High Down Payments: The Canadian Homeownership Hurdle

Table of Contents

The Rising Cost of Down Payments in Canada

Securing a mortgage in Canada often requires a substantial down payment, significantly impacting home affordability. The percentage required varies depending on the purchase price and mortgage type. For homes priced below $500,000, a 5% down payment is typically sufficient for the first $500,000. However, for the portion above $500,000, a 10% down payment is usually required. For homes exceeding $1 million, a minimum 20% down payment is often the norm. These percentages represent a significant financial barrier, especially in today's market.

Several factors contribute to the escalating cost of down payments in Canada. Soaring home prices, driven by high demand and limited supply, are a primary culprit. Furthermore, stricter lending regulations implemented in recent years, aimed at ensuring financial stability, have also contributed to higher down payment requirements.

- Average down payment percentages for different property types: Condos often require lower down payments than detached houses, although this can vary by location and lender.

- Regional variations in down payment requirements: Down payment expectations can differ considerably across Canada, with major metropolitan areas like Toronto and Vancouver typically demanding larger down payments than smaller cities.

- Impact of interest rates on affordability and down payment amounts: Rising interest rates increase borrowing costs and indirectly raise the effective down payment needed to qualify for a mortgage. A higher interest rate might mean needing a larger down payment to meet lender requirements.

Impact on First-Time Homebuyers

The impact of high down payments is disproportionately felt by first-time homebuyers in Canada. This group, often comprising younger generations, faces considerable challenges in saving enough for a substantial down payment. Many are grappling with student loan debt, rising living costs, and other financial obligations, making the task even more daunting.

- Statistics on first-time homebuyer numbers and their struggle with down payments: Recent reports indicate a significant decrease in first-time homebuyers due to the high barrier of entry.

- The impact of student debt and other financial obligations on saving for a down payment: The burden of student loans significantly reduces the disposable income available for down payment savings, delaying homeownership for many young Canadians.

- Potential solutions to help first-time homebuyers, such as government programs: Various government initiatives, such as the First-Time Home Buyers' Incentive, aim to ease the financial burden, but their effectiveness remains a subject of ongoing debate. Provincial programs also exist, differing by region.

Alternative Financing Options and Strategies

For many Canadians, saving for a large down payment feels insurmountable. Fortunately, several alternative financing options and strategies can help navigate this challenge.

- Using RRSPs: The Home Buyers' Plan (HBP) allows first-time homebuyers to withdraw up to $35,000 from their Registered Retirement Savings Plans (RRSPs) tax-free to put towards a down payment. This is a significant tool, but remember that the withdrawn amount must be repaid over a 15-year period.

- Gifts from family: Receiving financial assistance from family members can help bridge the gap, but it’s crucial to document such gifts properly to meet lender requirements.

- Home Equity Lines of Credit (HELOCs): If you already own a property, a HELOC can provide access to funds, but using existing home equity increases financial risk.

Pros and Cons: Each option has its own advantages and disadvantages. The HBP offers tax benefits but requires repayment. Gifts from family can be a great help, but can strain family relationships if not handled correctly. HELOCs are convenient but increase your debt load.

The Broader Implications for the Canadian Housing Market

The high cost of down payments has significant ramifications for the Canadian housing market. It contributes to housing market instability by restricting entry into the market for many potential buyers. The limited supply further exacerbates the issue, driving prices upward and creating a cycle of unaffordability.

- The relationship between down payment requirements and housing market stability: High down payments can create an imbalance, leading to market volatility.

- Potential for a correction in the housing market due to affordability issues: The current situation isn't sustainable in the long term and could lead to a market correction, although the timing and severity are uncertain.

- The long-term effects on economic growth and social mobility: The difficulty of homeownership hinders economic growth and impacts social mobility, making it harder for individuals and families to improve their financial standing.

Conclusion

High down payments represent a significant hurdle to homeownership in Canada, particularly for first-time buyers. The rising costs of homes, coupled with stricter lending regulations, have created a challenging landscape for those aspiring to own a home. While solutions like the HBP and family assistance exist, they don't fully address the systemic issue. Understanding alternative financing options and carefully planning your finances are crucial.

Navigating the complexities of high down payments in the Canadian housing market can be daunting, but understanding the options and planning carefully can increase your chances of homeownership. Start researching your options for securing a down payment and achieving your dream of owning a home in Canada. Learn more about Canadian mortgage options and strategies to overcome the hurdle of high down payments today!

Featured Posts

-

Bitcoin Rebound Understanding The Factors Driving The Recovery

May 09, 2025

Bitcoin Rebound Understanding The Factors Driving The Recovery

May 09, 2025 -

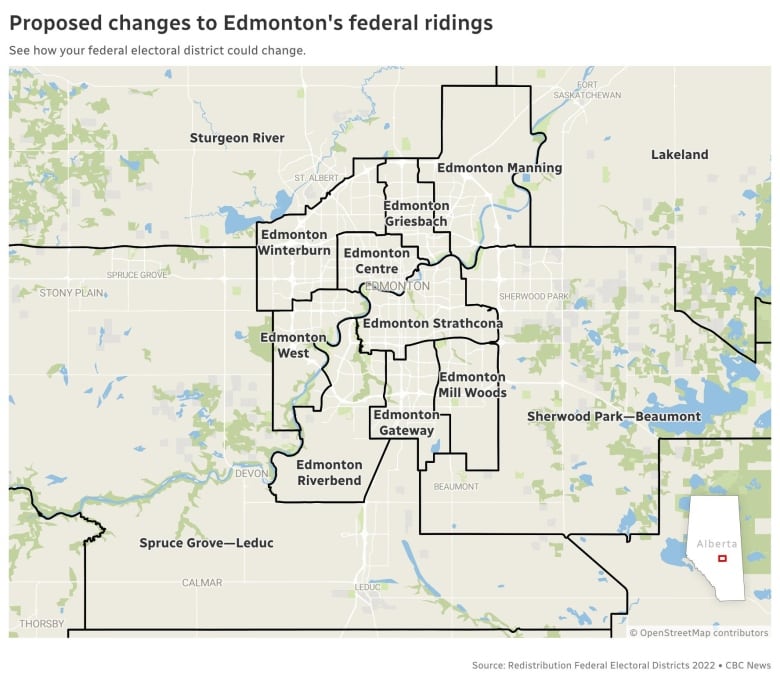

Edmonton Federal Riding Changes What Voters Need To Know

May 09, 2025

Edmonton Federal Riding Changes What Voters Need To Know

May 09, 2025 -

Aocs Fact Check On Fox News A Critical Examination Of Pirros Statements

May 09, 2025

Aocs Fact Check On Fox News A Critical Examination Of Pirros Statements

May 09, 2025 -

Stock Market Update Bajaj Twins Drag On Sensex And Nifty 50 Today

May 09, 2025

Stock Market Update Bajaj Twins Drag On Sensex And Nifty 50 Today

May 09, 2025 -

From 3 K Babysitter To 3 6 K Daycare How One Mans Plan Backfired

May 09, 2025

From 3 K Babysitter To 3 6 K Daycare How One Mans Plan Backfired

May 09, 2025