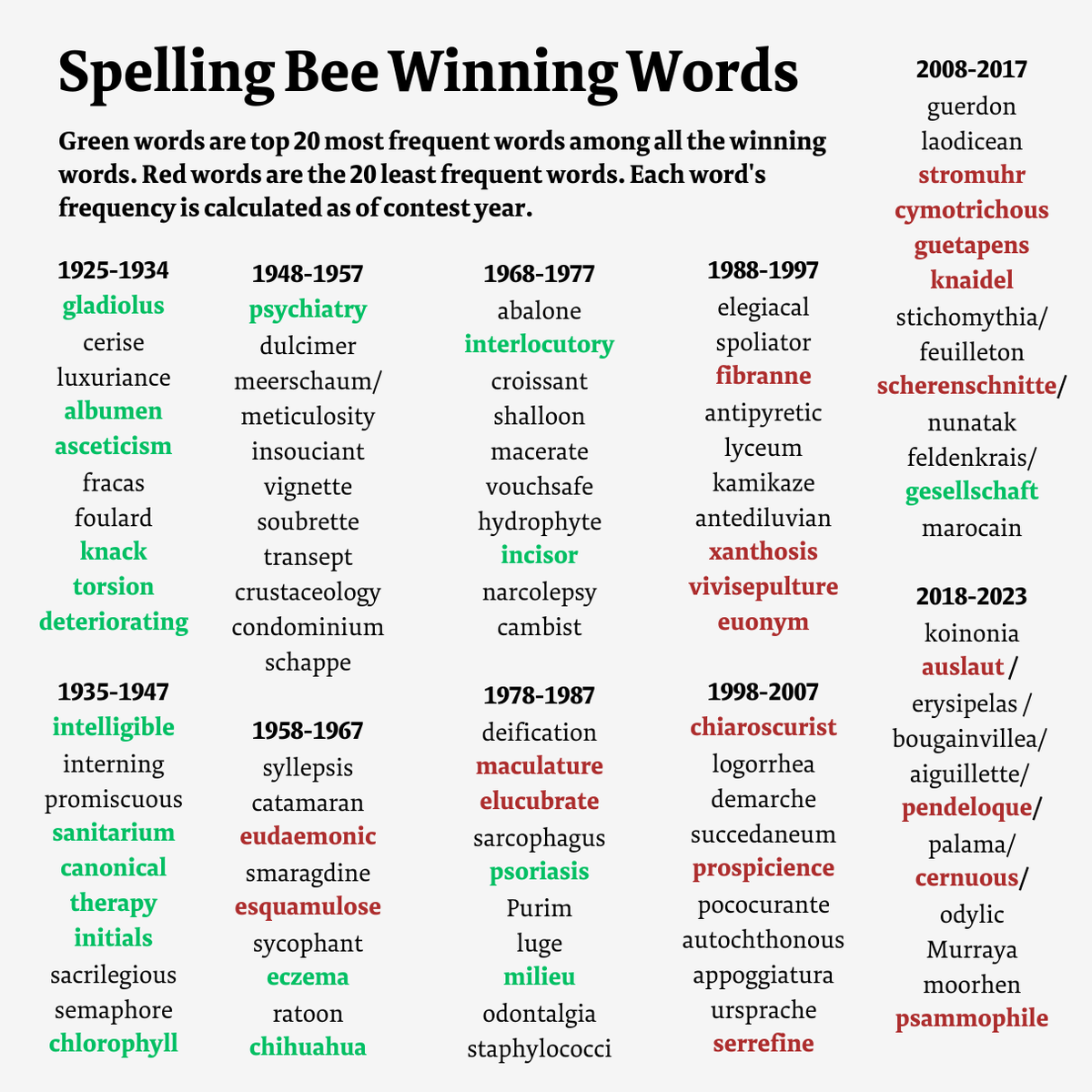

February 12 2025 Nyt Spelling Bee Complete Guide To Solutions

Apr 29, 2025

February 12 2025 Nyt Spelling Bee Complete Guide To Solutions

Apr 29, 2025