High Stock Market Valuations: Why BofA Thinks Investors Shouldn't Panic

Table of Contents

H2: BofA's Rationale: Why High Valuations Don't Necessarily Signal an Imminent Crash

BofA's argument against immediate market downturn predictions rests on several key pillars. They believe that while valuations are high compared to historical averages, several economic indicators suggest continued, albeit potentially slower, growth.

-

Strong Corporate Earnings: BofA points to robust corporate earnings reports as a significant factor supporting their positive outlook. Many companies continue to demonstrate strong profitability, suggesting underlying economic strength that can sustain current market levels, even with elevated valuations.

-

Interest Rate Impacts: BofA acknowledges the impact of rising interest rates on stock valuations. However, their analysis suggests that the current rate hikes are anticipated and factored into market pricing. They believe that the Federal Reserve's actions, while impacting growth, are not necessarily indicative of an impending market collapse.

-

Long-Term Growth Projections: BofA’s long-term projections incorporate factors such as technological advancements and global economic growth. These projections mitigate concerns about overvaluation by suggesting a longer runway for market expansion.

-

Valuation Metrics: BofA's analysis utilizes various valuation metrics, including the Price-to-Earnings (P/E) ratio and the cyclically adjusted price-to-earnings ratio (Shiller PE ratio). While acknowledging the elevated levels of these metrics, they highlight other factors, such as strong earnings growth, that temper the negative implications of high valuations. Their interpretation emphasizes a need for a holistic view rather than relying solely on valuation multiples.

H2: Factors Supporting Continued Market Growth Despite High Valuations

Beyond BofA's specific analysis, several other factors suggest a continued, albeit possibly more moderate, market growth trajectory.

-

Technological Innovation: Technological advancements continue to drive innovation and efficiency across various sectors. This ongoing innovation creates new opportunities for growth and contributes to long-term market expansion. Companies leveraging AI, automation, and other technologies are expected to outperform those that are not.

-

Global Economic Trends: While some regions may face economic headwinds, emerging markets present opportunities for growth. Increased global trade and investment can potentially offset domestic economic slowdowns, supporting overall market expansion.

-

Positive Policy Changes: Government policies, such as infrastructure investments or tax incentives, can positively influence market sentiment and encourage economic growth. While the impact of these policies can be debated, the potential for positive change should not be overlooked.

H2: Addressing Investor Concerns: Managing Risk in a High-Valuation Market

It's crucial to acknowledge the anxieties surrounding high stock market valuations. However, proactive risk management can help mitigate potential losses.

-

Diversification: Diversifying your investment portfolio across different asset classes (stocks, bonds, real estate, etc.) is a fundamental risk management strategy. This approach helps to reduce the impact of potential losses in any single asset class.

-

Focus on Fundamentals: Concentrating on fundamentally strong companies with robust earnings, consistent growth, and strong balance sheets is key. These companies are generally better positioned to weather market downturns.

-

Long-Term Investment Strategy: Short-term market timing is notoriously difficult. Adopting a long-term investment strategy, focusing on consistent contributions and weathering market fluctuations, is generally more successful.

-

Dollar-Cost Averaging: Dollar-cost averaging, which involves investing a fixed amount of money at regular intervals, can help mitigate the risk of investing a lump sum at a market peak. This strategy smooths out the impact of market volatility.

3. Conclusion: Navigating High Stock Market Valuations – A Balanced Perspective

BofA's analysis provides a valuable perspective on navigating high stock market valuations. While acknowledging the elevated valuations, their assessment suggests that an immediate market crash is not a foregone conclusion. Several factors, including strong corporate earnings, long-term growth projections, and technological innovation, support a more optimistic, though cautious, outlook. Remember that understanding high stock market valuations involves acknowledging the risks while also recognizing opportunities for long-term growth.

Ultimately, managing high stock market valuations requires informed decision-making and proactive risk management. Conduct thorough research, consult with a qualified financial advisor, and tailor your investment strategy to your individual risk tolerance and long-term financial goals. Navigating high stock market valuations successfully hinges on a balanced approach that accounts for both the challenges and the potential rewards.

Featured Posts

-

Lab Owner Pleads Guilty To Falsifying Covid 19 Test Results

Apr 24, 2025

Lab Owner Pleads Guilty To Falsifying Covid 19 Test Results

Apr 24, 2025 -

Miami Heats Herro Claims Nba 3 Point Contest Victory

Apr 24, 2025

Miami Heats Herro Claims Nba 3 Point Contest Victory

Apr 24, 2025 -

Broadcoms Proposed V Mware Price Hike At And T Reports A Staggering 1 050 Increase

Apr 24, 2025

Broadcoms Proposed V Mware Price Hike At And T Reports A Staggering 1 050 Increase

Apr 24, 2025 -

The Bold And The Beautiful February 20th Spoilers Steffy Comforts Liam Finns Warning

Apr 24, 2025

The Bold And The Beautiful February 20th Spoilers Steffy Comforts Liam Finns Warning

Apr 24, 2025 -

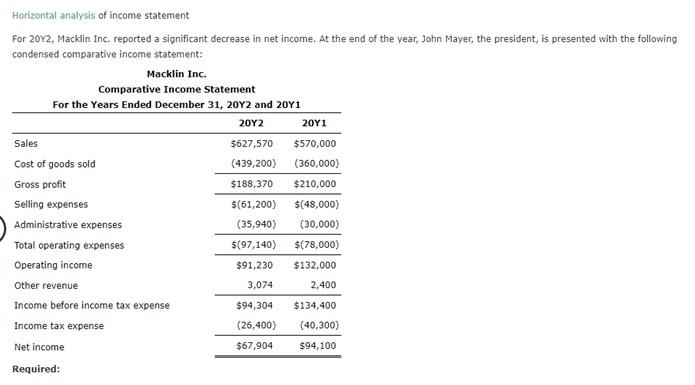

Analysis Of Teslas Q1 Earnings 71 Net Income Decrease Explained

Apr 24, 2025

Analysis Of Teslas Q1 Earnings 71 Net Income Decrease Explained

Apr 24, 2025

Latest Posts

-

Toxic Chemicals From Ohio Train Derailment Persistence In Buildings

May 10, 2025

Toxic Chemicals From Ohio Train Derailment Persistence In Buildings

May 10, 2025 -

Apples Ai Challenges And Opportunities Ahead

May 10, 2025

Apples Ai Challenges And Opportunities Ahead

May 10, 2025 -

Analyzing Apples Position In The Ai Revolution

May 10, 2025

Analyzing Apples Position In The Ai Revolution

May 10, 2025 -

Millions Lost Office365 Hack Exposes Executive Email Vulnerabilities

May 10, 2025

Millions Lost Office365 Hack Exposes Executive Email Vulnerabilities

May 10, 2025 -

Apples Ai Ambitions A Look At Its Competitive Landscape

May 10, 2025

Apples Ai Ambitions A Look At Its Competitive Landscape

May 10, 2025