Inflation Surprise Lifts Pound As Traders Pare BOE Rate Cut Wagers

Table of Contents

Unexpected Inflation Data and Market Reaction

The Office for National Statistics (ONS) released UK inflation data that significantly exceeded analyst forecasts. The Consumer Price Index (CPI) rose by X%, considerably higher than the predicted Y%, while the Retail Price Index (RPI) also showed a steeper-than-expected increase. This unexpected surge in UK inflation immediately sparked a strong reaction in the currency markets. The Pound Sterling (£) experienced a sharp rise against major currencies such as the US dollar (USD) and the Euro (EUR).

- CPI: Increased by X% (compared to the predicted Y%).

- RPI: Increased by Z% (compared to the predicted W%).

- GBP/USD: Reached a high of A during the day, a B% increase from the previous day's close.

- GBP/EUR: Reached a high of C, representing a D% increase.

- Trading volume in GBP pairs saw a significant increase, reflecting heightened market volatility.

This market volatility underscores the impact of this significant deviation from anticipated inflation figures. The unexpected data highlights the complexity of current economic conditions and the challenges faced by policymakers.

Reduced Expectations of BOE Rate Cuts

The higher-than-expected UK inflation figures significantly reduce the probability of the Bank of England (BOE) cutting interest rates in the near future. The BOE's primary mandate is to maintain price stability, and the unexpected inflation spike suggests that the current monetary policy may need to remain tighter or even become more restrictive to curb inflationary pressures. Maintaining or even increasing BOE interest rates becomes a more likely scenario to combat stubbornly high inflation. This is a departure from previous market sentiment which heavily favored a rate cut.

- Previous BOE Statements: The BOE had previously hinted at the possibility of rate cuts, based on previous economic indicators.

- Analyst Predictions: Before the data release, many analysts predicted a rate cut within the next quarter. Post-release, these predictions have been significantly revised upwards.

- Impact on Gilts: The yield on UK government bonds (gilts) rose following the inflation data release, reflecting increased investor demand for higher returns in an inflationary environment. This further underscores the diminished expectations of quantitative easing.

Impact on UK Economy and Consumers

The sustained higher-than-expected inflation presents both short-term and long-term challenges for the UK economy and its consumers. Increased interest rates will directly impact borrowing costs for businesses and individuals, potentially dampening consumer spending and economic growth. The rising cost of living will continue to put pressure on household budgets.

- Household Budgets: Higher prices for essential goods and services will squeeze household budgets, forcing consumers to cut back on discretionary spending.

- Business Investment: Increased borrowing costs may discourage businesses from investing in expansion and hiring, potentially slowing economic growth.

- Government Response: The government may need to consider additional fiscal measures to address the impact of high inflation on vulnerable households.

Traders Adjust Their Strategies

The "Inflation Surprise Lifts Pound" event has forced many traders to fundamentally reassess their strategies. The shift in market sentiment away from anticipated BOE interest rate cuts toward a potential hold or even hike has triggered a wave of adjustments in the forex trading world. Many are now reviewing their risk assessment and recalibrating positions based on the new economic outlook.

- Trading Strategy Adjustments: Traders previously long on GBP/USD may be looking to secure profits, while those short may be covering their positions.

- Derivatives Market Activity: Activity in GBP-denominated futures and options contracts is expected to increase as traders react to the new information and hedge their positions.

- Expert Opinion: Leading financial analysts have commented on the surprising shift in expectations and the increased uncertainty in the markets.

Conclusion: Inflation Surprise and the Future of the Pound

The unexpected inflation data has dramatically altered the outlook for the Pound Sterling and the Bank of England's monetary policy. The "Inflation Surprise Lifts Pound" event highlights the unpredictable nature of economic indicators and their profound impact on financial markets. The shift away from anticipated rate cuts underscores the challenges facing policymakers in balancing economic growth and inflation control. The future trajectory of the Pound remains uncertain, largely depending on future inflation data releases and subsequent BOE decisions.

Stay informed about future inflation surprises and their impact on the Pound by following the Office for National Statistics and reputable financial news outlets for the latest updates. Understanding these market shifts is crucial for navigating the complexities of the UK economy and the GBP exchange rate.

