Trump's Tariffs: CEOs Warn Of Negative Impact On Economy And Consumer Sentiment

Table of Contents

Increased Costs for Businesses and Consumers

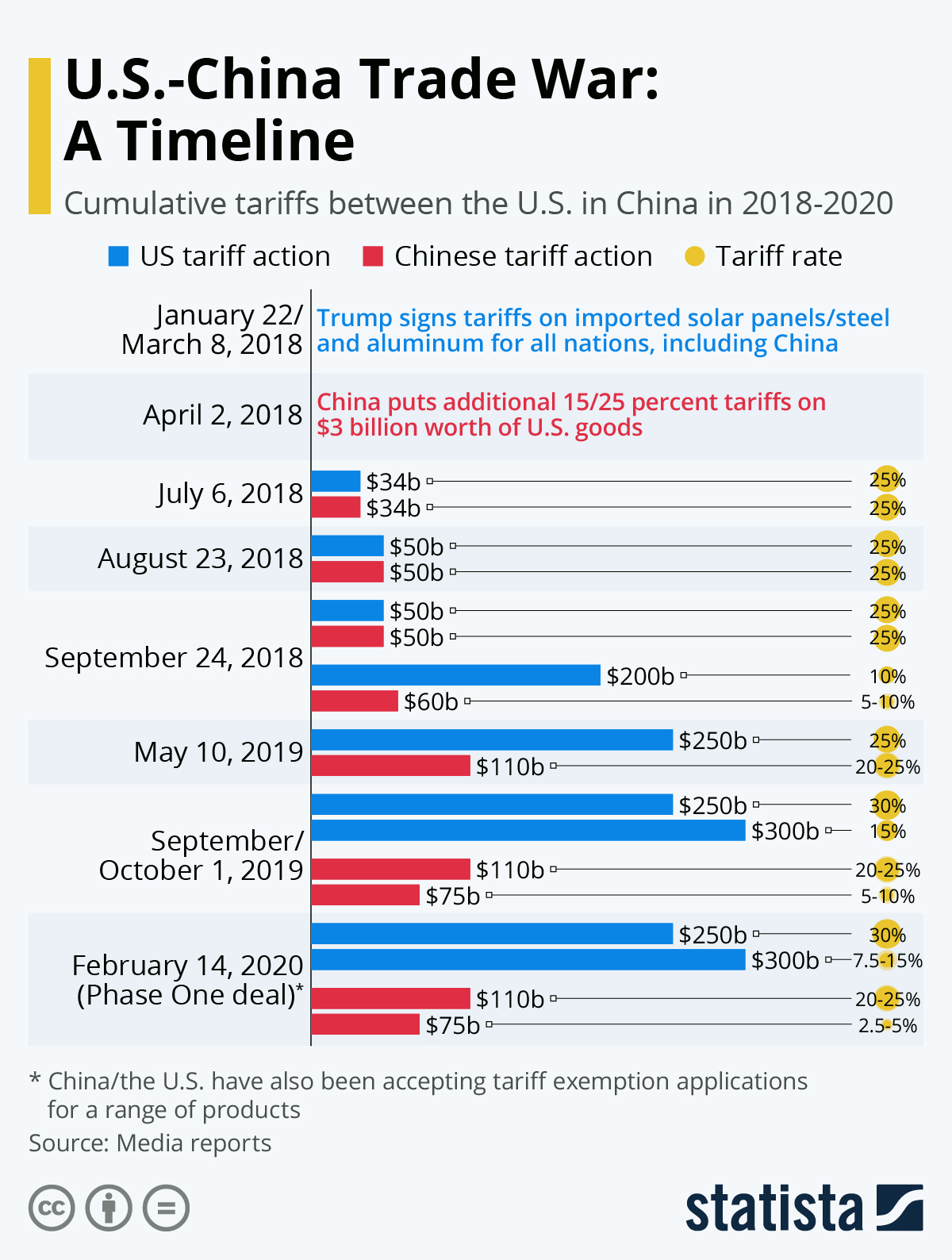

Trump's tariffs directly increased the cost of imported goods, creating a domino effect that impacted both businesses and consumers. The added costs associated with these tariffs were not absorbed by importers; instead, they were passed on, leading to significantly higher prices across the board. This ripple effect triggered a chain reaction throughout the economy.

- Increased production costs: Businesses relying on imported materials saw their production costs skyrocket, forcing them to either absorb the increased expenses, impacting profitability, or raise prices for their finished goods.

- Higher prices for consumers: Consumers faced higher prices for a wide range of goods, from everyday essentials to durable goods. This reduction in purchasing power significantly impacted consumer spending and overall economic activity.

- Supply chain disruption: Tariffs disrupted global supply chains, causing shortages and significant delays. The uncertainty surrounding future tariffs added further complexity and cost to importing and exporting goods.

- Industries heavily impacted: Manufacturing and agriculture were particularly hard hit, with many businesses struggling to compete with higher input costs and reduced demand. The automotive industry also felt the strain of increased prices for imported parts.

- Inflationary pressures: Data clearly illustrates a correlation between the implementation of Trump's tariffs and a subsequent rise in inflation rates. The increased cost of goods fueled inflationary pressures, eroding consumer purchasing power further.

