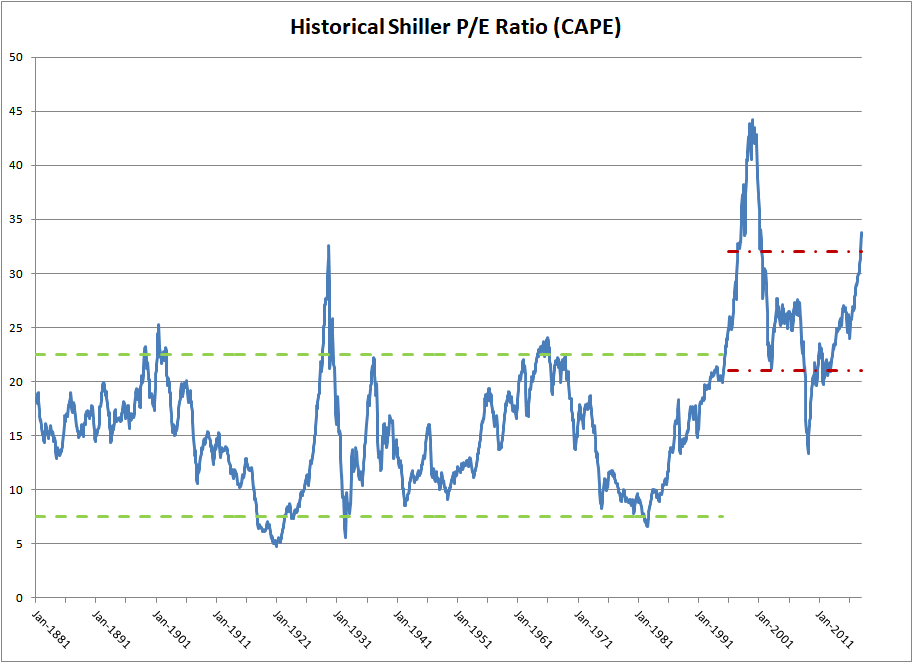

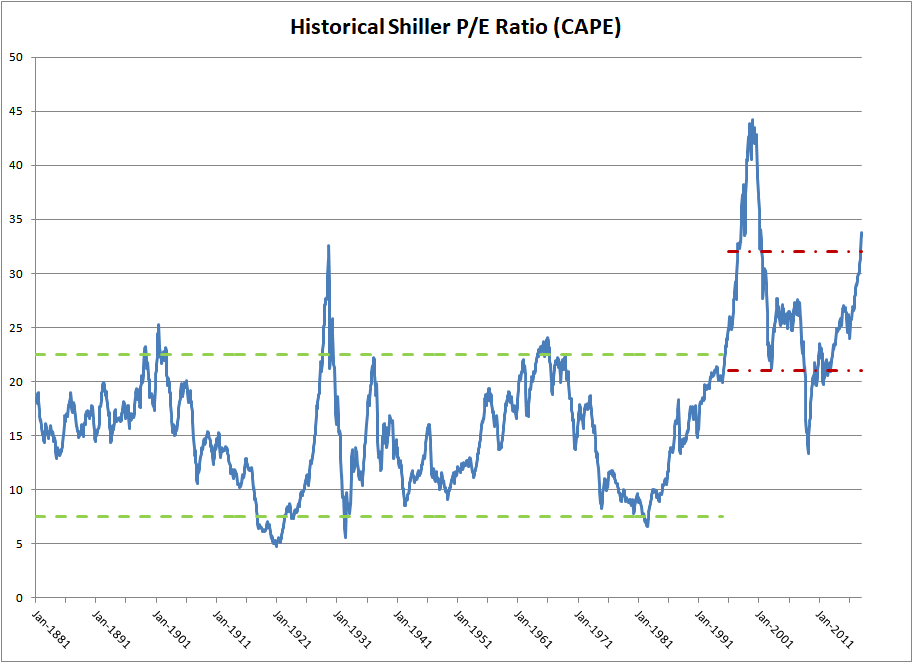

Ignoring High Stock Market Valuations: BofA's Rationale

Table of Contents

BofA's Justification for a Bullish Outlook Despite High Valuations

BofA's bullish outlook, despite acknowledging high stock market valuations, rests on several key pillars. Their analysis suggests that current valuations, while high, are not necessarily unsustainable, considering several powerful economic tailwinds.

