How Climate Change Impacts Your Ability To Buy A Home: A Credit Score Perspective

Table of Contents

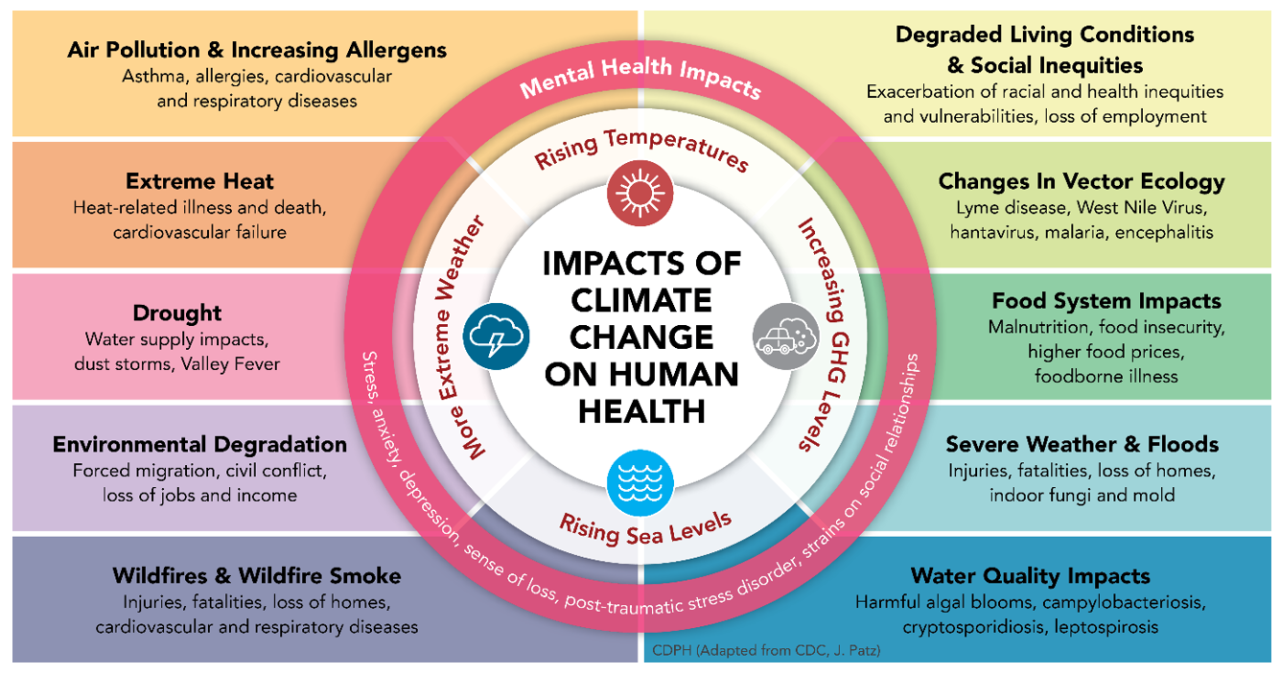

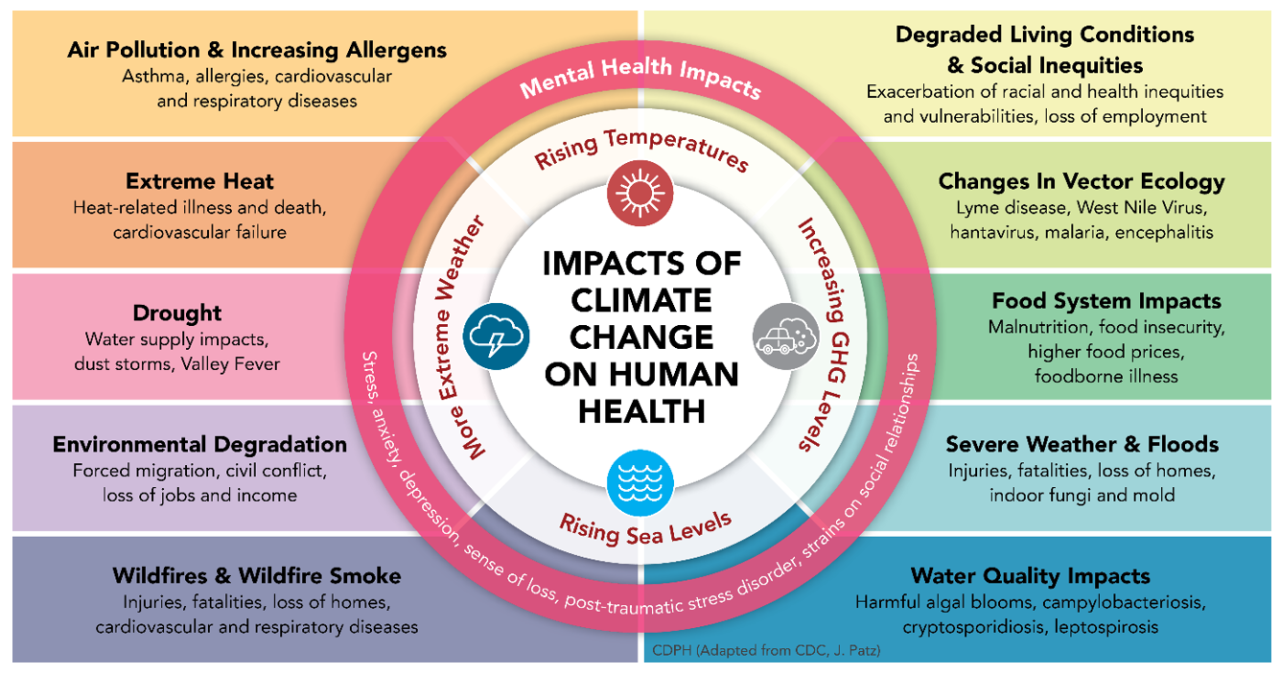

The frequency and intensity of extreme weather events are skyrocketing, with devastating consequences for homeowners and the housing market. A recent report shows that home insurance costs have risen by an average of 20% in high-risk areas over the last five years. This alarming trend directly impacts your ability to buy a home, specifically impacting your credit score and mortgage approval. This article will explore the critical connection between climate change, property values, insurance costs, and their subsequent effect on your credit score and home buying capabilities.

