HMRC Website Crash: Hundreds Of UK Users Locked Out Of Accounts

Table of Contents

Extent of the HMRC Website Crash

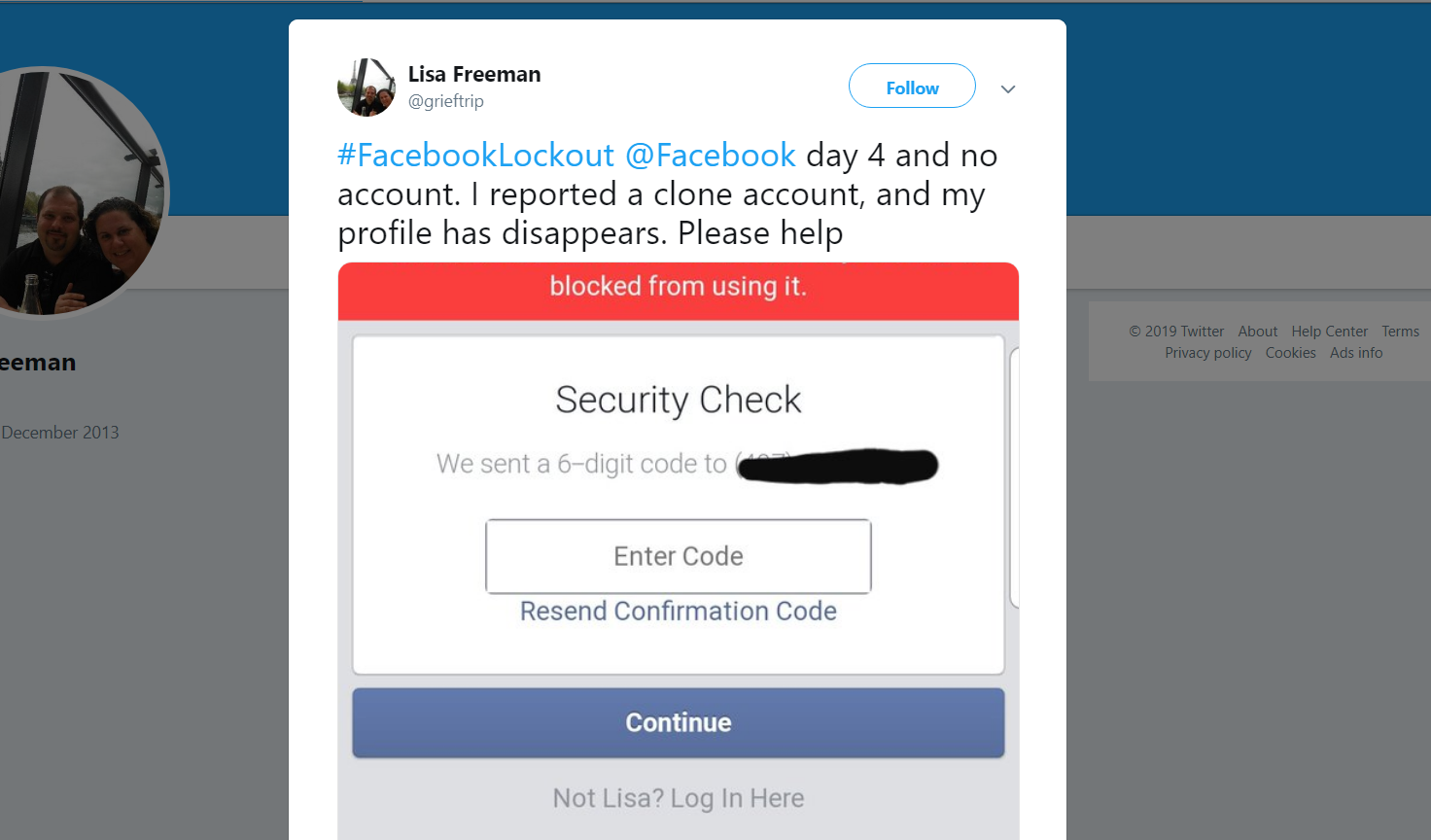

Reports of a widespread HMRC website down situation are flooding in from across the UK. Social media is ablaze with frustrated users expressing their inability to access their tax account access. While precise figures are still emerging, estimates suggest hundreds, and potentially thousands, of users are affected by this HMRC system failure. The geographical impact appears to be nationwide, with reports originating from various regions across the country. Numerous news articles and social media posts (links to be inserted here – replace with actual links) corroborate the scale of this significant HMRC outage. The sheer volume of complaints underscores the severity of the disruption to the UK's online tax infrastructure.

- Widespread reports of outages across the UK.

- Estimates of hundreds, possibly thousands, of affected users.

- Appears to be a nationwide outage, affecting users across the country.

- Significant user complaints and reactions visible across social media platforms.

- News articles and social media posts confirming widespread disruption (insert links to relevant sources).

