HMRC Refunds: Could Millions Be Entitled To A Payout? Check Your Payslip Today

Table of Contents

Understanding Common Reasons for HMRC Refunds

Many people overpay tax without realizing it. Several factors can contribute to this, leading to substantial HMRC refunds. Let's explore the most frequent causes.

Tax Code Errors

Incorrect tax codes are a leading cause of tax overpayment. Your tax code dictates how much income tax is deducted from your earnings. An incorrect code results in too much tax being withheld each month. Identifying this on your payslip is crucial.

- Examples of incorrect tax codes: 1100L instead of 1257L, missing letters (e.g., 1257 instead of 1257L), or codes that don't reflect your circumstances (e.g., using a single person's code when you're married).

- How to contact HMRC to correct your tax code: Contact HMRC directly via their website or phone lines. They'll need your National Insurance number and details about your employment. Correcting the code can lead to backdated HMRC refunds covering previous tax years.

- Potential for backdated refunds: Yes, HMRC will often backdate refunds to the start of the tax year when the error occurred, meaning you could receive a substantial lump sum.

Overpaid National Insurance Contributions (NICs)

National Insurance contributions are another area where overpayments can occur. This often happens due to errors in employment records or changes in circumstances that haven't been properly reflected. Your payslip should show your NIC deductions clearly.

- Scenarios of NI overpayment: Working multiple jobs without informing HMRC, changes in employment status (e.g., from self-employed to employed) not updated promptly.

- Relevant HMRC resources on national insurance contributions: [Link to relevant HMRC page on National Insurance].

- Process for claiming a refund: Similar to tax code errors, you'll need to contact HMRC to claim a refund for overpaid NICs.

Other Potential Reasons for Refunds

While less frequent, several other scenarios can lead to HMRC refunds:

- Marriage Allowance: This allows married couples or civil partners to transfer some of their personal allowance to their spouse, potentially reducing their tax bill.

- Childcare tax credits: If you're eligible, you might be entitled to tax credits to help with childcare costs. Any overpayments made can be reclaimed.

- Student Loan repayments: Overpayments can happen if your income falls below the repayment threshold.

