High Stock Valuations And Investor Confidence: BofA's Assessment

Table of Contents

BofA's Valuation Metrics and Concerns

BofA's assessment highlights several key concerns stemming from the current high stock valuations. Their analysis centers around several crucial metrics, painting a picture of a market potentially poised for correction.

Elevated Price-to-Earnings Ratios

One of BofA's primary concerns revolves around elevated Price-to-Earnings (P/E) ratios across numerous sectors. These ratios, which compare a company's stock price to its earnings per share, are significantly higher than historical averages in several key areas. For example, BofA's report may cite (insert specific examples and data from a hypothetical BofA report if available; otherwise, use general examples):

- Technology Sector: Excessively high P/E ratios in the technology sector, driven by rapid growth but potentially unsustainable in the long term.

- Consumer Discretionary Sector: High valuations in consumer discretionary stocks, reflecting strong consumer spending, but vulnerable to economic slowdowns or interest rate increases.

- Healthcare Sector: While generally considered more stable, certain segments within the healthcare sector may also be showing inflated P/E ratios compared to historical norms.

This divergence from historical averages raises concerns about the market's overall valuation and the potential for a significant market correction. The impact of recent interest rate hikes further exacerbates these concerns, as higher borrowing costs can diminish corporate profitability and make stocks less attractive compared to bonds.

Concerns about Future Earnings Growth

Beyond simply high P/E ratios, BofA expresses concerns regarding the sustainability of current earnings growth. Several potential headwinds threaten corporate profits and could impact investor sentiment negatively:

- Inflationary Pressures: Persistent inflation continues to increase input costs for businesses, potentially squeezing profit margins.

- Supply Chain Disruptions: Ongoing supply chain issues continue to hinder production and increase costs, impacting profitability across various sectors.

- Geopolitical Risks: Uncertainties stemming from geopolitical events create instability and negatively affect investor confidence and investment decisions.

These factors could significantly impact corporate profits in the coming quarters, potentially leading to a downward revision of earnings estimates and impacting stock prices.

