Import Duties USA: Impact On Clothing Prices

Table of Contents

How Import Duties are Calculated on Clothing Imports

Understanding how import duties are calculated is key to understanding the final cost of clothing. The process involves several steps, primarily relying on the Harmonized Tariff System (HTS). This standardized system uses specific codes to classify different types of goods, including clothing. Each HTS code is associated with a specific tariff rate, determining the amount of duty payable. These rates are expressed as either ad valorem duties (a percentage of the goods' value) or specific duties (a fixed amount per unit).

- Ad Valorem Duties: These are calculated as a percentage of the imported clothing's declared value. For example, a 15% ad valorem duty on a $50 shirt would add $7.50 to the import cost.

- Specific Duties: These are a fixed amount per unit of clothing, regardless of its value. This might be a certain amount per kilogram or per dozen items.

- Additional Fees: Beyond the basic tariff rates, additional fees like anti-dumping duties (to counter unfairly low pricing) or countervailing duties (to offset government subsidies in the exporting country) can further increase the US import duties.

- Finding HTS Codes: To determine the precise tariff rate for a specific clothing item, you need to find its corresponding HTS code. You can access the official HTS code database through the U.S. International Trade Commission website: [link to official HTS database]. This is crucial for accurate import duty calculation.

The Impact of Tariffs on Clothing Retail Prices

Increased import tariffs directly translate to higher prices for consumers. When US import duties rise, importers pass these added costs onto retailers, ultimately resulting in increased retail clothing prices. This price inflation affects consumers' purchasing power and affordability. The magnitude of the price increase depends on several factors, including the size of the tariff increase and the elasticity of demand for the specific clothing item.

- Examples: A tariff increase on cotton T-shirts from a specific country might lead to a $2-$5 price increase per shirt at the retail level, depending on the tariff rate and other factors. Similarly, higher duties on luxury imported silk dresses could lead to significantly higher price increases.

- Consumer Behavior: Facing higher clothing retail prices, consumers might respond by reducing their overall clothing spending, buying fewer items, opting for cheaper alternatives, or switching to domestically produced brands. The impact is more significant for low-income households, impacting clothing affordability.

- Inflationary Pressures: Widespread tariff increases across various clothing categories can contribute to broader inflationary pressures within the economy, affecting overall consumer spending.

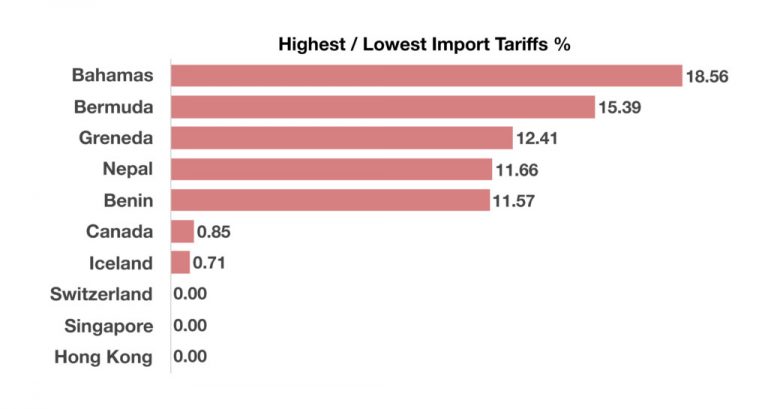

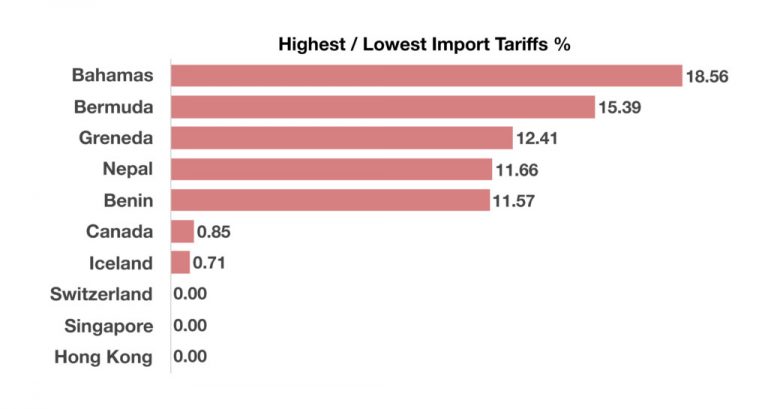

The Role of Country of Origin in Determining Import Duties

The country of origin of imported clothing significantly impacts the applicable import duties USA. Trade agreements between the USA and other countries determine preferential tariff treatment. For example, the United States-Mexico-Canada Agreement (USMCA), the successor to NAFTA, allows for duty-free or reduced-duty imports of certain clothing items from Mexico and Canada, compared to imports from countries without such agreements.