-

Robust Corporate Earnings Growth Projections: BofA projects robust corporate earnings growth for the coming years. This anticipated growth, driven by factors such as technological innovation and sustained consumer demand, is expected to justify current market prices and potentially drive further expansion. The projected earnings growth significantly outweighs the current market valuation concerns in their assessment.

-

Continued Low Interest Rates (or Projected Changes): Low interest rates, or even strategically managed interest rate adjustments, continue to stimulate investment. These low borrowing costs encourage companies to expand operations and invest in future growth, contributing to higher earnings and potentially justifying the elevated market valuations. BofA's analysis likely includes models that account for the potential impacts of interest rate changes.

-

Strong Consumer Spending Fueling Economic Growth: Strong consumer spending underpins the positive economic outlook. This sustained consumer confidence and spending power provide a solid foundation for corporate profitability and further market expansion. This key indicator is a major factor in BofA's positive projection of future earnings.

-

Strategic Allocation Towards Specific Sectors Showing High Growth Potential: BofA’s investment strategy doesn't involve a blanket bullish approach. They are likely strategically allocating capital towards specific sectors demonstrating high growth potential, such as technology and renewable energy, mitigating the risks associated with high overall market valuations.

-

Emphasis on Long-Term Investment Strategies Over Short-Term Market Fluctuations: BofA likely emphasizes the importance of long-term investment strategies that are less susceptible to short-term market volatility. This approach allows investors to ride out market corrections and benefit from long-term growth trends.

Analyzing the Risks Associated with High Valuations

While BofA maintains a bullish stance, they are not ignoring the risks associated with high stock market valuations. A balanced perspective requires acknowledging the potential downsides.

-

Possibility of Market Corrections Due to Overvaluation: High valuations inherently increase the probability of market corrections. A significant downturn, triggered by negative economic news or unexpected events, could lead to substantial losses.

-

Increased Susceptibility to Negative Economic News: Markets operating at high valuations are typically more sensitive to negative economic news. Any unexpected downturn or shift in economic conditions could trigger a sharper market reaction than would be seen in a more moderately valued market.

-

Higher Risk of Capital Loss in a Downturn: Investors should be prepared for the increased risk of capital loss if a market correction occurs. Understanding this risk and having a plan to manage it is crucial.

-

Importance of Diversification to Mitigate Risk: Diversification remains crucial in a high-valuation market. Spreading investments across different asset classes and sectors can help reduce the impact of potential losses in any single area.

-

The Need for a Robust Risk Management Strategy: A comprehensive risk management strategy is critical. This involves carefully assessing your risk tolerance, diversifying your portfolio, and having a plan for managing potential losses.

BofA's Investment Strategy and Recommendations

Navigating the current market requires a thoughtful investment strategy. BofA likely recommends a multi-faceted approach:

-

Specific Sectors BofA Recommends Investing In (with Reasoning): BofA's recommendations will likely favor sectors projected to exhibit strong growth despite market-wide valuations. Specific examples might include tech companies leading in AI, sustainable energy businesses, and companies positioned to benefit from long-term demographic trends.

-

Strategies for Mitigating Risk in a High-Valuation Market (e.g., Diversification, Value Investing): Diversification across sectors and asset classes is paramount. Value investing strategies, focusing on undervalued companies, can also be a prudent approach in this market.

-

Importance of a Long-Term Investment Horizon: Maintaining a long-term perspective is essential to weather short-term market fluctuations and benefit from long-term growth.

-

Advice on Adjusting Investment Portfolios Based on Risk Tolerance: BofA likely emphasizes adjusting investment portfolios according to individual risk tolerance levels. Conservative investors might choose lower-risk investments, while those with higher risk tolerance could allocate more towards growth-oriented assets.

