High Stock Market Valuations: BofA's Analysis And Investor Guidance

Table of Contents

BofA's Key Findings on Current Market Valuations

BofA's market analysis reveals a complex picture regarding current high stock market valuations. While acknowledging the robust growth in certain sectors, the firm expresses caution regarding the sustainability of these elevated prices. Their conclusions suggest a need for careful consideration and a diversified investment approach. BofA's analysis incorporates several key indicators to reach its conclusions:

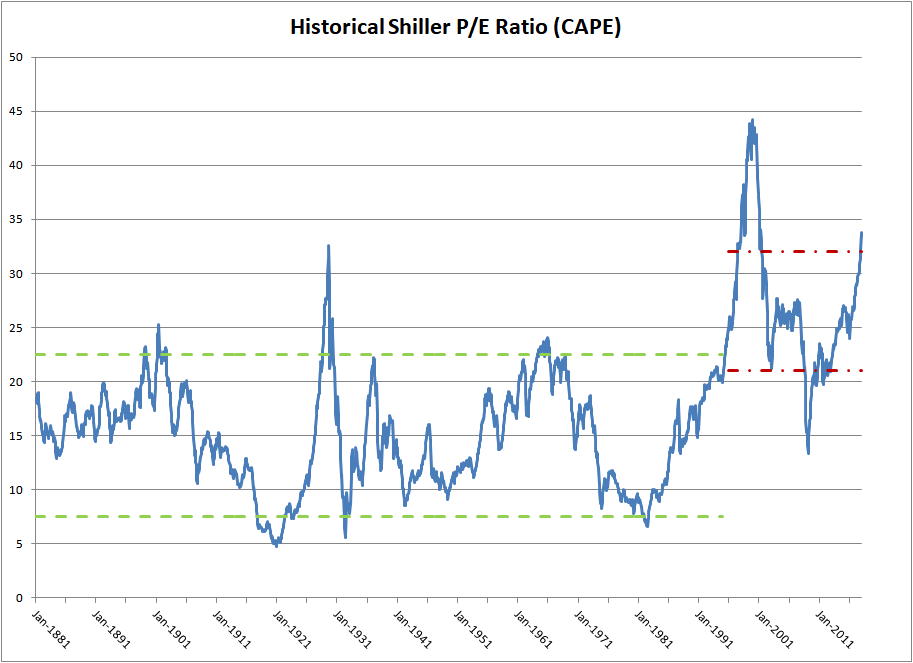

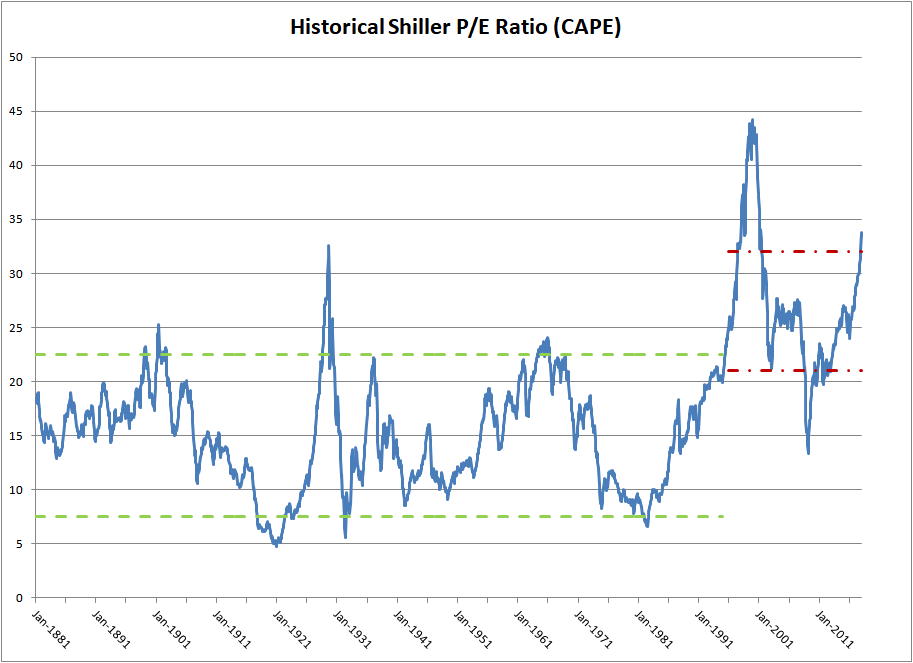

- Elevated P/E Ratios: BofA's report points to significantly higher Price-to-Earnings (P/E) ratios across various indices compared to historical averages, suggesting that stocks may be overvalued relative to their earnings. Specific data points from their analysis should be referenced here, if available (e.g., "The S&P 500's P/E ratio currently stands at X, significantly above the long-term average of Y").

- Market Capitalization: The overall market capitalization has reached record highs, indicating a substantial increase in the total value of publicly traded companies. This high market capitalization, in conjunction with elevated P/E ratios, raises concerns about potential overvaluation.

