Ryanair's Future Growth: Impact Of Tariff Wars And Buyback Strategy

Table of Contents

The Impact of Tariff Wars on Ryanair's Operations

International tariff wars create significant headwinds for airlines, and Ryanair is no exception. The impact manifests in several crucial areas, impacting both operational costs and demand.

Fuel Costs and Hedging Strategies

Increased fuel prices, a direct consequence of trade tensions and global instability, significantly impact Ryanair's profitability. Fuel is a major operational expense for any airline, and fluctuations in its price directly affect the bottom line. Ryanair employs hedging strategies to mitigate these risks, attempting to lock in future fuel prices at favorable rates.

- Success Rate of Past Hedging Strategies: While Ryanair has historically demonstrated some success with hedging, the effectiveness varies depending on the accuracy of market predictions. Unforeseen geopolitical events can render even the most sophisticated hedging strategies less effective.

- Impact of Future Tariff Escalations: Further escalations in tariff wars could lead to unpredictable spikes in fuel costs, potentially exceeding the protection offered by current hedging mechanisms. This necessitates a continuous evaluation and adaptation of their hedging strategies.

- Alternative Fuel Sources: The exploration of alternative, sustainable aviation fuels (SAFs) presents a long-term opportunity to reduce reliance on volatile fossil fuels. However, the widespread adoption of SAFs remains some years away, and their current cost and availability present significant challenges.

- Fuel Surcharges: To offset some of the increased fuel costs, Ryanair, like many other airlines, may pass on some costs to consumers through fuel surcharges, impacting ticket pricing and potentially affecting passenger demand.

Impact on Air Travel Demand

Trade wars can create economic uncertainty, leading to reduced consumer spending and a decline in air travel demand. This downturn disproportionately affects discretionary travel, which forms a significant portion of Ryanair's passenger base.

- Shifts in Passenger Demographics: Economic downturns may lead to a shift in passenger demographics, with a potential decrease in business travelers and leisure travelers opting for less expensive travel options.

- Impact on Specific Routes: Routes heavily reliant on trade-related travel (e.g., those connecting manufacturing hubs or business centers impacted by tariffs) will likely experience the most significant decline in passenger numbers. Ryanair will need to adapt its route planning to reflect these changes.

- Route Network Adjustments: In response to decreased demand on certain routes, Ryanair may adjust its network by reducing frequency or even eliminating unprofitable routes altogether, focusing resources on more resilient sectors.

Regulatory and Political Uncertainties

Tariff wars often create a climate of political and regulatory uncertainty. This can lead to unforeseen complications for airlines operating across international borders.

- Operational Challenges: Trade disputes can lead to delays or denials of flight permits, impacting Ryanair's operational efficiency and potentially leading to flight cancellations.

- Future Regulatory Hurdles: Changes in aviation regulations in response to trade tensions are a possibility, creating new compliance challenges and operational costs for airlines like Ryanair.

- Lobbying Efforts: Ryanair, like other airlines, might engage in lobbying efforts to influence policymakers and mitigate the negative impacts of trade disputes on its operations.

Ryanair's Share Buyback Strategy and its Implications for Future Growth

Ryanair's significant share buyback program is a key component of its financial strategy, with far-reaching implications for its future growth.

Financial Strength and Investor Confidence

The buyback program signals Ryanair's robust financial position and confidence in its long-term prospects. It aims to increase shareholder value by reducing the number of outstanding shares, thereby increasing earnings per share.

- Supporting Financial Metrics: Ryanair's strong cash flow, low debt levels, and consistent profitability provide the financial foundation for the buyback program.

- Rationale Behind the Buyback: From a financial perspective, the buyback is seen as a way to return capital to shareholders when other investment opportunities may offer lower returns.

- Comparison with Competitors: Comparing Ryanair's buyback strategy to those of its competitors provides context and highlights its aggressive approach to capital allocation.

Allocation of Resources and Investment Opportunities

The substantial funds allocated to the buyback represent a significant opportunity cost. These resources could instead be channeled into alternative investments.

- Opportunity Cost of the Buyback: Investing in fleet expansion, technological upgrades (e.g., improved IT systems, digitalization of services), or new route development could potentially yield higher long-term returns compared to the buyback.

- Return on Investment (ROI) Comparison: A thorough comparison of the ROI from the buyback versus other potential investment avenues is crucial for evaluating the optimal allocation of resources.