-

Potential Benefits of Dollar-Cost Averaging: Dollar-cost averaging, a strategy of investing a fixed amount at regular intervals, can help mitigate the risk of investing a large sum at a market peak.

Understanding BofA's Economic Outlook

BofA's investment strategy is intrinsically linked to their economic outlook. Their predictions for key economic indicators play a crucial role in shaping their valuation assessments.

-

BofA's Inflation Predictions and Their Impact on the Market: BofA's inflation forecasts will influence their view on interest rates and the overall market environment. High inflation could lead to increased interest rates, potentially impacting stock valuations.

-

BofA's Unemployment Rate Forecasts and Their Relevance: Unemployment rates are a key indicator of economic health. Low unemployment generally suggests strong economic growth and supports higher stock valuations, whereas high unemployment signals potential economic slowdowns.

-

How These Economic Factors Influence Their Assessment of Stock Market Valuations: By considering these intertwined economic factors – inflation, unemployment, and interest rates – BofA assesses whether current stock market valuations are justified in light of future economic expectations.

Conclusion

Bank of America's bullish outlook, despite acknowledging high stock market valuations, is based on projections of robust corporate earnings growth, the influence of low (or strategically managed) interest rates, and strong consumer spending. While acknowledging the inherent risks associated with high valuations – including the potential for market corrections and increased susceptibility to negative news – BofA's strategy emphasizes long-term investment horizons and strategic sector allocation. They likely advocate for diversification and a robust risk management plan tailored to individual investor profiles. Before making any investment decisions, conduct thorough research and consult with a qualified financial advisor. Exploring BofA's detailed economic forecasts and investment strategies can provide valuable insights into navigating the complexities of high stock market valuations. Remember, carefully considering high stock market valuations is crucial before investing.

Featured Posts

-

Everything We Know About Andor Season 2 Release Date Trailer And More

May 08, 2025

Everything We Know About Andor Season 2 Release Date Trailer And More

May 08, 2025 -

Breaking Bread With Scholars Building Relationships And Advancing Your Research

May 08, 2025

Breaking Bread With Scholars Building Relationships And Advancing Your Research

May 08, 2025 -

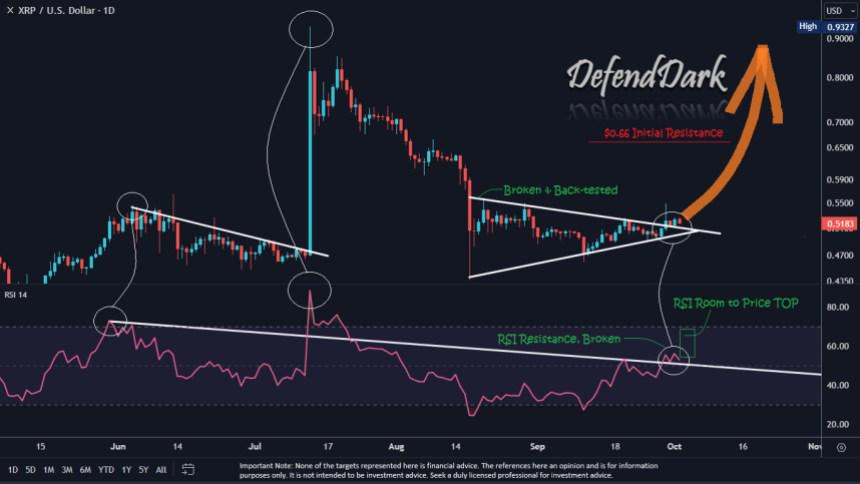

Is Xrps Recovery In Jeopardy Derivatives Market Hints At Challenges

May 08, 2025

Is Xrps Recovery In Jeopardy Derivatives Market Hints At Challenges

May 08, 2025 -

Jayson Tatums Bone Bruise Game 2 Status Update

May 08, 2025

Jayson Tatums Bone Bruise Game 2 Status Update

May 08, 2025 -

Vatican Finances Pope Francis Struggle For Reform And Transparency

May 08, 2025

Vatican Finances Pope Francis Struggle For Reform And Transparency

May 08, 2025