H2: Rising Home Insurance Premiums and Credit Scores

H3: The Link Between Climate Risk and Insurance Costs

Areas prone to floods, wildfires, or hurricanes are facing exponentially increasing insurance premiums. Insurers are basing their risk assessments on sophisticated climate models and historical weather data, accurately reflecting the increased probability of damage in these regions.

- Examples: Premiums in coastal areas of Florida have risen dramatically due to increased hurricane frequency. Similarly, areas in California prone to wildfires have seen significant premium increases.

- Detail: Insurers analyze factors like proximity to water bodies, wildfire risk index scores, and historical claims data to determine risk profiles and set premiums. This means homes in climate-vulnerable areas are automatically considered higher risk, regardless of individual homeowner practices.

H3: Impact on Credit Scores

The steep rise in insurance costs can create a ripple effect, significantly impacting your credit score. Many homeowners struggle to keep up with these inflated premiums, resulting in missed or delayed payments.

- Impact on Credit Reports: Late payments are reported to credit bureaus like Equifax, Experian, and TransUnion, negatively affecting your FICO score. Even a single late payment can lower your score, making it harder to secure a mortgage or other loans in the future.

- Detail: In extreme cases, insurers may cancel policies due to non-payment, leading to a further credit score hit. This can create a vicious cycle, making it increasingly difficult to secure affordable insurance, which in turn can further damage your credit rating.

H2: Decreasing Property Values in Climate-Vulnerable Areas

H3: Climate Change and Property Depreciation

Properties located in areas frequently impacted by extreme weather events are experiencing significant value depreciation. Repeated flooding, wildfires, or even extreme heat waves can cause structural damage, reduce property desirability, and lower market value.

- Examples: Coastal properties vulnerable to sea-level rise and storm surges are losing value. Similarly, homes in areas prone to wildfires are less attractive to buyers due to the significant risk of damage or destruction.

- Detail: The perception of risk plays a crucial role. Even if a property hasn't experienced direct damage, its location in a climate-vulnerable area can make it less desirable, driving down its market price.

H3: Impact on Mortgage Approval

Decreased property values directly affect your chances of getting a mortgage. Lenders assess risk based on the loan-to-value (LTV) ratio – the loan amount compared to the property's value.

- LTV Ratios: A lower property value means a higher LTV ratio, increasing the risk for lenders. Lenders are less likely to approve mortgages with high LTV ratios, requiring larger down payments or stricter credit requirements.

- Detail: In some cases, severely depreciated properties may make it impossible to secure a mortgage, effectively locking potential homebuyers out of the market.

H2: Increased Difficulty Securing a Mortgage in High-Risk Zones

H3: Lender Risk Assessment and Climate Data

Lenders are increasingly incorporating climate risk data into their assessment processes. They use sophisticated models to predict future climate risks and evaluate the long-term viability of properties in high-risk zones.

- Climate Risk Assessment Models: Many lenders utilize models that analyze factors like flood risk, wildfire probability, and sea-level rise projections.

- Detail: This means borrowers in high-risk areas face stricter lending criteria, higher interest rates, or even outright rejection of their mortgage applications.

H3: Strategies for Securing a Mortgage Despite Climate Risks

Homebuyers in high-risk zones can improve their chances of securing a mortgage by taking proactive steps.

- Home Resilience: Investing in home improvements that increase resilience to extreme weather events (e.g., flood-proofing, fire-resistant materials) can significantly reduce risk.

- Specialized Insurance: Securing specialized insurance policies that cover climate-related risks can demonstrate a commitment to risk mitigation to lenders.

- Transparency and Communication: Openly discussing climate risks with lenders and providing evidence of mitigation efforts can build trust and improve the chances of mortgage approval.

Conclusion:

Climate change is significantly impacting the ability to buy a home. Rising insurance premiums, decreasing property values, and stricter lending criteria all contribute to a more challenging home-buying environment, particularly affecting credit scores. Understanding how climate change impacts your ability to buy a home is crucial. Research climate risk in your target areas before starting your home search, and take proactive steps to protect your credit score and homeownership dreams. Investigate climate-related risk assessments and explore available mortgage options in your region to navigate these challenges effectively.

Featured Posts

-

Cultivating Resilience For Improved Mental Health And Wellbeing

May 20, 2025

Cultivating Resilience For Improved Mental Health And Wellbeing

May 20, 2025 -

Hmrcs New Side Hustle Tax Rules A Us Style Snooping Scheme

May 20, 2025

Hmrcs New Side Hustle Tax Rules A Us Style Snooping Scheme

May 20, 2025 -

Journees Parcours De Femmes A Biarritz Autour Du 8 Mars

May 20, 2025

Journees Parcours De Femmes A Biarritz Autour Du 8 Mars

May 20, 2025 -

Huuhkajat Saavat Vahvistusta Benjamin Kaellmanin Maalitykki Siivittaeae Menestystae

May 20, 2025

Huuhkajat Saavat Vahvistusta Benjamin Kaellmanin Maalitykki Siivittaeae Menestystae

May 20, 2025 -

Formula 1 Chinese Gp Hamilton And Leclercs Race Defining Contact

May 20, 2025

Formula 1 Chinese Gp Hamilton And Leclercs Race Defining Contact

May 20, 2025