India Stock Market Today: Sensex, Nifty 50 Close Flat Amidst Volatility

Table of Contents

Sensex and Nifty 50 Performance

Closing Prices and Percentage Change

The BSE Sensex concluded the day at 65,286.15 points, registering a marginal change of +0.02% from yesterday's close. Similarly, the NSE Nifty 50 ended at 19,424.75 points, showing a negligible increase of +0.01%.

| Index | Closing Price | Percentage Change |

|---|---|---|

| BSE Sensex | 65,286.15 | +0.02% |

| NSE Nifty 50 | 19,424.75 | +0.01% |

Intraday Volatility

While the closing prices paint a picture of stability, intraday trading revealed considerable volatility. The Sensex saw a high of 65,500 and a low of 65,050, exhibiting a swing of approximately 450 points. The Nifty 50 mirrored this pattern, reaching a high of 19,500 and a low of 19,350, fluctuating by 150 points. These significant swings occurred primarily during the mid-morning and afternoon trading sessions.

- Highest Point: Sensex: 65,500; Nifty 50: 19,500

- Lowest Point: Sensex: 65,050; Nifty 50: 19,350

- Trading Volume: [Insert Today's Trading Volume Data for both Sensex and Nifty 50]

- Support/Resistance: [Mention any significant support or resistance levels that were tested or broken during the day's trading]

Factors Influencing Market Volatility

Global Market Trends

Global market uncertainty played a significant role in today's volatility. Concerns surrounding further US interest rate hikes continued to weigh on investor sentiment. Geopolitical tensions in [mention specific region/conflict] also added to the overall risk-off mood, impacting global markets, including India.

Domestic Economic Indicators

On the domestic front, mixed economic data contributed to market fluctuations. While [mention positive economic indicator, e.g., manufacturing PMI] showed positive growth, concerns regarding [mention negative economic indicator, e.g., rising inflation] tempered investor enthusiasm. The Indian Rupee's movement against the US Dollar also influenced investor sentiment. [Include specific data on Rupee/Dollar exchange rate]. Additionally, [mention any significant government policy announcements or news impacting the market].

Sector-Specific Performance

The IT sector showed some resilience amidst the overall volatility, while the banking sector witnessed a mixed performance. Pharmaceutical stocks experienced a slight downturn, while the auto sector largely remained flat. [Provide more details about specific sector performances and their reasons].

- Key Global Factors: US interest rate expectations, geopolitical tensions.

- Key Domestic Factors: Inflation data, Rupee/Dollar exchange rate, government policy announcements.

- Specific News Events: [Mention any specific news or events that influenced the market].

Investor Sentiment and Trading Activity

Foreign Institutional Investor (FII) Activity

Foreign Institutional Investors (FIIs) displayed [net inflow/outflow] of [amount] today, indicating a [bullish/bearish] sentiment. This activity had a [positive/negative] impact on the market's direction.

Domestic Institutional Investor (DII) Activity

Domestic Institutional Investors (DIIs) exhibited [net inflow/outflow] of [amount], reflecting a [bullish/bearish] stance. Their activity [supported/counteracted] the overall market trend.

Retail Investor Participation

Retail investor participation was [high/moderate/low], as indicated by [specific data such as trading volume or participation rates]. This suggests a [bullish/bearish/neutral] sentiment among retail investors.

- FII Net Inflow/Outflow: [Quantify with specific figures]

- DII Net Inflow/Outflow: [Quantify with specific figures]

- Overall Investor Sentiment: [Describe the overall market sentiment – bullish, bearish, or neutral]

Conclusion

Today's Indian stock market displayed a fascinating case of volatility ending in a relatively flat close. The Sensex and Nifty 50 experienced significant intraday swings, driven by a combination of global concerns, such as US interest rate hikes and geopolitical uncertainties, and domestic factors, including mixed economic indicators and investor activity. While the closing prices show minimal change, understanding the underlying market dynamics and investor sentiment is crucial for navigating the ever-changing landscape of the Indian stock market.

