Honeywell (HON) And Johnson Matthey: Catalyst Business Acquisition Update

Table of Contents

Deal Details and Financial Implications

Acquisition Price and Structure

The acquisition price for Johnson Matthey's catalyst business was finalized at [Insert Acquisition Price if available – otherwise, state "a significant sum," and cite the source of information if known]. The structure of the transaction [Insert details of transaction structure e.g., "was primarily a cash deal," or "involved a combination of cash and stock," with details about percentage split if available]. The deal's completion signifies Honeywell's significant investment in expanding its presence in the catalyst market.

Honeywell's Strategic Rationale

Honeywell's pursuit of this acquisition is driven by several key strategic factors. The acquisition allows for significant market expansion within the automotive and chemical catalyst sectors. It provides Honeywell with access to Johnson Matthey's established customer base and distribution networks, strengthening its market position. Moreover, the integration will likely lead to synergies by combining Honeywell's technological expertise with Johnson Matthey's established market presence. This strategic acquisition also provides access to Johnson Matthey's cutting-edge technology and research and development capabilities, giving Honeywell a technological advantage over competitors.

Impact on Honeywell's Financials

The acquisition is expected to impact Honeywell's financials significantly. While the short-term impact might involve increased debt and integration costs, long-term projections suggest considerable revenue growth and improved profitability. However, a thorough risk assessment is necessary to account for potential integration challenges and market fluctuations.

- Analysts predict a [Insert percentage or specific figures if available] increase in Honeywell's revenue within [ timeframe] post-acquisition.

- Increased market share in the catalyst sector is anticipated, leading to improved profitability in the medium to long term.

- Integration costs and potential restructuring might negatively impact short-term earnings.

Impact on the Catalyst Market

Market Share Dynamics

This acquisition significantly reshapes the market share distribution within the catalyst industry. Honeywell's increased market share places it in direct competition with industry giants like BASF and Clariant. The acquisition could lead to increased competition and potential price adjustments within the sector. The combined entity's influence on pricing and market dynamics will be a crucial aspect to monitor in the coming years.

Technological Advancements

The combined expertise of Honeywell and Johnson Matthey promises significant advancements in catalyst technology. Both companies have a strong track record of innovation in research and development. The integration will likely accelerate the development of more efficient, sustainable, and high-performing catalysts.

- Improved automotive catalysts leading to reduced emissions in vehicles.

- Advancements in chemical catalysts enhancing efficiency in various industrial processes.

- Development of new catalysts for emerging applications, such as green technologies and renewable energy.

Environmental Impact

The acquisition's environmental impact is a key consideration. Improved automotive catalysts resulting from this merger will likely contribute to lower vehicle emissions, aligning with stricter environmental regulations globally. Advancements in chemical catalysts can also enhance the efficiency and sustainability of various industrial processes, reducing overall environmental impact.

Future Outlook and Predictions

Integration Challenges and Opportunities

Successful integration of two such large entities presents considerable challenges. Harmonizing different corporate cultures, streamlining operations, and optimizing resources will be crucial. However, this also offers significant synergy opportunities, including cost reductions and operational improvements, leading to enhanced efficiency.

Long-Term Growth Prospects

The long-term growth prospects for Honeywell's expanded catalyst business are promising. Continued innovation and expansion into new markets are expected to drive sustainable growth. Industry experts predict [Insert predictions and figures if available] growth in the coming years.

- Expansion into new markets and applications of catalyst technology.

- Potential for increased profitability through operational efficiencies and cost reduction.

- Risk factors include unforeseen market downturns and the success of the integration process.

Conclusion: Honeywell's Catalyst Acquisition: A Strategic Move for Growth?

The Honeywell (HON) acquisition of Johnson Matthey's catalyst business represents a significant strategic move with substantial financial implications and a considerable impact on the competitive landscape. While integration challenges exist, the potential for synergy and market expansion is considerable, promising long-term growth. The combined entity's focus on innovation and sustainability positions it favorably within the evolving automotive and chemical industries. Stay updated on further developments regarding the Honeywell (HON) and Johnson Matthey catalyst business acquisition and follow for more in-depth analysis. [Link to related resources or further analysis].