- Sectoral Variations: BofA's analysis likely highlights discrepancies in valuations across different sectors. Some sectors may be showing signs of overvaluation more prominently than others. This analysis provides investors with valuable insight into the specific risks within various sectors and sub-sectors of the market.

- Interest Rate Sensitivity: BofA's report will likely discuss the impact of interest rates on stock valuations. Rising interest rates can make bonds more attractive, potentially diverting investment away from equities. This is a crucial factor influencing current market valuations and future projections.

Understanding the Drivers of High Stock Market Valuations

Several interconnected factors contribute to the current high stock market valuations. Understanding these drivers is crucial for investors to make informed decisions.

- Low Interest Rates: Historically low interest rates have fueled investment in equities, driving up demand and prices. The low cost of borrowing has made it more attractive for businesses to expand and for investors to take on more risk.

- Strong Corporate Earnings (in some sectors): While overall corporate performance varies across sectors, strong earnings reports from certain companies have supported higher stock prices, although this is not uniformly the case across all sectors. This highlights the importance of performing thorough research into specific companies and sectors.

- Investor Sentiment and Market Psychology: Optimism and confidence in the market play a significant role in driving up valuations, even when underlying fundamentals might not entirely justify the price increases. This phenomenon can create bubbles and make accurate market valuation more challenging.

- Technological Advancements: Innovation and growth in technology sectors have significantly boosted market valuations. High-growth technology companies often command high valuations based on future growth potential rather than current earnings.

- Geopolitical Factors: Global events and geopolitical stability (or instability) have a direct impact on investor sentiment and market valuations. Uncertainty can trigger volatility, while stability tends to support higher valuations.

BofA's Recommendations for Investors Facing High Valuations

Given the current high stock market valuations, BofA likely recommends a cautious and strategic approach for investors:

- Diversification: BofA probably emphasizes the importance of diversifying investments across different asset classes (stocks, bonds, real estate, etc.) and sectors to mitigate risk.

- Sector-Specific Recommendations: BofA's analysis may suggest favoring sectors with stronger fundamentals and lower valuations over those that are considered overvalued.

- Risk Management Techniques: Investors should implement effective risk management strategies, such as stop-loss orders and diversification, to protect their portfolios from potential market downturns.

- Long-Term vs. Short-Term Strategies: BofA may advise investors to focus on long-term growth rather than short-term gains in this environment. This approach requires patience and a robust investment strategy based on fundamentals.

- Due Diligence and Research: Thorough research and due diligence are crucial in evaluating individual companies and sectors, considering their current valuations, growth potential, and associated risks.

Alternative Investment Strategies in a High-Valuation Market

Considering the elevated valuations in the equity market, investors may explore alternative investment strategies:

- Bonds and Fixed-Income Securities: Bonds can offer a degree of stability and income during periods of high equity valuations, helping to balance a portfolio.

- Real Estate Investment Trusts (REITs): REITs can provide diversification and potential for income generation. They are less correlated with the stock market, providing further portfolio diversification.

- Commodities and Precious Metals: Commodities and precious metals such as gold can act as a hedge against inflation and market uncertainty.

Conclusion: Actionable Insights on High Stock Market Valuations

BofA's analysis of high stock market valuations highlights the need for a cautious yet strategic approach for investors. Their recommendations emphasize diversification, thorough research, and a focus on long-term growth. Understanding the drivers behind these valuations – low interest rates, strong corporate earnings (in specific sectors), investor sentiment, technological advancements, and geopolitical factors – is crucial for making informed decisions. Investors should consider diversifying their portfolios into asset classes less correlated to equities to mitigate risks.

Understanding high stock market valuations is crucial for informed investment decisions. Use BofA's insights to navigate this market and build a resilient portfolio. Learn more about managing your investments in a high-valuation environment today!

Featured Posts

-

The Uncertain Future Of Elon Musks Robotaxi Initiative

Apr 25, 2025

The Uncertain Future Of Elon Musks Robotaxi Initiative

Apr 25, 2025 -

Ritorika Trampa Po Ukraine Ot Nachala Konflikta Do Segodnya

Apr 25, 2025

Ritorika Trampa Po Ukraine Ot Nachala Konflikta Do Segodnya

Apr 25, 2025 -

Unfunded Election Promises A Recipe For Economic Slowdown

Apr 25, 2025

Unfunded Election Promises A Recipe For Economic Slowdown

Apr 25, 2025 -

John Spytek Of The Raiders Attends Ashton Jeantys Boise State Pro Day

Apr 25, 2025

John Spytek Of The Raiders Attends Ashton Jeantys Boise State Pro Day

Apr 25, 2025 -

A Wwii Photograph Revealing Two Unsung Jewish Resistance Stories

Apr 25, 2025

A Wwii Photograph Revealing Two Unsung Jewish Resistance Stories

Apr 25, 2025