HMRC's New Voice Recognition System: Faster Call Handling

Table of Contents

How HMRC's Voice Recognition System Works

HMRC's new voice recognition system is designed to dramatically improve the efficiency and speed of taxpayer interactions. This sophisticated system leverages cutting-edge technology to provide a smoother, faster experience.

Automated Call Routing

The system utilizes automated call routing to direct calls to the appropriate department instantly. This intelligent routing is powered by natural language processing (NLP), enabling the system to understand the caller's intent even with varied phrasing.

- Uses natural language processing (NLP) to understand caller intent: The system isn't limited to specific keywords; it understands the context of the conversation.

- Reduces the need for manual operator intervention for simple queries: Simple requests, such as checking tax return status or inquiring about a payment, can be handled immediately without the need to wait for an agent.

- Integrates with HMRC's existing systems for seamless data access: The system seamlessly pulls relevant information from HMRC's databases, providing accurate and up-to-date responses.

- Examples of queries handled: The system can handle a wide range of queries, including tax return status updates, payment inquiries, general information requests about tax allowances, deadlines, and more.

Improved Accuracy and Efficiency

The accuracy of HMRC's voice recognition system is a key factor in its success. Continuous improvement through machine learning algorithms ensures that the system's accuracy increases over time.

- Continuous improvement through machine learning algorithms: The system constantly learns and adapts, improving its understanding of various accents and dialects.

- Reduces errors associated with manual data entry: By automating the data collection process, the system minimizes the risk of human error.

- Allows agents to focus on more complex issues: Agents are freed from handling simple queries, allowing them to focus on more intricate taxpayer issues requiring specialist knowledge.

- Data showing improved call handling times: (Insert statistics here if available, e.g., "Internal testing has shown a 30% reduction in average call handling time since implementing the new system.")

Enhanced Security Measures

Protecting taxpayer data is paramount. HMRC has implemented robust security measures to ensure the privacy and security of all information processed by the voice recognition system.

- Data encryption and secure storage protocols: All data is encrypted both in transit and at rest, protecting it from unauthorized access.

- Compliance with relevant data protection regulations (GDPR etc.): The system is fully compliant with all relevant data protection regulations.

- Measures to prevent fraud and identity theft: Multi-layered security protocols are in place to prevent fraudulent activity and protect taxpayer identities.

- Regular security audits and updates: Regular audits and software updates ensure that the system remains secure and protected against emerging threats.

Benefits for Taxpayers

The HMRC voice recognition system offers several key benefits for taxpayers, resulting in a significantly improved experience.

Reduced Waiting Times

The most immediate benefit is a significant reduction in waiting times. This means less time spent on hold and faster access to the information or assistance needed.

- Faster connection to the relevant department: Calls are routed efficiently, minimizing delays.

- Less time spent on hold: The system handles many queries automatically, reducing the need to wait for an agent.

- Improved overall customer experience: Faster service and efficient handling lead to a more positive interaction.

- Potential for 24/7 availability: (If applicable, mention 24/7 access to self-service options).

Increased Accessibility

The system also improves accessibility for individuals with disabilities.

- Potential for multiple language support: (If applicable, mention language support options).

- Improved accessibility for visually impaired individuals: (If applicable, mention screen reader compatibility or other assistive technology integration).

- More convenient interaction for individuals with mobility issues: The system allows taxpayers to access services without needing to travel to an office or rely on others for assistance.

24/7 Self-Service Options

The voice recognition system offers the potential for increased self-service options, accessible around the clock.

- Access to information and services at any time: Taxpayers can access information and services at their convenience, regardless of call center operating hours.

- Reduces reliance on call center during peak hours: Self-service options ease the burden on the call center, reducing wait times for everyone.

- Potential integration with HMRC's online portal: (If applicable, mention integration with the online portal for a more seamless experience).

Conclusion

HMRC's new voice recognition system represents a significant advancement in taxpayer service. By streamlining call handling, improving accuracy, and enhancing accessibility, this technology promises a faster, more efficient, and ultimately more satisfying experience for all. The benefits, from reduced wait times to improved security, are clear. Learn more about how this innovative system can benefit you by visiting the HMRC website and exploring their self-service options using their new voice recognition system. Stay informed about further developments in HMRC’s voice recognition technology to maximize your efficiency when contacting the agency.

