How Climate Risk Affects Your Ability To Buy A Home

Table of Contents

Rising Insurance Premiums and Unaffordability

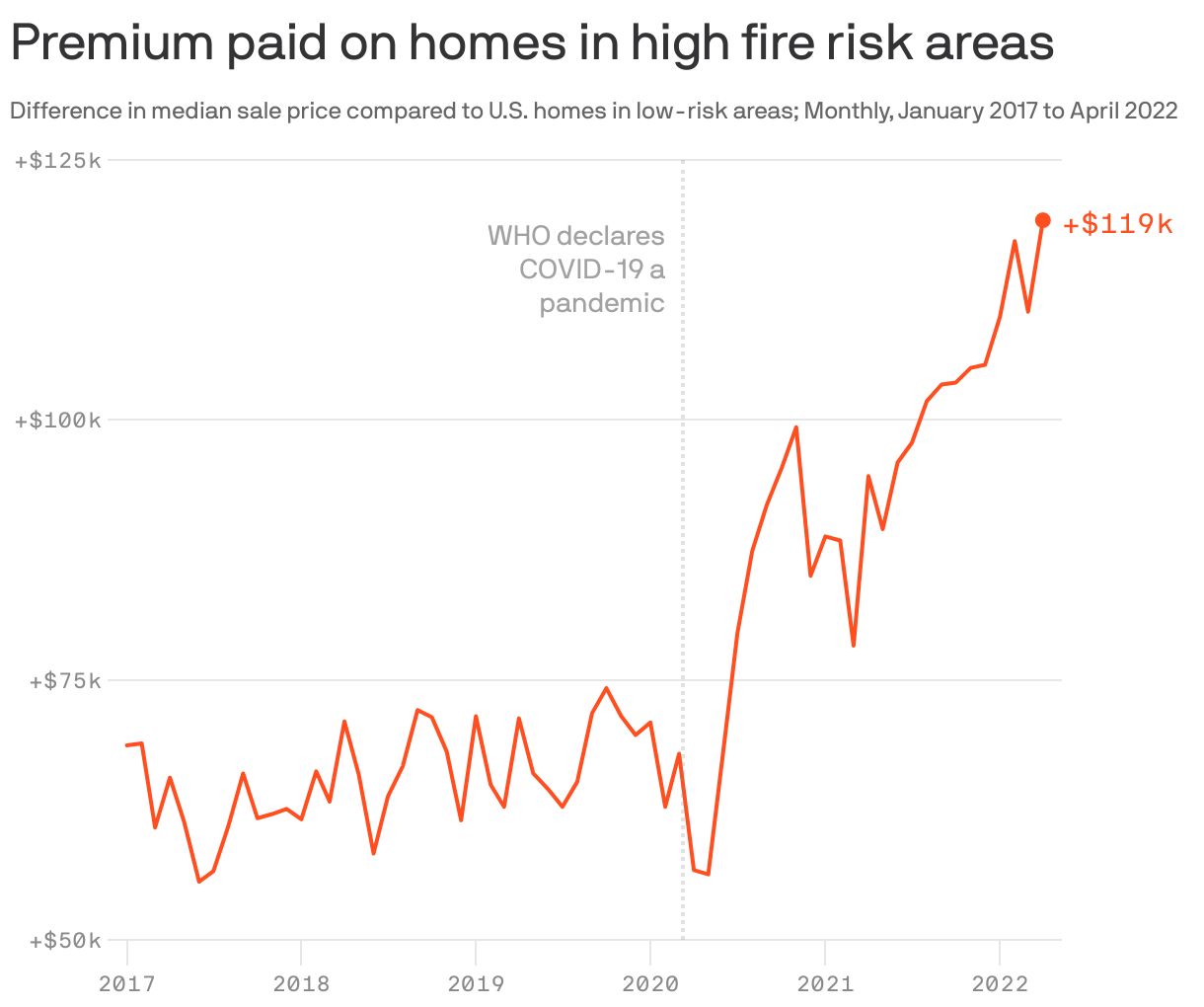

Climate change is intensifying extreme weather events, leading to a dramatic increase in insurance premiums for properties in high-risk areas. Floods, wildfires, and hurricanes are no longer rare occurrences in many regions, and insurance companies are factoring this increased risk into their pricing models. This translates directly to higher costs for homebuyers.

- Higher premiums make mortgages more expensive or unaffordable: The added cost of climate change insurance can significantly increase the overall cost of a mortgage, making homeownership unattainable for many. A seemingly affordable home can quickly become out of reach when factoring in exponentially rising flood insurance or wildfire risk premiums.

- Difficulty securing insurance altogether in high-risk zones: In some areas severely impacted by climate change, securing home insurance is becoming increasingly difficult, if not impossible. Lenders often require proof of insurance before approving a mortgage, leaving buyers in these high-risk zones with limited options.

- Impact on property value due to increased risk: The higher risk of damage from extreme weather events directly impacts property value. Properties in floodplains or fire-prone areas may see their value decrease, making it harder to resell or refinance in the future.

