Tesla Earnings Plunge: Political Backlash Impacts Q1 Results

Table of Contents

Reduced Sales & Demand – A Key Factor in the Tesla Earnings Plunge

The decline in Tesla's Q1 earnings can be largely attributed to reduced sales and softening demand. Several factors contributed to this decrease, impacting the overall financial performance and leading to the significant "Tesla earnings plunge."

Impact of Price Wars and Competition

The EV market is becoming increasingly competitive. Established automakers and new EV entrants are aggressively vying for market share, triggering price wars that have squeezed Tesla's profit margins.

- Increased pressure from established automakers and new EV entrants: Companies like Ford, GM, and numerous Chinese manufacturers are rapidly expanding their EV offerings, directly competing with Tesla's model lineup.

- Reduced average selling prices impacting overall revenue: Tesla's strategy of aggressive price cuts, while boosting sales volume to some extent, significantly reduced the average selling price per vehicle, impacting overall revenue generation.

- Lower-than-expected demand for some Tesla models: Despite price reductions, demand for certain Tesla models fell short of projections, indicating a shift in consumer preferences or a saturation in specific market segments.

- Analysis of competitor strategies and their impact on Tesla sales: Competitors are not only offering comparable EVs but also leveraging superior supply chain management and marketing strategies, further eroding Tesla's market dominance.

Geopolitical Instability and Supply Chain Disruptions

Global uncertainties and persistent supply chain disruptions added another layer of complexity, impacting both production and sales.

- Impact of raw material price fluctuations: Volatility in the prices of key raw materials like lithium and nickel significantly increased production costs, affecting Tesla's profitability.

- Challenges related to logistics and transportation: Global shipping delays and disruptions impacted timely delivery of vehicles and components, leading to production bottlenecks and lost sales opportunities.

- Effects of geopolitical tensions on manufacturing and distribution: Geopolitical instability in various regions directly affected Tesla's manufacturing and distribution networks, creating operational challenges and hindering sales growth.

- Discussion of Tesla's strategies to mitigate supply chain risks: While Tesla has implemented measures to diversify its supply chains and improve its logistics, the ongoing global uncertainties continue to pose a substantial challenge.

Political Backlash and Regulatory Hurdles Exacerbating the Tesla Earnings Plunge

Beyond market forces, a growing political backlash and regulatory hurdles played a significant role in the "Tesla earnings plunge."

Government Regulations and Subsidies

Changes in government policies regarding EV subsidies and regulations have had a notable impact on Tesla's market position in several key regions.

- Analysis of specific policy changes in different countries: Variations in government incentives and stricter emission regulations in various markets have created uneven playing fields, impacting Tesla's sales and profitability.

- Impact of changes in tax incentives and other government support: Reductions or eliminations of tax credits and other government support programs for EVs in some countries have decreased the affordability and attractiveness of Tesla vehicles.

- Tesla's lobbying efforts and responses to regulatory changes: Tesla has actively engaged in lobbying efforts to influence government policies, but the evolving regulatory landscape continues to present considerable challenges.

Negative Publicity and Public Perception

Negative press coverage and growing public concerns surrounding Tesla's practices also contributed to the decline in consumer confidence.

- Analysis of recent controversies and their impact on brand image: Recent controversies surrounding Tesla's autopilot system, safety concerns, and labor practices have negatively affected the company's brand image and customer perception.

- Examination of social media sentiment towards Tesla: Social media sentiment analysis reveals a decline in positive sentiment towards the brand, indicating a growing erosion of public trust.

- The role of media coverage in shaping public opinion: Negative media coverage played a crucial role in shaping public perception and contributed to the decline in consumer confidence.

- Strategies for improving public relations and brand image: Tesla needs to implement effective public relations strategies to address negative publicity, rebuild consumer trust, and improve its overall brand image.

Financial Implications and Future Outlook for Tesla Earnings

The "Tesla earnings plunge" has significant financial implications, requiring a comprehensive analysis of Q1 performance and a careful examination of future strategies.