Negative Impact on Consumer Sentiment and Spending

The combination of rising prices and economic uncertainty stemming from Trump's tariffs significantly impacted consumer sentiment and spending habits. As prices increased and the economic outlook darkened, consumers became more cautious and less willing to spend.

- Decline in consumer confidence: Various consumer confidence indices showed a clear decline following the announcement and implementation of major tariff increases. This reflected growing anxieties about the economy and personal finances.

- Reduced discretionary spending: Consumers reduced their discretionary spending, opting to save more and postpone purchases of non-essential items. This decrease in consumer spending had a significant impact on retail sales and various other sectors.

- Increased savings rates: As consumers braced for a potential economic downturn, many increased their savings rates, further reducing the overall level of economic activity.

- Impact on consumer sectors: Retail, automotive, and other consumer-facing sectors experienced significant slowdowns due to reduced consumer spending.

- Surveys and Studies: Numerous surveys and studies conducted during this period clearly demonstrated the negative correlation between tariff increases and consumer confidence levels.

CEO Concerns and Warnings about the Economy

The negative impacts of Trump's tariffs were not just felt by consumers; CEOs across various industries voiced serious concerns about the long-term implications for their businesses and the overall economy. Many issued stark warnings about potential negative consequences.

- CEO statements: Numerous CEOs publicly expressed concerns about the increased costs, supply chain disruptions, and decreased consumer demand resulting from the tariffs. Many warned of potential job losses and reduced investment.

- News reports and citations: Credible news sources widely reported on CEO statements, highlighting the widespread concern within the business community.

- Job losses and reduced investment: The uncertainty surrounding tariffs led to a decrease in business investment and hiring, further contributing to the economic slowdown.

- Recession predictions: Some CEOs warned of a potential recession resulting from the economic instability and decreased consumer spending caused by the tariffs.

- Market volatility: The uncertainty surrounding trade policy and the ongoing impact of tariffs contributed to increased market volatility, reflecting investor anxieties.

Alternative Economic Policies and Their Potential Benefits

While Trump's administration pursued a protectionist trade policy, alternative economic approaches, such as embracing free trade agreements, could have fostered greater economic growth and stability.

- Advantages of free trade: Free trade agreements generally promote economic growth by reducing barriers to trade, increasing competition, and improving efficiency.

- Successful examples: The history of successful free trade agreements demonstrates the positive economic outcomes that can be achieved through international cooperation and reduced trade barriers.

- Benefits of reduced tariffs: Reducing tariffs and promoting international cooperation can lead to lower prices for consumers, increased efficiency for businesses, and greater economic growth for participating nations.

- Tariffs vs. free trade: A comparison of the economic consequences of protectionist tariffs versus free trade policies clearly favors the latter in terms of economic growth and consumer benefits.

Conclusion

Trump's tariffs had a demonstrably detrimental effect on the US economy, impacting businesses and consumers alike. The increased costs, supply chain disruptions, and uncertainty contributed to lower consumer confidence, reduced spending, and increased inflationary pressures. The concerns voiced by CEOs regarding the potential for job losses and a recession were not unfounded. Understanding the lasting consequences of Trump's tariffs is crucial for navigating the current economic climate; continue to research the ongoing effects of these trade policies on consumer sentiment and the overall economy.

Featured Posts

-

Trumps Legacy A Herculean Task For The Next Fed Chair

Apr 26, 2025

Trumps Legacy A Herculean Task For The Next Fed Chair

Apr 26, 2025 -

Mission Impossible 7 Analyzing Tom Cruises Intense Stunt Work

Apr 26, 2025

Mission Impossible 7 Analyzing Tom Cruises Intense Stunt Work

Apr 26, 2025 -

Why Is Gold Soaring Trade Wars And The Bullion Market

Apr 26, 2025

Why Is Gold Soaring Trade Wars And The Bullion Market

Apr 26, 2025 -

New York Giants Shedeur Sanders As A Potential Solution

Apr 26, 2025

New York Giants Shedeur Sanders As A Potential Solution

Apr 26, 2025 -

Abb Vies Upbeat Q Quarter Number Earnings New Drugs Fuel Sales Surge And Revised Guidance

Apr 26, 2025

Abb Vies Upbeat Q Quarter Number Earnings New Drugs Fuel Sales Surge And Revised Guidance

Apr 26, 2025

Latest Posts

-

Police Save Choking Toddler Bodycam Footage Shows Dramatic Rescue

May 10, 2025

Police Save Choking Toddler Bodycam Footage Shows Dramatic Rescue

May 10, 2025 -

Feds Rate Hike Pause A Different Approach To Global Monetary Policy

May 10, 2025

Feds Rate Hike Pause A Different Approach To Global Monetary Policy

May 10, 2025 -

The Fentanyl Crisis And Its Impact On Us China Trade Discussions

May 10, 2025

The Fentanyl Crisis And Its Impact On Us China Trade Discussions

May 10, 2025 -

The Impact Of Trade Wars On Chinese Exports A Focus On Bubble Blasters And Similar Products

May 10, 2025

The Impact Of Trade Wars On Chinese Exports A Focus On Bubble Blasters And Similar Products

May 10, 2025 -

Les Mis Cast Considers Protest Over Trumps Kennedy Center Performance

May 10, 2025

Les Mis Cast Considers Protest Over Trumps Kennedy Center Performance

May 10, 2025