Interest Rate Hikes: Understanding The Fed's Different Strategy

Table of Contents

The Fed's Primary Goal: Inflation Control

The Fed's mandate centers on maintaining price stability and maximum employment. While maximum employment is a key goal, the Fed often prioritizes controlling inflation, as persistent high inflation can severely damage the economy.

Understanding Inflation and its Impacts

Inflation, a general increase in the prices of goods and services in an economy over a period of time, erodes purchasing power. This means your money buys less than it did before. High inflation can lead to:

-

Reduced purchasing power: Your salary may increase, but if inflation outpaces those increases, your real income decreases.

-

Economic instability: High and unpredictable inflation makes it difficult for businesses to plan and invest, hindering economic growth.

-

Uncertainty in the market: Investors become hesitant, leading to market volatility.

-

CPI (Consumer Price Index): Measures the average change in prices paid by urban consumers for a basket of consumer goods and services.

-

PPI (Producer Price Index): Measures the average change over time in the selling prices received by domestic producers for their output.

-

Relationship between inflation and interest rates: Inflation and interest rates have an inverse relationship. Generally, higher inflation leads to higher interest rates and vice-versa.

Interest Rate Hikes as an Inflation Control Mechanism

The Fed uses interest rate hikes as a key mechanism to curb inflation. By raising interest rates, the cost of borrowing money increases. This leads to:

- Higher borrowing costs: Individuals and businesses are less likely to take out loans for large purchases (houses, cars) or investments.

- Reduced spending: Decreased borrowing translates to less consumer spending and business investment.

- Lower demand: Reduced demand for goods and services puts downward pressure on prices, thus combating inflation.

However, it's crucial to understand the lag effect. Changes in interest rates don't immediately impact inflation; there's a delay of several months, sometimes even longer, before the full effect is felt.