Featured Posts

-

Ecowas Economic Affairs Department Sets Strategic Priorities At Niger Retreat

May 20, 2025

Ecowas Economic Affairs Department Sets Strategic Priorities At Niger Retreat

May 20, 2025 -

Los Antzeles Endiaferon Gia Ton Giakoymaki

May 20, 2025

Los Antzeles Endiaferon Gia Ton Giakoymaki

May 20, 2025 -

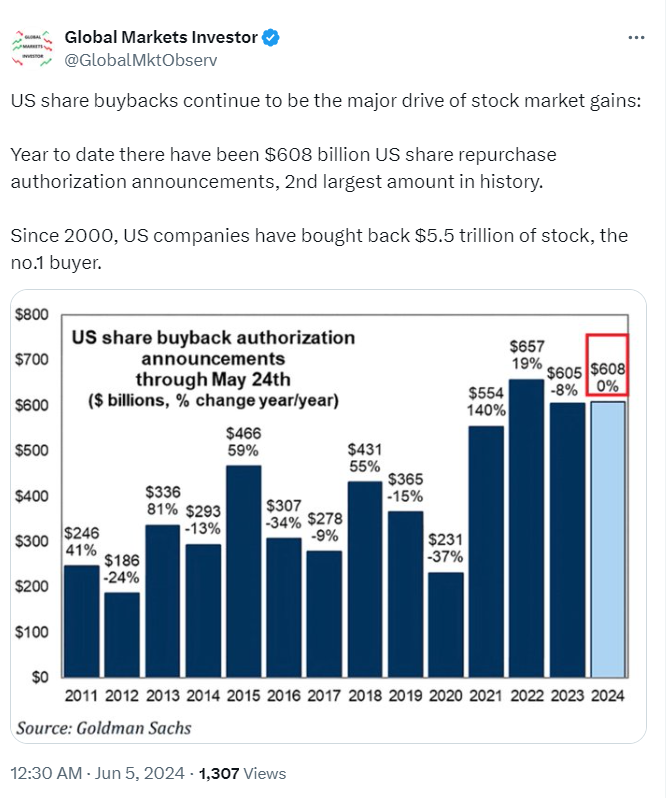

Ryanairs Future Growth Impact Of Tariff Wars And Buyback Strategy

May 20, 2025

Ryanairs Future Growth Impact Of Tariff Wars And Buyback Strategy

May 20, 2025 -

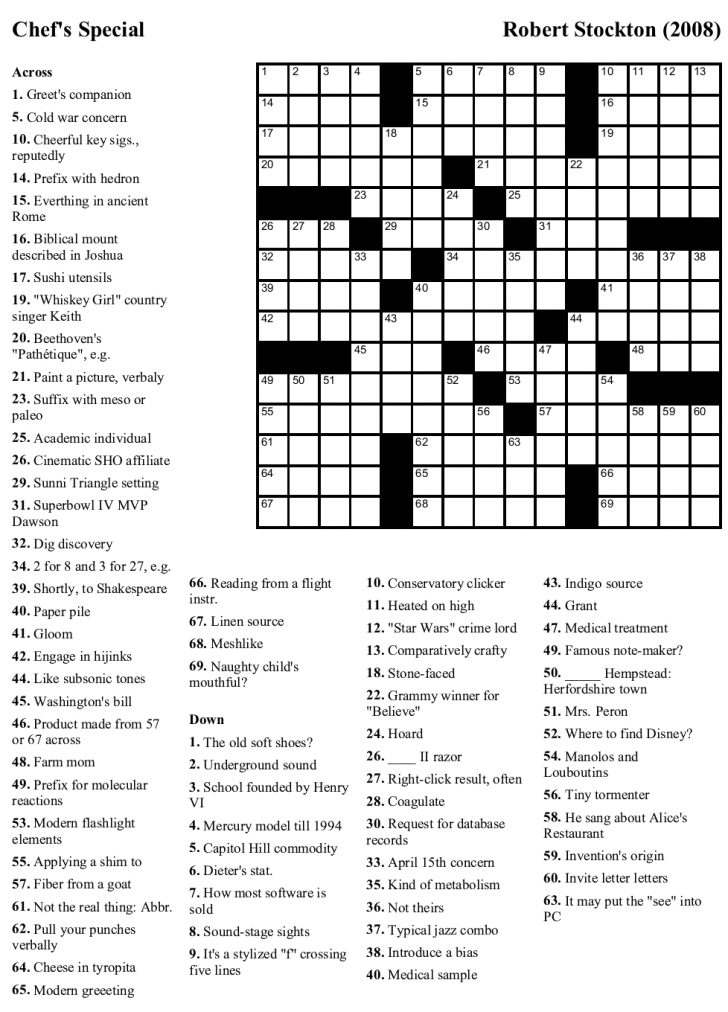

Nyt Mini Crossword Answers March 16 2025 Full Solution Guide

May 20, 2025

Nyt Mini Crossword Answers March 16 2025 Full Solution Guide

May 20, 2025 -

Backstage Report The Latest On Aj Styles Wwe Contract

May 20, 2025

Backstage Report The Latest On Aj Styles Wwe Contract

May 20, 2025