Featured Posts

-

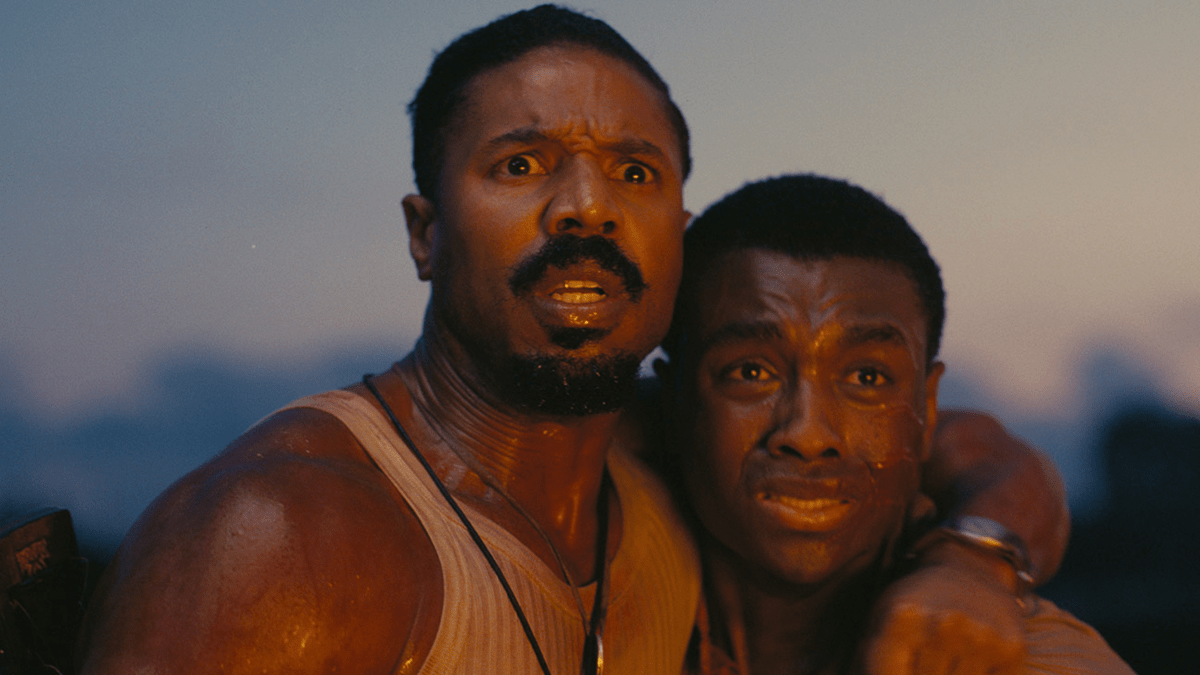

Experience Sinners The Louisiana Horror Film In Theaters Soon

May 26, 2025

Experience Sinners The Louisiana Horror Film In Theaters Soon

May 26, 2025 -

Kidnapped Idf Soldier Matan Angrest A Photo Reveals His Wounds

May 26, 2025

Kidnapped Idf Soldier Matan Angrest A Photo Reveals His Wounds

May 26, 2025 -

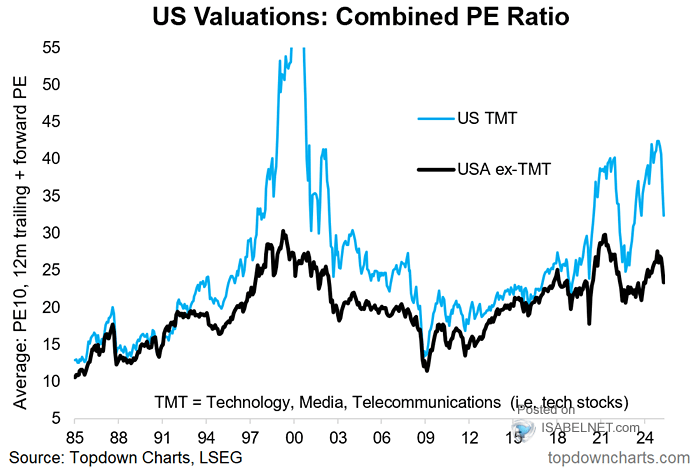

High Stock Market Valuations Bof As Arguments For Investor Calm

May 26, 2025

High Stock Market Valuations Bof As Arguments For Investor Calm

May 26, 2025 -

Atletico Madrid Geriden Gelisin Hikayesi

May 26, 2025

Atletico Madrid Geriden Gelisin Hikayesi

May 26, 2025 -

Jadwal Moto Gp Inggris 2025 Balapan Pekan Ini

May 26, 2025

Jadwal Moto Gp Inggris 2025 Balapan Pekan Ini

May 26, 2025