- Potential Future Investments: Future investment decisions will need to be made carefully, balancing the benefits of the buyback with the need for continuous investment in fleet modernization, technological advancements, and network expansion.

Long-Term Growth Strategy and Shareholder Value

The buyback strategy’s success depends on its alignment with Ryanair’s long-term growth objectives and its commitment to enhancing shareholder value.

- Long-Term Implications for Shareholders: The buyback’s long-term impact on shareholder value will depend on the performance of Ryanair’s overall business and the market’s reaction to the reduced number of shares.

- Sustainability of the Buyback Strategy: The sustainability of the buyback hinges on Ryanair's ability to maintain its profitability and cash flow generation in a dynamic and competitive environment.

- Changes to the Buyback Strategy: Market conditions, future investment opportunities, and shareholder feedback will likely influence any adjustments to Ryanair’s buyback strategy.

Conclusion

Ryanair's future growth trajectory is inextricably linked to its ability to navigate the challenges posed by international tariff wars and to make informed decisions regarding its share buyback program. Mitigating the impact of fluctuating fuel prices, maintaining passenger demand, and strategically allocating resources are all crucial for long-term success. Analyzing the opportunity cost of the buyback compared to other growth-oriented investments is vital. Continuous monitoring of these key factors will be essential for understanding Ryanair's future growth and its continued market dominance. To stay informed about Ryanair's future growth, follow reputable financial news sources and consult their investor relations communications.

Featured Posts

-

Poslednji Pozdrav Andelki Milivojevic Tadic Tuga Kolega I Prijatelja

May 20, 2025

Poslednji Pozdrav Andelki Milivojevic Tadic Tuga Kolega I Prijatelja

May 20, 2025 -

Budget De Biarritz Logements Saisonniers Et Sainte Eugenie Decisions Du Conseil Municipal

May 20, 2025

Budget De Biarritz Logements Saisonniers Et Sainte Eugenie Decisions Du Conseil Municipal

May 20, 2025 -

Taiwans Nuclear Phase Out The Rise Of Lng Imports

May 20, 2025

Taiwans Nuclear Phase Out The Rise Of Lng Imports

May 20, 2025 -

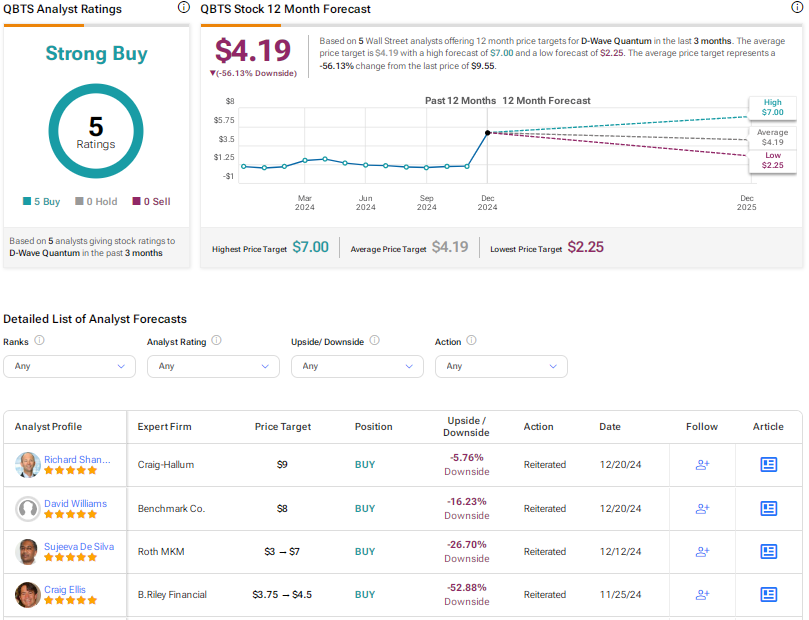

D Wave Quantum Qbts Stock Plunge Understanding Mondays Decline

May 20, 2025

D Wave Quantum Qbts Stock Plunge Understanding Mondays Decline

May 20, 2025 -

Colombian Models Murder Femicide Condemnation After Mexican Influencers Killing

May 20, 2025

Colombian Models Murder Femicide Condemnation After Mexican Influencers Killing

May 20, 2025