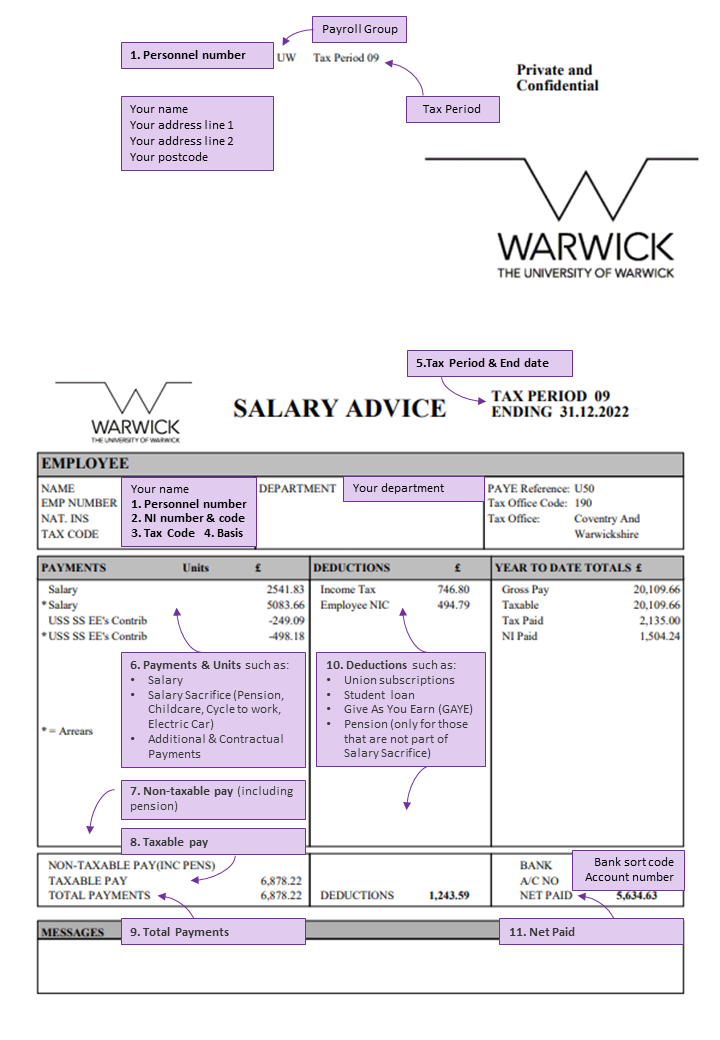

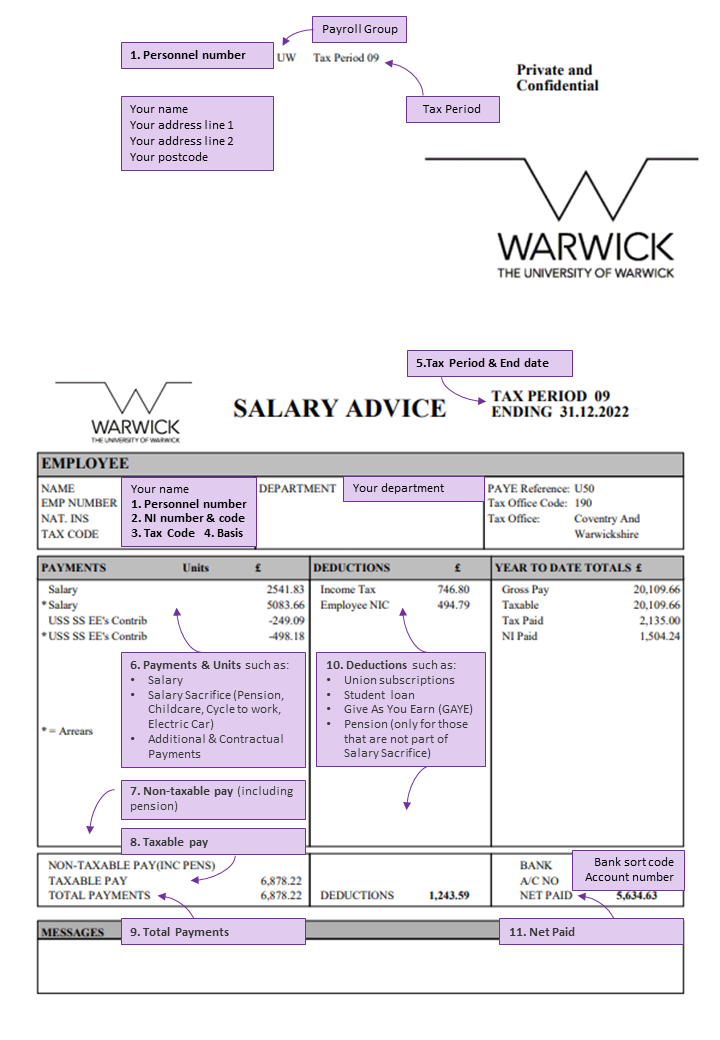

How to Check Your Payslip for Potential HMRC Refunds

Carefully examining your payslips is the first step in identifying potential HMRC refunds. Here's what to look for:

Key Information to Look For

Your payslip contains crucial information to determine if you've overpaid tax:

- Tax code: Check for accuracy as described above.

- Deductions: Compare the amount deducted for tax and NICs against your gross pay. Are they unusually high?

- Net pay compared to gross pay: A significant difference might suggest overpayment.

- Step-by-step guide: [Insert screenshots or examples of payslips highlighting key areas].

- Comparing payslips: Review several payslips from the past tax year to identify any inconsistencies.

Understanding Your Tax Year and Tax Returns

The tax year runs from 6 April to 5 April the following year. Understanding this is crucial as potential HMRC refunds relate to this period.

- Self Assessment: If you're self-employed or have other untaxed income, your Self Assessment tax return is vital for identifying potential overpayments. Remember the deadline!

- Tax return deadline: [Insert the relevant tax return deadline].

Using Online HMRC Tools

HMRC provides online services to check your tax records:

- Step-by-step guide on navigating the HMRC website: [Provide clear, concise instructions with screenshots].

- Relevant online tools or portals: [Link to relevant HMRC online tools and portals].

Claiming Your HMRC Refund

Once you've identified a potential overpayment, you can claim your refund.

Gathering Necessary Documents

Before claiming your refund, gather the following:

- Payslips from the relevant tax year

- P60 form (if applicable)

- Any other relevant documentation supporting your claim

The Application Process

Claiming your HMRC refund typically involves:

- Accessing the online HMRC portal: [Link to the official HMRC online claim portal]

- Completing the necessary forms

- Providing all required documents

Expected Processing Times

HMRC typically processes refunds within several weeks, but processing times can vary.

Secure Your HMRC Refund Today!

Many individuals unknowingly overpay tax each year. By carefully checking your payslips for tax code errors, overpaid National Insurance contributions, or other potential issues, you could be entitled to a significant tax rebate—potentially thousands of pounds! Don't miss out on getting your money back. Check your payslips immediately and initiate the claim process for your HMRC refund today! [Link to relevant HMRC webpage].

Featured Posts

-

Avauskokoonpano Paljastettu Kamaran Ja Pukkin Tilanne

May 20, 2025

Avauskokoonpano Paljastettu Kamaran Ja Pukkin Tilanne

May 20, 2025 -

Sasol Sol Investor Concerns Following 2023 Strategy Presentation

May 20, 2025

Sasol Sol Investor Concerns Following 2023 Strategy Presentation

May 20, 2025 -

Future Of Canada Post Report Suggests Shifting Away From Daily Door To Door Mail

May 20, 2025

Future Of Canada Post Report Suggests Shifting Away From Daily Door To Door Mail

May 20, 2025 -

The Construction Of Chinas Space Based Supercomputer A Detailed Look

May 20, 2025

The Construction Of Chinas Space Based Supercomputer A Detailed Look

May 20, 2025 -

Hmrc Child Benefit Important Notifications You Need To See

May 20, 2025

Hmrc Child Benefit Important Notifications You Need To See

May 20, 2025