Potential Causes of the HMRC Outage

The exact cause of this significant HMRC website down situation is still under investigation. However, several potential factors are under scrutiny. Was it a simple server issues? Did a cyberattack compromise the system? Was it a case of planned maintenance that went drastically wrong? Or could it be a complex software glitch? Analyzing past HMRC system failures, we can see a range of contributing factors, from overloaded servers to security breaches. The incident raises serious questions about the robustness of HMRC's digital infrastructure and the potential vulnerabilities within the system. The importance of resilient systems for handling peak demand and mitigating the risk of future failures cannot be overstated.

- Potential causes: Server overload, cyberattack, unplanned maintenance issues, or software bugs.

- Analysis of past HMRC system failures to identify recurring issues and vulnerabilities.

- Discussion of the potential impact of security breaches and data loss.

- Emphasis on the crucial need for robust and resilient IT infrastructure at HMRC.

Impact of the HMRC Website Crash on Users

The consequences of this HMRC website crash are far-reaching and deeply impactful for countless users. The inability to access online services is creating significant hurdles for many. Tax return filing delays are inevitable, particularly for those approaching self-assessment deadlines. Similarly, the inability to make online tax payments will cause anxiety and potential financial penalties. Businesses reliant on timely access to HMRC online services for corporation tax and other compliance matters face severe disruption. The potential for incurring late payment penalties adds further stress to an already difficult situation.

- Significant delays in filing tax returns (self-assessment, corporation tax, VAT returns).

- Inability to make online tax payments, potentially leading to penalties.

- Widespread disruption to businesses relying on timely access to HMRC online services.

- Increased stress and anxiety for affected taxpayers.

- Potential for financial penalties due to missed deadlines.

HMRC's Response and Potential Solutions

At the time of writing, HMRC has yet to release a comprehensive statement detailing the cause of the outage and a definitive timeline for service restoration. However, we expect an official HMRC statement to be released shortly, outlining the steps being taken to address this critical issue. Users should monitor official HMRC channels for updates on system recovery. The availability of customer support remains crucial. We encourage users to check for updates on the HMRC helpline and other support channels. In the meantime, basic troubleshooting steps such as checking internet connectivity and clearing browser cache might prove helpful. Looking ahead, preventative measures such as investing in more robust infrastructure, implementing rigorous cybersecurity protocols, and conducting regular system stress tests are vital to prevent future HMRC website crash events.

- Details on HMRC's official response to the outage and any steps taken to resolve it.

- Information on available customer support channels (phone, email, online help).

- Advice for users on troubleshooting common login issues and website access problems.

- Discussion of preventative measures to enhance system resilience and prevent future outages.

Conclusion

This HMRC website crash has caused significant disruption to the lives and businesses of countless UK taxpayers, exposing the vulnerability of the nation's crucial online tax system. The impact, from delayed tax returns to potential penalties, is substantial. While the underlying cause remains under investigation, this incident underscores the critical need for robust system infrastructure, proactive security measures, and reliable customer support.

Call to Action: Stay informed about the latest updates on the official HMRC website and social media channels. If you are experiencing problems accessing your HMRC online account, contact HMRC's customer support immediately for assistance. Regularly check for HMRC service updates to avoid further disruption to your tax affairs. Understanding the potential implications of an HMRC website crash is vital for all UK taxpayers.

Featured Posts

-

Middle Managers The Unsung Heroes Of Effective Organizations And Happy Employees

May 20, 2025

Middle Managers The Unsung Heroes Of Effective Organizations And Happy Employees

May 20, 2025 -

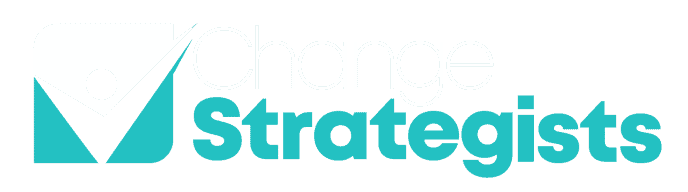

Staying Informed School Delays And Winter Weather Advisories

May 20, 2025

Staying Informed School Delays And Winter Weather Advisories

May 20, 2025 -

Analyzing The Sharp Drop In D Wave Quantum Inc Qbts Stock 2025

May 20, 2025

Analyzing The Sharp Drop In D Wave Quantum Inc Qbts Stock 2025

May 20, 2025 -

Esperida Megalis Tessarakostis Stin Patriarxiki Akadimia Kritis

May 20, 2025

Esperida Megalis Tessarakostis Stin Patriarxiki Akadimia Kritis

May 20, 2025 -

D Wave Quantum Qbts Stock Plunge Kerrisdale Capitals Valuation Concerns

May 20, 2025

D Wave Quantum Qbts Stock Plunge Kerrisdale Capitals Valuation Concerns

May 20, 2025