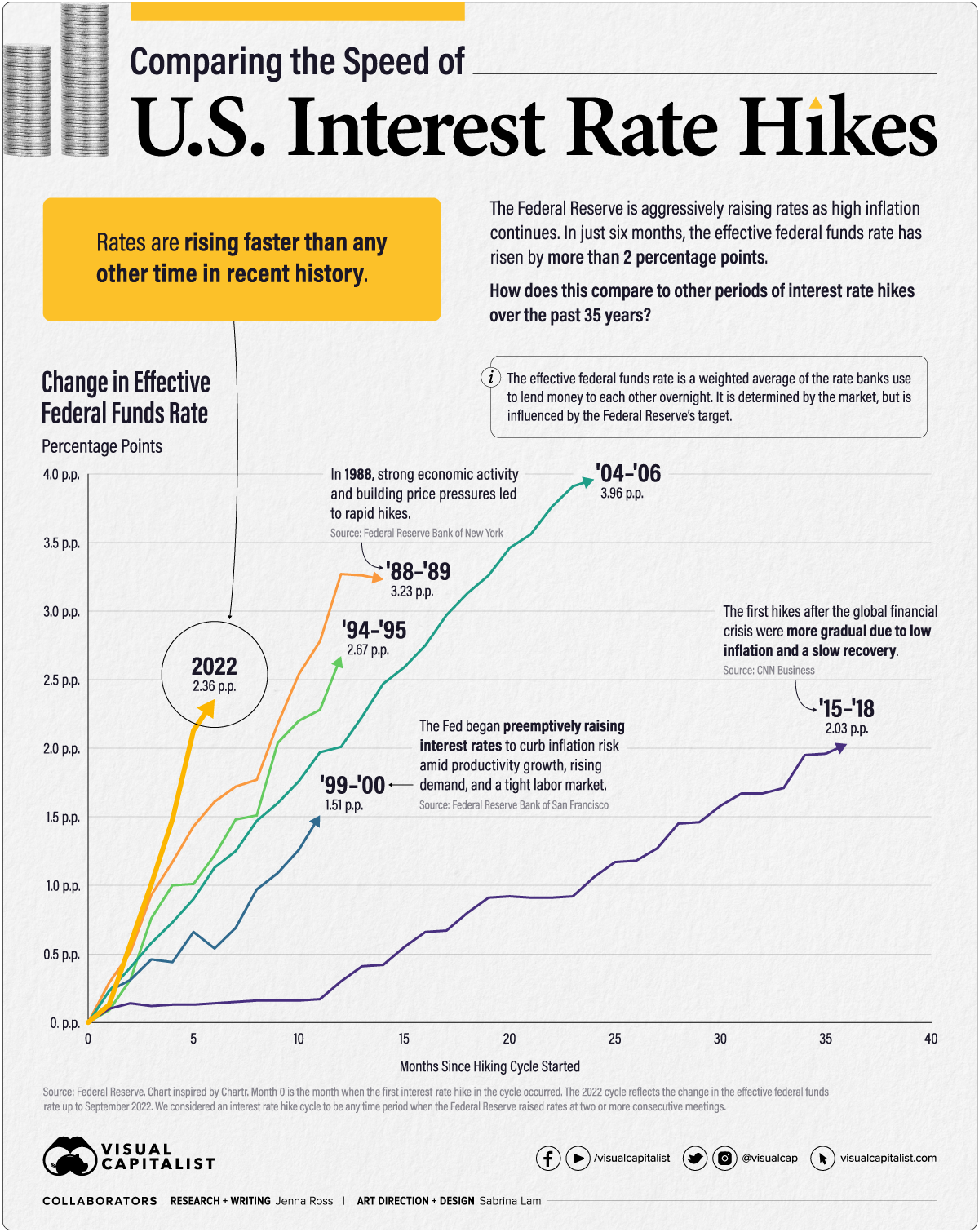

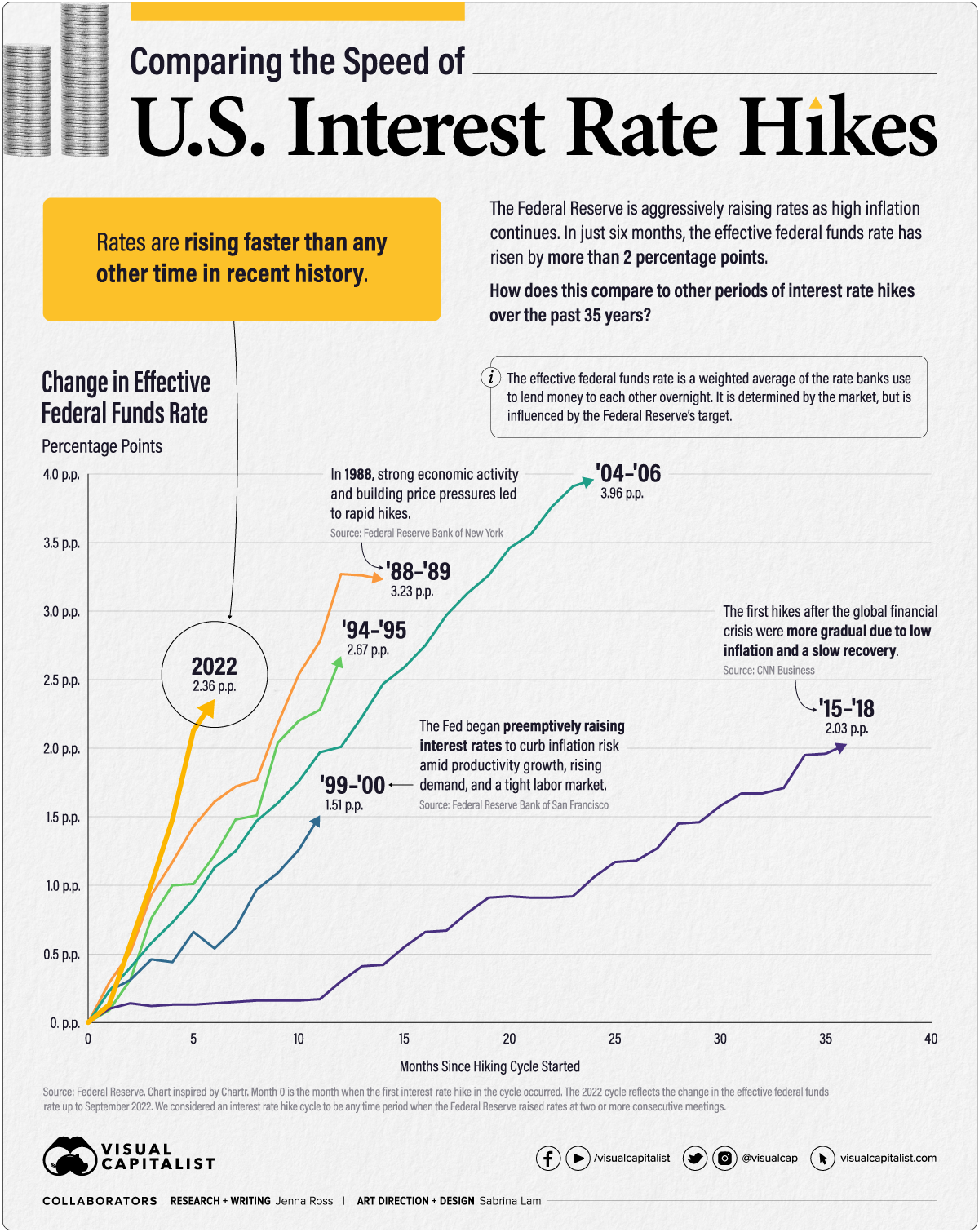

Different Strategies Employed by the Fed in Interest Rate Hikes

The Fed doesn't employ a one-size-fits-all approach to interest rate hikes. Its strategies vary depending on economic conditions.