- Preferential Tariff Treatment: Trade agreements like the USMCA reduce or eliminate tariffs on certain products, impacting clothing import costs. This encourages trade between participating countries.

- Examples: Clothing imported from countries with preferential trade relationships with the USA will typically face lower customs duties than those imported from countries without such agreements.

- Trade Wars and Their Impact: Trade wars or disputes between countries can lead to significant increases in import duties, sometimes including punitive tariffs. These can disrupt supply chains and drastically impact the price of imported clothing.

Navigating Import Duties: Strategies for Businesses

Businesses involved in importing clothing need strategies to effectively manage and mitigate the costs associated with US import duties. Understanding import compliance is crucial to avoid penalties and delays.

- Customs Brokers: Utilizing experienced customs brokers can significantly simplify the import process. Brokers can handle paperwork, ensure compliance with regulations, and help minimize duty costs.

- Sourcing Strategies: Optimizing sourcing strategies, including exploring alternative suppliers in countries with preferential trade agreements, can help reduce clothing import costs.

- Duty Drawback Programs: Businesses can explore duty drawback programs offered by the US government. These programs allow for the refund of duties paid on imported goods that are subsequently exported or used in the manufacture of exported goods. This could provide a significant duty mitigation strategy.

- Supply Chain Management: Efficient supply chain management is essential for minimizing delays and related costs. A well-managed supply chain can help anticipate and adjust to changes in tariff policies.

Conclusion

This article highlighted the significant impact of import duties USA on clothing prices, illustrating how tariff calculations, country of origin, and trade agreements influence the final cost consumers pay. We explored the complexities of the Harmonized Tariff System and discussed strategies for businesses to navigate these challenges. Understanding the implications of import tariffs and their effect on the cost of goods is crucial for both businesses and consumers.

Call to Action: Understanding Import Duties USA is crucial for both consumers and businesses. Stay informed about changes in tariff rates and explore available resources to navigate the complexities of importing clothing. Learn more about how to effectively manage US import duties and their effects on clothing prices.

Featured Posts

-

Dreyfus Case A Modern Examination Of Justice And Military Honor In France

May 24, 2025

Dreyfus Case A Modern Examination Of Justice And Military Honor In France

May 24, 2025 -

Pomnite Li Konchita Vurst Transformatsiyata Na Bradatata Pobeditelka Ot Evroviziya

May 24, 2025

Pomnite Li Konchita Vurst Transformatsiyata Na Bradatata Pobeditelka Ot Evroviziya

May 24, 2025 -

Atfaq Washntn Wbkyn Aljmrky Ydfe Mwshr Daks Laela Artfae Ila 24 Alf Nqtt

May 24, 2025

Atfaq Washntn Wbkyn Aljmrky Ydfe Mwshr Daks Laela Artfae Ila 24 Alf Nqtt

May 24, 2025 -

Joy Crookes Releases New Single Carmen

May 24, 2025

Joy Crookes Releases New Single Carmen

May 24, 2025 -

Trud I Istoriya Lyubvi Ili Ilicha Podrobnosti Iz Gazetnykh Publikatsiy

May 24, 2025

Trud I Istoriya Lyubvi Ili Ilicha Podrobnosti Iz Gazetnykh Publikatsiy

May 24, 2025

Latest Posts

-

The Pilbara Debate Rio Tintos Response To Environmental Concerns Raised By Forrest

May 24, 2025

The Pilbara Debate Rio Tintos Response To Environmental Concerns Raised By Forrest

May 24, 2025 -

Sses 3 Billion Spending Cut Reasons And Implications For The Future

May 24, 2025

Sses 3 Billion Spending Cut Reasons And Implications For The Future

May 24, 2025 -

Rio Tinto And Andrew Forrest Clash Over Pilbaras Environmental Future

May 24, 2025

Rio Tinto And Andrew Forrest Clash Over Pilbaras Environmental Future

May 24, 2025 -

Rio Tinto Responds To Forrests Pilbara Concerns Addressing Environmental Impacts

May 24, 2025

Rio Tinto Responds To Forrests Pilbara Concerns Addressing Environmental Impacts

May 24, 2025 -

Post Fire Price Gouging The La Rental Market Under Scrutiny

May 24, 2025

Post Fire Price Gouging The La Rental Market Under Scrutiny

May 24, 2025