How Trump's Trade Policies And The Fed Are Affecting Bitcoin (BTC) Prices

Table of Contents

Trump's Trade Policies and their Ripple Effect on Bitcoin

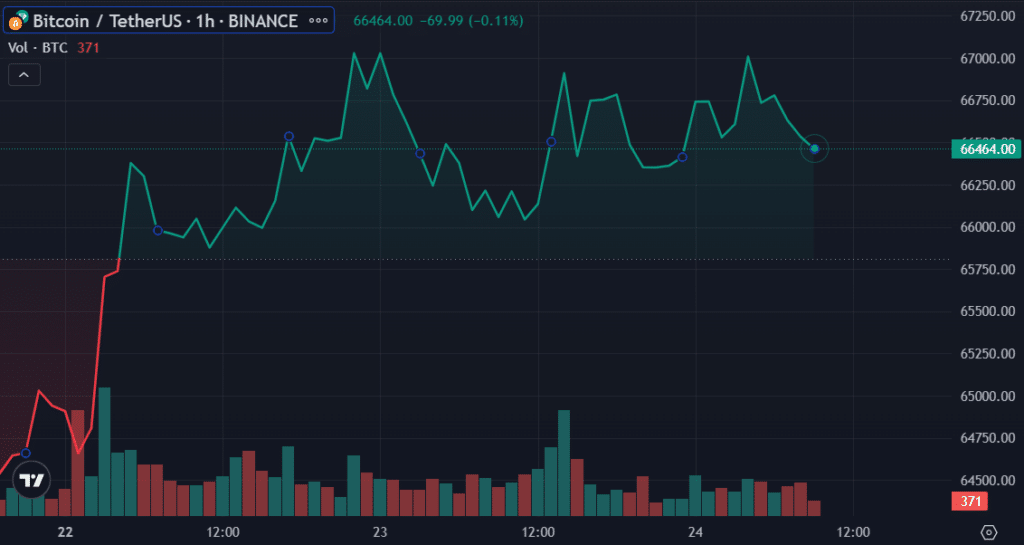

Trump's "America First" trade policies, characterized by tariffs and trade disputes, significantly impacted global markets and, consequently, Bitcoin.

Tariffs and Global Uncertainty

Trade wars create uncertainty, unsettling investors and prompting a search for alternative, less correlated assets. Bitcoin, often viewed as a decentralized and less susceptible to geopolitical turmoil, becomes an attractive option during such times. Tariffs also contribute to inflation. As the cost of imported goods increases, the purchasing power of fiat currencies diminishes, potentially increasing the appeal of Bitcoin as a hedge against inflation. For example, the imposition of tariffs on steel and aluminum in 2018 coincided with a period of increased Bitcoin price volatility, suggesting a correlation between trade tensions and investor behavior in the crypto market.

- Increased market volatility: Trade disputes introduce significant uncertainty into global markets, leading to increased volatility in traditional asset classes and cryptocurrencies alike.

- Safe haven potential: Bitcoin's decentralized nature and limited supply make it a potential safe haven asset during times of geopolitical and economic uncertainty fueled by trade wars.

- Impact on investor sentiment: Negative investor sentiment stemming from trade wars can spill over into other asset classes, including Bitcoin, leading to price corrections.

The Federal Reserve's Monetary Policy and its Influence on Bitcoin

The Federal Reserve's monetary policy, particularly interest rate adjustments and quantitative easing (QE) programs, significantly influences the US dollar and, by extension, other asset classes, including Bitcoin.

Interest Rate Hikes and Bitcoin's Price

When the Fed raises interest rates, it typically strengthens the US dollar. This can lead to a decline in the price of Bitcoin, as investors might shift their capital from riskier assets (like Bitcoin) to higher-yielding, more stable investments. The increased attractiveness of traditional assets like bonds and treasury bills during periods of rising interest rates reduces the demand for Bitcoin. Historically, periods of increased interest rates have shown a negative correlation with Bitcoin's price.

- Impact on USD value: Higher interest rates generally strengthen the US dollar, potentially impacting the price of dollar-denominated assets like Bitcoin.

- Traditional investments' attractiveness: Increased interest rates make traditional, low-risk investments more appealing, drawing funds away from riskier assets such as Bitcoin.

- Shift in investor sentiment: A shift towards less volatile assets during periods of rising interest rates leads to decreased demand and potential price drops for Bitcoin.