Gradual vs. Aggressive Rate Hikes

The Fed can choose between gradual or aggressive interest rate hikes.

- Gradual Rate Hikes: Small, incremental increases provide stability and predictability for the economy. This approach minimizes the risk of shocking the system. However, it might be less effective in rapidly controlling high inflation.

- Aggressive Rate Hikes: Larger, more frequent increases are employed when inflation is soaring. While potentially effective in quickly curbing inflation, this approach carries a higher risk of triggering a recession.

Historical examples abound; the Fed's approach during the 1970s inflation crisis differed significantly from its response to the 2008 financial crisis or the recent inflation surge.

The Role of Forward Guidance

Forward guidance, a form of communication from the Fed, involves providing insights into the likely path of future interest rate decisions. This aims to:

- Influence market expectations: By signaling its intentions, the Fed can shape market expectations, reducing uncertainty and volatility.

- Impact borrowing decisions: Clear signals about future rate hikes allow businesses and consumers to make informed decisions about borrowing and spending.

- Challenges of effective forward guidance: Unexpected economic events can necessitate changes in policy, potentially undermining the credibility of forward guidance. Balancing transparency with flexibility is a key challenge.

Data Dependence and its Impact on Rate Hike Decisions

The Fed's decisions are heavily data-dependent. It meticulously analyzes various economic indicators before making rate hike decisions. Key indicators include:

- Employment figures (Nonfarm Payroll): Provides insights into labor market conditions.

- Inflation reports (CPI and PPI): Measure the rate of price increases.

- GDP growth: Indicates the overall health of the economy.

Interpreting economic data is complex, and potential biases can influence the Fed’s decisions. Unexpected economic data can significantly alter the planned path of interest rate hikes.

The Impact of Interest Rate Hikes on Different Sectors

Interest rate hikes have ripple effects across various sectors of the economy.

Impact on Consumers

- Increased borrowing costs: Higher interest rates make mortgages, auto loans, and credit card debt more expensive.

- Potential decrease in consumer spending: Increased borrowing costs may lead to reduced consumer spending as individuals prioritize debt repayment.

- Potential increase in savings: Higher returns on savings accounts might encourage greater savings.

Impact on Businesses

- Increased borrowing costs for businesses: Higher interest rates increase the cost of borrowing for businesses, potentially reducing investments and expansion plans.

- Potentially reduced investment and hiring: Businesses may postpone hiring and investment projects due to increased borrowing costs, potentially impacting economic growth.

Impact on the Stock Market

- Potential for short-term market corrections: Interest rate hikes can trigger short-term market corrections as investors reassess valuations.

- Long-term effects on corporate earnings and valuations: Higher interest rates can impact corporate profitability and influence stock prices over the long term.

Conclusion

The Federal Reserve's strategy on interest rate hikes is complex, influenced by a web of economic factors and data analysis. Grasping the nuances of its approach—from gradual versus aggressive hikes, the role of forward guidance, and data dependence—is crucial for understanding the potential impacts on consumers, businesses, and the overall economy. By closely monitoring economic indicators and the Fed's communication, individuals and businesses can better navigate the economic landscape during periods of interest rate hikes. Stay informed about future interest rate hikes and their potential implications to make sound financial decisions.

Featured Posts

-

Boxeur De Dijon Accuse De Violences Conjugales Audience Fixee En Aout

May 09, 2025

Boxeur De Dijon Accuse De Violences Conjugales Audience Fixee En Aout

May 09, 2025 -

Draisaitls Injury Update On Edmonton Oilers Leading Goal Scorer

May 09, 2025

Draisaitls Injury Update On Edmonton Oilers Leading Goal Scorer

May 09, 2025 -

Did Snls Harry Styles Impression Miss The Mark The Singers Reaction

May 09, 2025

Did Snls Harry Styles Impression Miss The Mark The Singers Reaction

May 09, 2025 -

Harry Styles Devastated Reaction To Poor Snl Impression

May 09, 2025

Harry Styles Devastated Reaction To Poor Snl Impression

May 09, 2025 -

Market Rally Sensex 200 Nifty Crosses 18 600 Despite Ultra Tech Fall

May 09, 2025

Market Rally Sensex 200 Nifty Crosses 18 600 Despite Ultra Tech Fall

May 09, 2025