Q1 Financial Results Breakdown

Tesla's Q1 2024 financial performance showed a significant decline in profitability compared to previous quarters and the same period last year.

- Comparison with previous quarters and year-over-year performance: A detailed comparison highlights the magnitude of the decline in revenue, profit margins, and other key financial metrics.

- Analysis of key financial ratios and indicators: An in-depth analysis of key financial ratios such as gross margin, operating margin, and return on equity provides a comprehensive picture of Tesla's financial health.

- Predictions for future earnings based on current trends: Based on current trends and market analysis, projections for future earnings can be made, considering the ongoing challenges and Tesla's strategies for recovery.

Tesla's Strategies for Recovery and Growth

Tesla is implementing various strategies to address the challenges and return to profitability.

- Cost-cutting measures and efficiency improvements: Tesla is streamlining its operations, reducing costs, and improving efficiency across its manufacturing and supply chains.

- New product development and market expansion plans: Tesla is actively developing new EV models and expanding its market presence into new geographical regions to boost sales.

- Focus on improving production capacity and optimizing supply chains: Tesla is investing in enhancing its production capacity and optimizing its supply chains to mitigate supply chain risks and ensure timely delivery of vehicles.

- Long-term vision and future growth potential: Despite the current challenges, Tesla maintains a long-term vision for growth and expansion in the global EV market.

Conclusion

Tesla's Q1 2024 earnings report highlights a significant "Tesla earnings plunge," driven by reduced demand, intensified competition, and a growing political backlash. While the challenges are substantial, Tesla's innovative spirit and adaptability suggest a potential for recovery. However, successfully navigating these headwinds requires proactive strategies to mitigate risks, address public concerns, and adapt to the ever-changing regulatory landscape. Staying informed about the unfolding situation and carefully analyzing future "Tesla earnings" reports is crucial for investors and industry stakeholders. Understanding the intricacies of this downturn is key to anticipating future performance and making informed decisions about Tesla's stock and the broader electric vehicle market.

Featured Posts

-

Bold And The Beautiful Spoilers February 20 Steffy Liam And Poppys Impact On Finn

Apr 24, 2025

Bold And The Beautiful Spoilers February 20 Steffy Liam And Poppys Impact On Finn