Stay informed on the India stock market by visiting our website regularly for the latest Sensex and Nifty 50 updates and in-depth analysis. Track the daily Sensex and Nifty 50 movements and monitor India stock market volatility to make informed investment decisions. Subscribe to our newsletter to receive daily market reports and alerts.

Featured Posts

-

Exec Office365 Breach Millions Made By Hacker Feds Say

May 09, 2025

Exec Office365 Breach Millions Made By Hacker Feds Say

May 09, 2025 -

3 000 Babysitter 3 600 Daycare One Mans Expensive Lesson In Childcare

May 09, 2025

3 000 Babysitter 3 600 Daycare One Mans Expensive Lesson In Childcare

May 09, 2025 -

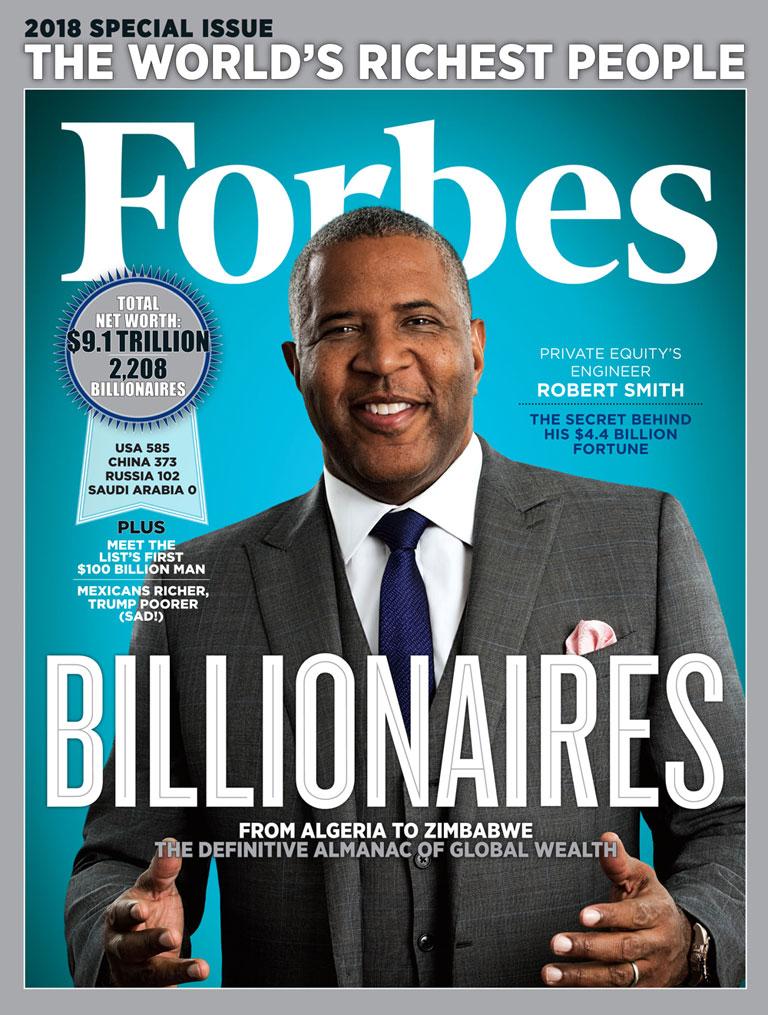

Billionaires Favorite Etf Predicted 110 Surge In 2025

May 09, 2025

Billionaires Favorite Etf Predicted 110 Surge In 2025

May 09, 2025 -

Living Legends Of Aviation Honors Firefighters And Other Heroes

May 09, 2025

Living Legends Of Aviation Honors Firefighters And Other Heroes

May 09, 2025 -

Post 2025 Nhl Trade Deadline Playoff Predictions And Analysis

May 09, 2025

Post 2025 Nhl Trade Deadline Playoff Predictions And Analysis

May 09, 2025