Quantitative Easing and Bitcoin's Growth

Conversely, quantitative easing (QE), a monetary policy tool where central banks inject liquidity into the market by purchasing assets, can lead to inflation and potentially boost Bitcoin's price. QE increases the money supply, potentially devaluing fiat currencies, making alternative stores of value like Bitcoin more attractive. Historically, periods of significant QE have often been followed by periods of Bitcoin price appreciation.

- Influence of money supply expansion: An increase in the money supply can lead to inflation, boosting the demand for alternative assets, like Bitcoin, as a hedge against inflation.

- Bitcoin as an inflation hedge: Bitcoin's limited supply makes it a potential hedge against inflation caused by expansionary monetary policies like QE.

- Historical analysis: Examining Bitcoin's performance during past periods of QE reveals a potential positive correlation between the two.

The Interplay Between Trump's Policies, the Fed, and Bitcoin's Price

The relationship between Trump's trade policies, the Fed's actions, and Bitcoin's price is complex and not always straightforward.

Synergistic Effects

In certain scenarios, the effects of Trump's trade policies and the Fed's monetary policy can be synergistic, amplifying Bitcoin's price volatility. For instance, trade wars causing uncertainty combined with rising interest rates could create a perfect storm, leading to significant price drops.

Divergent Effects

In other instances, these factors may have opposing effects. For example, trade-war-induced inflation might drive up Bitcoin's price, while simultaneously, rising interest rates could pull investment away from it, creating a countervailing force.

Predicting Future Trends

Predicting Bitcoin's price based solely on macroeconomic factors like Trump's economic legacy and the Fed's policy is challenging. While correlation can be observed, establishing direct causation is difficult due to the interplay of numerous other variables influencing the cryptocurrency market. However, continuous monitoring of these macroeconomic factors is crucial for understanding potential future price movements.

Conclusion: Navigating the Uncertainties: Bitcoin in the Era of Trump's Legacy and Shifting Monetary Policy

Trump's trade policies and the Fed's monetary decisions have demonstrably impacted Bitcoin's price volatility. The relationship is complex and unpredictable, influenced by a multitude of intertwined factors. Understanding the potential influence of these macroeconomic forces is crucial for navigating the volatile world of Bitcoin investment. Therefore, stay informed about both the ongoing effects of Trump's economic legacy and the Fed's future policy decisions to make more informed investment decisions in Bitcoin (BTC). Further research into the specific correlations and causal links between these macroeconomic variables and Bitcoin’s price is encouraged.

Featured Posts

-

Liam Collapses After Bill Showdown The Bold And The Beautiful April 3 Recap

Apr 24, 2025

Liam Collapses After Bill Showdown The Bold And The Beautiful April 3 Recap

Apr 24, 2025 -

Trump Denies Plans To Remove Fed Chair Jerome Powell

Apr 24, 2025

Trump Denies Plans To Remove Fed Chair Jerome Powell

Apr 24, 2025 -

Tesla Earnings Plunge Political Backlash Impacts Q1 Results

Apr 24, 2025

Tesla Earnings Plunge Political Backlash Impacts Q1 Results

Apr 24, 2025 -

Bold And The Beautiful Recap April 3rd Liams Health Crisis And Hopes Move

Apr 24, 2025

Bold And The Beautiful Recap April 3rd Liams Health Crisis And Hopes Move

Apr 24, 2025 -

The Bold And The Beautiful Wednesday April 16 Recap Liams Behavior And Bridgets Discovery

Apr 24, 2025

The Bold And The Beautiful Wednesday April 16 Recap Liams Behavior And Bridgets Discovery

Apr 24, 2025

Latest Posts

-

Bubble Blasters And Beyond Analyzing The Effects Of Trade Chaos On Chinese Imports

May 10, 2025

Bubble Blasters And Beyond Analyzing The Effects Of Trade Chaos On Chinese Imports

May 10, 2025 -

Did The Fentanyl Crisis Open Doors For Us China Trade Talks

May 10, 2025

Did The Fentanyl Crisis Open Doors For Us China Trade Talks

May 10, 2025 -

Les Miserables Cast May Boycott Trumps Kennedy Center Appearance

May 10, 2025

Les Miserables Cast May Boycott Trumps Kennedy Center Appearance

May 10, 2025 -

Fentanyl Crisis A Catalyst For Us China Trade Negotiations

May 10, 2025

Fentanyl Crisis A Catalyst For Us China Trade Negotiations

May 10, 2025 -

Incredibly Dangerous Months Of Warnings Before Newark Atc System Failure

May 10, 2025

Incredibly Dangerous Months Of Warnings Before Newark Atc System Failure

May 10, 2025