Apr 24, 2025 -

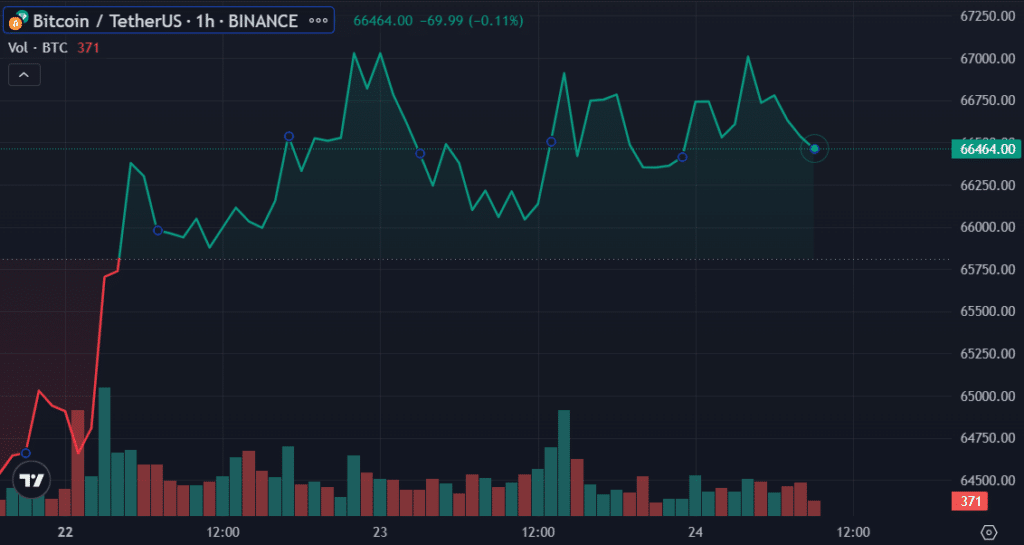

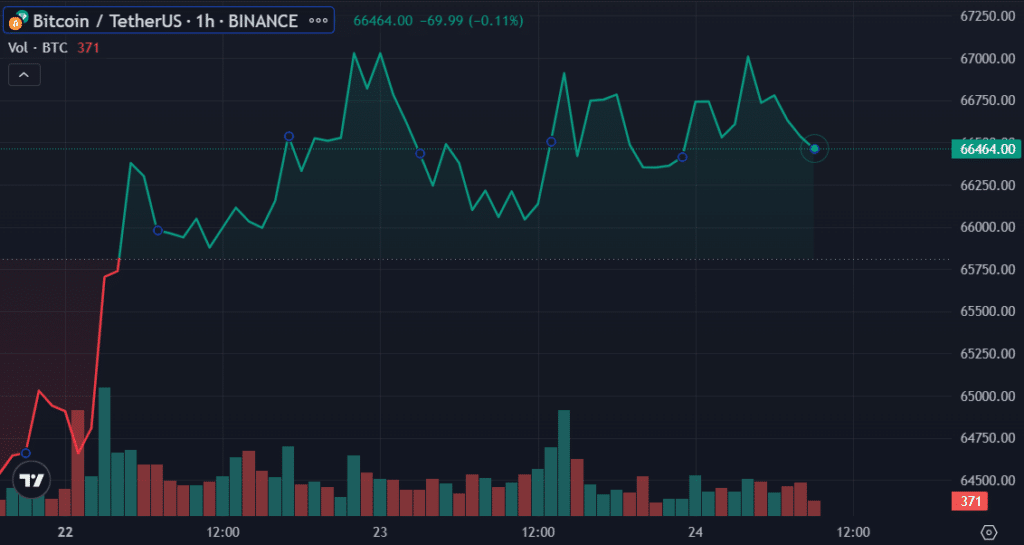

Cantors 3 Billion Crypto Spac Deal Tether And Soft Bank Involvement

Apr 24, 2025

Cantors 3 Billion Crypto Spac Deal Tether And Soft Bank Involvement

Apr 24, 2025 -

Open Ai And Chat Gpt The Ftc Investigation And Future Of Ai Regulation

Apr 24, 2025

Open Ai And Chat Gpt The Ftc Investigation And Future Of Ai Regulation

Apr 24, 2025 -

John Travoltas Daughter Ella Bleu Unveils A Dazzling Makeover

Apr 24, 2025

John Travoltas Daughter Ella Bleu Unveils A Dazzling Makeover

Apr 24, 2025 -

I Sygkinisi Toy Tzon Travolta Gia Ton Thanato Toy Tzin Xakman

Apr 24, 2025

I Sygkinisi Toy Tzon Travolta Gia Ton Thanato Toy Tzin Xakman

Apr 24, 2025

Latest Posts

-

2025 Hurun Report Elon Musk Still Richest Despite Massive Net Worth Decline

May 10, 2025

2025 Hurun Report Elon Musk Still Richest Despite Massive Net Worth Decline

May 10, 2025 -

Hurun Global Rich List 2025 Elon Musks 100 Billion Loss And Continued Reign

May 10, 2025

Hurun Global Rich List 2025 Elon Musks 100 Billion Loss And Continued Reign

May 10, 2025 -

Fluctuations In Elon Musks Net Worth A Us Economic Perspective

May 10, 2025

Fluctuations In Elon Musks Net Worth A Us Economic Perspective

May 10, 2025 -

Hurun Global Rich List 2025 Elon Musks Net Worth Drops By Over 100 Billion But Remains Top Spot

May 10, 2025

Hurun Global Rich List 2025 Elon Musks Net Worth Drops By Over 100 Billion But Remains Top Spot

May 10, 2025 -

Analyzing Elon Musks Net Worth The Role Of The Us Economy

May 10, 2025

Analyzing Elon Musks Net Worth The Role Of The Us Economy

May 10, 2025