- Examples of specific locations experiencing these challenges: Coastal communities in Florida, California's wildfire-prone areas, and regions prone to severe flooding across the Midwest are already experiencing these challenges, with insurance premiums skyrocketing and availability dwindling. These trends are only expected to worsen in the coming years. Related keywords: Climate change insurance, flood insurance, wildfire risk, hurricane risk, mortgage affordability, home insurance costs.

Increased Property Damage and Repair Costs

The frequency and severity of climate-related damage are increasing, leading to substantial repair costs for homeowners. Flooding can cause extensive damage to foundations and interiors, while wildfires can destroy entire properties. Extreme heat can also lead to significant damage to infrastructure and appliances.

- Higher repair costs post-disaster can strain homebuyers' finances: The cost of repairing climate-related damage can be enormous, potentially exceeding the value of the property itself. Homeowners may face significant financial strain, especially those without adequate insurance coverage.

- Risk of properties becoming uninhabitable due to repeated damage: Repeated damage from climate-related events can render a property uninhabitable, leading to significant financial losses and displacement.

- Challenges in securing loans for properties with a history of climate-related damage: Lenders are increasingly hesitant to offer loans on properties with a documented history of climate-related damage, further limiting the options for potential homebuyers.

- Examples of climate-related damage and associated costs: The cost of repairing flood damage can range from thousands to hundreds of thousands of dollars, depending on the extent of the damage. Wildfire damage often requires complete rebuilding, incurring substantial expenses. Related keywords: Property damage, home repair costs, climate change damages, extreme weather events, disaster recovery.

Decreased Property Values in High-Risk Areas

Climate risk significantly impacts property values, reducing homebuyers' equity and investment potential. As the risks associated with climate change become clearer, the demand for properties in vulnerable areas decreases.

- Banks and lenders may be hesitant to offer loans in high-risk areas: Lenders assess risk before offering loans, and climate risk is now a major factor in their lending decisions. This makes it harder to secure financing for homes in high-risk zones.

- Reduced demand for properties in climate-vulnerable locations: Potential buyers are increasingly wary of purchasing properties in areas prone to flooding, wildfires, or other climate-related disasters, reducing demand and impacting property values.

- The long-term impact on property values due to climate change projections: Future climate change projections indicate an increase in extreme weather events, further depressing property values in at-risk areas. This long-term depreciation is a significant factor to consider.

- Examples of areas experiencing decreased property values due to climate risk: Areas previously considered desirable are now seeing declining property values due to increased climate risk. This is particularly true for coastal communities and regions prone to wildfires. Related keywords: Property value, real estate investment, climate risk assessment, market value, home appraisal, depreciation.

The Growing Importance of Climate Risk Disclosure

Transparency regarding climate risk is becoming increasingly crucial in real estate transactions. Buyers have a right to know about potential climate-related hazards associated with a property before making a purchase.

- Buyers' right to know about potential climate risks associated with a property: Full disclosure of climate-related risks is essential to informed decision-making.

- The role of real estate agents and sellers in disclosing this information: Real estate professionals have a responsibility to disclose known climate risks to potential buyers.

- Future regulations and legislation regarding climate risk disclosure: Increasingly stringent regulations are likely to mandate more comprehensive climate risk disclosures in the future.

- Resources for accessing climate risk data for specific properties: Several resources, including government agencies and private companies, provide climate risk data for specific properties and locations. Utilizing these tools is critical for informed home buying decisions. Related keywords: Climate risk disclosure, environmental due diligence, real estate transparency, climate risk reports, sustainable real estate.

Conclusion:

Climate risk significantly impacts the ability to buy a home, affecting insurance costs, increasing property damage and repair expenses, and depreciating property values in high-risk areas. Understanding these risks is crucial before making a significant investment. To mitigate climate risk in your home purchase, thoroughly research climate vulnerabilities in your target area before making an offer. Consult with a real estate agent specializing in climate risk and review available climate risk reports. By proactively addressing climate risk, you can make a more informed and secure home-buying decision, ensuring a safer and more sustainable future. Remember, understanding climate risk before buying a home is key to protecting your investment and securing your future.

Featured Posts

-

Patra Efimeries Giatron Gia To Savvatokyriako 12 And 13 Aprilioy

May 21, 2025

Patra Efimeries Giatron Gia To Savvatokyriako 12 And 13 Aprilioy

May 21, 2025 -

Bbc Antiques Roadshow Couples National Treasure Trafficking Conviction

May 21, 2025

Bbc Antiques Roadshow Couples National Treasure Trafficking Conviction

May 21, 2025 -

Improving Siri Apples Focus On Llm Technology

May 21, 2025

Improving Siri Apples Focus On Llm Technology

May 21, 2025 -

Ryanairs Growth Prospects Under Threat From Tariff Wars Buyback Plan Unveiled

May 21, 2025

Ryanairs Growth Prospects Under Threat From Tariff Wars Buyback Plan Unveiled

May 21, 2025 -

Qbts Stock Predicting The Earnings Report Impact

May 21, 2025

Qbts Stock Predicting The Earnings Report Impact

May 21, 2025