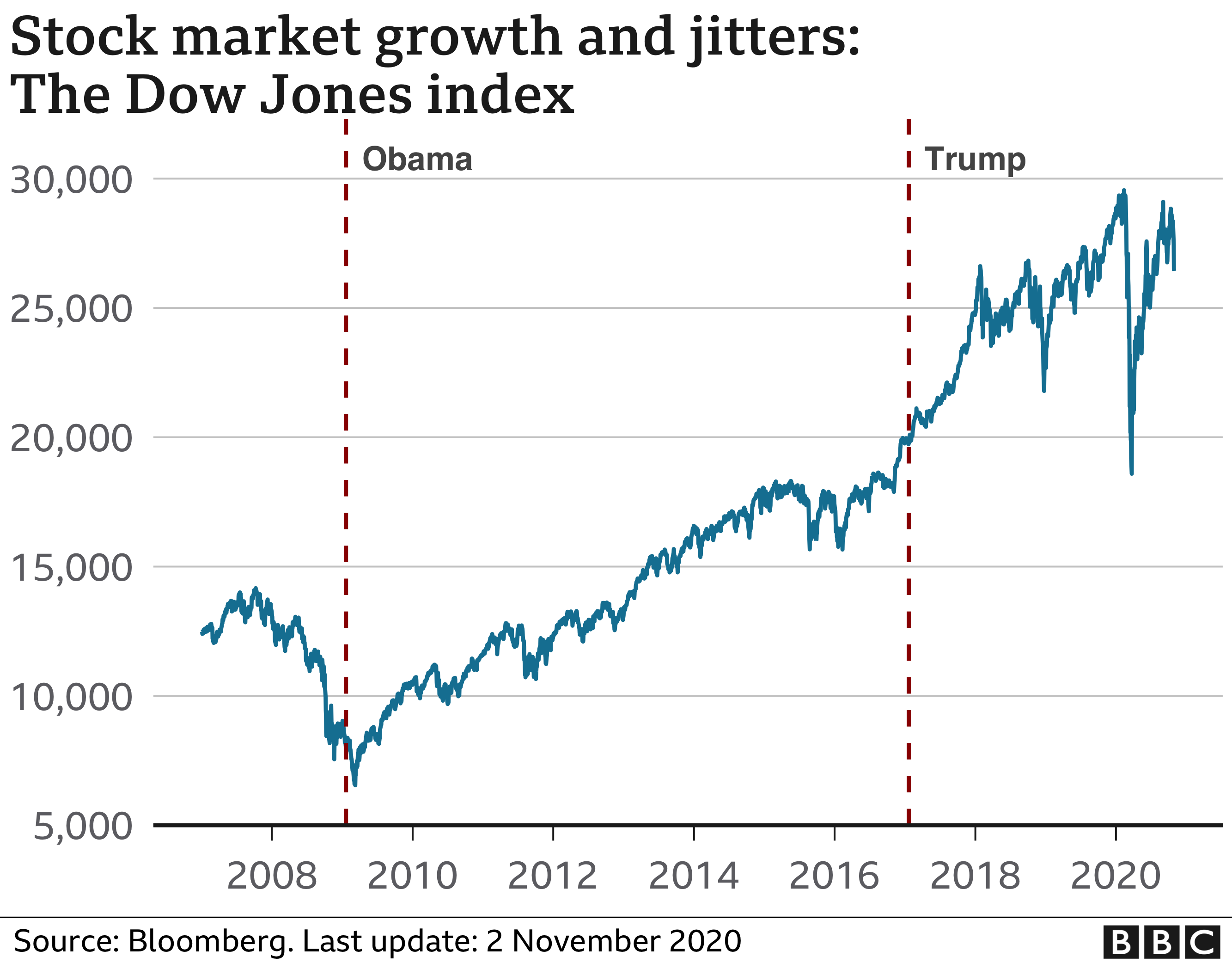

The Role of Monetary Policy

BofA's analysis also considers the significant role of monetary policy in shaping stock valuations and investor confidence. The recent series of interest rate hikes by central banks aim to curb inflation. However, these hikes have consequences:

- Rising Bond Yields: Higher interest rates make bonds more attractive, diverting investment away from stocks.

- Increased Borrowing Costs: Higher borrowing costs impact corporate investment and expansion plans, negatively affecting growth prospects.

- Potential for Market Corrections: The combination of higher interest rates and reduced corporate earnings could trigger a market correction, leading to a significant decline in stock prices.

This interplay between monetary policy and market valuations is a critical factor in BofA's cautious outlook.

Investor Sentiment and Behavioral Factors

Beyond fundamental valuation metrics, BofA also considers the influence of investor sentiment and behavioral factors on the market.

Impact of Geopolitical Uncertainty

Global events significantly influence investor behavior and market volatility. Increased geopolitical uncertainty often leads to:

- Investor Flight to Safety: Investors tend to move their investments towards safer assets like government bonds during times of uncertainty.

- Reduced Risk Appetite: Uncertainty dampens investors' willingness to take on risk, leading to decreased investment in equities.

- Increased Market Volatility: Geopolitical events introduce significant uncertainty, leading to increased market fluctuations.

These factors can significantly impact stock valuations and overall market sentiment.

The Role of Speculation and Market Psychology

Speculative trading and market psychology also play a crucial role in shaping current valuations.

- Speculative Bubbles: Certain sectors may be experiencing speculative bubbles, driven by excessive optimism and herd behavior.

- FOMO (Fear of Missing Out): The fear of missing out can drive investors to chase high-performing stocks, further inflating valuations.

- Social Media Influence: Social media platforms can amplify market sentiment, leading to rapid price swings based on speculative narratives rather than fundamentals.

Understanding these psychological factors is essential for navigating the market effectively.

BofA's Recommendations and Investment Strategies

Given their assessment, BofA likely recommends a cautious and strategic approach for investors.