Featured Posts

-

Motor De Combustion Revolucionario El Reino Unido Quema Agua Para Generar Energia

May 23, 2025

Motor De Combustion Revolucionario El Reino Unido Quema Agua Para Generar Energia

May 23, 2025 -

Metallicas Hampden Park Gig Your Guide To Securing Tickets

May 23, 2025

Metallicas Hampden Park Gig Your Guide To Securing Tickets

May 23, 2025 -

Brundles Report Previously Unknown Facts About Lewis Hamilton

May 23, 2025

Brundles Report Previously Unknown Facts About Lewis Hamilton

May 23, 2025 -

Exploring The 2025 Rendez Vous With French Cinema Festival Highlights And Award Predictions

May 23, 2025

Exploring The 2025 Rendez Vous With French Cinema Festival Highlights And Award Predictions

May 23, 2025 -

Psl X Sikandar Razas All Round Heroics Power Lahore Qalandars Victory

May 23, 2025

Psl X Sikandar Razas All Round Heroics Power Lahore Qalandars Victory

May 23, 2025

Latest Posts

-

A Real Pain Eric Andre Reveals Regret Over Missed Opportunity

May 23, 2025

A Real Pain Eric Andre Reveals Regret Over Missed Opportunity

May 23, 2025 -

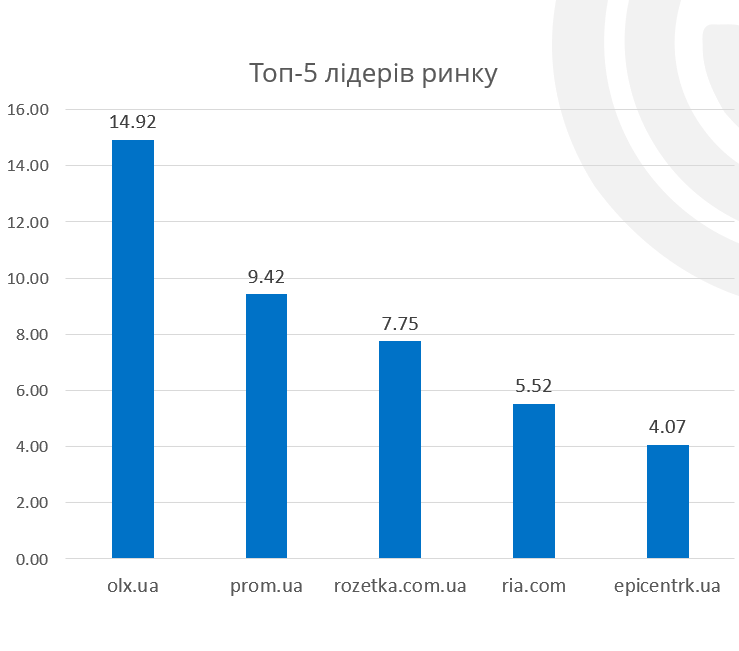

Finansoviy Reyting Ukrayini 2024 Uspikh Credit Kasa Finako Ukrfinzhitlo Atlani Ta Credit Plus

May 23, 2025

Finansoviy Reyting Ukrayini 2024 Uspikh Credit Kasa Finako Ukrfinzhitlo Atlani Ta Credit Plus

May 23, 2025 -

Ing Group Publishes 2024 Financial Results Form 20 F Filing

May 23, 2025

Ing Group Publishes 2024 Financial Results Form 20 F Filing

May 23, 2025 -

Credit Kasa Finako Ukrfinzhitlo Atlana Credit Plus Lideri Finansovogo Rinku Ukrayini 2024

May 23, 2025

Credit Kasa Finako Ukrfinzhitlo Atlana Credit Plus Lideri Finansovogo Rinku Ukrayini 2024

May 23, 2025 -

Eric Andre Regrets Turning Down A Real Pain Role

May 23, 2025

Eric Andre Regrets Turning Down A Real Pain Role

May 23, 2025