Defensive Investment Strategies

In a high-valuation environment, BofA likely suggests focusing on defensive investment strategies to mitigate risk:

- Portfolio Diversification: Diversifying across asset classes (stocks, bonds, real estate) helps reduce overall portfolio risk.

- Sector Rotation: Shifting investments from overvalued sectors to those with better value propositions.

- Focus on Value Stocks: Identifying undervalued companies with strong fundamentals and long-term growth potential.

- Risk Management Techniques: Employing strategies like stop-loss orders to limit potential losses.

These measures are crucial for protecting capital in a potentially volatile market.

Opportunities Amidst Uncertainty

Despite the high valuations, BofA may identify potential investment opportunities for long-term investors:

- Growth Stocks in Undervalued Sectors: Identifying growth stocks in sectors that are not experiencing overvaluation.

- Long-Term Investment Horizons: Maintaining a long-term perspective can help investors weather short-term market fluctuations.

- Undervalued Companies with Strong Fundamentals: Focusing on companies with strong fundamentals that are currently trading below their intrinsic value.

Conclusion

BofA's assessment of high stock valuations and investor confidence reveals a market characterized by elevated risks and potential rewards. High P/E ratios, concerns about future earnings growth, and the impact of monetary policy all contribute to a cautious outlook. Understanding investor sentiment, geopolitical uncertainties, and the influence of speculation is crucial for navigating this complex environment. BofA likely recommends a diversified and defensive investment strategy, focusing on risk management while seeking out potential opportunities in undervalued sectors or companies. Conduct thorough research, consider seeking professional financial advice, and develop a robust investment strategy that accounts for the current high stock valuations. Stay informed about BofA's ongoing analysis on high stock valuations and investor confidence to make well-informed investment decisions.

Featured Posts

-

Trumps Tariffs Ceos Warn Of Negative Impact On Economy And Consumer Sentiment

Apr 26, 2025

Trumps Tariffs Ceos Warn Of Negative Impact On Economy And Consumer Sentiment

Apr 26, 2025 -

Shedeur Sanders Athleticism Deions Perspective On Inherited Traits

Apr 26, 2025

Shedeur Sanders Athleticism Deions Perspective On Inherited Traits

Apr 26, 2025 -

The Ajax 125th Anniversary A Focus On Dam Safety And Security

Apr 26, 2025

The Ajax 125th Anniversary A Focus On Dam Safety And Security

Apr 26, 2025 -

Saint Laurent And Charlotte Perriand A Collaboration Showcased At Milan Design Week 2025

Apr 26, 2025

Saint Laurent And Charlotte Perriand A Collaboration Showcased At Milan Design Week 2025

Apr 26, 2025 -

Hungarys Central Bank Accused Of Fraud Index Report Details Allegations

Apr 26, 2025

Hungarys Central Bank Accused Of Fraud Index Report Details Allegations

Apr 26, 2025

Latest Posts

-

100 Days Of Trump How Did It Affect Elon Musks Net Worth

May 10, 2025

100 Days Of Trump How Did It Affect Elon Musks Net Worth

May 10, 2025 -

The Impact Of Trumps First 100 Days On Elon Musks Financial Status

May 10, 2025

The Impact Of Trumps First 100 Days On Elon Musks Financial Status

May 10, 2025 -

The Tesla Dogecoin Connection Examining The Influence Of Elon Musk And Market Volatility

May 10, 2025

The Tesla Dogecoin Connection Examining The Influence Of Elon Musk And Market Volatility

May 10, 2025 -

Analyzing The Change In Elon Musks Net Worth The Trump Presidencys First 100 Days

May 10, 2025

Analyzing The Change In Elon Musks Net Worth The Trump Presidencys First 100 Days

May 10, 2025 -

Analyzing The Impact Of Teslas Stock Performance On Dogecoins Value The Elon Musk Factor

May 10, 2025

Analyzing The Impact Of Teslas Stock Performance On Dogecoins Value The Elon Musk Factor

May 10, 2025